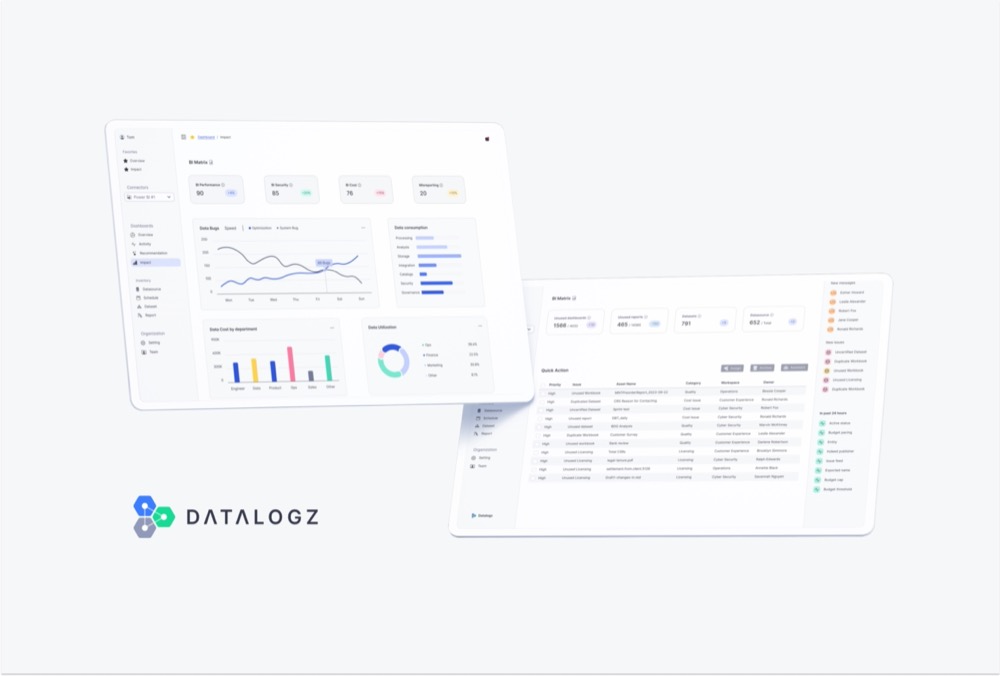

25% of organizations use 10 or more business intelligence (BI) platforms, 61% of organizations use four or more, and 86% of organizations use two or more according to Forrester. While the adoption of multiple platforms for the enterprise can serve varied needs and departments, it creates data sprawl. Datalogz is a BI ops platform that allows organizations to optimize and manage their business intelligence environments in a seamless solution. The security risks, computing cost, and compliance challenges an organization faces all increase as the amount of data organizations utilize, analyze, process, and gain insight from increases in the form of BI sprawl. Datalogz, through its BI Ops recommendation engine, removes the bloat within an organization’s BI and data stacks through automation while ensuring organizations are using the most appropriate data in their decisioning. The platform seamlessly integrates directly with popular BI tools already in use like Looker, Tableau, Power BI, Qlik, Tibco, and Mode, allowing Datalogz to be adopted at any data-mature organization.

AlleyWatch caught up with Datalogz CEO and Founder Logan Havern to learn more about the business, the company’s strategic plans, latest round of funding, and much, much more…

Who were your investors, and how much did you raise?

Datalogz’s most recent round was $5M led by GreatPoint Ventures with participation from Squadra Ventures, Berkeley SkyDeck, Mana Ventures, Defined, and Graphene Ventures. This brings Datalogz’s total funding for 2023 to just under $8M in seed funding.

Tell us about the product or service that Datalogz offers.

Datalogz is ending Business Intelligence (BI) Sprawl across massive organizations, and the world is noticing! Most companies are seeing a high adoption of business intelligence platforms, leaving them thousands of dashboards, complex reporting pipelines, and a heavy volume of analytics. This surge in activity results in duplication, unused dashboards, security risks, inefficiencies, and governance challenges.

To address the risks and costs of growing business intelligence reports, Datalogz automatically optimizes and administrates large BI environments, reducing costs and risks.

What inspired the start of Datalogz?

When I was working at JetBlue a few years ago, I realized that as the airline invested in digital transformation, the number of reports quickly grew from a couple hundred to thousands, each tracking different key performance indicators and projects. As a data analyst, I was constantly juggling mountains of reports on customer information, flight delays, lost baggage, and other forms of data and realized the struggle in managing large BI environments.

How is Datalogz different?

Datalogz is the first and only automated BI Ops software. Typically, Datalogz competes with legacy solutions and manual projects (often done by consultants or firms) to clean or de-risk these environments.

What market does Datalogz target, and how big is it?

Every data-mature Fortune 2000 company can benefit from Datalogz.

What’s your business model?

At Datalogz, we sell enterprise software contracts to data-mature organizations. The decision-makers are often data directors/leaders or C suite. Typically, we work with analytics, data, and BI teams as the end users and implementers of Datalogz.

How are you preparing for a potential economic slowdown?

Our software instantly reduces data computing and licensing costs, so Datalogz is able to build a very clear value proposition for clients even during an economic downturn.

What was the funding process like?

During our first round in 2023, we pitched almost 100 investors to close our funding round back in January. Fortunately, because of the excitement of multiple enterprise success stories and high product demand, we had investors approach us with interest in this round of funding. We were able to work towards a quick close.

What are the biggest challenges that you faced while raising capital?

Initially, it felt like we were in a constant catch-22 with more capital required to get more customers and more customers required to get more capital. Eventually, we were able to break through this cycle and find the right early-stage partners that led to the opening of later investment doors and funding to build an incredible game-changing product in our space.

What factors about your business led your investors to write the check?

We’re solving a problem that no other company is today and have built an incredible team with real market-proof points on why we can be a $1B company in the next five years. Our team has deep expertise in this space and has proven our ability to sell.

What are the milestones you plan to achieve in the next six months?

We aim to close 20 Fortune 2,000 customers and 5x of our current revenue.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

I always advise putting yourself out there to meet new people and continuously talk to customers about what you are building. Without external interest, it’ll be tough to build a company. I believe as a founder, you’ll either convince people to buy your product or learn enough to pivot to something people pay for.

Where do you see the company going now over the near term?

At Datalogz, we remain laser-focused on solving business intelligence problems for data-mature organizations.

What’s your favorite winter destination in and around the city?

I personally love to play indoor soccer in the city! You’ll likely find me hanging out in Upper 90 in Astoria.