Vertigo3d

Broadstone Internet Lease (NYSE:BNL) is a REIT with a concentrate on single-tenant business actual property. These properties are web leased on a long-term foundation to a diversified group of tenants in 5 sectors: Industrial; Healthcare; Eating places; Retail; and Workplace. At practically 50% of whole annualized base lease (ABR), Industrials account for the biggest share of BNL’s whole revenues. With no single tenant driving greater than 2.1% of ABR, the corporate’s portfolio is well-diversified throughout 200 completely different business tenants.

As a web leased REIT, BNL advantages from sturdy money flows and long-dated lease phrases. In the latest interval, the weighted common lease time period of the portfolio was 10.5 years, with latest acquisitions made at phrases in extra of 19 years. With embedded escalators in 80% of their leases, the corporate can also be afforded safety towards broader inflationary pressures.

At practically 100% occupancy ranges and full collections, BNL faces restricted near-term challenges. Shares, nevertheless, are down about 13% YTD. Although markedly higher than the broader index, there may be nonetheless room for upside. At a good 52-week unfold of lower than $10 between its excessive and low, shares additionally present safety towards market volatility. For traders looking for a flight to security, BNL is one REIT that provides safety at a reduction.

Broadstone Internet Lease – Earnings Assessment and Different Reportable Occasions

For the interval ended March 31, 2022, BNL reported whole revenues of +$93.8M. This was about 13% higher than anticipated however simply shy of estimates. FFO and earnings, alternatively, have been in-line. Driving revenues and earnings progress within the present interval have been contributions from latest acquisitions accomplished within the fourth quarter of 2021.

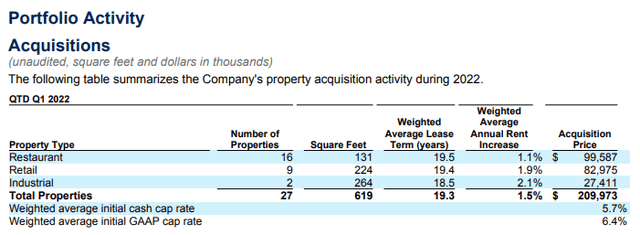

Through the quarter, the corporate was extremely energetic available in the market, with Q1 marking the biggest first quarter quantity in BNL’s historical past. In whole, the corporate invested +$210M in 27 properties with a weighted common lease time period of 19.3 years and embedded annual escalators of 1.5%. The acquisitions have been made, nevertheless, at barely elevated valuations in comparison with prior intervals, with an preliminary cap price of 5.7% versus 6% in This autumn and 6.1% over the previous 12 months.

The acquisitions throughout the interval have been concentrated in eating places and retail, with the 2 accounting for practically 90% of their whole funding. Put up-acquisition, the 2 sectors now account for 15% and 12% of whole ABR, respectively, with publicity to eating places up 200 foundation factors. With extra shoppers shifting their spending from items to companies, the improved publicity could also be a well timed transfer for the corporate.

Q1FY22 Investor Presentation – Portfolio Acquisition Exercise

Through the interval, BNL additionally acquired property in Canada. This is able to be their first focused acquisition within the area. The properties are positioned within the premier city markets of Vancouver, Calgary, Winnipeg, Ottawa, and Toronto and are purposed for prime quality retail. As a proportion of whole ABR, the area accounts for simply 2.4%, which is in-line with the corporate’s diversification technique.

General occupancy held robust at interval finish at 99.8%. Money collections have been additionally 100%. Moreover, considerably all their properties have been topic to lease and have been occupied by over 200 completely different business tenants. Continued energy within the portfolio supported the reiteration of full-year steering, which requires an AFFO/share vary of $1.38 – $1.42, representing progress of 6.9% on the midpoint from the prior yr.

BNL Fundamentals

As of March 31, 2022, BNL reported whole property of +$4.9B and whole liabilities of +2.0B, comprised principally of whole web unsecured debt of +$1.7B. As a a number of of annualized adjusted EBITDAre, web debt was 5.1x, which was per the identical interval final yr and in-line with an inner goal of lower than 6x.

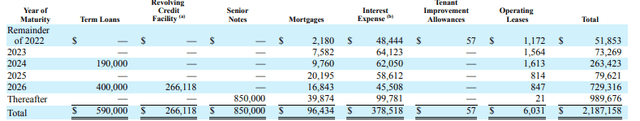

With practically 50% of whole contractual obligations due after 2026, BNL has well-laddered maturities that present cushion towards any near-term reimbursement dangers and dangers related to the present rising price atmosphere. Moreover, the corporate possesses an investment-grade credit standing from Moody’s and S&P International. The steady ranking supplies confidence of continued entry to debt markets at charges comparable or higher than the prevailing market.

Q1FY22 Type 10-Q – Abstract of Contractual Obligations

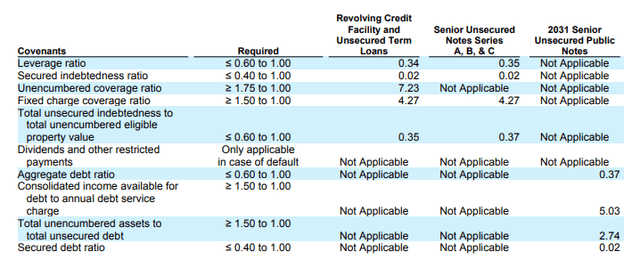

BNL can also be comfortably in compliance with their covenant necessities. Unencumbered protection and consolidated revenue, for instance, are at 7.2x and 5x, respectively, which vastly exceeds the minimal requirement. Ought to the corporate require extra debt financing, respiration room inside their covenants is actually there.

