Sean Anthony Eddy

Investment Summary

In my informed opinion, I reiterate that Cross Country Healthcare, Inc. (NASDAQ:CCRN) is a buy following its Q1 FY’23 earnings. The company has transparently laid out growth challenges this year, which have already been priced in swiftly by the market. The stock has rallied back above the 50DMA and the question is where to from here. Investors expect a pullback in forward earnings, but may have over-shot their estimates.

Added to that, you’ve got a complete valuation swing since my last CCRN coverage in August last year, with the stock now trading at 9.7x forward earnings, otherwise a 50% discount to the sector. I believe this is too deep of discount and there’s scope to see CCRN re-rate on that alone in my view. Looking forward, the firm could to $2.1-$2.2Bn in top-line revenues this year, and my numbers call for it to do $150-$180mm in post-tax earnings. Net-net, I believe CCRN is undervalued and look to see it trading back at $33, or $1.2Bn market valuation. Reiterate buy.

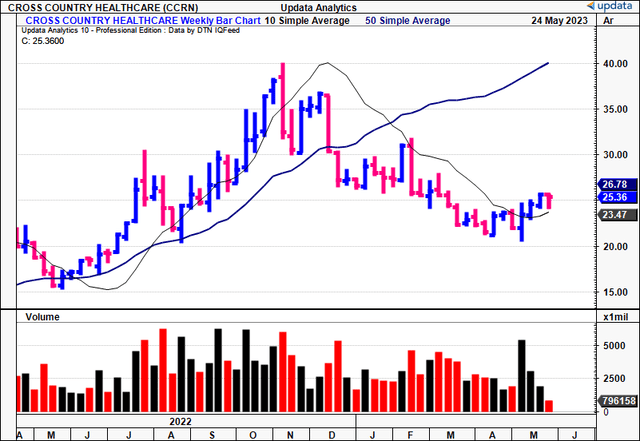

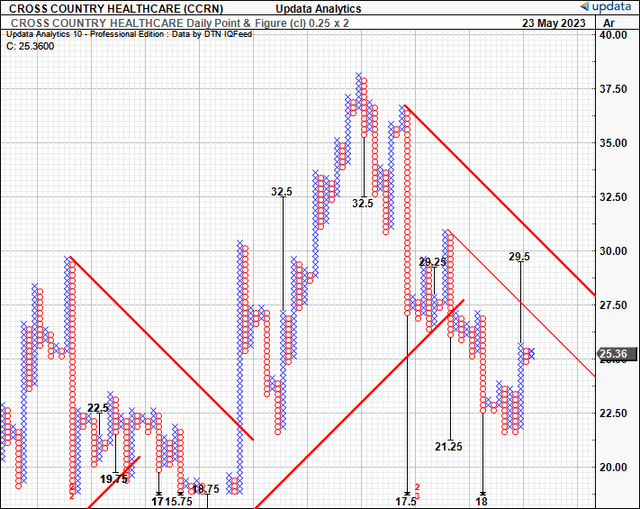

Figure 1.

Data: Updata

Q1 Numbers in detail

Following my comprehensive analysis of CCRN’s first quarter, findings suggest CCRN is well positioned to attract further investment going forward.

Firstly, the negatives. Quarterly revenue pulled in to $623mm, a negligible sequential decline of ~100bps, but substantial YoY collapse of 21%. Management attributed the bulk of downside of travel bill rates returning to range, which impacted growth and overall revenue generation. Key investment findings follow.

I. Top-line desegregation

1. Divisional Takeouts

- The standout in my eyes was the physician staffing segment, clipping 75% YoY growth to $40mm, also 9% sequential upside.

- Nursing clipped revenue of $582mm, reflecting a sequential decrease of 100bps and 24% decrease compared to the prior year. The travel nurse and allied division, the firm’s largest business, declined 2% sequentially and 27% YoY. Revenues were down due to a decline in the number of travellers on assignment, especially the 13-week assignment range. Reason being, organizations have sought to normalize their contingent labor usage in the last 3-6 months, what with the pandemic settling back to dust. This will be a headwind for the remainder of the year for two reasons. Firstly, the drop in demand was unexpected. Second, it is an industry-wide headwind that isn’t unique to CCRN. Management expect utilization rates to lift with seasonality by Q3 this year, but we’ll see because, as mentioned, it is industry wide.

- Similarly, the mobile segment was down secondary to a 22% drop in average bill rates. You’re looking at further drops in bill rates going forward too, suggesting demand is as soft as a down feather. I’d note this as a potential headwind as well, as management expect average bill rates to trend lower throughout FY’23. Keep an eye on this for sure.

