Sohel_Parvez_Haque/iStock via Getty Images

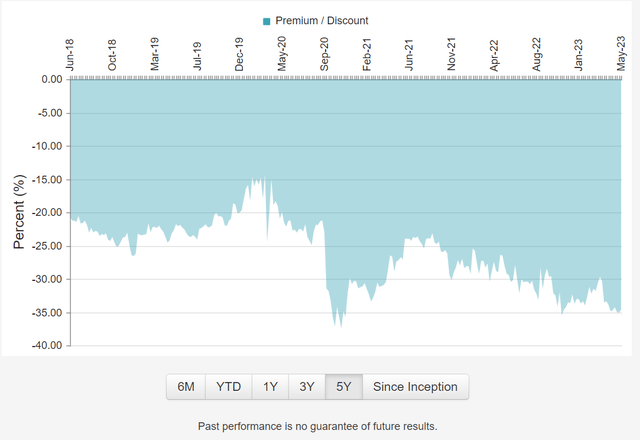

In the comments to a recent article I wrote on the deeply discounted Destra Multi-Alternative Fund (DMA), a reader suggested I take a look at the Dividend and Income Fund (OTCPK:DNIF), a similarly deeply discounted closed-end fund trading at a 35% discount to NAV.

Fund Overview

The Dividend and Income Fund is a closed-end fund (“CEF”) that seeks high current income from a portfolio of income producing equity securities.

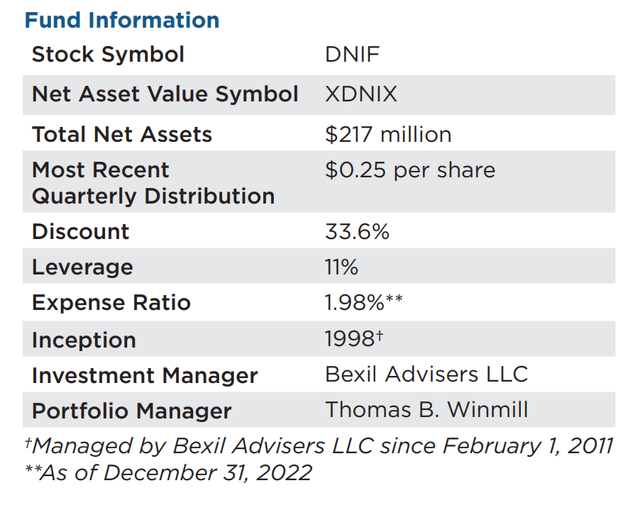

The DNIF fund currently has $217 million in assets and charges a 1.98% expense ratio as of December 31, 2022 (Figure 1).

Figure 1 – DNIF fund overview (dividendandincomefund.com)

The DNIF fund may employ leverage to enhance returns and as of March 31, 2023, the DNIF fund had 11% leverage.

Long Convoluted Path To OTC Listing

The DNIF fund began operations in June 1998 as the Chartwell Dividend and Income Fund, Inc. (“CWF”), a small convertible securities fund. However, in February 2011, Bexil Advisers took over as the fund’s investment manager and changed the fund’s name to Dividend and Income Fund, Inc. with the ticker “DNI”. At the time of the takeover, the CWF/DNI fund only had $35 million in assets. Through several dilutive rights offerings over the years (Seeking Alpha author George Spritzer detailed DNI’s history here, including the major rights offerings), DNI was able to grow the size of the fund to approximately $190 million by 2019.

However, the DNI fund’s deep discount to NAV drew the attention of activist investors including Bulldog Investors and Saba Capital Management. After an activist-led shareholder proposal to convert the fund into an open-ended mutual fund failed, the DNI fund decided to voluntarily delist from the New York Stock Exchange on October 8, 2020 and became quoted on the OTC market with the current ticker “DNIF”.

