Thesis

sevenstockstudio/iStock Editorial by way of Getty Photos

Crombie REIT (OTC:CROMF) is about to understand considerably in right now’s local weather of inflation and shortages of actual items. As costs rise, actual property equivalent to grocery shops ought to see continued appreciation at the same time as different property fall in worth. Crombie Reit is the one Canadian REIT with giant publicity to grocery shops.

Crombie REIT is a Canadian Grocery Retailer REIT that works in shut proximity with Empire (OTCPK:EMLAF), the proprietor of Sobey’s chain of grocery shops. Empire presently owns 41.5% curiosity in Crombie successfully making them a quasi subsidiary. Crombie’s portfolio is 84% Grocery associated retail, 11% retail-related industrial, and 5% workplace house. The corporate’s most liquid itemizing is on the Canadian TSX (CRR.UN) but additionally trades on the OTC within the US. As the corporate primarily operates and trades in Canada all numbers will probably be in Canadian {Dollars}.

Share Efficiency

Earlier than I begin explaining why I am presently bullish on Combie REIT, I need to level to the spectacular efficiency that this inventory has achieved.

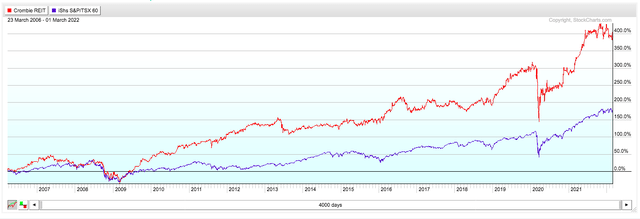

The corporate has outperformed the TSX/S&P 60 since its IPO in 2006 when counting reinvested dividends. Returning over 400% since its IPO far outperforming the TSX/S&P 60, 175% return.

Complete Return (StockCharts.com)

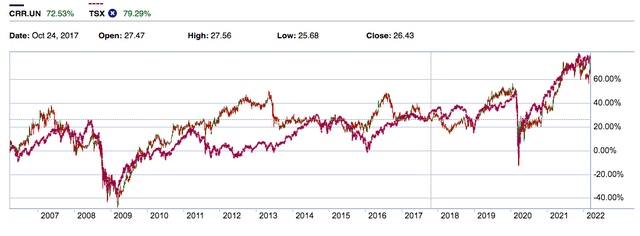

The story will get much more spectacular once you look at the return with out reinvested dividends and see that the corporate has about carried out on par with the identical index excluding dividends.

Crombie In comparison with TSX/S&P 60 excluding dividends (RBC Direct Investing)

Friends

Probably the most direct peer that Crombie has is CT REIT (OTC:CTRRF), which manages the properties for Canadian Tire Company. The 2 firms each primarily handle the properties for a big retail model. Have comparable dividend buildings, comparable credit score scores and are a comparable dimension. CT REIT’s places are primarily targeted on Canadian Tire (OTC:CDNTF) and their further manufacturers which occupy 92% of CT REIT’s gross leasable space. Canadian Tire is concentrated on promoting commerce and recreation items. Crombie is extra diversified, getting about 55% of its hire from Sobey’s.

Credit standing

DBRS Morningstar (MORN) downgraded Crombie REIT’s credit score standing from BBB Steady to BBB Low in June of 2021. The downgrade was attributable to a rise within the debt to EBITDA ratio to 10.7. The debt to EBITDA was anticipated to be 10.5 on the finish of YE 2021. DBRS Morningstar mentioned the development may return to steady if Crombie meets or exceeds morning star expectations of 10.5 at YE 2021 and 9.3 YE 2022. A optimistic ranking would possible be the results of improved asset high quality and diversification and a debt to EBITDA under 8.0x and an EBITDA protection ratio rises above 3.00

Since that point Crombie has offloaded a few of its industrial non-core properties and dropped its Debt to EBITDA to eight.25x and EBITDA/ curiosity protection ratio of three.13x. That is forward of the DBRS schedule and offers a excessive possible hood that Crombie could have a good rerating upwards. Sadly, the senior notes will not be traded so traders cannot provoke a place.

Debt Concerns

Crombie lately rolled over the Sequence B notes that expired final 12 months into the Sequence J notes expiring August 12, 2031, and incurred an curiosity financial savings of .829% or $1,243,500 a 12 months. Crombie additionally has the collection D maturing in November 2022. This can be affected by larger rates of interest because the BOC has begun to boost charges. Most of Crombie’s debt has already been rolled ahead to make the most of favorable charges. Presently, the corporate seems to be prioritizing their fixed-rate mortgages which might end in having much less encumbered properties. The unencumbered property worth is 1.75 billion as of This fall.

