Paul Morigi

Co-produced with “Hidden Opportunities”

Bad news sells very effectively and Wall Street is known to create fear to make you an active trader. There’s so much news around – if I could process all the information and react quickly, I could master the art of market timing… right? That’s what Wall Street hopes that you believe and keep trying.

Wall Street makes its money on activity. You make your money on inactivity. – Warren Buffett

Real fortunes are made when your money makes money for you without your day-to-day involvement. You must transform your portfolio into a cash-producing machine to make money in your sleep. I’ll let you in on a secret – the price of this machine is highly cyclical. It’s costly to build in a bull market and cheap in a bear market.

Main Street commentary and sentiment may seem very convincing that you should stay away from equities until the Fed stops raising rates. But this can be a costly mistake, and the average investor will certainly be late to the party.

The future is never clear; you pay a very high price in the stock market for a cheery consensus. Uncertainty actually is the friend of the buyer of long-term values. – Warren Buffett

The billionaires talking about bad feelings about the economy and dark skies and telling you to batten down the hatches will not come out to say that the coast is clear to buy. For someone with a long-term focus, we see deeply discounted, high-quality parts for that income-producing machine on sale. Without further ado, we will discuss two picks with up to 10% yields to take you closer to your dream retirement.

Pick #1: THW, Yield 10.2%

Some industries do well (or even thrive) during recessions. We call them “inelastic” businesses. Their consumer demand remains stable regardless of variations in the economic climate. Consumer staples, healthcare, and utilities typically get classified into this category of defensive stocks.

Healthcare is an essential service that people can’t go without. People get ill with equal probability during bull and bear markets and require care, lifesaving treatments, and medication. The goods and services from care providers (hospitals and medical centers), insurance companies, pharmaceuticals, medical devices, and consumer healthcare companies (those that produce everyday items like band-aids and rubbing alcohol) remain in demand, irrespective of the sentiments of the financial markets.

Larger biopharma companies are highly profitable, maintain tremendous competitive advantage, and experience inelastic demand for their products and treatments. But this industry is not known for its generous dividends, and its product pipeline, research, and approval processes are beyond the scope of understanding for the average investor.

This bear market has shrunk the valuation of several rapidly-growing healthcare companies, strengthening the M&A activity in the sector. At the June Goldman Sachs healthcare conference, executives at companies including Merck (MCK), Amgen (AMGN), and Johnson & Johnson (JNJ) said that they’re committed to making deals. We already have seen significant transactions announced this year:

-

Pfizer acquired Biohaven Pharmaceuticals for $11.6 billion

-

UnitedHealth and Optum acquired LHC for $6.1 billion

-

Bristol-Myers Squibb bought Turning Point Therapeutics for US$4.6 billion

Prolonged bear markets and an economic recession will lead to more M&A activity in this cash flow-rich industry. Leaders will acquire niche players to fortify their drug portfolios and expand their moats.

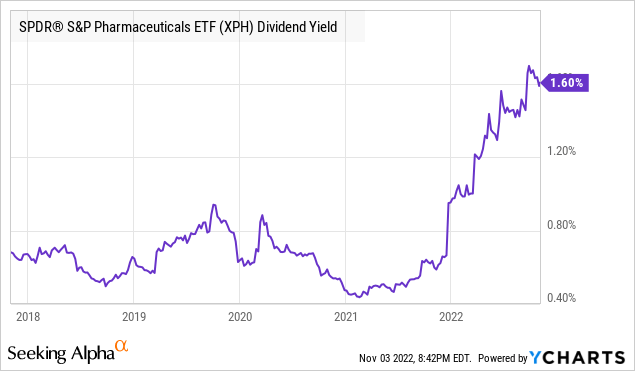

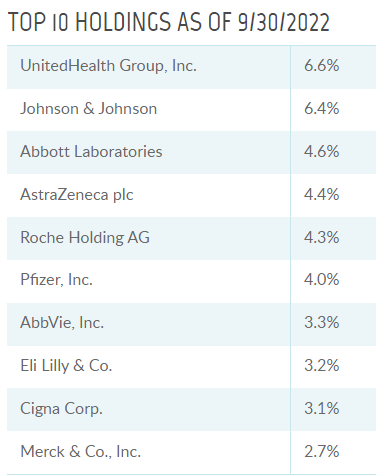

As income investors, we like the importance of the healthcare industry to humankind, the wide moat these companies have, and their ability to pass on inflationary pressures to consumers. Hence, we’re looking into this CEF – Tekla World Healthcare Fund (THW), whose objective is to produce current income and long-term capital appreciation through investments within healthcare. THW’s top holdings are global healthcare giants. (Source: THW Website)

THW Website

50% of the fund is composed of pharma and biotech companies. Unlike its sibling THQ, THW has significant assets (>40% of its managed assets) invested in companies organized or located outside the U.S. or that do a substantial amount of business outside the U.S. And unlike its cousin HQH, THW has significant investments in fixed-income securities like bonds. This CEF holds several convertible and non-convertible notes of leading pharma companies with varying maturities.

