Coverdash is an insurance coverage dealer that may provide help to generate quotes and purchase enterprise insurance coverage by means of its companions. Then, you need to use Coverdash to pay your premiums, file claims and replace your protection as wanted.

You probably have comparatively easy insurance coverage wants — for instance, in case you want basic legal responsibility or employees’ comp insurance coverage to adjust to contracts or state legal guidelines — Coverdash affords an environment friendly procuring expertise. Quotes come from respected insurance coverage corporations, and the platform supplies loads of element that will help you make an knowledgeable determination.

Sadly, you’ll have to buy elsewhere for industrial auto insurance coverage. And in case you want extremely specialised forms of protection, like key individual insurance coverage, an in-person insurance coverage dealer might be your finest wager.

Coverdash insurance coverage: Execs and cons

Get a number of quotes for basic legal responsibility, skilled legal responsibility, enterprise homeowners’ insurance policies, D&O and employees’ comp insurance coverage with one utility.

Pay premiums and file claims by means of the Coverdash platform.

Coverdash’s insurance coverage companions embody a few of NerdWallet’s top-rated enterprise insurance coverage corporations, together with Chubb, Vacationers and Nationwide.

No industrial auto insurance coverage.

Coverdash is a brokerage, not an insurance coverage firm. Your protection can be supplied by a 3rd social gathering.

How Coverdash works

Coverdash will get insurance coverage quotes from a number of corporations based mostly on the data you present. You’ll want to supply:

-

Primary data like your title, telephone quantity, e-mail handle and enterprise web site, in case you have one.

-

Your corporation sort, authorized construction, business, handle and yr based.

-

Annual estimated income and payroll.

After that, Coverdash will generate quotes from its companions.

Coverdash insurance coverage companions

What it’s wish to get a quote from Coverdash

👋 I’m Rosalie Murphy, NerdWallet’s author protecting enterprise insurance coverage. Right here’s what you’ll be able to anticipate once you get a quote from Coverdash.

I advised Coverdash I operated a brand new, one-person home-based business as a florist and wanted basic legal responsibility insurance coverage. I predicted $10,000 in annual income. (That is hypothetical; sadly, I’m not a florist on the facet.)

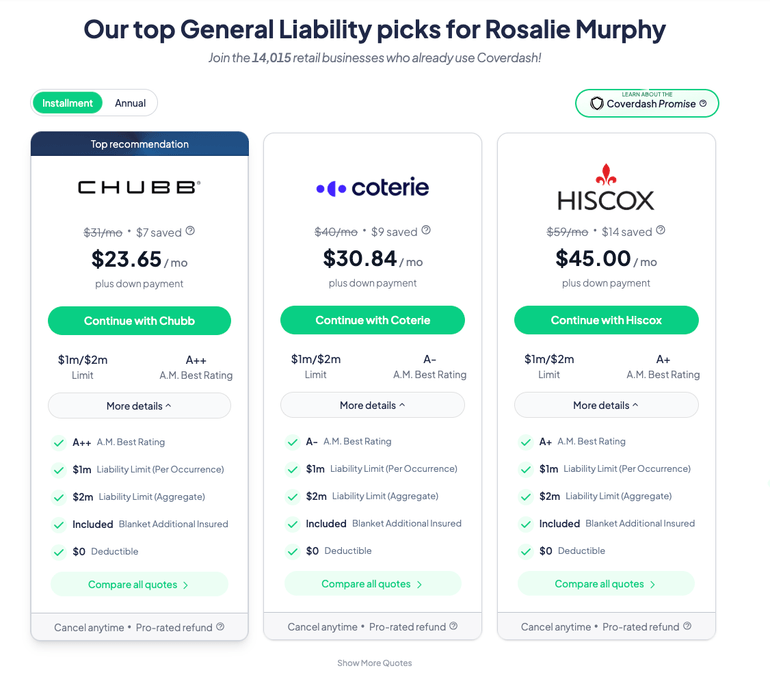

In lower than a minute, the service supplied a number of quotes for a basic legal responsibility coverage:

