Bellwether Bitcoin skilled a drawdown of 36 per cent from its peak of $126,198 on October 6 to a low of $80,660 on November 21, wiping out practically $700 billion of buyers’ wealth.

The world of cryptocurrencies is reeling from a large $1.16 trillion wealth erosion over the previous 50 days. Bellwether Bitcoin skilled a drawdown of 36 per cent from its peak of $126,198 on October 6 to a low of $80,660 on November 21, wiping out practically $700 billion of investor wealth.

This tally of $1.16 trillion includes over a trillion {dollars} in worth misplaced by prime 10 cryptocurrencies and a couple of hundred billion in market-cap misplaced by a handful of crypto shares equivalent to Technique Inc. of the US (Technique, in brief; previously generally known as MicroStrategy Inc).

Technique’s shares are down 67 per cent from the all-time excessive recorded in November 2024, reminding buyers of how the inventory crashed 95 per cent throughout the dotcom bubble.

Bitcoin has recovered over the week, on the expectation of a fee minimize and a potential restart of bond purchases by the US Federal Reserve in its December coverage, per consultants. Hopes of the speed minimize and a resultant gush of liquidity appear to have helped Bitcoin discover its backside. The irony right here is that it’s the identical liquidity or extra cash provide that it got down to struggle with its restricted 21 million float, is conserving it afloat. It now trades at $90,915 or down about 28 per cent from its October peak.

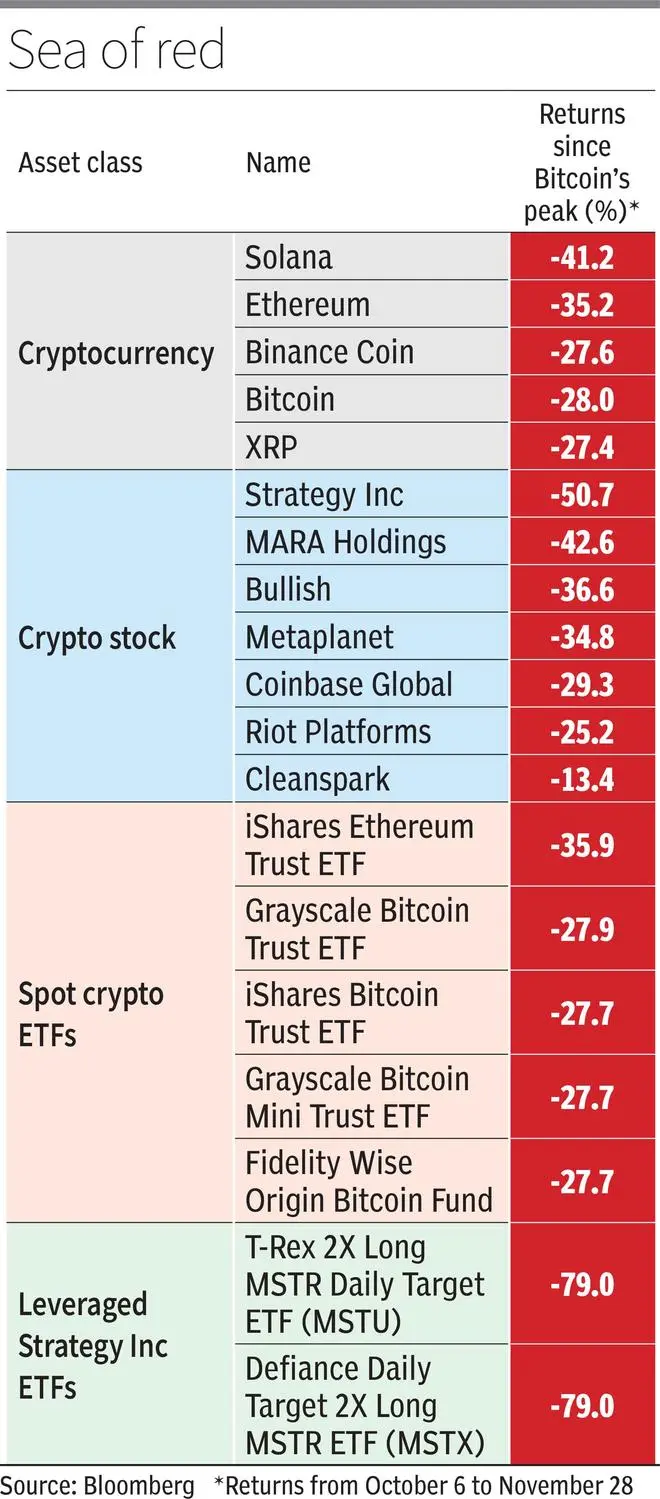

Different main cryptocurrencies, too, continued to tumble triggered by Bitcoin (see graphic).