Q1FY22 Investor Complement – Debt Covenant Compliance Abstract

With liquidity of roughly +$1B at interval finish, BNL’s obligations are adequately funded for the subsequent a number of years. Moreover, the corporate is producing steady money from operations by continued earnings progress, aided partly by annual escalation provisions embedded of their leases. A diversified tenant base with cross-industry publicity supplies safety towards dangers related to higher focus. This supplies assurance to money stream continuity.

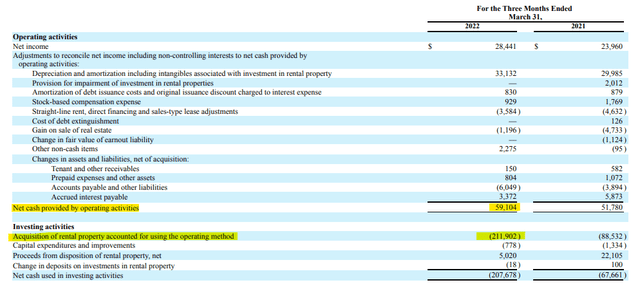

Whereas the corporate is producing optimistic money flows, they’re, nevertheless, burning by obtainable money on acquisitions. Within the present interval, they spent +$212M on investing actions. That is on high of the practically +$150M spent throughout Q4FY21. Although these acquisitions have been accretive prior to now, there may be the chance the corporate is shopping for right into a market high. Deterioration in financial circumstances might thus have an adversarial impact in future intervals by declining valuations and/or elevated vacancies.

Q1FY22 Type 10-Q – Partial Money Circulate Assertion

For revenue traders, shares in BNL presently provide a yield of over 5% after having been most not too long ago elevated by about 2%. As a comparatively newer REIT, the corporate doesn’t have an extended public observe document of progress. But it surely does profit from the identical traits of different web lease REITs, specifically diminished threat and sturdy money flows. At an working protection of 1.4x and an AFFO payout ratio of 74%, there does seem like spare capability for progress.

Main Dangers

A focus of BNL’s technique is to put money into single-tenant, triple-net leased properties. Whereas this construction does have benefits, there are specific and important dangers associated to tenant default. As a result of there is just one tenant, BNL’s publicity to monetary default is elevated. If default have been to happen, BNL wouldn’t solely lose the revenue on the property, however the worth of that property would seemingly additionally decline. This might end in additional points in re-leasing or promoting the property.

This threat is amplified in circumstances the place the corporate leases a number of properties to a single tenant underneath a grasp lease. As of December 31, 2021, grasp leases represented simply over 30% of whole ABR. A tenant failure or default underneath a grasp lease might scale back or eradicate income from a number of properties and will considerably have an effect on BNL’s outcomes of operations.

Although the long-term nature of BNL’s leases is one benefit in retaining tenants and producing steady money flows, the construction presents the corporate with restricted alternatives to extend rents. In the latest submitting interval, for instance, BNL’s weighted common lease time period was 10.5 years. Although considerably all their leases include escalation clauses, these built-in will increase could also be lower than what the corporate can in any other case obtain within the prevailing market.

BNL’s outsized publicity to Industrials, at 46% of ABR as of Q1FY22, might current headwinds in future intervals. Just lately, Amazon (AMZN) decided to sublease as much as 30M sq. ft of warehouse area or renegotiate leases. The pullback in spacing wants put the new warehouse sector on alert following the announcement. Additional unfavourable developments might create extra pressure within the sector and negatively influence BNL’s working outlook.

Within the present interval, BNL’s acquisitions have been weighted extra closely in the direction of eating places and retail, with the 2 now accounting for a barely greater share of whole ABR. With inflationary pressures at document highs and shoppers more and more involved concerning the financial system, there’s a heightened threat of a broader financial slowdown. Any ensuing downturn would disproportionally have an effect on these two sectors as a result of discretionary nature of the industries. BNL, subsequently, is exposing themselves to elevated threat by investing in sectors which may be on the tops of their enterprise cycles.

Conclusion

BNL’s focus on the web lease mannequin is a aggressive energy that gives draw back safety in difficult working circumstances. With prolonged lease maturities and embedded escalators, the online leased portfolio generates sturdy and predictable money flows. Intensive portfolio diversification supplies additional insulation towards concentrated dangers in sure sectors of the financial system.

Although the corporate has heightened publicity to the Industrial sector, BNL’s latest market exercise have been weighted extra in the direction of eating places and retail. As shoppers more and more redirect their spending habits from items to companies, this transfer ought to show well timed. Although recession dangers abound, there aren’t any clear indicators of tenant misery. Occupancy is sort of 100% and the corporate collected 100% of money rents owed within the present interval.

For traders looking for portfolio safety, shares in BNL provide a good 52-week buying and selling unfold with an annual dividend payout yielding greater than 5%. Whereas shares are down 13% YTD, the efficiency remains to be stronger than the broader index, which is buying and selling in bear territory. At an estimated low cost price of about 6% and a dividend progress price of two%, shares can be valued at roughly $27 utilizing a dividend low cost mannequin with an estimated future payout of $1.07. In a flight to security, shares in BNL are presently providing safety at a reduction.