JHVEPhoto

Introduction

As a dividend growth investor, I seek new investment opportunities in income-producing assets. I take advantage of market volatility by purchasing attractively valued assets and diversifying my holdings to increase my dividend income with minimal capital. Therefore, I combine adding to existing positions with starting new ones.

The healthcare sector is an exciting area for investment as it tends to be relatively stable and has a consistent demand, so it fits a volatile era. I own shares in pharmaceuticals, medical devices, and insurers. One is CVS Health (NYSE:CVS), which offers a unique combination of pharmacy and insurance services. This diversification allows CVS to benefit from multiple revenue streams and can potentially provide a hedge against industry-specific challenges.

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that:

CVS Health Corporation provides health services in the United States. The company’s Health Care Benefits segment offers traditional, voluntary, and consumer-directed health insurance products and related services. It serves employer groups, individuals, college students, part-time and hourly workers, health plans, health care providers, governmental units, government-sponsored plans, labor groups, and expatriates. Its Pharmacy Services segment offers pharmacy benefit management solutions, including plan design and administration, formulary management, retail pharmacy network management, mail order pharmacy, specialty pharmacy and infusion, clinical, and disease and medical spend management services.

Fundamentals

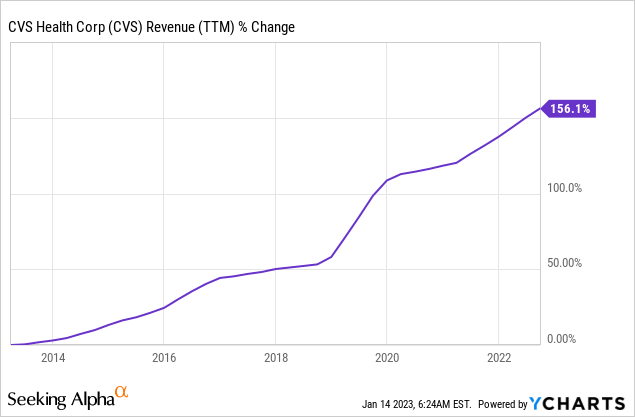

Over the past decade, CVS Health’s revenues have experienced significant growth, more than doubling to 156%. It is attributed to organic growth within the pharmacy business and strategic acquisitions. The acquisition of Aetna, in particular, has been a significant contributor to this revenue growth. This acquisition allowed CVS to expand its portfolio of services, providing customers with a one-stop shop for care, drugs, and coverage. In the future, as seen on Seeking Alpha, the analyst consensus expects CVS to keep growing sales at an annual rate of ~3% in the medium term.

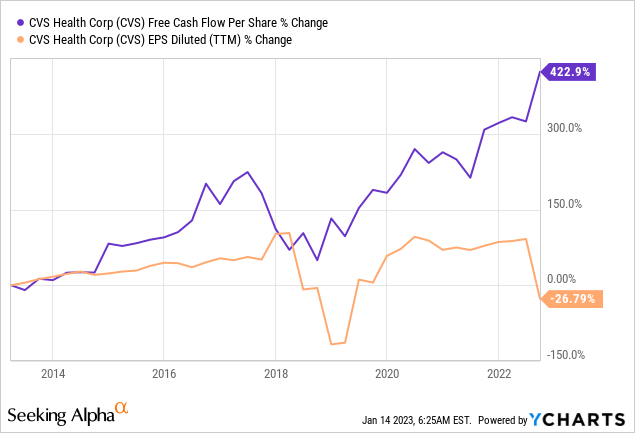

This graph’s EPS (earnings per share) may be misleading as it has decreased by 27% over the last decade. These figures are GAAP figures and include one-time non-cash expenses, which can skew the growth. However, looking at the free cash flow figures, it becomes clear that CVS has experienced a significant growth of 423% over the last decade and is now generating much more cash than in the past. In the future, as seen on Seeking Alpha, the analyst consensus expects CVS to keep growing EPS at an annual rate of ~5% in the medium term.