Entrenched Manager Is A Major Shareholder

Not only is Bexil the manager of the fund, it also owns 11% of the fund’s units. Bexil Advisers is a small boutique investment manager managing the DNIF fund, the Midas Funds, and Foxby Corp. (OTCPK:FXBY). Bexil is controlled by Thomas Winmill, a corporate securities lawyer by training who acts as the President, Chief Executive Officer, and a Trustee of the DNIF fund and President, Chief Executive Officer, and General Counsel of the Investment Manager.

Portfolio Holdings

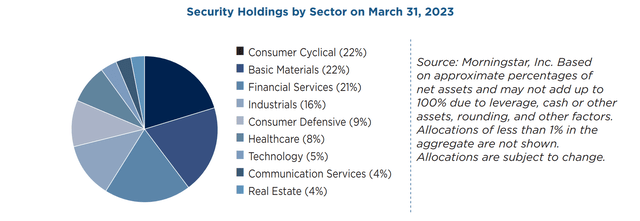

The DNIF fund’s sector allocation is shown in Figure 2. The fund is generally concentrated in Consumer Cyclicals (22%), Basic Materials (22%), Financials (21%), and Industrials (16%).

Figure 2 – DNIF sector allocations (DNIF factsheet)

Going through the fund’s latest annual report, the DNIF fund’s holdings appear to be mostly straightforward equity positions like Steel Dynamics (STLD) and AutoZone (AZO), with a handful of corporate bonds and preferred equity securities. The fund’s top 10 holdings as of March 31, 2023, are shown in Figure 3.

Figure 3 – DNIF top 10 holdings (DNIF factsheet)

Returns

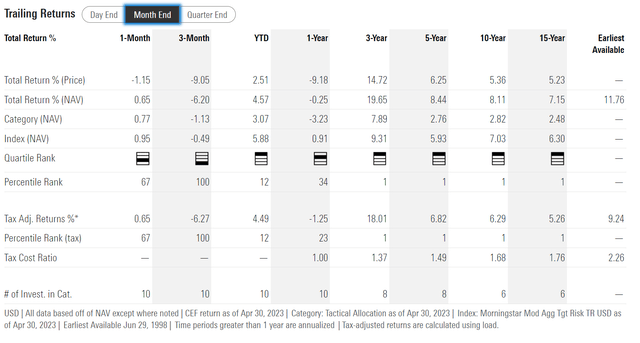

Figure 4 shows the historical returns of the DNIF fund. The DNIF fund has delivered solid 19.7%/8.4%/8.1%/7.2% on 3/5/10/15Yr time frames to April 30, 2023.

Figure 4 – DNIF historical returns (morningstar.com)

However, investors should be mindful that the 3Yr average return figure may appear higher than reality as April 2020, the starting period, was near the COVID-pandemic lows and may have boosted 3Yr return calculations. I believe DNIF’s longer-term 5 and 10Yr average annual return figures of 8.4% and 8.1% may be more representative of the fund’s earnings power.

Distribution & Yield

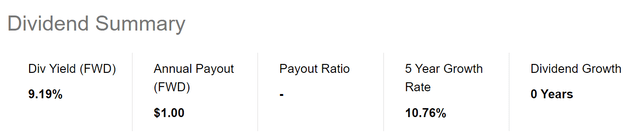

The DNIF fund pays a generous quarterly distribution currently set at $0.25 / quarter or a 9.2% forward distribution yield (Figure 5). Investors should note that based on latest NAV of $16.79, the fund is actually only paying a 6.0% distribution yield.

Figure 5 – DNIF is yielding 9.2% (Seeking Alpha)

