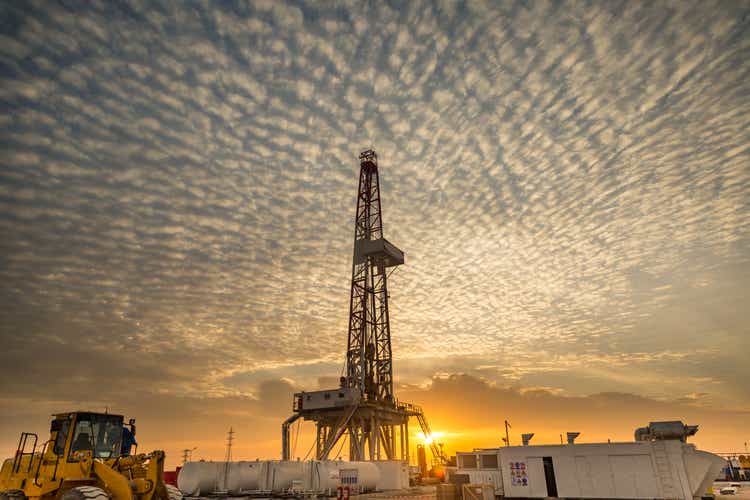

sasacvetkovic33/E+ by way of Getty Pictures

Chesapeake Power (NASDAQ:CHK) was initiated with a Purchase ranking and $137 worth goal on Tuesday at Benchmark, saying it has “one of many business’s most beneficiant return-of-capital packages,” and its long-term return of capital mannequin applied since rising from chapter is “not absolutely appreciated within the firm’s low cost a number of to the E&P sector and different gasoline shares.”

Chesapeake’s (CHK) $5B in acquisitions through the previous six months have constructed scale and stock, and have “improved the corporate’s capital depth, requiring proportionately much less capital to take care of increased manufacturing volumes,” Benchmark’s Subash Chandra wrote.

The corporate doesn’t lead the sector in free money circulation yield but it surely does lead “when it comes to complete return,” in line with Chandra, including that its return-of-capital ambitions are supported by main positions within the Haynesville and Marcellus shale performs.

Citing the corporate’s sturdy steadiness sheet after rising from chapter, Goldman Sachs lately reinstated protection of Chesapeake (CHK) with a Purchase ranking and $106 worth goal.