Steve Jennings

Introduction

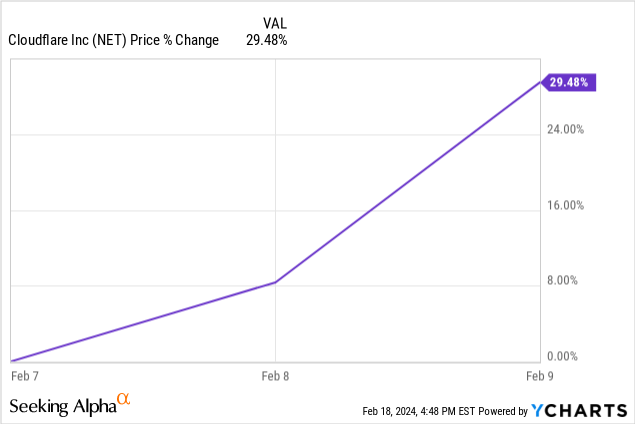

On Thursday, February 8, Cloudflare, Inc. (NYSE:NET) reported its Q4 2023 earnings. If you are a shareholder, like I am, you probably remember that, as the stock price jumped considerably.

Ycharts

So, let’s look at what made the market enthusiastic before determining if the stock is still attractive today.

The Numbers

Q4

- Revenue of $362.5M, up 32.0% year-over-year, a beat by $9.5M.

- Q4 Non-GAAP EPS of $0.15, a beat by $0.03.

- Operating cash flow was $85.4 million, or 24% of revenue, and free cash flow was $50.7 million, or 14% of total revenue. Both were at record levels.

- GAAP gross profit was $279.2 million or 77.0% gross margin, up from $206.9 million or 75.3%, in Q4 2022.

- Non-GAAP gross profit was $286.0 million or a 78.9% gross margin, up from $212.5 million, or 77.4%, in Q4 2022.

- GAAP loss from operations was $42.8 million, or 11.8% of total revenue, compared to $50.7 million, or 18.5% of total revenue, in the fourth quarter of 2022.

- Non-GAAP income from operations was $39.8 million, or 11.0% of total revenue, compared to $16.8 million, or 6.1% of total revenue, in the fourth quarter of 2022.

- Fourth quarter operating expenses as a percentage of revenue decreased by 3% year-over-year to 68%.

- Fourth quarter operating margin was 11%, an increase of 490 basis points year-over-year.

Fiscal year 2023

- FY 2023 revenue totaled $1.3 billion, up 33% year-over-year.

- GAAP loss from operations was $185.5 million, or 14.3% of total revenue, compared to $201.2 million or 20.6% of total revenue, in fiscal 2022.

- Non-GAAP income from operations was $122.0 million, or 9.4% of total revenue, compared to non-GAAP loss from operations of $35.7 million, or 3.7% of total revenue, in fiscal 2022.

- GAAP net loss was $183.9 million compared to $193.4 million for fiscal 2022. GAAP net loss per basic and diluted share was $0.55, compared to $0.59 for fiscal 2022. Non-GAAP net income was $169.7 million compared to $44.4 million for fiscal 2022. Non-GAAP net income per diluted share was $0.49, compared to $0.13 for fiscal 2022.

Guidance

For Q1 2024:

- Revenue of $372.5 to $373.5 million, slightly higher than the consensus of $372.49M.

- Non-GAAP income from operations of $34.0 to $35.0 million

- Non-GAAP net income per share of $0.13, slightly higher than the $0.12 consensus.

For the full year 2024:

- Revenue of $1.648B to $1.652 million more or less in line with the $1.65B consensus.

- Non-GAAP income from operations of $154.0 to $158.0 million.

- Non-GAAP net income per share of $0.58 to $0.59, higher than the $0.56 consensus.

My take on the numbers

Cloudflare knows how to play the Wall Street Shuffle: beat a bit, raise guidance a bit, rinse and repeat. Management has always been very clear that it can balance between growth and profitability as it wishes, and these results show that again.

