A_Columbo/iStock via Getty Images

Crude Oil’s (CL1:COM) ever-changing tone continues confusing both sides of the story. On the surface, investors might be tempted to throw the instrument away believing it’s an impossible task in determining the sounds of future pricing. Change occurred, positive change for users, but can it continue long-term remains the question. Much hasn’t changed. Small differences in production vs. usage still determine commodity markets such as oil or natural gas. The production vs. demand circumstance still remains tight. The delicate nature of fine sounds from premium instruments creates an interesting analogy in viewing this marketplace. The musician entered the hall and is now sitting down for the recital. Is the instrument in tune? Shall we head inside to listen? A Stradivarius just might be in the musician’s hands.

The Big Change & Its Meaning

Before the big change is discussed, it might be worth considering recent, yes recent headlines on oil.

- $85 Is Just The Beginning Of The Oil Rally (August).

- Seven-Week Oil Price Rally Ends, But Fundamentals Support Bulls (August).

- Oil Soars Above $90 As Saudi Arabia Extends Deep Output Cuts (September).

- Oil Prices Continue To Climb Toward $100 (September).

- Standard Chartered: $98 Oil Is Well Supported By Fundamentals (November).

Crude trades now in the low $70s. What happened? Can it be explained with just a few simple words, increases in production? In spite of an anti-crude oil production policy from Washington, producers set an American record. In the past several months, production rates, primarily driven from frackers, increased by the needed shortfall of 700,000 barrels per day. From the latest EIA report, crude oil storage, in total, stood at 796 million barrels up from a low of 777 million barrels in September. The price dropped from the low $90s into the high $60s for a short period of time. Production remained steady at 13.2 million barrels per day up from the middle 12s earlier in the year.

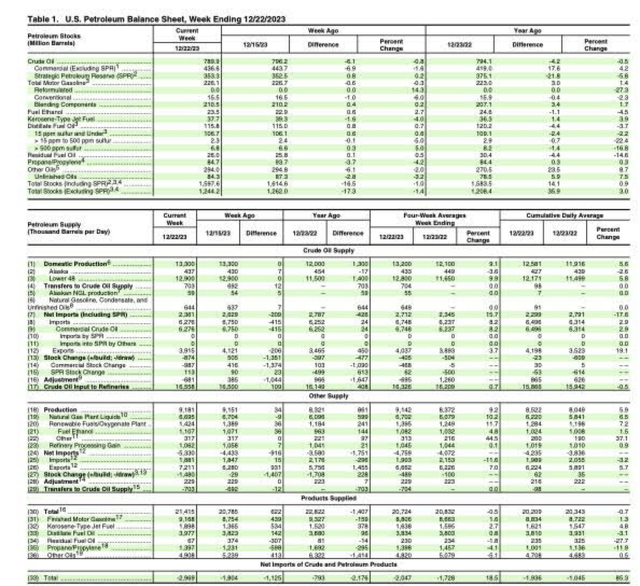

A copy of the latest EIA report follows.

EIA

Inside the report is an interesting comparison year over year, the four-week average is up 1 million barrels per day. The increase came with fewer operating drilling rigs. The increase also using few drilling assets came from a practice known as high grading, drilling, or finishing at only premium locations, and lateral drilling technology means for extending well life. It has also offset recent OPEC+ cuts.

Is this All?

If this were all, this wouldn’t be worth the time to write or read. It isn’t. Several factors, at least four or five, stand to bring about a significant reversal. In order of importance, these are:

- It’s only 700,000 barrels of increased production from earlier in the year. OPEC could easily cut that amount to reverse it. (The data is in table 1, the Excel version.)

- The economic circumstance strongly suggests that manufacturing is in a recession. Diesel usage is considerably lower even with gasoline usage slightly above last year. From the latest EIA report, “Distillate fuel product supplied averaged 3.6 million barrels a day over the past four weeks, down by 4.2%.” Over the past several reports, distillate fuel consistently shows a negative 5% year over year. Jet fuel supplied negatively in the 5% range also.

-

Rate of refinery operation is in the lower 90s% rather than the more typical of the higher 80s for this time of the year.

- No one knows how long the high-grading approach will last. Once this begins dissipating, producers will require higher prices from more expensive production.

- Restoring the Strategic Petroleum Reserve 180 million barrels used in government’s ill-advised attempt to lower crude prices needs to be repurchased. This could by itself reverse the bias at 0.5 million per day over a year.

With tight markets still in vogue, any one of the above could signal the change in tone. And the low crude price isn’t deterring analysts from recommending several oil producers including Exxon Mobil Corp. (XOM), Occidental Petroleum (OXY), and Diamondback Energy, Inc. (FANG). Their sense is that the negative portion of this cycle ended.

Risk

Risks, with crude, are two-sided. For shorts, the list above stands to spoil their parade and change their tune. OPEC’s decision, a few weeks ago, to add more cuts to its already initial cuts in late summer, carried zero weight with the markets. With cuts in place and a stronger usage cycle, summer approaching, its targets could change that reaction. On the economy issue, the Federal Reverse might begin lowering rates in early spring believing that inflation is in balance. It isn’t and those of us who snoop around understand fully. But we aren’t the Fed.

On the other side, longs, a deep recession with material deficits in demand, places oil pricing venerable with possible significant price drops. We expect, at worst, weakness in growth, but certainly not catastrophic collapses. In our view, the analysts recommending buying certain premium producers listed above are probably the closest to the truth being a bottom or close to one, is in place. The next rotation upward approaches. We expect a level of price support followed by a more bullish marketplace. Our stance remains neutral, formally, but with a bullish slant. The instrument played a quite clear tune.