The monetary sector is seeing an increase in challenger suppliers focusing on the distinctive wants of its 47M+ immigrant inhabitants in the US. These innovators are addressing key challenges immigrants face in banking, similar to constructing credit score, overcoming language limitations, and accessing appropriate fee companies. Comun, a digital banking platform, stands out on this house by providing immigrant-focused monetary companies. Their choices embrace no-fee accounts with no minimal stability necessities, entry to an unlimited money deposit community, and remittance companies to seventeen Latin American international locations. This method has resonated strongly, leading to a powerful 52% month-over-month progress in energetic clients since launching. By tailoring their companies to the precise wants of immigrant communities, Comun shouldn’t be solely tapping into a big market alternative but additionally selling better monetary inclusion in the US.

AlleyWatch caught up with Comun Cofounder and CEO Andres Santos to study extra concerning the enterprise, the corporate’s strategic plans, newest spherical of funding, which brings the corporate’s complete funding raised to $26M, and far, far more…

Who have been your buyers and the way a lot did you increase?

Our buyers have been Redpoint Ventures, ANIMO Ventures, Costanoa Ventures, FJ Labs, RTP World, and South Park Commons. Redpoint Ventures led our Sequence A funding spherical of $21.5M.

Inform us concerning the services or products that Comun provides.

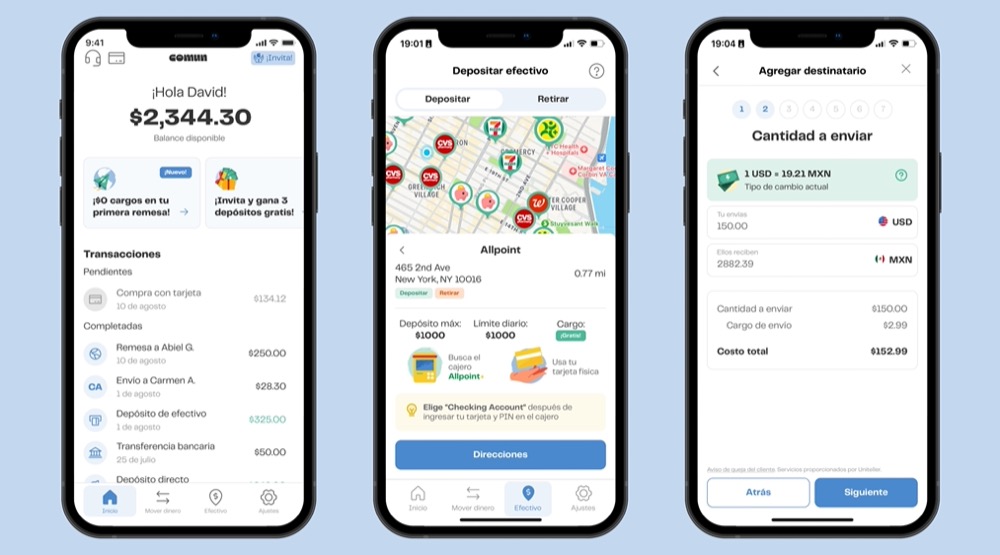

At Comun, we provide an inclusive, low-fee, digital monetary resolution that features an FDIC-insured US checking account, VISA debit card, on the spot remittance service, entry to Zelle, and entry to the most important money deposit community within the U.S., all accessible through a user-friendly, Spanish-first cellular app.

What impressed the beginning of Comun?

My cofounder, Abiel Gutierrez, and I have been impressed to begin Comun after going through monetary exclusion within the U.S. after we migrated from Mexico. After we each got here to the US to review, we confronted a number of challenges opening a checking account, from a language barrier to ID necessities.

As we appeared into this matter, we discovered the Latino group has been underserved in accessing monetary services and products that match their distinctive wants. Many don’t have social safety numbers or credit score scores within the US, so the extra conventional methods banks assess and perceive potential clients don’t work for this group. Along with these obstacles, entry to monetary companies within the US will be extraordinarily pricey. Latinos are 3x extra prone to go unbanked and pay a mean of 5x increased charges for fundamental companies. All these elements, together with our personal experiences, impressed us to begin Comun. We need to present all Latinos within the US with easy-to-access and inexpensive banking options and assist them obtain upward mobility.