Dividend

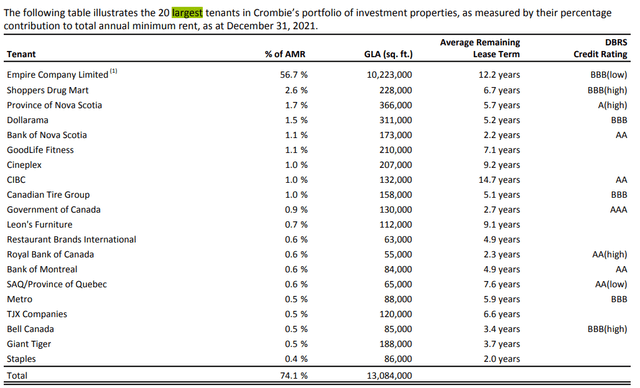

There’s a dividend fee of .89 per 12 months which represents roughly a 5% dividend yield. The dividend is paid month-to-month which makes it a sexy revenue play. Crombie has had a steady FFO payout ratio for the total 12 months of 2021 of 78.1% a strong decline from the 2020 FFO payout ratio of 83.2%. Presently, I see the dividend as secure. My fundamental concerns for this are that the corporate has collected 99% of complete Lease up to now 12 months and the power of their tenants. Crombie has managed to efficiently diversify itself with totally different investment-grade tenants. The core of the portfolio is Empire which has a powerful curiosity in paying its rents to Crombie because it owns 41.5% of the corporate.

Tenants This fall 2021 (Crombie This fall Report)

Valuation

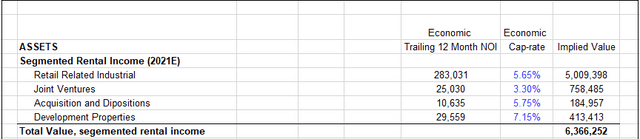

I did a NAV Calculation for this REIT as I consider that’s the easiest way to actually get an correct worth of the REIT and the worth that it’s buying and selling at. The entire knowledge used to find out NAV was from the 2021 Annual Doc which you may get on Sedar and thru my very own assumptions.

Cap Charges and Worth assumptions (By Writer)

The cap charges for growth properties had been decided by including 1.5% of the anticipated quantity of rate of interest improve this 12 months to the retail and associated industries to precisely mirror the place charges will probably be when the buildings begin to hire to tenants.

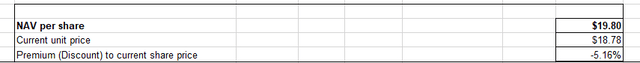

NAV per share (By Writer)

NAV per share got here in at $19.80 per share a 5% premium to market costs when the NAV was computed.

Drivers

Rising inflation, Rising Charges

The present rise in the price of dwelling goes to be hitting affecting the way in which a considerable amount of Canadians will probably be spending their cash. A survey from the Canadian Payroll Affiliation that was reported on January sixth, 2022 mentioned that 36% % of Canadians reside paycheck to paycheck. On the similar time, Canadians have by no means been in as a lot debt with a debt to revenue ratio of 186%. Inflation will drive extra Canadian households to chop spending on leisure objects and spend that cash on primary requirements. On the similar time had been the Financial institution of Canada is elevating rates of interest to fight inflation. This may also cut back the quantity of disposable revenue out there to Canadians as the price of servicing their money owed will increase. The rising charges may match to struggle inflation however the total impact will nonetheless be much less disposable revenue for Canadians. This could drive traders to place their cash to work shopping for actual property which are presently producing cash-flows. I consider that firms which are promoting primary requirements may also be enticing to investments and if there’s a mixture of the 2 they are going to be particularly enticing.

Crombie is well-positioned to profit with roughly ~63% of the corporate’s largest tenants promoting primary requirements.

Credit score Rerating

Crombie seems to be forward of the schedule DBRS set for the corporate to have a optimistic rerating on their credit standing. I consider that DBRS will give Crombie a good rerating someday in 2022. It will preserve certainty for traders that Crombie will preserve an investment-grade credit standing. It will be certain that Crombie is not going to see an increase in the price of capital moreover what will be anticipated from rising rates of interest.

The mixture of traders seeking to become involved in Crombie for its enterprise and the steady investment-grade credit standing ought to cut back the price of capital.

Headwinds

Rising Curiosity Charges

Rising rates of interest sometimes lower the valuation of REITs because it will increase the price of capital. Crombie is not going to be resistant to this as they roll their mortgages and unsecured ahead. The corporate has been profitable in pushing ahead most of their debt to additional expirations nonetheless they nonetheless have 14.1% of debt maturing this 12 months, with one other 23.3% maturing within the years 2023 and 2024. It will cut back the cap charge of each the corporate and the precise buildings which can negatively have an effect on NAV.

Conclusion

Crombie is presently well-positioned to profit from excessive inflation, rising charges atmosphere. The corporate’s distinctive attributes of renting to firms promoting value inelastic items, and proudly owning actual property in prime places throughout Canada ought to drive up demand for shares. One can even count on NAV to extend as investor demand, and an anticipated credit score rerating lowers the price of capital. The most important a part of this story is that the corporate ought to see a boon in investor curiosity as demand for actual property continues to rise on this interval of excessive inflation and investor uncertainty. For these causes, I label Crombie a purchase.