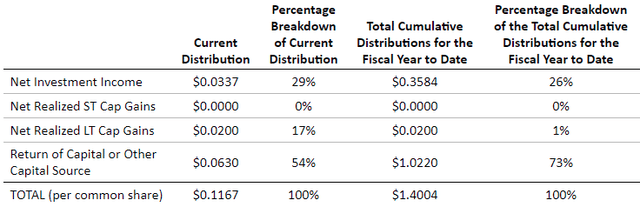

THW pays a $0.1167 monthly dividend that has remained steady since the CEF’s inception in 2015. This calculates to an attractive 10.2% annualized yield. THW trades at a modest 4% premium to NAV and presents an attractive high-yield opportunity to benefit from this recession-resistant industry. From time to time, this CEF employs Return of Capital in its distribution which comes with tax advantages for shareholders. Notably, 73% of the YTD distribution has been ROC. (Source: Tekla)

teklacap.com

Let me explain this further, since its inception in 2015, THW has paid over $10.30/share in distributions while its stock price trades ~$6.4 below its IPO price. A bulk of the unrealized loss has been during this 2022 bear market sell-off. The CEF is well-positioned to recoup these as its underlying companies exhibit solid fundamentals and value propositions. Patient investors can reap the rewards in the form of a healthy monthly distribution while waiting for the tide to turn.

Worried about a recession and unsure about where to place your money? Look at industries that experience recession-resistant demand. Healthcare is an attractive sector because the demand for medicines is relatively inelastic – financial pressures will force people to cut down on fancy dinners or vacations but not on their pills. Profit margins of industry leaders will be protected, and we will collect large distributions by owning a basket of top names through THW.

Pick #2: RVT, Yield 9.1%*

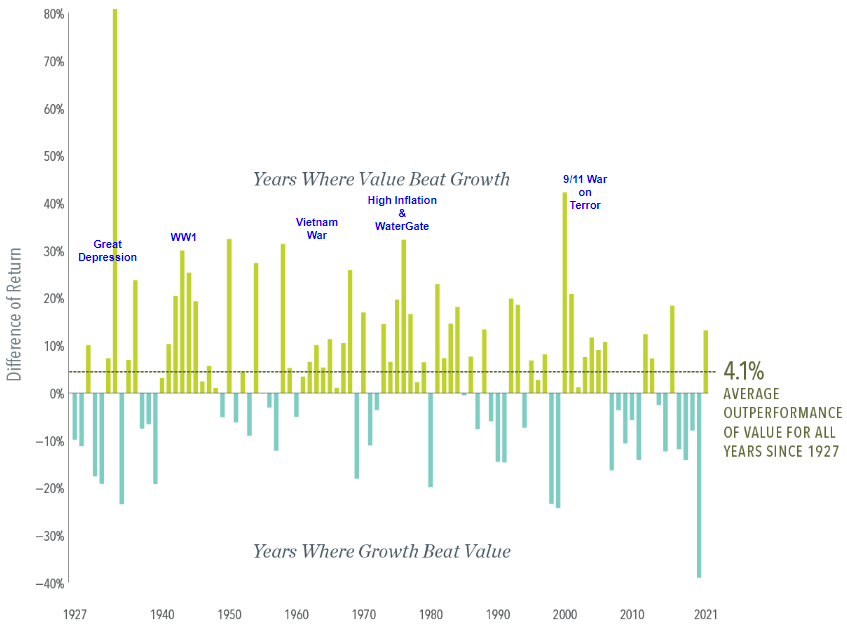

There’s strong historical evidence of value outperforming growth in the long term. A study analyzing ~100 years of market performance showed that value achieved a 4.1% outperformance overgrowth. Value’s strong performance is more notable during precarious times for the U.S. economy, namely the great depression, wars, and periods of very high inflation.

Value vs Growth

If you’re a value investor who likes big dividends, then Royce Value Trust (RVT) is a match made in heaven. RVT is one of the oldest CEFs, and their management – Royce Investment Partners, used the below image to open their semi-annual letter to RVT shareholders.