Rout in crypto shares

Crypto shares, too, have misplaced as a lot. Shares of Bitcoin treasury firms (an organization that invests and holds Bitcoin as a part of its monetary property) equivalent to Technique and Metaplanet (Japan) are down 51 per cent and 35 per cent, respectively. Bitcoin miners MARA Holdings and Riot Platforms are down 43 per cent and 25 per cent. Crypto exchanges Coinbase and Bullish have seen losses of 29 per cent and 37 per cent.

Technique Inc, ETFs

Ever for the reason that US authorities gave the go forward for spot Bitcoin ETFs in January 2024, the market has been flooded with crypto ETFs. These not solely embrace spot ETFs but in addition leveraged ETFs which are merely devices of mass hypothesis. A leveraged ETF borrows cash other than buyers’ funds to commerce in cryptos. Funds that search to ship twice the every day returns of spot Bitcoin are the most well-liked. Twice the returns, twice the drawdowns too!

These aside, there are additionally leveraged ETFs which are uncovered to Technique, which in flip is a levered agency uncovered to Bitcoin. These have extra layers (of leverage) than your common pastry!

Now, what’s so particular about Technique that there are ETFs monitoring its inventory? Technique is in truth a knowledge analytics firm that reworked right into a Bitcoin treasury firm in 2020. It raises funds, each debt and fairness, towards the collateral of Bitcoins. With these funds, it buys Bitcoin and bets on the long-term appreciation of the crypto. It now has 6.4 lakh Bitcoins or about 3.1 per cent of your entire Bitcoin float (about 20 million) at a mean worth of $74,000 (as of Q3 2025).

Nonetheless, the mannequin hinges on an unrealistic assumption that Bitcoin returns can persistently beat buyers’ anticipated fee of returns. Volatility in Bitcoin costs rock Technique’s shares, too. For example, the market-cap to Bitcoin NAV ratio, which was about 1.7x in July 2024, is now 1.1x. This might worsen when MSCI takes a choice to exclude firms with over 50 per cent of property invested in digital property (Technique is one such firm), from its indices, in January.

MSTU and MSTX are two massive leveraged ETFs that purpose to ship twice the every day returns of Technique’s shares. The mixed AUM of those ETFs was about $4.7 billion in December 2024. Now they’ve been diminished to be value simply $831 million. Crypto ETFs, along with such leveraged ones, have eradicated $72 billion of buyers’ wealth since Bitcoin’s peak in October.

Gold: The actual hedge

All these deliver up the query: What goal do cryptos like Bitcoin serve? Are they a retailer of worth or are they a hedge towards inflation?

With such volatility, can they actually be a retailer of worth? With such drawdowns and inflation nonetheless not reined in, have they protected buyers? Apparently not. And they’re nowhere near changing into authorized tender.

However, gold has completed the precise reverse. In greenback phrases, gold has returned 62 per cent year-to-date, whereas Bitcoin has delivered a detrimental 2.7 per cent.

What’s baffling is that gold, valued at about $32 trillion globally, has attracted $43 billion of internet flows into US gold ETFs, to date in 2025. In the meantime, cryptos that are a $3-trillion asset (per CoinMarketCap), have attracted flows of an equal $44 billion into crypto ETFs traded on US exchanges. Makes one query the sanity of crypto bulls.

Final 12 months identical time, we had posed the query whether or not Bitcoin is a forex, retailer of worth or a funds innovation. A 12 months therefore and after 16 years of Bitcoin, the query stays.

On this backdrop, India’s stance on cryptos stands in stark distinction.

Printed on November 29, 2025