Turning to the positives:

- For one, CCRN’s education business (within the nurse and allied segment) came in with its strongest quarter in history, up 25% YoY in volumes.

- Secondly, combined with its home care staffing services segment, is on an annual run rate of approximately $100mm over both divisions.

These are reasonable growth percentages in my opinion but I’d still expect to see $2.2Bn in top-line revenues this year, ~21% YoY decrease.

2. Unit Economics

As mentioned above, the firm’s physician staffing division was strong with a 75% growth rate. You can thank the increase in number of days filled, and improved bill rates, as key drivers here. Breaking this down further:

- First is the improvement in overall collections, producing $47mm in quarterly operating cash flow, a 10x jump on last year’s $4mm.

- This came from a 2-day reduction in days sales outstanding (“DSO”) to 70 days. CCRN expects further improvements in DSO going forward too, and this tells me it will have less cash tied up in working capital, and thus more cash to invest, or to throw off as earnings.

Unfortunately, these efficiencies weren’t shared with the broad nursing segment, as mentioned, as travel assignment demand is compressed due to underlying market trends.

3. Marginal Analysis

In the realm of gross profit, CCRN attained $139mm, commanding ~30bps YoY and sequential lift in gross margin to 22.4%. Primary catalyst underneath this was the amelioration in bill pay spreads within the travel business. Looking further down the P&L:

- It lost ~10% leverage at the SG&A line to $84mm, also up 300bps sequentially.

- Much of this came from salary, 2022 growth investments, and acquisition-related costs.

- SG&A margin stands at 13.5%, up ~60bps from the 12.9% in Q4, and the 9.7% margin set in Q1 FY’22.

- Hence, you’d be looking for the margin to pull back towards the 11-12% range if the increase SG&A was just in-face one-time items, or if this is a more permanent cost structure.

II. Capital Recycling, Value-Creation

1. Gross Productivity

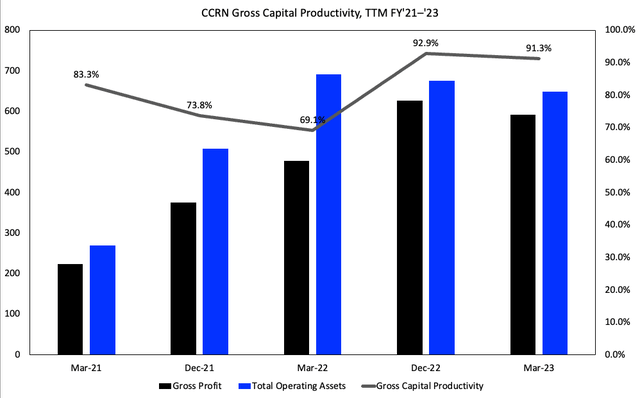

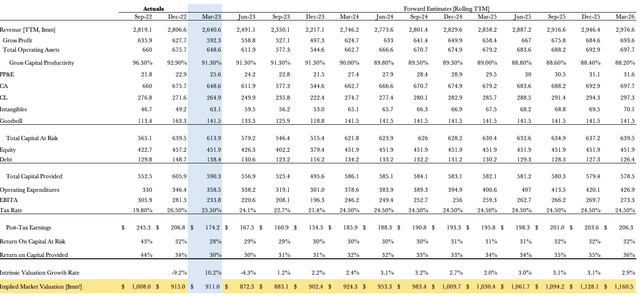

CCRN has a captivating set of business economics in my opinion, revealing its ability to generate exceptional returns on investor capital and drive future economic earnings. The impressive efficiency is exemplified by the fact that for every dollar invested in productive assets, the firm yields a noteworthy $0.91 return as of Q1 (TTM figures). You can see this in Figure 2, tracking the gross profit scaled by total assets across 2021-2022. Both operating assets and gross profit have increased substantially, and the gross capital productivity has risen from 83% to 91%. You’re getting close to 1:1 here, and that would really be something on the profitability front.

Figure 2.

Data: Author, CCRN SEC Filings

The context of this becomes even more apparent as you factor in scaling of the company’s operating assets, which soared from $270mm in 2021 to a staggering $648mm in Q1. Underneath this, the total capital provided by investors escalated from $270mm to $590mm, with the company dedicating 103% of this capital toward productive assets [Figure 3].