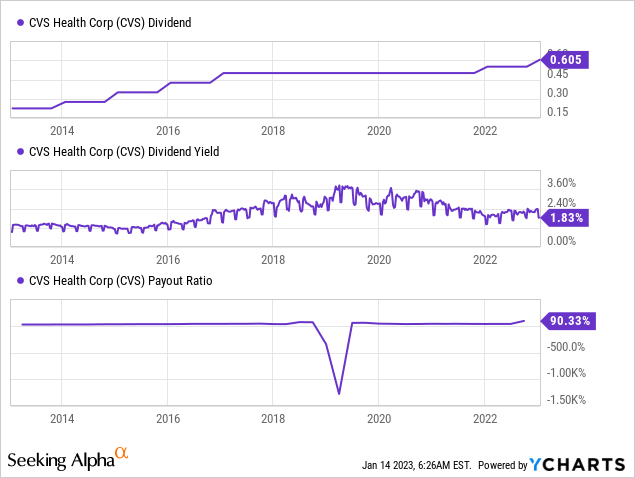

The dividend is one key point for CVS. The company has been paying dividends for 25 years without a decrease. It has frozen its dividend following the Aetna acquisition to deleverage since we had two increases. The dividend is likely safe as the payout ratio is 90% using GAAP earnings and 28% using non-GAAP earnings. The current yield is attractive at 2.7% following the increase paid in February 2023. CVS is a very reliable dividend growth payer, and the future growth of the dividend offers inflation protection to investors.

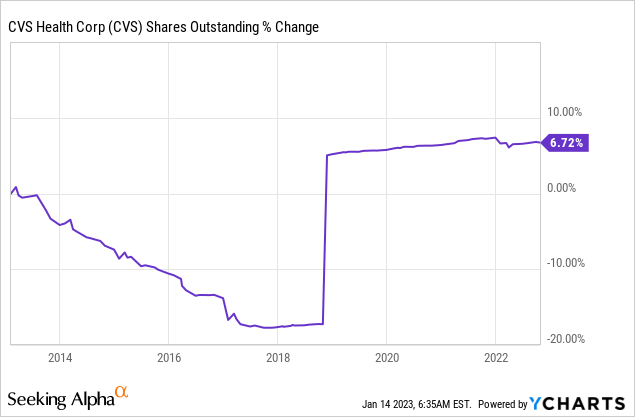

Companies often return capital to shareholders through share repurchase plans along with dividends. Share buybacks can supplement EPS growth by reducing the number of outstanding shares and are most effective when the share price is low. CVS’s number of shares has risen by 7% in the last decade due to the Aetna acquisition, which was financed with cash and stock. However, the company has announced a $10 billion buyback plan which will help to decrease the number of outstanding shares.

Valuation

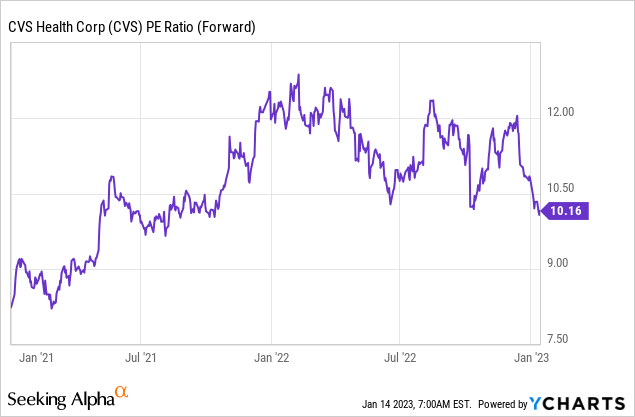

The P/E (price to earnings) ratio of CVS, when using the 2023 EPS forecast, stands at 10. It is the lowest P/E ratio over the last twelve months. The current valuation takes the company back to 2021 when it comes to valuation. The company is growing and paying a reliable dividend. Therefore, paying ten times forward earnings for its shares makes sense.

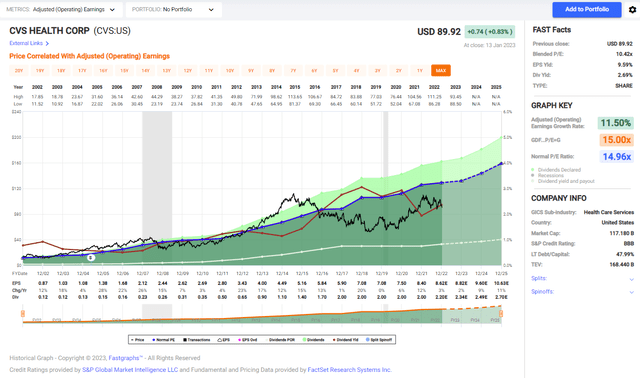

The graph below from Fastgraphs emphasizes how CVS looks attractive at the moment. The P/E ratio of the company stands at 10, while the average P/E ratio over the last two decades has been almost 15. During these twenty years, the growth rate was also faster. However, I do not believe it justifies a deep discount for a quality company such as CVS. Therefore, I think that CVS is trading for an attractive price.