How is Comun completely different?

Clients can open an account with over 100 IDs from Latin America – now we have a really complete KYC system that has allowed us to take away most of the friction factors immigrants sometimes face whereas additionally blocking fraudulent actors.

Our accounts don’t embrace charges – There’s a $0 opening payment, $0 minimal stability, $0 month-to-month payment, and $0 membership payment.

One of many largest and inexpensive money networks – our customers can deposit and withdraw money at ~100k areas across the US without cost or at industry-leading costs.

Worldwide transfers (remittances) to 17 international locations in Latin America – relations in LATAM can obtain funds at a checking account or by way of a money community of over 300k retailers throughout the area at industry-leading costs in comparison with incumbents like Western Union.

Spanish-first buyer assist – clients can contact Comun 24/7 by cellphone, e-mail, chat, and WhatsApp with native audio system.

Peer-to-peer on the spot fee community – clients of Comun can ship cash simply to family and friends who even have Comun accounts for no value.

What market does Comun goal and the way large is it?

At Comun, our mission is to empower immigrants and their households to show their arduous work into upward mobility. At present, the Hispanic inhabitants within the U.S. is greater than 63M and is predicted to achieve 111M by 2060.

What’s your online business mannequin?

Just like different fintech companies like Chime, our income comes from interchange charges and different product choices like our remittance program and money deposit community.

How are you getting ready for a possible financial slowdown?

We’re lucky that our remittance service and expanded money deposit community have diversified our income streams, lowering our reliance on interchange charges and demonstrating resilience in opposition to 2025’s unsure macroeconomic headwinds. Our focus this 12 months is to proceed providing the perfect product expertise and increasing our remittance program into different international locations in Latin America. We now have additionally been very considerate in increasing our workforce and have remained lean regardless of our progress.

What was the funding course of like?

To be frank, we weren’t trying to increase our subsequent spherical. We began receiving preemptive provides from buyers, which led us to launch a full course of. We obtained considerably extra curiosity than we might settle for, and each earlier investor determined to double down.

What are the largest challenges that you simply confronted whereas elevating capital?

We really feel very lucky that our buyers consider in our mission, which sparked this funding spherical.

What elements about your online business led your buyers to put in writing the examine?

We obtained optimistic suggestions from our buyers. A standard theme amongst buyers was our progress. Many VCs informed us that we have been one of many fastest-growing shopper fintech corporations they’d seen not too long ago. We have been additionally informed we had superior unit economics than most different corporations they evaluated.

What are the milestones you propose to realize within the subsequent six months?

We now have aggressive targets set for this 12 months that can assist deepen our relationship with our clients. That features offering clients with extra alternate options on how they fund their accounts, enhancing our fraud detection capabilities, ensuring each buyer has a fantastic product expertise, and together with extra international locations in Latin America the place clients can ship cash.

What recommendation are you able to supply corporations in New York that would not have a recent injection of capital within the financial institution?

Be laser-focused on what really issues. At Comun, we stripped away something non-essential and zeroed in on our core mission. We stayed near our clients and ruthlessly prioritized solely what would considerably transfer the needle. In powerful instances, the flexibility to prioritize ruthlessly could make all of the distinction.

The place do you see the corporate going now over the close to time period?

We envision Comun because the one-stop trusted monetary companion for immigrants within the US. Nevertheless, to get there, we acknowledge that immigrants want entry to credit score options, the information on tips on how to construct a fantastic credit score rating and ongoing monetary recommendation, whether or not it’s round saving for retirement, shopping for a home, or constructing an emergency fund. We consider we’re well-positioned to turn out to be that trusted companion for our clients.

What’s your favourite summer season vacation spot in and across the metropolis?

I really like occurring highway journeys with my spouse and daughter and discovering new locations round New York. There’s all the time one thing new to discover only a quick drive from the town.