Robin Gentry

I was planning to exit Coherus BioSciences (NASDAQ:CHRS) this month for the following reasons – a) it already reached my PT once, so I don’t “owe” my CHRS idea anything, b) I don’t like a too long list because it is difficult to manage, and c) I want to add two other stocks, which both look promising. I also mentioned that if TPT members purchased CHRS at the current lows, that they should hold onto the stock until Humira biosim’s approval and toripalimab’s launch after the FDA’s inspection of their Chinese manufacturing facility.

My decision was caused by a couple of things – one, I entered CHRS around January at around $7 and the stock quickly climbed to $10.52 at its peak in about 10 days, which is a profit of 50.29%. I got lucky and took profits, however, I should have just sold out, because I never planned to hold CHRS long term, and the company has not had a similar performance in the last 6 months after that – in fact, it has steadily fallen. Second, the stock has fallen because of the tori delay and the Humira biosim uncertainty/delay. I thought Coherus would do something about that. Instead, they went ahead and bought Surface Oncology – and my first thought was, what the hell! I know Surface well, and it is a company struggling to produce good data. Moreover, their programs overlap with three CHRS programs, and all I could think was – this just delayed my exit. So I took stock of my situation, saw that I was up around 30% overall, and decided to exit the stock.

But my decision faced strong resistance from TPT members, so here I am, putting my arguments together to see if I should reconsider.

Coherus is a developer of biosimilars that, in the last couple of years, decided to switch tracks and become an oncology therapy developer. This it did by gaining rights to a Chinese anti-PD 1 molecule called toripalimab. This is a promising molecule – in China, at least – being the first locally developed anti-PD 1. In an article earlier, I had written about the stiff market competition in the anti-PD 1 space, but also commented on the need for a new one. However, tori met with a frustrating hurdle when the FDA was unable to inspect its Chinese manufacturing facility due to COVID.

Thus, Coherus was lucky it did not completely give up on its biosim business. Although Udencya, its core revenue generator, has been faltering due to tough competition, its newly launched Humira biosimilar has a lot of expectation behind it. So anyway, here are my notes from June updates provided internally to TPT members:

China accepted toripalimab application for review. FDA inspected China site, found 3 issues which are “readily addressable.” Mark Cuban’s Cost Plus Drug Company will sell CHRS Humira biosim. Presented Tori TNBC data at ASCO. Reported promising overall survival data from a Phase 3 study for toripalimab in the treatment of aggressive head and neck cancer.

These are upbeat developments, and I had an internal buy rating on CHRS. So why did I change my rating in less than 3 weeks? What gave?

Well, right after my note above, AbbVie and Coherus got into a new legal battle over Humira’s biosimilar. However, it appears that the battle was resolved as soon as it began, based on AbbVie’s earlier deal with Coherus. Here’s where matters stand now:

On June 6, 2023, Coherus BioSciences, Inc., a Delaware corporation (the “Company”), received a notice letter from AbbVie Inc. (“AbbVie”) alleging the Company breached its settlement and license agreement with AbbVie (the “AbbVie Agreement”), which grants the Company a royalty bearing, non-exclusive license under AbbVie’s intellectual property rights to commercialize YUSIMRY in the United States commencing on July 1, 2023, because of the Company’s announcement on June 1, 2023 of its pricing agreement with Mark Cuban Cost Plus Drug Company, PBC (“CPD”) and its plans to offer YUSIMRYTM to CPD customers beginning in July 2023. The Company sent a response letter to AbbVie on June 11, 2023 denying the allegation in full and requesting that AbbVie provide more information about the allegation.

Solely to maintain certainty that it would have continued access to the license granted by AbbVie to the Company in the AbbVie Agreement with an upcoming planned launch of YUSIMRY in July 2023, the Company filed a motion for a temporary restraining order against AbbVie in the Delaware Court of Chancery on June 13, 2023. In response, AbbVie filed a motion for preliminary injunction on June 13, 2023.

The parties engaged in discussions to attempt to resolve the dispute and on June 14, 2023 entered into a stipulation resolving the Company’s motion for temporary restraining order, whereby AbbVie agreed that it will not seek to terminate the AbbVie Agreement based on its June 6, 2023 notice, and that it will not terminate the Agreement unless it first serves a new notice of breach and affords the Company an opportunity to cure any alleged breach.

Thus, AbbVie’s intention does not seem to be to terminate their original agreement, it is just trying to seek more clarity on the Mark Cuban arrangement. I have no reason to believe this is not a good thing.

On July 3, Coherus launched Yusimry, finally, at a launch price of $995 per cartoon, which is an 85% discount to Humira’s list price. There was no overwhelming improvement in the stock price on the news, a part of the reason for which may be that a South Korean company launched its own version of Humira generic just a day later, bringing the number of Humira generics in the US market to a total of 8.

What really made me decide against retaining CHRS was the next item on the news – the Surface Oncology acquisition. The terms of the acquisition were complex:

Under the terms of the agreement, Coherus will issue shares of its common stock at a price of $5.2831 per share to acquire all outstanding shares of Surface stock for a total value equal to the sum of $40 million plus Surface’s net cash at closing of the transaction (currently expected to be between $20 and $25 million). Surface shareholders will also receive CVRs for 70% of milestone and royalty-based value of existing programs with Novartis AG (NZV930) and GSK plc (GSK4381562), as well as CVRs for 25% of upfront payments made pursuant to potential ex-US licensing agreements for SRF114 and 50% of upfront payments made pursuant to potential ex-US licensing agreements for SRF388, subject to certain deductions as set forth in the contingent value rights agreement. Amounts under these CVRs are payable for a period of ten years following the closing of this transaction.