Royce Invest

“Don’t worry – I’ve seen movies like this before.”

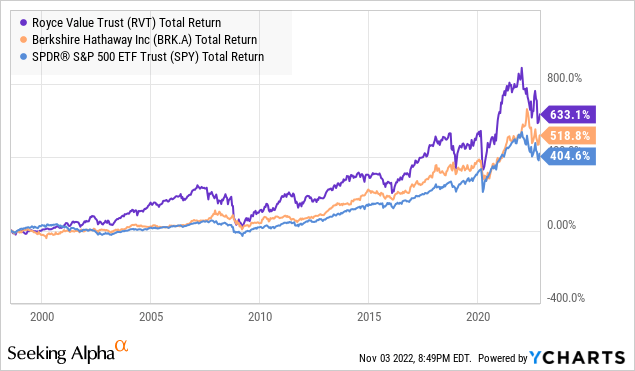

It’s interesting because RVT management is one of the few that can actually say this and mean it. This is one of the oldest CEFs and has been delivering outstanding value to shareholders for almost four decades. RVT has massively outperformed the S&P 500 and billionaire value investor Warren Buffett’s Berkshire Hathaway (BRK.A) (BRK.B) since the late 90s (this is up to where YCharts was able to show relative total returns).

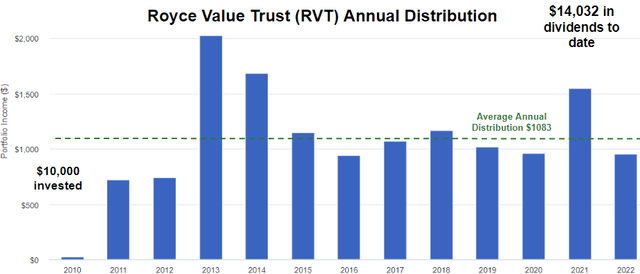

RVT is heavily diversified across 478 securities in the small-cap value space. The CEF is composed of 90% U.S.-based equity investments and carries a small 4% leverage. A $10,000 investment in RVT in January 2010 would have produced $14,032 in total distributions to date, and you would be sitting on a modest 16% capital gain. This calculates to a healthy 10.8% average annual yield. (Source: Portfolio Visualizer)

Portfolio Visualizer

RVT earns most of its distribution in the form of Short-Term or Long-Term capital gains and employs a small Return of Capital (‘ROC’) component. (Data Source: RVT)

|

Distribution Per Share |

NII |

Net Realized ST Gains |

Net Realized LT Gains |

ROC |

|

$1.03 |

$0.0432 (3%) |

$0.1223 (12%) |

$0.8071 (78%) |

$0.0664 (7%) |

*It is noteworthy that RVT’s distributions are variable per its managed distribution policy. The CEF’s quarterly distributions will be an annual rate of 7% of the average of the prior four quarter-end NAV, with Q4 being the greater of these annualized rates or the distribution required by IRS regulations. We expect $0.29/share in Q4 distributions per this distribution policy.

Value stocks present the best opportunities in this bear market. Their relatively low valuation offers a much-needed margin of safety in these punitive market conditions. Are you looking to hop onto the value train? RVT’s 9.1%* yield offers solid diversification in this category, and you don’t have to lose out on income in the process.

Dreamstime

Conclusion

If you approached the financial markets as a persistent buyer in 2021 and are a persistent seller in YTD 2022, you are doing it wrong. We get a lot of comments for our articles, with investors attacking our timing, saying that the best time to buy anything will be when the Fed pivots from its hawkish pursuits. Let me share the wise words of the Oracle of Omaha.

Most people get interested in stocks when everyone else is. The time to get interested is when no one else is. You can’t buy what is popular and do well. – Warren Buffett

Buy high, sell higher was the motto of 2021. The proliferation of blank check IPOs (SPACs), cannabis revival, an intense billionaire interest in cryptocurrencies, controversial short squeezes, and so much more. To me, it sounds like a lot of work to keep track of what is cool, buy as it rises, and sell it before it falls down the cliff.

From home appliances to checkout counters at the grocery store, we aspire for increased simplification through automation. Why should it be different for income? At HDO, we help investors generate paychecks in sickness and health, employment and retirement, and most importantly, in bull and bear markets. With an adequately diversified portfolio of income generators, you, too, can sleep well at night as the paychecks come in passively. Two picks with up to ~10% yields for a dream retirement.