Once you lack a Social Safety quantity, it might probably get in the best way of your capability to construct credit score within the U.S., because it’s a requirement on most bank card purposes. Plus, bringing your credit score historical past from a distinct nation is not normally an choice, so you may have two potential roadblocks on the trail to establishing credit score.

However regardless of these obstacles, it is nonetheless potential to begin the clock in your credit score historical past right here. Some bank cards can help you bypass one or each of those necessities.

It’s usually U.S. residents and noncitizens with licensed work permits on this nation who qualify for a Social Safety quantity. Nevertheless, you might qualify for an alternate type of identification, equivalent to an Particular person Taxpayer Identification Quantity (ITIN), no matter your immigration standing. Some bank card issuers can help you apply with this quantity, or with different types of ID, equivalent to a passport.

Listed here are some bank cards which you can get with out a Social Safety quantity.

With no Social Safety quantity or ITIN

Firstcard® Secured Credit score Builder Card

CARD DETAILS

-

As much as 15% money again at 29,000 associate retailers.

-

As much as 10% money again on qualifying purchases. This charge is stackable with different money again earned. To entry this bonus money again, cardholders should spin the wheel within the Firstcard® Secured Credit score Builder Card app, which can decide the bonus cash-back charge for every eligible transaction.

-

“Limitless” money again of 0.1% to 1% on all purchases, relying on the subscription plan you select. This charge additionally stacks with the others.

Annual charge: $4.99-$12.99 month-to-month or $48-$120/12 months relying on subscription plan.

BENEFITS

The Firstcard® Secured Credit score Builder Card is pleasant to college students and newcomers to the U.S. It skips the Social Safety quantity and credit score examine requirement. As a substitute, you should utilize an ITIN or your passport data to qualify. The cardboard may also help you construct credit score by recording your cost historical past with all three main credit score bureaus: TransUnion, Equifax and Experian. These corporations report the knowledge used to calculate your credit score scores. Amongst secured bank cards in its class, the cardboard stands out as one of many few starter playing cards that earns rewards.

DRAWBACKS

The cardboard’s annual charge makes it more durable to maintain the account open over a long run to protect the size of your credit score historical past. It additionally lacks a path to improve to a daily unsecured bank card when you’re prepared.

Neu Card

CARD DETAILS

Rewards: 1.25% again on all purchases.

Annual charge: $4 per thirty days ($48 yearly) or $7 per thirty days ($84 yearly), relying on eligibility.

BENEFITS

The Neu Card eliminates the credit score historical past, safety deposit and Social Safety quantity necessities for eligible college students. You may be capable of qualify with a legitimate Visa stamp that has six months till it expires. The cardboard doesn’t cost curiosity or charges (you are actually unable to hold a stability from one month to the subsequent). In contrast to different bank cards in its class, it additionally gives the choice to speak to reside customer support representatives, which will be useful when you have questions as you’re getting began with credit score.

DRAWBACKS

As of this writing the cardboard reviews funds solely to TransUnion, so your cost historical past received’t be recorded with Equifax and Experian. Ideally, you need your cost historical past recorded by all three credit score bureaus. The month-to-month charge additionally makes it much less advantageous to maintain the cardboard open and energetic when you climb your means up the credit score ladder, particularly for the reason that issuer doesn’t present an choice to graduate to a greater bank card.

Zolve Bank card

CARD DETAILS

Rewards: As much as 5% money again, relying on which subscription plan you’re eligible for.

Signal-up bonus: As much as $50 in worth, relying on which subscription plan you’re eligible for.

Annual charge: $0 to $299, relying on which subscription plan you’re eligible for.

APR: 19% to 35.25% as of January 2025.

BENEFITS

The Zolve bank card is pleasant to worldwide college students and H1-B and L-1 visa holders. In case you lack a Social Safety quantity, you’ll be able to qualify with various documentation like provide letters, pay slips or different eligible paperwork. The cardboard has three subscription plans, and the credit score restrict you’re accepted for determines which choice you’ll be able to select. The Traditional plan with a $0 annual charge is your best option for learners, provided that it makes it simpler to maintain the cardboard open and energetic over time and have that replicate positively in your credit score. The cardboard reviews funds to all three main credit score bureaus. It additionally earns rewards, which range relying on the plan.

DRAWBACKS

This card just isn’t as clear as different starter playing cards. As an example, the web site doesn’t point out the completely different subscription plans or how they work. Once you’re beginning out with credit score, it’s useful to have easy data upfront to keep away from confusion.

With an ITIN

Chase Freedom Rise®

CARD DETAILS

Rewards: 1.5% money again on all eligible purchases.

Signal-up bonus: Earn a $25 assertion credit score after signing up for automated funds inside the first three months of opening your account.

APR: The continuing APR is 25.99% Variable APR.

The Chase Freedom Rise® doesn’t require a credit score historical past, and you’ll apply with an ITIN quantity in case you don’t have a Social Safety quantity. You will be thought-about for a credit score restrict enhance inside six months in case you use the cardboard responsibly and make funds on time. If granted, a credit score restrict enhance can have a optimistic impression in your credit score scores, supplied that you simply hold your credit score utilization low. As you make purchases, you’ll even be rewarded with a strong flat charge. In your account anniversary, the account is robotically reviewed to see whether or not you’re eligible to improve to the Chase Freedom Limitless®.