During the pandemic, the market asked for growth and Cloudflare served it. In the post-pandemic crash, the market asked for profitability and Cloudflare gave up some of its growth to balance profitability and growth. It didn’t grow at 50% consistently, as it did for 9 quarters in a row in 2020-2021, but it settled around 30% growth, combined with profitability.

Companies that can fine-tune this so precisely show that they have full control over their company and can push the buttons that are expected from them like a puppeteer pulling the strings.

An example is given by CFO Thomas Seifert:

With the evolution of the composition of our infrastructure, we undertook an assessment of the useful lives of our service and network equipment.

In January 2024, we determined that continuous advancements in hardware technology and improvements in our data center designs have increased the efficiency of how we operate our equipment, resulting in the estimated useful lives of these assets extending from four to five years starting in fiscal 2024.

That sounds like corporate speak, and it is, but Seifert means that the useful life of Cloudflare’s hardware infrastructure went from 4 years to 5 years. That’s an immediate cost reduction of 20% without any effort. Cloudflare can do this because it was so visionary that it left space for GPU chips that can handle AI demands when it changed its infrastructure in the previous cycle. I already wrote about that in more detail in my previous Cloudflare analysis.

A New President Of Revenue

I make it sound like the transition from growth-at-every-cost to balancing profitability and growth was smooth for Cloudflare, but that was not the case. It never is. But great management sees fast that it doesn’t have the right tool set for a new approach. That doesn’t have to do with incompetency but often with focusing on your core competencies and hiring the best people for all the rest.

I think that’s what Matthew Prince, founder and CEO, and Michelle Zatlyn, founder, COO and President, recognized very well. They hired Marc Boroditsky from Twilio to join Cloudflare as its first CRO, Chief Revenue Officer, in November 2022. He did a great job landing big customers and Prince said he was sometimes “embarrassed” by the things Boroditsky found, as they were nowhere near optimization for sales. In essence, the product had sold itself up to then. Prince on the Q4 2023 conference call:

At the time, we had enterprise customers, but we hadn’t operationalized repeatedly and consistently landing them. Mark changed all that. He’s brought in the process and discipline we needed to be world-class in sales the same way we already were in product and engineering.

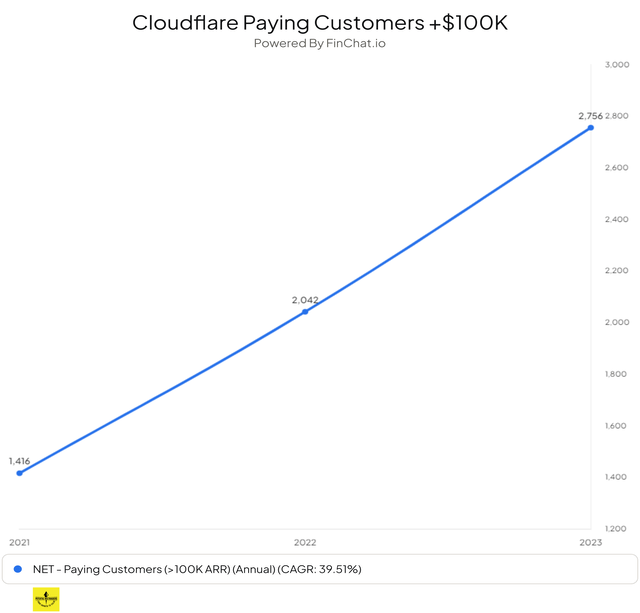

In Q4 2023, 66% of revenue comes from large customers, up from 63% in Q4 2022. 346 customers spent over $500,000, a 56% increase year-over-year. Over the last two years, Cloudflare could double its big customers, from 1,416 at the end of 2021 to 2,754 at the end of 2023.

Finchat

There were also some things that might have indicated friction. When Prince said in Q2 2023 that Cloudflare had sacked the underperformers in the sales team, the market didn’t like it. It was an atypical thing to say for Prince, as he has always been very respectful to employees. The company has always had open meetings with all employees about everything discussed at the Board meetings. Now, it still does that, although there are stricter rules for a public company and, therefore, the communication about certain confidential information is sometimes postponed, but never canceled.