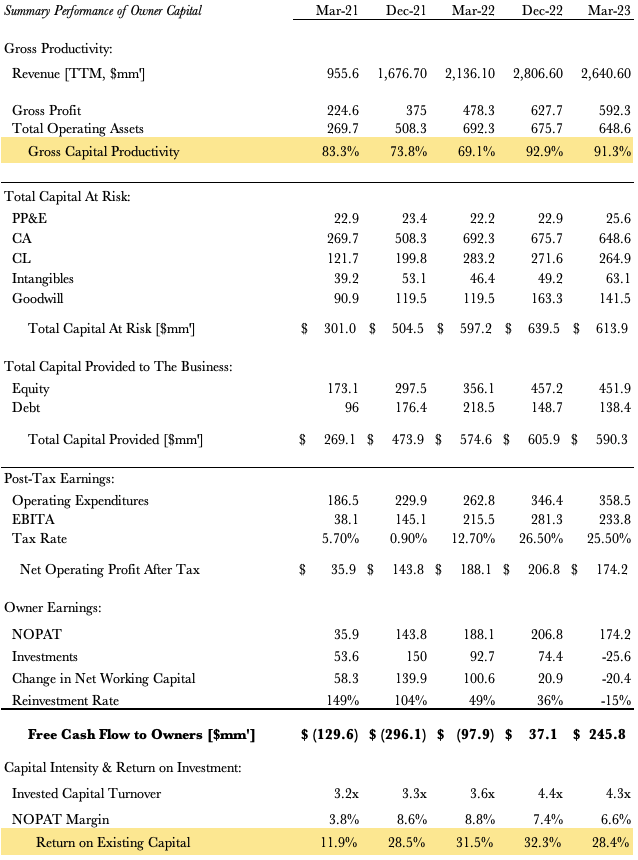

2. Post-tax Earnings Growth

Of utmost significance to the buy thesis is the compelling growth in post-tax earnings over the testing period. Note in Figure 3:

- The tremendous incremental growth in earnings from $36mm $174mm from Q1 2021-’23, representing a cumulative growth of 383%;

- Driving this, CCRN compounding TTM earnings on existing capital at an enviable rate of 25-30% each period.

Furthermore, the company actively reinvested a substantial portion of its earnings (ranging from 50% to 150%), back into the business. I am more than fine with the resulting in negative FCF if the firm is hovering investment returns around the range of 25-30% in my face.

Figure 3.

Data: Author, CCRN 10-K’s

3. Economic Earnings

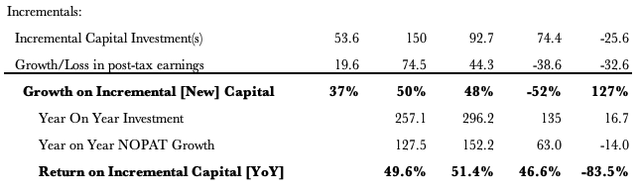

- One cannot overlook the compelling evidence showcased in Figure 4, highlighting the accretive nature of incremental returns. It shows the growth on new capital ranged from an already generous 37% to a very tidy 127%, bar one exceptional setback of -50% in Q4 last year.

- This is even more apparent looking at a YoY basis across each period.

- This has warranted strong intrinsic valuation growth rates, ranging from 12-30% (taking growth as ROIC x reinvestment rate).

Figure 4.

Data: Author

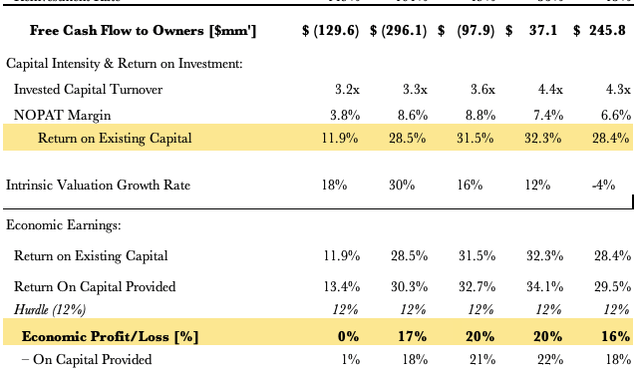

- You’ve got CCRN producing 28-29% trailing economic earnings and return on total capital provided, providing investors with tremendous value for their capital. Put simply, investors have contributed $590mm to the company, only to witness an outstanding 29% trailing return on their investment in Q1.

- It is clear that CCRN’s enticing business economics contribute to its potential for higher valuations over time, ranging from 12-18% per quarter.

Figure 5.

