sitox

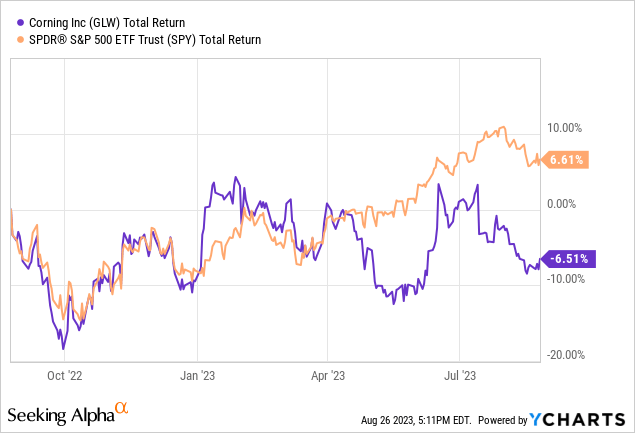

Over the past year, Corning (NYSE:GLW) stock has provided minimal return, fluctuating around the $32-34 price range and underperforming the broader market. However, the premise presented in my previous 2022 article about GLW, in which I recommended it as a buy, remains largely unchanged: the stock remains a compelling option for long-term value investors, with the potential to outperform the S&P over the long run.

With the down cycle almost over and certain changes planned by the management, GLW is likely to return to its growth stage soon, which means now is the perfect time to accumulate a position in my view.

Corning’s stock offers exposure to high quality business with strong pricing power

As long-term investors, our focus should be on fundamentally robust businesses that can survive and flourish independent of market conditions. One of the key aspects we should pay attention here is pricing power, or the ability of a company to increase prices without causing substantial demand disruption. This idea is largely promoted by Warren Buffett, who identifies pricing power as the “single most important decision in evaluating a business.”

Corning is one of the prime examples of a company with strong pricing power in its core business units.

Hence, there is limited competition to Corning’s display and glass business. Corning’s Gorilla Glass had been incorporated into nearly six billion devices as of 2020 and now covers smartphones from Samsung (OTCPK:SSNLF), Sony (SONY), Google (GOOG) (GOOGL), OnePlus, and dozens other phone manufacturers. Moreover, Gorilla Glass remains the exclusive choice for all iPhone models by Apple (AAPL). According to research, Corning achieved 73% penetration in the global smartphone industry in 2016, and in 2022, it commanded a dominant position in the general display glass market, with a market share of 40%.

A similar trend is evident in Corning’s optical communications segment. Corning is the world’s largest fiber optics cable manufacturers, holding a market share of 17% in 2021.

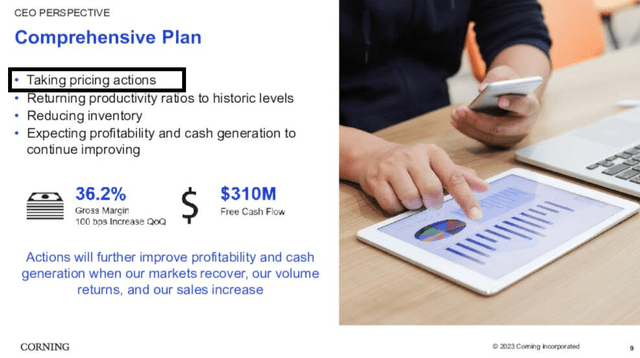

With a strong grip on the largest market share in two major segments, the company’s leadership seems well aware of their leading position. Leveraging this, the management has already made the decision to adjust the pricing structure higher. In optical communications, pricing actions already took place in Q2, which helped Corning offset weaker demand in this segment. A similar change is set to kick in for the display unit during Q3.

From the latest earning call:

I would like to now walk you through the elements of our plan and the strong results we’re delivering. We’re taking pricing actions. Most recently in Display, we expect these actions will contribute to overall profitability improvement in the third quarter.

Corning Q2 2023 earnings presentation

In turn, display technologies and optical communication segments contribute to about 57% of Corning’s revenue and 66% of net income, which means pricing adjustments within these two segments are likely to substantially enhance the company’s revenue and profitability. Consequently, we can anticipate a positive uplift in margins and revenue in the coming quarters, a development that may not yet be factored into market expectations in my opinion.

