Ink Business Premier is the latest business card from Chase. It’s not the greatest business card from Chase.

No, it’s not a terrible product. It’s a good fit for business owners with relatively high spending needs, particularly those who make large purchases throughout the year. But it has some key disadvantages to other Chase business cards, including a high annual fee and a wonky rewards program that offers less value than it should.

Were I in the market for a new business card, I wouldn’t apply for Ink Business Premier. You might, though — so let’s walk through its upsides and downsides together.

What Is the Ink Business Premier Card?

The Ink Business Premier Card is a small-business charge card with a generous cash-back rewards scheme and an excellent sign-up bonus. Its spending limit is higher if you pay in full each month, but many purchases are eligible for Chase’s Flex for Business plan, which lets you pay for purchases over time (with interest).

Like other Chase cash-back cards, Ink Business Premier participates in the Ultimate Rewards program, which lets you redeem for cash, Amazon purchases, travel, gift cards, and more.

However, you can’t combine points earned with your Ink Business Premier card with points earned on other Chase cards. That means you can’t earn a redemption bonus on them if you have an eligible Chase card like Chase Sapphire Reserve or Sapphire Preferred. You also can’t transfer points earned with Premier to Chase travel partners, where they’re often worth more at redemption.

Ink Business Preferred has a $195 annual fee, higher than other Chase business cards. There’s no fee for additional employee cards, however.

What Sets the Ink Business Premier Card Apart?

Ink Business Premier stands out from the rest of Chase’s spending card lineup — and from most other issuers’ too — for three reasons:

- Pay in Full By Default. Ink Business Premier is Chase’s only charge card, and one of only a few well-known charge cards on the market right now. That’s certainly a selling point if you have the cash flow to avoid carrying balances from month to month.

- Higher Cash-Back Rate on Big Purchases. Ink Business Premier pays 2.5% cash back on individual purchases over $5,000 (versus 2% on purchases under $5,000). If your business tends to make fewer, larger purchases or just bigger purchases in general, this makes a meaningful difference over time.

- Excellent Cell Phone Protection Benefit. This benefit isn’t unique to Ink Business Premier, but its value is better than any other business cards’. It’s worth up to $1,000 per claim, minus a $100 deductible per claim, and applies to as many as three claims per year. Normal limits are more like $600 per claim and no more than two claims per year.

Key Features of the Ink Business Premier Card

These are the most important features of the Ink Business Premier card. Note the excellent sign-up bonus, above-average cash-back earning rate, and the rules around paying your balance in full vs. carrying balances from month to month.

Sign-Up Bonus

Ink Business Premier has an excellent sign-up bonus for new cardmembers: Earn $1,000 bonus cash back after making $10,000 in purchases in the first three months from account opening.

You’ll need to spend about $3,334 per month to earn it, but that should be doable if you run a growing business with lots of inventory or equipment needs.

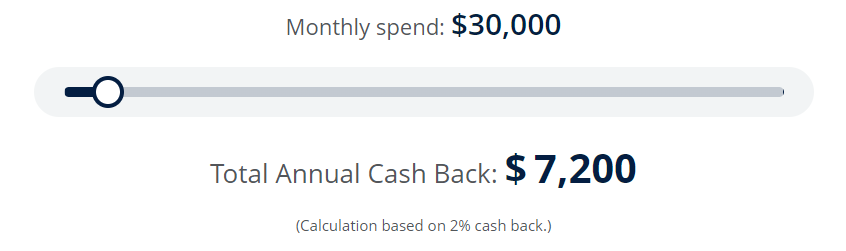

Earning Cash-Back Rewards

Ink Business Premier has a three-tiered rewards program that’s particularly generous for business travelers and big spenders:

- Earn unlimited 5% cash back on travel purchased through the Ultimate Rewards travel portal (Chase Travel)

- Earn unlimited 2.5% cash back on individual purchases totaling $5,000 or more

- Earn unlimited 2% cash back on all other eligible purchases

Cash back accrues as Ultimate Rewards points, which are worth up to $0.01 apiece at redemption. Points don’t expire as long as your account remains open and in good standing.

Redeeming Cash-Back Rewards

The best way to redeem your points is for cash, either as statement credits or bank account deposits. This option values your points at $0.01 apiece.

Other options include travel, gift cards, and Amazon purchases. Avoid Amazon redemptions if possible, as they cut point values to $0.008 apiece.

Pay-in-Full Option

Ink Business Premier is technically a charge card, which means the default option is to pay your bill in full each month. Your credit limit is higher on pay-in-full purchases, so you should strive to do this if you can afford it. And if you prefer to carry balances from month to month due to inadequate or uneven cash flow, consider another credit card.

Flex for Business Option (Carried Balances)

Chase may elect to set aside a portion of your credit limit as “Flex for Business.” You can pay for Flex for Business purchases over time, as you would with a regular credit card. Like a regular credit card, Flex for Business purchases accrue interest, so try to minimize its use if at all possible.

