(Bloomberg) — Join the New Economic system Every day e-newsletter, comply with us @economics and subscribe to our podcast.

Most Learn from Bloomberg

China’s financial system is paying the value for the federal government’s Covid Zero coverage, with industrial output and shopper spending sliding to the worst ranges because the pandemic started and analysts warning of no fast restoration.

Industrial output unexpectedly fell 2.9% in April from a 12 months in the past, whereas retail gross sales contracted 11.1% within the interval, weaker than a projected 6.6% drop. The unemployment fee climbed to six.1% and the youth jobless fee hit a report. Traders responded by promoting all the things from Chinese language shares to U.S. index futures and oil.

China’s financial system has taken an unlimited hit from the federal government’s stringent efforts to maintain the virus at bay, with main cities like Shanghai locked down for a number of weeks and restrictions in lots of different locations reducing into spending, shutting factories and blocking provide chains.

The federal government is insisting on sticking with its Covid Zero technique to curb infections, though the excessive transmissibility of the omicron variant places cities at larger danger of repeatedly locking down and reopening. Shanghai is slowly beginning to reopen, nevertheless it’s more likely to take a very long time for companies to return to regular operation.

Zhang Zhiwei, chief economist at Pinpoint Asset Administration, stated it’s potential the financial system may contract within the second quarter, placing the federal government’s formidable full-year progress goal of round 5.5% additional out of attain.

Whereas the “authorities faces mounting strain to launch new stimulus to stabilize the financial system” the effectiveness of any new insurance policies relies on how Beijing adjusts its zero-tolerance coverage in opposition to the omicron disaster, he stated.

China’s benchmark CSI 300 inventory was down 0.7% as of 11:19 am native time. The onshore yuan was little modified at 6.7895 per greenback, whereas the yield on 10-year authorities bonds rose 1 foundation level at 2.83%. Healthcare and shopper staples shares have been the worst performers within the CSI 300 Index, whereas energy-related shares have been the most effective performers. S&P 500 Index futures slumped 0.7% and oil declined 1.4%. US Treasuries rose as international traders shifted into haven belongings.

What Bloomberg Economics Says

“China’s April exercise knowledge laid naked the injury from Covid lockdowns in Shanghai and different components of the nation. The affect was a lot wider and deeper than anticipated.”

“The information level to a deeper slowdown this 12 months than anticipated.”

Chang Shu and Eric Zhu

For the total report, click on right here

Beijing has signaled that coverage makers will step up help for the financial system, with Premier Li Keqiang just lately urging officers to make sure stability by means of fiscal and financial coverage.

The Individuals’s Financial institution of China took steps on Sunday to ease a housing crunch by lowering mortgage charges for first-time homebuyers. Nonetheless, it left the rate of interest on one-year coverage loans unchanged on Monday, as inflation strain and worries about capital outflows scale back the scope for extra easing.

“It’s clear that the affect of lockdowns, or the worry of lockdowns, overwhelmed any financial easing, and the Shanghai lockdown had ripple results throughout the nation,” stated Wei Yao, head of analysis for Asia Pacific and chief economist at Societe Generale SA. The soar within the jobless fee can be of specific fear to China’s management, stated Wei.

“If this set doesn’t increase the urgency of adjusting the zero-Covid measures to permit the financial system to normalize, we don’t know what’s going to,” she stated.

The Nationwide Bureau of Statistics stated the Covid outbreaks had a “large affect” on the financial system in April, however the results are more likely to be short-lived. “With progress in Covid controls and insurance policies to stabilize the financial system taking impact, the financial system is more likely to recuperate progressively,” it stated, including that it doesn’t anticipate GDP to contract within the second quarter.

Mounted-asset funding elevated 6.8% within the first 4 months of the 12 months, probably supported by the federal government’s push to broaden infrastructure spending. Nonetheless, cement output was down 18.9% in April and manufacturing of crude metal and metal merchandise each dropped greater than 5%. The manufacturing of automobiles plunged 44% and complete manufacturing output dropped 4.6%.

The authorities put a bullish spin on the numbers, with the official assertion saying the “basic development of high-quality growth remained unchanged regardless of the elevated downward strain.”

Financial stimulus is proving much less efficient within the face of Covid lockdowns, with knowledge on Friday displaying companies and shoppers had little urge for food to borrow in April. Credit score progress weakened sharply final month, with new yuan loans sinking to the bottom degree since December 2017.

Banks may lower their important lending charges on Friday this week, which might assist to additional decrease mortgage charges for homebuyers after the lower introduced by the PBOC over the weekend. Nonetheless, economists see the affect as pretty restricted for now.

