Disaster bond market issuance has already set a brand new file for the first-four months of the yr in 2025, even with half the month of April nonetheless to run and billions extra in issuance scheduled to settle earlier than Might, which has the potential to make this the busiest four-month stretch ever for the sector.

The gorgeous begin to 2025 for the disaster bond market continues, with provide of latest cat bonds persevering with to speed up.

Having already set a brand new file for first-quarter cat bond issuance, even with April solely half manner by means of the quantity of danger capital issued in disaster bond format has already exceeded the file set a yr in the past for the primary 4 months of the yr.

At present, we’ve analysed and tracked approaching $7.9 billion of latest and settled cat bond issuance within the Artemis Deal Listing this yr.

An extra $100 million will get added to that whole tomorrow, because the Zenkyoren sponsored Nakama Re 2025-1 issuance is scheduled to settle then, so the entire will likely be approaching $8 billion at that stage.

However, even earlier than the Zenkyoren deal settles, the almost $7.9 billion of cat bonds already settled this yr has damaged the 2024 file of simply over $7.7 billion settled by means of the tip of April.

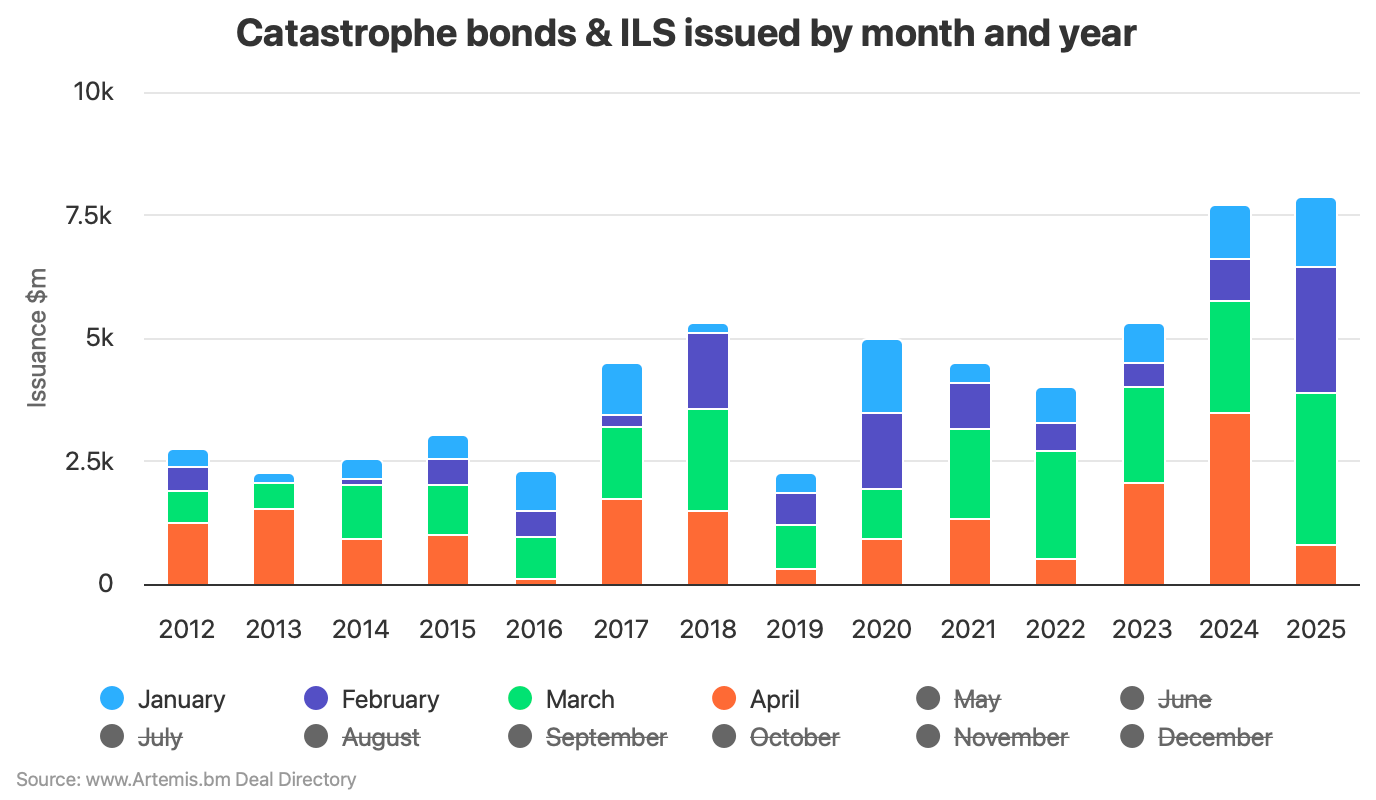

Analyse disaster bond issuance by month and yr utilizing our chart. You may deactivate months utilizing the chart legend to simply evaluate any interval of the yr versus historic cat bond issuance.

2025 would be the third yr in a row that the disaster bond market will set a brand new file for issuance settled by the tip of April.

Final yr, we recorded simply over $7.7 billion in new disaster bond and associated insurance-linked securities (ILS) issuance over the first-four months of 2024.

In 2025, we’re already forward of that, approaching $7.9 billion and set to be almost $8 billion tomorrow, however extra impressively there’s an in depth pipeline for the remainder of April this yr.

Actually, given the way in which the pipeline has been constructing and the very fact cat bond points are typically upsized in 2025, there’s a likelihood issuance for the first-four months of the yr may method and even surpass $10 billion, though there’s some timing uncertainty and offers may fall into Might.

Which, relying on whether or not settlement dates get pushed again for any offers, may additionally make this the busiest of any four-month stretch within the disaster bond market’s historical past.