Cell Phone Protection Benefit

Cell phone protection is no longer a novelty in the credit card world, but Ink Business Premier goes above and beyond. Its protection plan promises up to $1,000 in coverage per claim (minus a $100 deductible per claim) on up to three claims per year.

This benefit applies to whatever devices your Ink Business Premier card pays the bills on. If you issue phones to all your employees, throw them on the card and take full advantage of the policy.

Travel Benefits

Ink Business Premier has a standard lineup of travel benefits and protections:

- Trip cancellation and interruption insurance

- Trip delay reimbursement

- Baggage delay insurance

- Rental car collision damage waiver

- Travel and emergency assistance services, like roadside dispatch

To claim the insurance and reimbursement benefits, including rental car coverage, you’ll need to charge relevant expenses to your card. That means personal travel expenses are out of reach unless you charge them to a personal credit card with similar benefits.

Important Fees

Ink Business Premier’s annual fee is $195. Employee cards don’t cost extra, no matter how many you order, and there’s no foreign transaction fee.

Credit Required

The Ink Business Premier Card requires good to excellent credit. If your business is relatively new, you may need to apply using your personal credit score, meaning you’ll need to personally guarantee your charges.

Advantages of the Ink Business Premier Card

These are Ink Business Premier’s top selling points.

- Outstanding Sign-Up Bonus. Ink Business Premier has one of the best sign-up bonuses in the business credit card space. It’s not too difficult to obtain for moderate-spending businesses, either.

- 5% Cash Back on Eligible Chase Travel Purchases. Like most other Chase cards, Ink Business Premier earns 5% cash back on eligible Chase Travel bookings. That’s a perk for frequent business travelers (and consolation for the lack of travel transfer partners here).

- 2.5% Cash Back on Purchases Greater Than $5,000. Ink Business Premier really shines on big purchases. You’ll earn 2.5% cash back on all purchases over $5,000, with no limits on how much you can earn.

- Strong Baseline Cash-Back Rate. Ink Business Premier also earns unlimited 2% cash back at a baseline, in line with other top business credit cards.

- Excellent Cell Phone Protection Benefit. Ink Business Premier has the best cell phone protection benefit of any business credit card I’ve seen. If your business has multiple cell phones, three claims per year isn’t unreasonable.

- Option to Pay in Full or Carry a Balance. Ink Business Premier is “pay in full” by default, but it offers the flexibility to carry a balance on specific purchases with the Flex for Business plan. The tradeoff: Your spending limit is lower with Flex for Business.

- No Fee for Employee Cards. You never have to pay extra for employee cards with Ink Business Premier. Excellent news if you trust your employees enough to charge on the company’s dime.

Disadvantages of the Ink Business Premier Card

Consider these drawbacks before you apply for the Ink Business Premier Card. Clearly, it’s not for everyone.

- $195 Annual Fee. Ink Business Premier has a $195 annual fee. That’s a cinch to offset if you spend more than $10,000 each year and pay your balance in full each month. If your business budget is smaller, consider a no-annual-fee business card.

- Doesn’t Play Nice With Other Chase Cards. Ink Business Premier stands alone in the Chase ecosystem. You can’t transfer points earned here to other Chase cards, where they may be worth up to 50% more at redemption. Your points’ redemption value tops out at 1% here.

- No Travel Transfer Partners. You also can’t transfer your points to any of Chase’s more than 15 travel partners, which include major airlines and hospitality families. The right transfer can boost your points’ redemption value by 200% or more and slash your business travel costs in the process.

How Ink Business Premier Stacks Up

See how Ink Business Premier compares to another popular Chase business card: the Chase Ink Business Cash Credit Card.

| Ink Business Premier | Ink Business Cash | |

| 5% Earn Rate | Chase Travel purchases | Office supply and telecom purchases, up to $25,000 per year |

| 2.5% Earn Rate | Purchases over $5,000 | None |

| 2% Earn Rate | All other eligible purchases | Gas station and restaurant purchases, up to $25,000 per year |

| 1% Earn Rate | None | All other eligible purchases |

| Pay in Full? | Yes, but many purchases eligible to pay over time | Not required |

| Transfer Points? | No | Yes, to other Chase cards and Chase travel partners |

| Annual Fee | $195 | $95 |

Other Alternatives to Consider

If you’re not sure Ink Business Premier or Ink Business Cash are right for you, consider these other small-business card options.

Final Word

The Chase Ink Business Premier Card is ideal for people who own growing businesses with fairly high spending requirements. If you make multiple purchases of $5,000 more each year and can afford to pay your charges in full each month, you can’t do better within the Chase ecosystem.

Which is the other side of the coin. If you have multiple Chase cards, the fact that you can’t transfer Business Premier points to those accounts — or transfer them out to travel partners and potentially boost their redemption value — is a major drawback. So is the lack of other travel perks beyond the general travel insurance coverages you’d get with any premium Visa or Mastercard.

But if you’re focused on earning cash back in the here and now, Premier has you covered. You make the call.