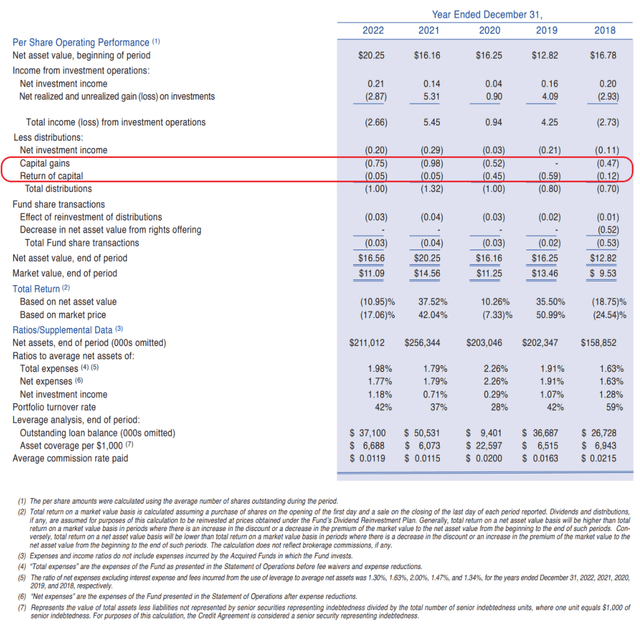

Although the DNIF fund has generally relied on capital gains and return of capital (“ROC”) to fund its distribution, that is not necessarily a cause for concern (Figure 6).

Figure 6 – DNIF has relied on capital gains and ROC for distributions (DNIF annual report)

The key factor to consider is whether the fund earn returns sufficient to fund its distribution yield using a concept called ‘return of principal’. Comparing DNIF’s 5-Year average annual returns of 8.4% to its 6.0% of NAV distribution yield, I believe DNIF’s current distribution rate is sustainable.

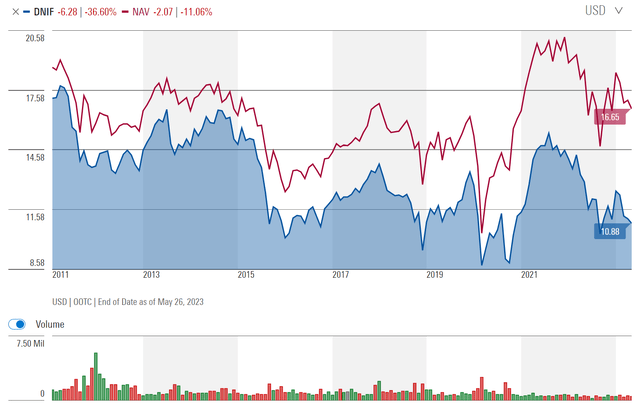

This is confirmed by looking at DNIF’s NAV profile, which has traded sideways since Bexil took over management in 2011 (Figure 7).

Figure 7 – DNIF NAV profile does not suggest concern about distribution sustainability (morningstar.com)

OTC Status Is Likely The Main Cause Of The Discount

As mentioned at the beginning of this article, the DNIF fund is currently trading at a steep 35% discount to NAV (Figure 8).

Figure 8 – DNIF trades at a steep discount (cefconnect.com)

After reviewing the fund’s history, holdings, and structure, I believe this discount is justified by the fund’s OTC status. OTC securities generally have higher risk and lower liquidity, so it is reasonable that investors are penalizing the DNIF fund for its OTC status.

Furthermore, in my opinion, management’s history of dilutive rights offerings and strategy of delisting the fund to rebuff activist investors show a general deficiency in corporate governance, which may add an extra risk premium.

Conclusion

On the plus side, DNIF’s portfolio appears to be plain vanilla stocks and preferred equities that are straightforward to value, so unlike the DMA fund, I have few concerns regarding the fund’s portfolio. However, I believe management has engaged in a history of questionable actions such as dilutive rights offerings and delisting the fund, which suggest there may be a conflict of interest.

The quickest way to surface value in the DNIF fund is if the manager converts the fund into an open-ended structure such that unitholders can redeem their units at NAV. This could create an immediate 50% return on investment. However, with management deeply entrenched and being major shareholders themselves, this possibility appears remote. Closing the NAV discount will most likely happen on management’s timetable, i.e. there may be a liquidity event when Mr. Winmill retires.

Overall, I believe the DNIF fund is able to earn its generous 9.2% distribution yield, as it only represents a yield of 6.0% on NAV, so investors looking for yield may find the DNIF fund suitable. However, investors considering the DNIF fund should be mindful of its OTC status, which increases operational risk and reduces liquidity.

Caveat Emptor.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.