However, both manner, the brand new file already set for January to April disaster bond issuance in 2025 is important and an extra sign that the market is nicely on-track to set morte information for the first-half of the yr, maybe even the full-year (though there’s some option to go on that).

Including the virtually $7.9 billion of disaster bond issuance settled thus far this yr to the presently $3.71 billion pipeline, provides us a complete issuance determine as soon as the present pipeline is closed of just about $11.6 billion.

It’s price noting that the file set a yr in the past for cat bond issuance throughout the first-five months of the yr stands at $11.72 billion, so there’s virtually definitely going to be a brand new file set for that interval as nicely.

Actually, with the first-half issuance file standing at simply over $12.6 billion, once more set a yr in the past, we presently count on the disaster bond market will see that file fall in 2025 as nicely, maybe meaningfully.

Don’t neglect, you possibly can monitor disaster bond issuance and the pipeline of offers resulting from settle on this chart.

You may monitor settled cat bond issuance by month and quarter on this chart (use the important thing of months on the backside to incorporate and exclude any out of your evaluation).

The Artemis Deal Listing lists all disaster bond and associated transactions accomplished for the reason that market was fashioned within the late 1990’s. The listing additionally lists the cat bonds ready to settle, that are highlighted in inexperienced on the prime of the checklist.

Analyse the disaster bond market utilizing our charts and visualisations, that are saved up-to-date as each new transaction settles.

Obtain our free quarterly disaster bond market reviews.

We monitor disaster bond and associated ILS issuance knowledge, probably the most prolific sponsors available in the market, most energetic structuring and bookrunning banks and brokers, which danger modellers characteristic in cat bonds most often, plus rather more.

Discover all of our charts and knowledge right here, or by way of the Artemis Dashboard which supplies a helpful one-page view of cat bond market metrics.

All of those charts and visualisations are up to date as quickly as a brand new cat bond issuance is accomplished, or as older issuances mature.

All of our disaster bond market charts and visualisations are up-to-date and embody knowledge on new cat bond transactions as they settle.