At the time, I pointed out in my article that the problem was strongly exaggerated by the market and I rated Cloudflare as a strong buy. The stock is up almost 150% since then.

After 15 months, another Mark, this time one with a k instead of a c, Mark Anderson replaces Boroditsky as Cloudflare’s President of Revenue.

Anderson is a much more well-known figure in Silicon Valley than Boroditsky. He was the CEO of Alteryx, Inc. (AYX) until recently when the company was acquired. On top of that, Anderson served on Cloudflare’s Board since 2019.

Prince said in the press release:

It’s not often that such a unique opportunity like this presents itself.

and that Anderson is:

a respected industry veteran with a proven track record of driving growth at scale across multiple enterprise technology organizations, who also has a deep knowledge of our business, leadership, and team.

Before becoming Alteryx’s CEO in October 2020, Anderson worked for over six years as president at Palo Alto Networks, Inc. (PANW).

I think this is a good move from Cloudflare. Anderson’s address book will be much bigger than that of Boroditsky, and he has much more experience with big SaaS companies. He could really take Cloudflare to the next level.

Matthew Prince on the conference call:

It’s hard to be the turned-around-guy, and we owe Marc (Boroditsky) a huge debt of gratitude for playing that role.

But there’s someone we always whispered about as our ideal go-to-market leader if we could ever have him as a full-time member of our team, Mark Anderson. He built Palo Alto Networks’ world-class sales organization into the machine it is today. He has an incredible domain expertise and contacts in our industry.

More insights from the call

Cloudflare’s management shared several significant customer wins, like a $33 million deal with the US Department of Commerce and a $6.6 million contract with a leading technology company for Zero Trust Suite.

But Matthew Prince also emphasized that many customers expanded their relationship with Cloudflare, showing the land-and-expand flywheel is still working. You can also see that in the numbers. There were 17% more new customers than last year, but with 32% revenue growth, the rest comes from expansion.

The company is ahead in the implementation schedule of GPU chips, 120 of its hubs versus the planned 100. And this is important for the implementation of AI. Matthew Prince on the conference call:

The breadth and potential impact of the use cases we are seeing with Workers AI are extraordinary. And we’re super excited about the opportunity to establish Workers’ AI serverless model built on Cloudflare’s trusted global network as the best infrastructure for running AI inference tasks.

Just for context, AI inference means doing the task. The huge data consumption for AI and/or LLMs (large language models) is in the training phase. If you use ChatGPT, that is inference and that can be done on the edge.

Workers AI allows you to run machine learning models on the Cloudflare network, and it’s a big success so far:

From our launch in September to the month of December, the average number of daily workers’ AI requests increased 9x. Furthermore, one-third of the thousands of workers’ AI accounts are new to the workers’ platform, suggesting that workers’ AI is not just a significant opportunity in and of itself, but also a potential accelerant to the adoption of the workers’ overall platform.

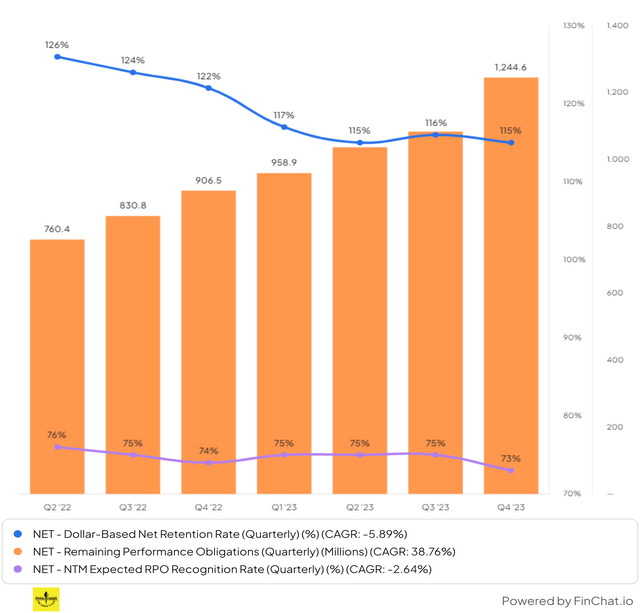

Finchat

Important KPIs

Here are a few metrics that I follow for the stock.