We can safely ignore the CVRs for now, for their impact on CHRS share price today should be theoretically negligible. So CHRS paid $65mn for $25mn of SURF’s cash of $25mn and the rest of its shares (pipeline), valued at $40mn. A TPT member tells me the following:

They did NOT pay for Surface, they RECEIVED a net payment: first, the $20-25M in net cash that Surface will have on its balance sheet at the time of the closure. Second, Coherus will save about $50M in (duplicate) R&D. $75M is much more than it is paying for Surface and its interesting compounds.

The first statement is, of course, correct. The second one is debatable. Are they saving $50mn in duplicate R&D, or are they sending good money after bad?

Coherus plans to use Surface programs in conjunction with tori’s development programs, with which there are synergies. However, this implies two things – that toripalimab is a promising molecule, and Surface programs have traction.

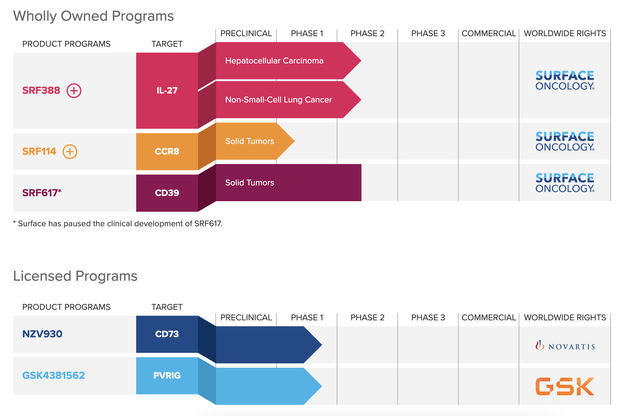

For reference, here is the Surface pipeline:

SURF pipeline (SURF website)

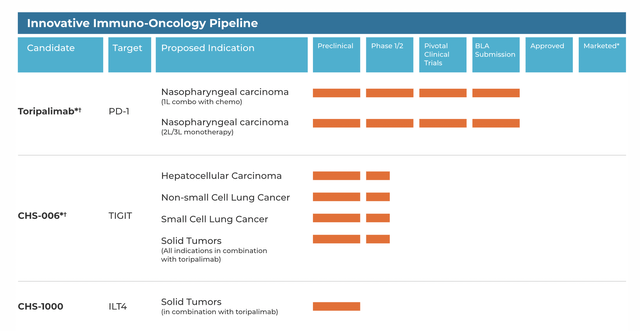

If you compare that with the CHRS oncology pipeline, you can see that some of the programs target the same or similar indications:

CHRS pipeline (CHRS website)

Thus, common indications include hepatocellular carcinoma and NSCLC, where CHRS has a TIGIT molecule and SURF has SRF388, an IL-27 targeting molecule. IL-27 regulates TIGIT in certain ways:

…[based on] recent studies describing IL-27 regulation of TIGIT …. we found that IL-27Rα was associated with the upregulation of TIGIT on memory CD4+ T cells.

Thus, there are synergies that could be explored. However, while I could be open to arguments about tori’s potential, I am not convinced the future for Surface is an easy one. They are very, very far from success; and the synergy, if it exists, is not immediate. Thus, the Surface acquisition delays my ability to exit CHRS quickly – and this was always my intention. I never considered CHRS a truly long term play except on the basis of its biosim business. Since focusing on its R&D pipeline takes it away from the biosim business, I think this is not a good deal for me.

Financials

CHRS has a market cap of $403mn and a cash balance of $128mn. Last quarter, they had revenues of $32mn from their legacy business, including $26mn from UDENCYA, which is a reducing number, and $6mn from Cimerli, which is a new revenue addition. The company expects its 2023 net product revenue will exceed $275 million, including at least $100 million of CIMERLI® net revenue. In May, the company made a bid to raise $50mn from the market.

Cost of goods sold (COGS) was $16.9 million for the three months ended March 31, 2023, R&D was $34.2 million, and G&A was $49.2 million. These are very large numbers for a company with $128mn in cash and a projected $275mn net revenue for 2023. Taken everything together, CHRS simply does not have a cash runway beyond the next 4-5 quarters, and this constitutes a singularly critical risk for the stock.

The stock has a very high institutional presence, and a high average trading volume of over 3 million shares. This tells me that big players are buying and selling this stock in large volume; which often makes the stock move in unpredictable ways. The largest holders are all the market makers like BlackRock, Temasek, AllianceBernstein, J.P.Morgan and others. Insiders have never bought stock in the last 2 years.

Risks

Apart from the cash runway risk, the Surface deal, as I mentioned, is another major downside for someone like myself who does not want to hold on to this stock for too long. In fact, this is the risk that the bulk of my article focuses on discussing, so there is no need to talk about it here again.

The other risk, one that I have covered in my CHRS coverage before, is that I was never too convinced about the need for another anti-PD1 inhibitor like toripalimab in the US market, which already has many of these. Indeed, it could be a good sell in China, where it is touted as the first “domestic” anti-PD1. In the US, however, it could quite probably be considered as just another “me too” molecule in an overcrowded space.

Bottom Line

So I am going to exit the stock because I have couple other candidates I would like to buy. On the other hand, I did clearly say that these are low prices, and there are reasons that someone who bought at these lows could expect it to go higher. Whether that profit will be more than what I would do with the two other stocks I have in mind, is not yet determined. Having been in CHRS for a while now, and with a 30% profit at the time of writing, I have decided to gamble on that chance.