solarseven

Dominion Energy: So Much Fear Over Its Business Review

Dominion Energy, Inc. (NYSE:D) is a leading integrated energy company operating over 30 GW of electric generation capacity. The company’s decision to conduct a “top-to-bottom business review” has struck fear in investors as they parse the potential impact on its future earnings power.

Utility investors generally don’t like unpredictability to earnings estimates, as utility stocks are considered more defensive instruments with less cyclicality to economic upswings/downswings. As such, they could potentially maintain robust and predictable profit margins throughout the cycle, which we believe is critical to underpin their valuations.

As such, Dominion Energy’s review was likely unwelcome by investors as CEO Bob Blue didn’t rule out “the outcome of the review could lead to different growth qualitatively and quantitatively.” Notwithstanding, he believes it could deliver “long-term value for our shareholders.”

Therefore, investors likely aren’t satisfied enough with management’s outlook, even as they await the outcome of its business review. Moreover, with the macroeconomic conditions worsening for the US economy, investors are likely anticipating a worse outcome that could markedly impact its projected 5Y utility rate-based CAGR of 9%.

Dominion Energy: Wall Street Also Panicked

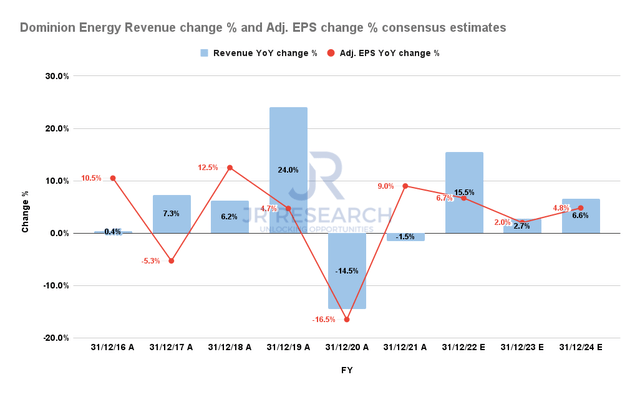

Dominion Energy Revenue change % and Adj. EPS change % consensus estimates (S&P Cap IQ)

Therefore, even Wall Street analysts have decided to downgrade the company’s FY23 adjusted EPS estimates to reflect such uncertainties. Accordingly, the revised estimates suggest an adjusted EPS increase of just 2%, well below the company’s “path to 6.5% EPS growth” in 2023. Investors need to remember that, pending the outcome of the business review, that rate could also be at risk.

We believe the analysts’ pessimism makes sense. If the business has been doing well, there seems to be little justification for conducting a strategic review at a time of significant macro headwinds. Therefore, we believe the reaction of D’s stock performance since its highs in April 2022 has likely considered significant challenges to the company’s execution.

BofA noted that Dominion Energy’s “unique Virginia regulatory construct” could impact its cash flows, crimping another layer of support for its valuation. Also, the performance guarantee dispute and settlement in Virginia have reflected another risk factor for investors to consider.

But then, has the market reflected significant headwinds in its stock performance, as it tends to discount the unknown?

D: Significant Fear Likely Discounted

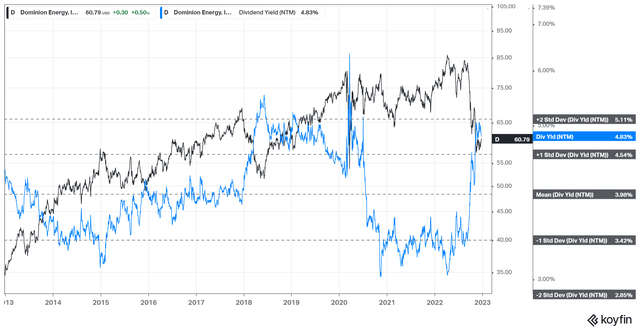

D NTM Dividend yields % valuation trend (koyfin)

We think so. Consider that D last traded at an NTM EBITDA of 9.2x, well below its 10Y average of 12.2x. It’s also below its peers’ median of 11.7x (according to S&P Cap IQ data). Moreover, its NTM dividend yield of 4.83% has surged to the two standard deviation zone over its 10Y average, corroborating our conviction that the market has likely priced in significant pessimism.

There seems to be a plenitude of red flags that investors need to consider carefully as they parse the outcome of the company’s business review. For example, are the company’s margins at risk? What about its cash flow drivers concerning its Virginia settlement?

With the Fed remaining hawkish through 2023, financing its heavy investments in renewable energy, particularly in its offshore wind projects, could be more challenging. Therefore, investors should not rule out a further impact on its free cash flow, worsening the uncertainty from the outcome of its business review.

Takeaway

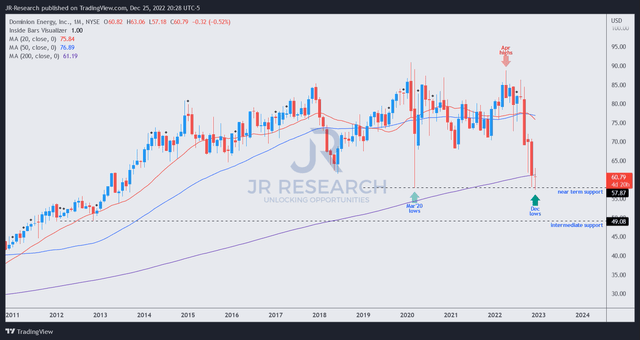

D price chart (weekly) (TradingView)

Still, we assessed that the extent of its steep selloff has taken out the lows last seen in March 2020, undergirded by its 200-month moving average (purple line). Given the fundamental challenges and technical damage, we don’t expect D to recover markedly from here. However, we believe a constructive consolidation zone could form, helping to sustain its buying momentum for subsequent recovery.

Therefore, we believe D’s price action is constructive, reflecting the significant hammering in its valuations, even as the outcome of its business review remains uncertain for now. But, if the review turns out to be better than feared, it could help to lift its buying sentiments markedly.

Therefore, we believe the current entry zone proffers investors an opportunity to layer in, capitalizing on its de-risked estimates and valuations.

Rating: Buy