Kwarkot

Funding Thesis

Cherry Hill Mortgage Funding Company (NYSE:CHMI) is a micro-REIT (actual property funding belief) that provides its buyers a pretty dividend yield of 16.07% on the present share worth. Because of the Covid-19 influence and present volatility out there, the corporate’s share worth has decreased considerably, creating an ideal entry level for the buyers to earn secure and excessive returns by making a brand new place in CHMI on the present worth ranges.

Firm Overview

Cherry Hill Mortgage Funding is a residential actual property firm specializing in buying, investing, and working residential mortgage properties within the USA. The corporate operates aspiring to generate enticing dividend yield and capital appreciation returns. The corporate generates its income by means of three segments: investments in Residential Mortgage-Backed Safety (RMBS), investments in Servicing Associated Belongings, and Different Providers. Belongings beneath RMBS encompass Company RMBS, residential mortgage pass-through certificates, Collateralized Mortgage Obligations (CMOS), and To Be Introduced (TBA) bonds. The corporate’s present portfolio consists of MSRs, RMBS with maturities of 30 years, and RMBS with maturities of lower than 20 years. The servicing-related belongings encompass Mortgage Servicing Rights (MSRs) and Extra MSRs. The income for FY2021 was $49.75 million.

The corporate has a gross revenue margin of 72.39% and a web earnings margin of 39.37%, which signifies substantial operational and monetary leverage, respectively. The corporate presently has a present ratio of 0.22x and a fast ratio of 0.17x, that are thought-about low. Within the final yr, the corporate has grown its earnings by 46.7%, whereas the trade earnings have grown solely by 5.4%. It has given a return on fairness of seven.7%, marginally decrease than the trade common of 8%. The corporate has important long-term debt on its steadiness sheet that’s not regarding as it’s working in the actual property enterprise, which is named a capital-intensive enterprise.

Anyway, many of the debt is backed by actual property property which mitigates the chance of rising debt. The corporate is certified as REIT beneath taxation because it has maintained its capital distribution coverage of distributing a minimum of 90% of its taxable web earnings to its shareholder. The corporate has one of many highest dividend yields within the trade. Presently, it has a dividend yield of 16.07%, with a mean payout ratio of 90.76%.

Sturdy Dividend Yield of 16.07%

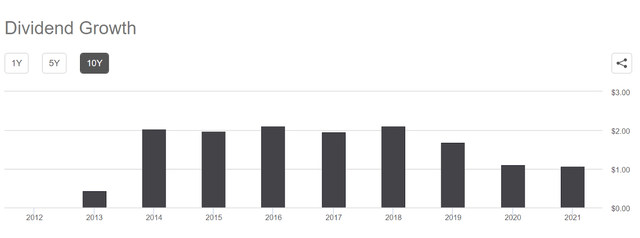

The corporate has lately introduced a quarterly dividend cost of $0.27, which is an annualized dividend cost of $1.08. If we divide the annualized dividend cost by the present share worth of $6.78, it’s going to give a dividend yield of 16.07%.

Searching for Alpha

The corporate has a secure and strong dividend coverage, however throughout FY2019, the dividend cost decreased considerably because of the Covid-19 disaster. I imagine the dividend cost will present important enchancment within the quick time period as a result of the corporate has proven enchancment in revenue margins and income in Q1 2022 and is predicted to proceed this development even within the coming quarters. I believe the present dividend yield of 16.07% could be very enticing for these buyers who wish to earn mounted returns with restricted danger publicity.

Searching for Alpha

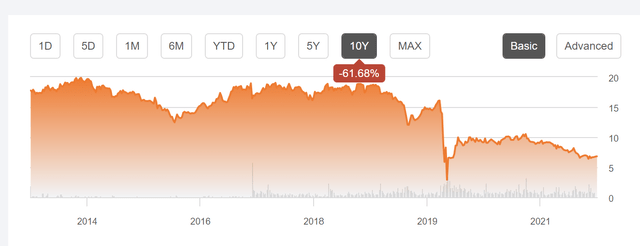

The corporate is a micro-REIT. Earlier than FY2019, the corporate used to commerce within the worth vary of $17-$18. With a mean annualized dividend cost of $2.00, the dividend yield was within the vary of 10%-12%. I believe that on the present worth ranges, buyers have one of the best entry level to earn secure returns of 16.07% on their investments.

Key Danger Issue

Enhance within the rate of interest: Because of the elevated value of borrowing, rising rates of interest sometimes lead to a lower within the demand for mortgage loans. The quantity of goal belongings out there to the corporate might change if fewer mortgage loans are originated, which could negatively influence its capability to accumulate belongings that meet its funding objectives. The corporate’s goal belongings that had been issued earlier than a rise in rates of interest might likewise supply yields which might be decrease than these of the present market. The corporate mitigates this danger by means of rate of interest hedging actions, however these hedging contracts might be costly relying on the volatility degree out there. Thus, the rising curiosity is a reason behind concern for the corporate.

Valuation

CHMI has a market cap of $126 billion and is presently buying and selling at a share worth of $6.78. The corporate has witnessed a YTD decline of 19.29% within the share worth. The corporate is buying and selling at a P/E a number of of 5.72x with FY22 EPS estimates of $1.20 (this REIT experiences EPS and never FFO). I imagine the corporate is buying and selling at a pretty valuation on the present worth degree. The strong 16.07% dividend makes it an much more enticing funding alternative. Going forward, I imagine the corporate can commerce at a P/E a number of of 6.5x, which is near the commercial P/E common. This provides us a goal worth of $7.80, a 16% upside from present worth ranges.

Conclusion

CHMI has a robust dividend yield of 15.86%, with a 16% upside potential within the share worth. The corporate has proven enchancment within the revenue margins in Q1 2022, and I imagine the revenue margins will stay sturdy all through FY22. The corporate has witnessed a major decline within the share worth up to now six months, and I imagine the inventory is undervalued at present worth ranges. I assign a purchase ranking for CHMI on the idea of its sturdy dividend yield and important upside potential within the inventory worth.