When you’re promoting a second-hand HD-DVD participant otherwise you need to promote your automobile, there are many Internet 2.0-empowered options that may show you how to out. Life is barely totally different in case you are attempting to shift an earth-mover or two. That’s the market Increase & Bucket has entered; hauling the business of second-hand heavy equipment gross sales into the present millennium. The corporate is digging in its heels and simply raised a $5.5 million spherical to tackle this deeply entrenched business.

The issue the founders are fixing is the normal manner of promoting heavy gear — there’s Craigslist, or native auctions. Each have downsides, and neither have the extent of belief that customers have began to understand from the Carvanas and Shifts of the world. Furthermore, not like, say, an eBay public sale, there appears to be a tacit understanding that once you purchase one thing, you purchase it as-seen, as-is and where-is. Horror tales abound on purchases that didn’t prove fairly the way in which the client meant.

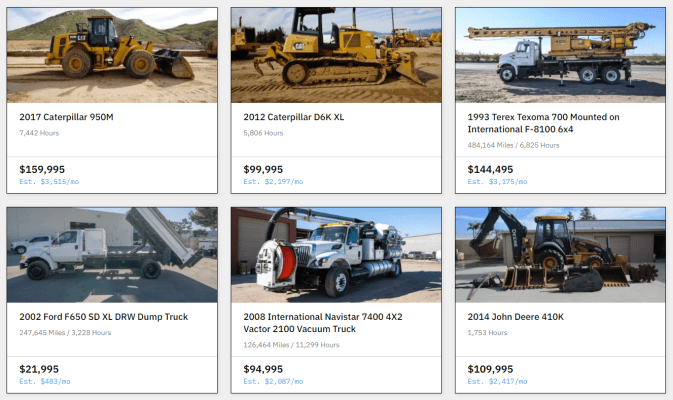

There may be actual cash in play, too. “I’m taking a look at our Offers thread in the present day in Slack,” says Adam Lawrence, co-founder and CEO of Increase & Bucket. “It’s individuals who have made affords on machines: $75,000; one other $75,000; $50,000. The largest factor we’ve bought price greater than half one million bucks — and the least costly factor that we’ve bought is round $12,000 or so.”

The corporate is attempting to resolve some huge points on this business; belief, visibility and financing.

“EBay has had a ‘motors’ class since 1997. The issue with that’s {that a} machine can present up they usually can look flawless — that may be a widespread factor on this house. Somebody painted it shiny yellow, now it appears new, however it could have a elementary flaw. The engine overheats, or the hydraulic tubes all have to be changed,” says Lawrence. “We’ve a buyer testimonial from somebody who purchased a $350,000 bulldozer from us. He had purchased one from public sale beforehand and had pushed it up this large mountain, and it overheated up there. The earlier proprietor had swapped out a very good engine for a nasty one and coated up the oil warning gentle. That’s usually what you get once you roll the cube at public sale. In order that’s what we’re attempting to resolve.”

The corporate has already bought hundreds of thousands of {dollars}’ price of apparatus, with early clients together with SunState Tools Leases, Spiniello Development and Los Angeles County. The typical machine falls within the excessive five-figure vary, and the corporate has bought “virtually 100 machines” since launching its platform in February.

“The typical piece of apparatus has bought for 40% greater than it might at wholesale auctions, made attainable by the added layers of belief and reassurance,” Lawrence says. “These machines are the lifeblood of our clients — it’s like actually one thing that they rally round. That is the gear that builds the infrastructure for America, and it needs to be dependable. When you’re constructing a bridge and your excavator breaks, and you’ve got 10 dump vans lined as much as take dust away, the entire day is ruined for everyone. And so we’ve got this means to underwrite that and be sure that the standard stays excessive.”

The corporate employs 15 folks, and is fueling up its equipment to enter a severe development part, beginning with comprehensively fixing the availability facet of this market play first.

“We need to develop fairly considerably. We need to construct and launch the core platform,” says Lawrence, saying that the primary model of the app is stay on the web site now. If you wish to purchase a $300,000 bulldozer, he has you coated. “We need to work with a lot of massive clients on the availability facet and show out the worth proposition to them, after which proceed to develop the crew fairly considerably.”

The $5.5 million spherical of seed funding was co-led by Human Capital and Brick & Mortar Ventures, the biggest construction-focused enterprise fund. Supporting buyers embrace 8VC, World Founders Capital, Streamlined Ventures, Quiet Capital and MaC Enterprise Capital.