Data: Author

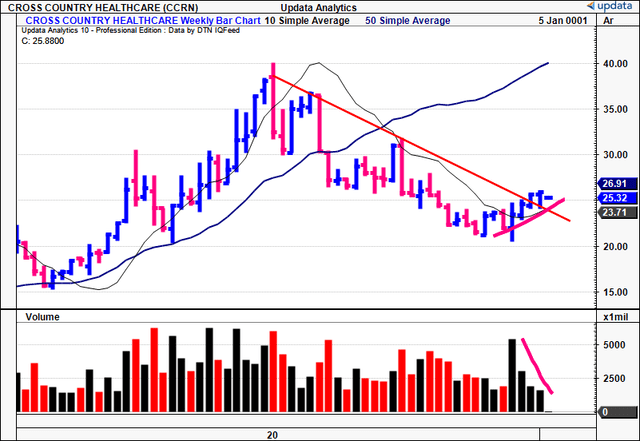

Market Generated Data

First things first. CCRN has broken long-term resistance on low-volume buying. You can see the divergence between price action and volume in Figure 6. Key points to note:

- It had tried to break this resistance line 2x since the October 2022 high.

- The 200DMA is still pushing higher, meaning price could converge to this anyways.

- The break above the 50DMA 4 weeks ago. It has closed higher for the last 3 weeks in a row now, and a 4th week would be remarkable.

Hence, I’d like to see some move volume into the move to suggest there’s serious investment going on there. You can contrast this to times in 2022, when the price rallied from $15 to $40, the demand present to create those kind of moves. There, we had 7-months of continuous upside.

Figure 6.

Data: Updata

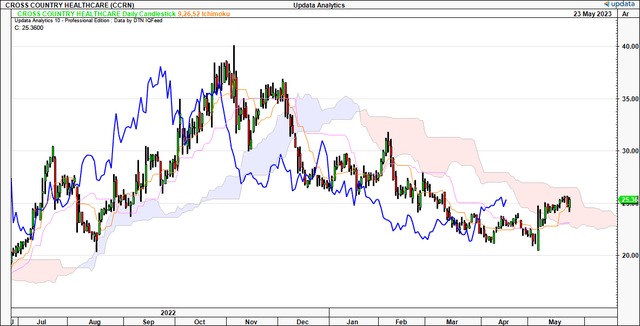

The stock has some work to do in order to turn bullish on the daily frame, looking out to the coming weeks. Shares are trading into the cloud, but the lagging line hasn’t got there yet. It would need to break $25 in the coming weeks for momentum indicators to change. To me this presentation supports a neutral view, and is a continuation of the longer-term downtrend.

Figure 7.

Data: Updata

As such, we have downsides at $21 then $18, with an upside target to $29. This is something to consider. A move higher would be interesting, potentially signalling a move to the $29 mark. Otherwise, if the trend continues lower, I’d be looking towards the 2 previous downside targets as the next objectives. There will be an interesting battle ahead, that’s for sure.

Figure 8.

Data: Updata

Valuation

Heavy bullish weight is added to the risk/reward symmetry when factoring in current market multiples. CCRN is priced at a 50% discount to the sector at 9.7x forward earnings (sector at 19.4x) and 7.5x forward EBIT (sector at 16.5x). This is certainly notable and attracts an ‘A’ rating from the quant system. The firm is also priced at 2x book value, which is about part with the sector, thus demonstrates the market value the firm has created above its net asset value at these multiples.

At the current market cap, assuming a 12% discount rate, the market expects $110mm in post-tax earnings from the company going forward getting you to the $916mm (110/0.12 = $916). This off the trailing number of $174mm, but this trend is in-line with management’s projected decline in turnover as well. Hence, the question is, will CCRN outperform or not?

My numbers have the firm to do $154mm in post-tax earnings this year, so I’d expect some upside on the current market valuation at some point down the line (154/0.12 = $1,280), not without incurring challenges this year. I get to this number at the 7.5x forward EBIT multiple too (7.5×154/36 = $32). Looking to my FY’26 estimates, the firm could compound its intrinsic value to $1.16-$1.2Bn (ROIC x reinvestment rate), supporting the steady-state valuation. Hence, I believe this disconnect in market expectations to my own warrants a buy rating.

Figure 9.

Data: Author Estimates

In short

In summation, CCRN can unlock future value for shareholders over the coming 12-18 months in my estimation. The firm is compounding capital at above-market rates of return, and reinvesting these heavily into future growth. You’re looking at a firm that has doubled its capital at risk since 2021 and more than tripled post-tax earnings in the same time.

This attracted a strong investment over the past 2-years, but investors have cooled off the rally since 2022. My numbers suggest there could be a potential mispricing in the market’s expectations, and this is a bullish factor. That, and you’re buying the company at just 9.7x forward earnings, 50% discount to the sector. I certainly do not believe this is a fair valuation, and there’s scope for a re-rating even there. Net-net, I reiterate CCRN a buy at revised price target of $33 per share.