GLW trades at a ~13.5 forward P/E, provides consistent earnings and dividend growth, and maintains a robust balance sheet

When it comes to financials, I believe GLW continues to prove itself as a safe investment.

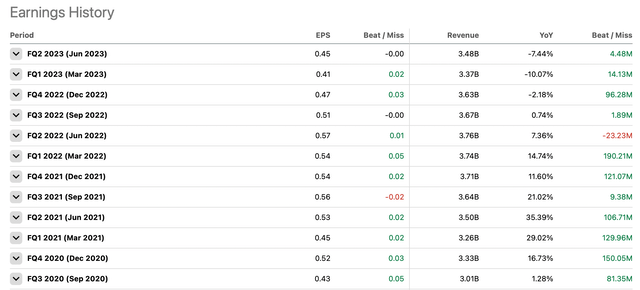

First of all, Corning’s revenue has been growing consistently over the past few years, aside from the last three quarters. During this period, the declines can mainly be attributed to cyclicality and broader market conditions. We can anticipate that the uptrend will resume in the next few quarters, boosted by pricing actions, new smartphone releases, and the ongoing demand for fiber technology, particularly given the surge in AI advancements.

Seeking Alpha

Secondly, the stock is currently trading at a P/E ratio that is close to historical lows. With just ~13.8 forward P/E and solid history of earnings growth (Net income 3-year CAGR is 46%), GLW is one of the lowest-valued quality stocks in the market.

Additionally, despite ongoing investments in its core technology, Corning offers a solid forward dividend yield of 3.45% with a payout ratio of approximately 60%. Its 5-year dividend CAGR sits at around 10.4%, indicating that even during periods when the stock price is in the accumulation zone, investors are supported by consistent dividend payments.

Finally, Corning’s balance sheet remains robust. Yes, the debt burden might appear relatively high on paper, with about $7.4 billion in long-term obligations and $1.5 billion in cash. However, Corning has generated an average of $2.7 billion in cash flows from operating activities and about $1 billion in free cash flow over the last 3 years, which positions the company well to manage its debt obligations comfortably.

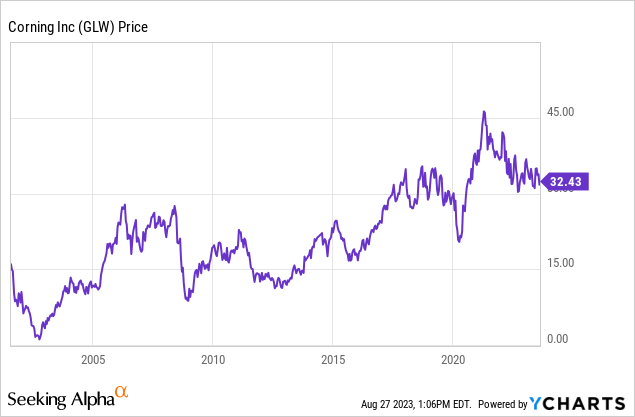

The stock has been in the accumulation zone and is poised to go up from here

As mentioned at the beginning of this article, the stock has provided marginal-to-no return in the recent years, with its price fluctuating around the $32-34 level (notwithstanding positive overall returns due to dividend payouts). However, looking at the longer timeframes, it’s evident that GLW has maintained a consistent upward trend since 2001, and the current price plateau probably signifies an accumulation phase. Given the management’s pricing adjustments and the probable resurgence of demand in the coming years, we can expect the next bullish cycle to kick off soon.

Key takeaway: Corning is set for an upturn and could offer a safe bet for long-term investors

Corning’s stock has shown minimal returns in the past year, staying around $32-34 and underperforming the broader market. However, the recommendation to buy remains consistent from my 2022 article due to GLW’s potential for long-term value investors.

With the management implementing pricing adjustments and the end of a recent downturn potentially in sight, GLW is poised to enter a growth phase, making it an ideal time to accumulate shares. Corning’s dominance in key market segments, such as display technologies and fiber optics, and its strategic pricing moves are likely to positively impact revenue and profitability. Low valuation (~13.8 forward P/E), stable earnings growth, a solid dividend yield (3.45%), and a robust balance sheet make the stock a safe bet in my opinion.