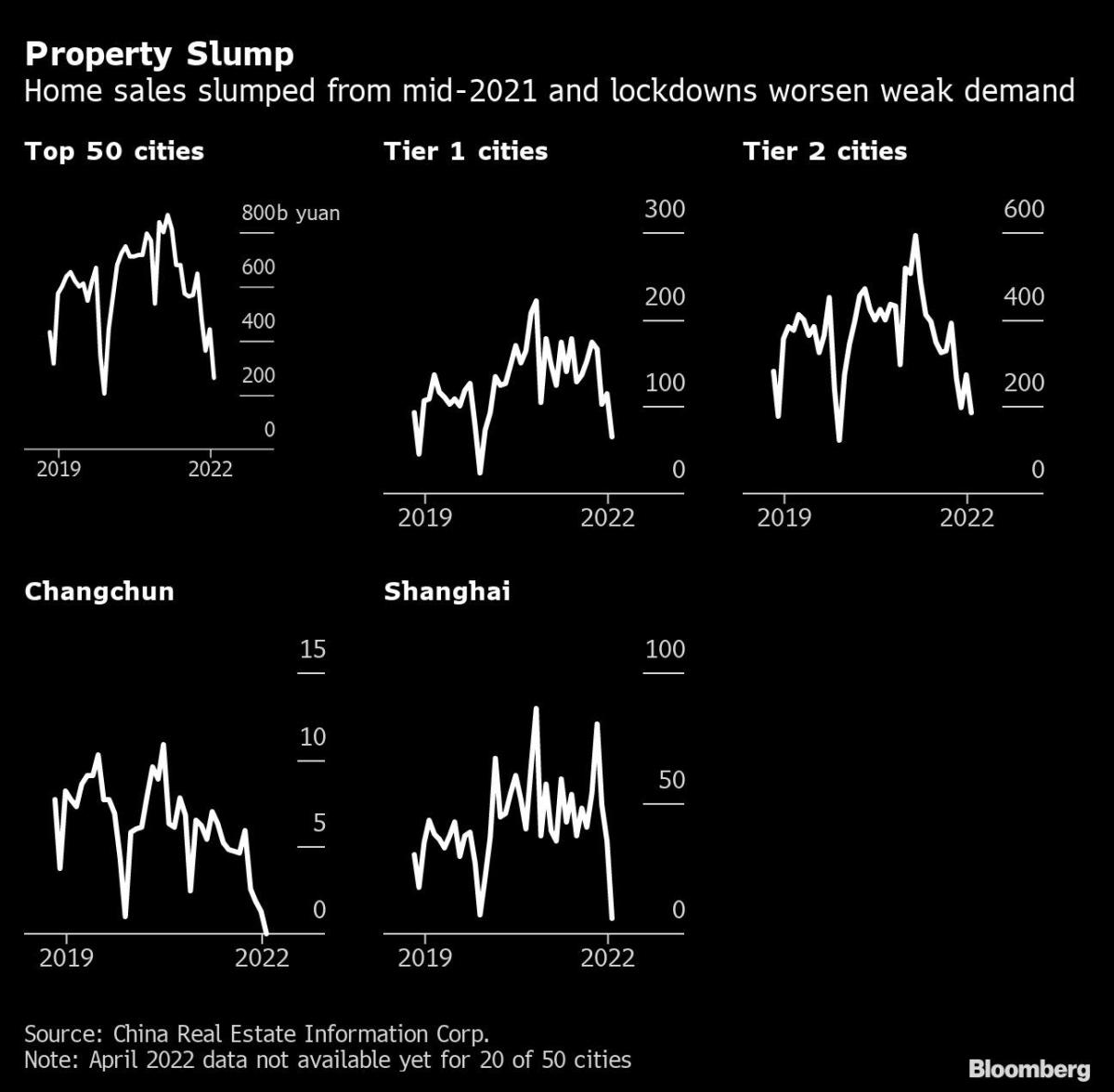

China’s housing market is a vital supply of progress for the home financial system however has been in a hunch for nearly a 12 months, with gross sales dropping at a double-digit tempo each month since August 2021 and costs of latest houses additionally falling after a authorities crackdown on indebted property builders.

Funding in property growth fell 2.7% within the first 4 months of the 12 months, whereas the worth of houses gross sales dropped 32%, the information confirmed.

“The most important downside that we presently see is the continued present strain on credit score, and to the extent that the enterprise confidence is being shaken, and subsequently credit score demand is now essentially being broken,” Helen Qiao, economist for Larger China at Financial institution of America, stated in an interview on Bloomberg TV. “And subsequently it takes greater than only a easy rate of interest lower to spice up the credit score demand.

(Updates with extra particulars all through.)

Most Learn from Bloomberg Businessweek

©2022 Bloomberg L.P.