Finchat

First, the DBNRR or dollar-based net retention rate. That is the number that shows how much the whole cohort of customers of the previous year spends in the year that follows, including churn. So, if you have 100 customers in year 1, spending $100,000 in total, and in year 2 there are 10 who churn and the 90 spend $120,000, you get a dollar-based net retention rate of 20%.

The dollar-based net expansion rate, like Twilio Inc. (TWLO) uses, for example, excludes churn, so it only looks at what the remaining 90 customers have spent. So, you divided that $120K by 90, and you get a dollar-based net expansion rate of 33.33%. Quite a difference, right?

The DBNRR is 115%, and that’s quite good in this environment. It shows Cloudflare remains crucial for its customers. CFO Thomas Seifert on the call:

As we mentioned last quarter, there can be some variability in this metric quarter-to-quarter, but we continue to believe the prior decelerating trend in DNR is stabilizing near these levels.

The second KPI is RPO or remaining performance obligation. That’s what the company already has under contract, but it can’t recognize it yet because it still has to give the services in the future. You see the regular growth there. RPO is up 37.9% compared to Q4 2022 and this shows the company is not expected to slow down its revenue growth any time soon.

If you look at the third KPI, you see what is called “current RPO” or that part of RPO that is expected to be recognized over the next 12 months. As you see, this becomes a smaller and smaller part of the total RPO. That’s good, as it indicates that Cloudflare gets longer and longer contracts.

So, here too, only green flags.

Is The Stock A Buy Now?

The market recognizes that Cloudflare is an exceptional company and those are always expensive. Amazon.com, Inc. (AMZN), Netflix, Inc. (NFLX) and Tesla, Inc. (TSLA), for example, have been extremely expensive for 10 or 15 years, or they still are. But I prefer expensive stocks as long as the company executes like Cloudflare did again in this quarter. And expensive also has shades of grey.

For high-growth stocks, a P/E ratio makes no sense at all, as they are not optimized for earnings but for growth. A good proxy is often price/gross profit, as this indicates the ballpark in which the company could monetize once it’s in its maturity phase.

With $989 million in gross profits over the last 12 months and a current market cap of about $33 billion, Cloudflare roughly trades at a price/gross profit ratio of 33, which is definitely very expensive.

That’s why I rate the stock a hold at this point. I added substantially to my position when the stock tanked after its Q1 2023 earnings, but I don’t intend to buy at this price any time soon.

So, why not a sell rating in that case? I am a long-term investor and I have read extensively about investing. Every single research shows the same: the more you buy and sell stocks, the more you underperform. Holding the stocks of the best companies is not easy for people who can’t stomach it, but I can. If the stock of a great company sells off undeservedly (in my opinion), I can even become very enthusiastic. That’s why I made Adyen N.V. (OTCPK:ADYEY, OTCPK:ADYYF) my biggest position when it plunged, for example, seeing it as a temporary drop.

That’s why I won’t sell my Cloudflare position. I think the chances are slightly higher that the stock will drop over the next months than that they go up. But so what? That’s not my investment horizon. I want to hold the best stocks for the long term, the only term over which they can give life-changing returns for investors. If your investment horizon is shorter, you may consider selling or trimming, but you could also (partly) miss a rally then, as you never know what stocks will do over the short term.

Conclusion

Cloudflare, Inc. chalked another impressive quarter. With the addition of Mark Anderson, it adds someone to the C-suite with tons of relevant experience. He knows the company, the industry and big potential customers. I think this will prove to be a very valuable addition.

If you zoom out, you see a company that continues to execute at an astonishingly high level. The company has not delivered a single disappointing quarter since I picked it in September 2020 at $39. Yes, the stock price sometimes dropped or even nose-dived, but when I analyzed those quarters, the reason was never in the fundamentals but rather in sentiment and, of course, the high valuation.

So, the thesis is fully intact, another great quarter for Cloudflare, Inc. and on to the next one!

In the meantime, keep growing!