The cardboard permits you to enhance your odds of approval with a Chase checking or financial savings account that holds a minimal stability of $250 — however since these sorts of accounts require a Social Safety quantity prime open, you might not be capable of reap the benefits of this feature.

Blue Money On a regular basis® Card from American Specific

CARD DETAILS

-

3% again* at U.S. supermarkets on as much as $6,000 spent per 12 months.

-

3% again at U.S. gasoline stations on as much as $6,000 spent per 12 months.

-

3% again on U.S. on-line retail purchases on as much as $6,000 spent per 12 months.

-

1% again on different purchases.

Signal-up bonus: Earn a $200 assertion credit score after you spend $2,000 in purchases in your new Card inside the first 6 months. Phrases Apply.

APR: 0% intro APR for 15 months on purchases and stability transfers, after which the continuing APR of 18.24%-29.24% Variable APR.

With an ITIN, you could be eligible to make use of your credit score historical past from a distinct nation to use for the Blue Money On a regular basis® Card from American Specific. In case you’re from Australia, Brazil, Canada, the Dominican Republic, India, Kenya, Mexico, Nigeria, Philippines, South Korea, Switzerland or the UK, AmEx (by way of a partnership with Nova Credit score) could have the opportunity. to entry your worldwide credit score historical past and weigh it within the utility course of.

In case you can qualify for this feature, you’ll construct credit score and get the perks usually reserved for individuals who’ve already constructed an excellent credit score historical past within the U.S. The Blue Money On a regular basis® Card from American Specific gives prime rewards in on a regular basis classes and useful introductory gives. There’s additionally a month-to-month $15 assertion credit score for Residence Chef, a meal package supply service, and a $7 month-to-month assertion credit score for a subscription to The Disney Bundle. Phrases apply.

Because the card belongs to the American Specific community, you might face restricted card acceptance when trying to make use of it overseas.

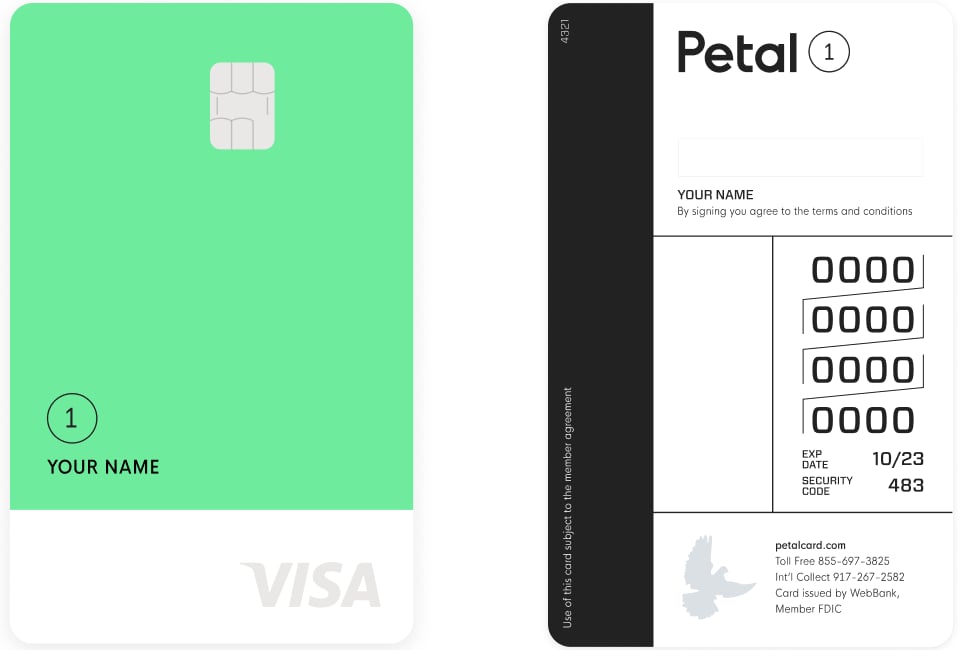

Petal bank cards

Signal-up bonus: Varies by card.

Annual charge: Varies by card.

If it’s a must to pay an annual charge, will probably be tougher to maintain a Petal card open and energetic to reap the advantages it might probably have on the size of your credit score historical past.

Capital One Quicksilver Secured Money Rewards Credit score Card

CARD DETAILS

Rewards: 1.5% money again on all eligible purchases.

Annual charge: $0, however a minimal safety deposit of $200 is required.

APR: The continuing APR is 29.74% Variable APR.

The Capital One Quicksilver Secured Money Rewards Credit score Card builds credit score and earns rewards. It additionally allows you to apply with an ITIN. The cardboard requires a safety deposit, however you may get it again finally in case you’ve maintained on-time funds when you shut the cardboard or get upgraded to the common, unsecured Capital One Quicksilver Money Rewards Credit score Card. It is one of many card’s two standout options, the opposite being the opportunity of a credit score restrict enhance. (You’re robotically thought-about for a better credit score restrict in six months, which may assist your credit score.)

The cardboard requires a safety deposit, which may current an impediment if it doesn’t align together with your funds.