Fastgraphs

CVS Health has solid fundamentals, with revenue growth and EPS growth driving dividends and buybacks. These factors make CVS an interesting company. Additionally, the company offers an attractive valuation with these fundamentals. If the company has decent growth opportunities and limited risks, it may be a good opportunity for investors to consider.

Opportunities

CVS is a healthcare company that operates through two main segments: pharmacy and insurance. CVS’s acquisition of Aetna, a health insurance company, has allowed it to expand its services portfolio, providing customers with two possible avenues to meet CVS. They may meet the company as their employer offers healthcare plans or in one of the thousands of CVS pharmacies. It has increased the number of potential clients and diversified the revenue stream going forward.

CVS’s integrated model may give it a competitive advantage as the healthcare industry continues to evolve and adapt to changing consumer needs. The acquisition of Aetna can potentially create significant synergies for the company. Integrating insurance and pharmacy services could lead to customer cost savings and increase customer loyalty. Furthermore, the acquisition of Aetna also expands CVS’s customer base, allowing the company to cross-sell its products and services to a more extensive customer base. Additionally, the acquisition of Aetna also gives CVS access to a wealth of data and insights into customer healthcare needs and preferences, which can improve and tailor its offerings.

The COVID-19 pandemic has created a greater need for pharmacies as more people stay home and avoid non-essential trips. It has led to an increase in demand for home delivery and online ordering of prescription drugs, and CVS Health has been able to capitalize on this digital trend. The company has accelerated its digital transformation by investing in technology and expanding its online and mobile services, such as ordering prescription refills, tracking delivery status, and connecting with pharmacists through its website and mobile app. The company has also opened new drive-thru testing sites across the country and provides COVID-19 vaccination services. It has helped CVS capture a larger market share as more people have started to rely on pharmacies for their healthcare needs.

Risks

One of the main risks in CVS Health is the ongoing consolidation and competition in the healthcare industry. As more healthcare companies merge and acquire other businesses, as CVS did, the competition for customers becomes increasingly fierce. It can lead to pricing pressure and margin compression, negatively impacting CVS’s profitability. CVS also faces competition from other large retail pharmacies, such as Walgreens and Rite Aid, as well as online retailers, such as Amazon, that are expanding their presence in the healthcare space. As the pandemic fades slowly, there is less need for vaccines and the drive-thrus, and CVS will need to find new ways to attract clients.

Another risk to investing in CVS Health is the company’s heavy debt load. As a result of the Aetna acquisition, CVS Health has taken on a significant amount of debt, which can be a concern for investors. High debt levels can limit the company’s financial flexibility, making it more difficult to respond to unexpected challenges or opportunities. The debt level is being lowered by the management, yet at a higher rate. It may still be a burden as interest expenses will rise.

CVS’s PBM business (pharmacy benefit management) also poses a risk to investors. CVS’s PBM segment highly depends on contracts with large payers, such as employers and health plans. If these contracts were to be lost or not renewed, it could adversely affect the company’s financial results. Additionally, the PBM industry is facing increased regulatory scrutiny and potential reimbursement policy changes, which could negatively impact the company’s profitability.

Conclusions

CVS Health has solid fundamentals, an attractive valuation, and several opportunities with manageable risks, making it an exciting option for investors of dividend growth. The company has a diversified business model with a strong brand and a history of revenue growth and EPS growth, leading to dividends and buybacks.

Furthermore, the acquisition of Aetna has the potential to create significant synergies for the company, and the company’s management’s commitment to return capital to shareholders is a positive sign. Given the factors mentioned above, I rate CVS as a BUY. I believe investors should gradually build a position in the company and capitalize on any market volatility for a long-term investment.