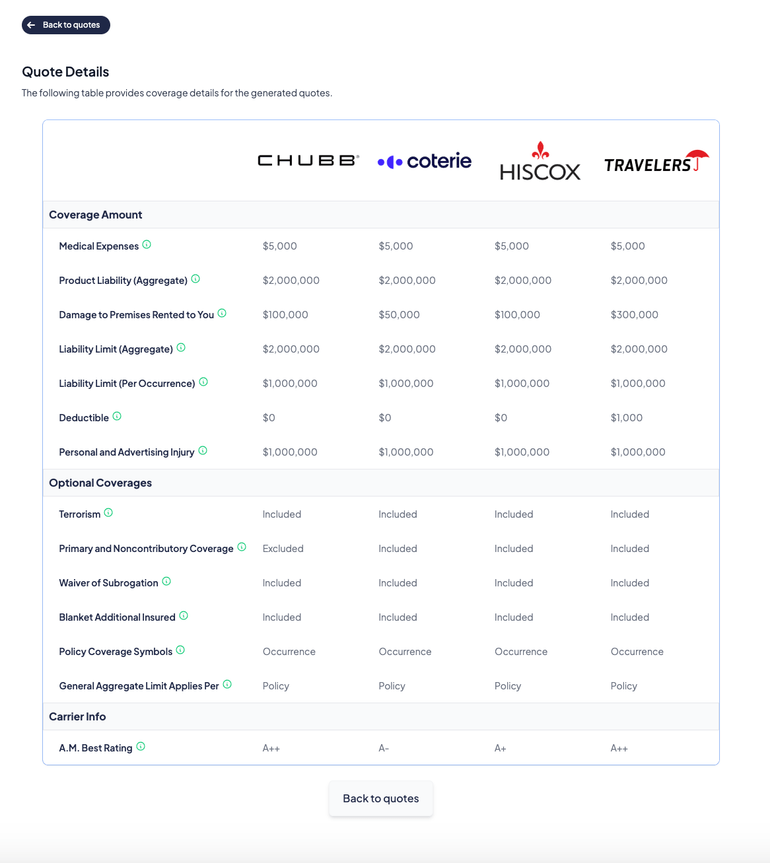

Once I dug deeper, Coverdash supplied a useful desk that allow me evaluate protection limits, deductibles and extra coverages. This made it straightforward to determine variations in insurance policies relative to their costs:

General, these insurance policies are fairly related. However as an example, Chubb — the most cost effective quote — truly affords extra protection for harm on rented premises than Coterie, which is barely costlier.

Chubb doesn’t embody main and noncontributory protection, although. Meaning Chubb’s coverage received’t pay out earlier than any others that may cowl the identical declare. For my hypothetical floral enterprise, that in all probability doesn’t matter. Nevertheless that protection is typically required for different professions, like contractors.

Whereas I didn’t choose an insurer, I did have to supply contact data to see their quotes. Coverdash adopted up through e-mail and with two telephone calls the following day. (The calls didn’t proceed after that, which is at all times a priority with companies like this.)

My quote was additionally saved after I logged within the subsequent day.

Coverdash insurance coverage: Kinds of protection

Via its companions, Coverdash affords the next insurance policies:

All companies want: Common legal responsibility insurance coverage

Common legal responsibility insurance coverage protects your online business in case of third-party claims of bodily damage and property harm. NerdWallet recommends that each one enterprise homeowners carry a basic legal responsibility coverage. Some leases and contracts require you to have this protection.

🤓Nerdy Tip

If your online business has a bodily location, contemplate a enterprise proprietor’s coverage as an alternative. BOPs embody basic legal responsibility insurance coverage together with industrial property insurance coverage, which pays out in case your stuff is destroyed in a lined occasion like a hearth. Most additionally embody enterprise interruption insurance coverage, which helps cowl your bills whilst you’re making repairs and may’t function usually.

For companies with lower than $1 million in income, Coverdash says the overall legal responsibility insurance policies it sells normally have premiums in these ranges:

-

Retail companies: $700-$1,500 yearly.

-

Skilled, scientific and technical companies: $700-$1,300 yearly.

-

Wholesale commerce: $700-$2,500 yearly.

-

Lodging and meals companies: $1,000-$3,000 yearly.

-

Building companies: As much as $5,000 yearly.

Many companies want: Employees’ compensation

Employees’ comp is required in most states, although which corporations want it varies by business and what number of workers you’ve. Protection kicks in if certainly one of your workers is injured on the job and wishes medical care and day without work to get well.

Employees’ comp prices can fluctuate extensively relying in your business. For example, building companies are likely to have the very best prices since building employees typically have extra threat of damage than retail employees.

For companies with lower than $1 million in income, Coverdash says the employees’ comp insurance policies it sells normally have premiums in these ranges:

-

Retail: $500-$1,600 yearly.

-

Wholesale commerce: $500-$1,600 yearly.

-

Lodging and meals service: $900-$2,500 yearly.

-

Building: $1,000-$10,000 yearly (varies by state and what companies the corporate supplies)

Many companies want: Skilled legal responsibility insurance coverage

Skilled legal responsibility insurance coverage, often known as errors and omissions insurance coverage, protects your online business in case a shopper accuses you of negligent or insufficient work. Should you present companies to prospects for a price, you need to have E&O insurance coverage.

For companies with lower than $1 million in income, Coverdash says the skilled legal responsibility insurance policies it sells normally have premiums in these ranges:

-

Skilled, scientific and technical companies: $800-$3,500 yearly.

-

Building (a particular E&O coverage for contractors): $1,200-$5,000 yearly.

-

Expertise: $1,300-$2,400 yearly.