Inside Creative House/iStock via Getty Images

It’s been a while since I last covered Donegal Group, Inc. (NASDAQ:DGICA). I was too optimistic then, so I only saw stock price slippages recently. Also, I checked it more broadly and noticed the things I missed before. To that end, I am doing another review of this company.

Today, Donegal sees higher revenues but hammered margins. It is reasonable, though, given the impact of inflation and fire damages. Also, its financial positioning is ideal, with adequate liquid assets. This aspect allows it to cover its operating capacity amidst macroeconomic volatility. And since potential opportunities outweigh risks, DGICA may capitalize on these market trends.

However, the stock price appears almost unchanged in over a decade. Actual investment returns are quite dull and overvalued.

Company Performance

The P&C insurance industry is integral to financial resilience amidst climate change. The extra financial protection it offers guarantees safety for individuals and entrepreneurs. As such, P&C insurance has become a staple for residential and commercial properties. Donegal is one of those promising financial security. Its primary operations are in Pennsylvania. But it is also present in some states along the Atlantic Coastline. These include Delaware, Georgia, Maryland, Northern Carolina, and Southern Carolina. With that, Donegal may have impressive policy renewals and applications. However, these states are at higher risk of natural calamities, mainly hurricanes. The combined impact of these external factors is reflected in DGICA’s performance.

In 3Q 2022, the operating revenue amounted to $212.84 million, a 5% year-over-year increase. Premiums and investments remained the primary revenue growth driver. Premiums comprised 96% of the total revenues with a 5% year-over-year growth. Thanks to the increased demand amidst inflationary headwinds. Typically, 2Q and 3Q have more demand for policies since it is the hurricane and wildfire season. The composition of premiums is strategic since commercial lines comprise 62% of premiums. It is timely and relevant as business reopenings continue despite recessionary fears. Also, claims are more manageable in commercial lines than personal lines.

Operating Revenue (MarketWatch)

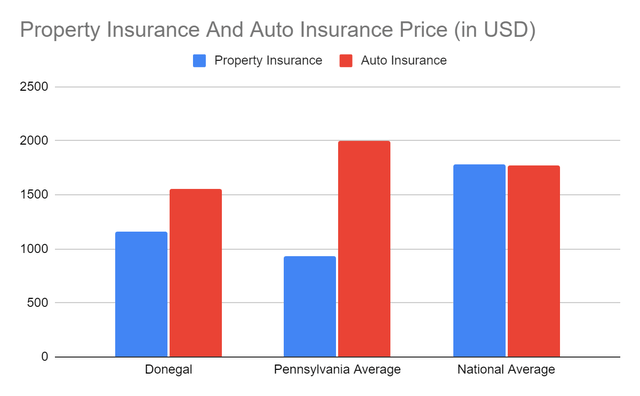

Moreover, Donegal has a favorable and flexible pricing strategy amidst the skyrocketing prices. For instance, its average auto insurance price is only $1,551 versus the PA average of $2,002. This aspect gives DGICA an extra advantage for price adjustments amidst market volatility. Given its premium growth, it can still lower prices if demand drops. I will discuss it further in the next section. Meanwhile, its home insurance price of $1,164 is higher than the PA average of $930. But it is considered one of the best insurance providers for those with poor credit quality. Donegal is more essential today amidst the rising interest rates. Those who can hardly buy one because of credit can turn to Donegal. Although it comes at a higher price, its quality should not be discounted. Also, it may still adjust its price, given the premium growth. It may be easier this year as inflation continues to relax.

Insurance Prices (Bankrate And NerdWallet)

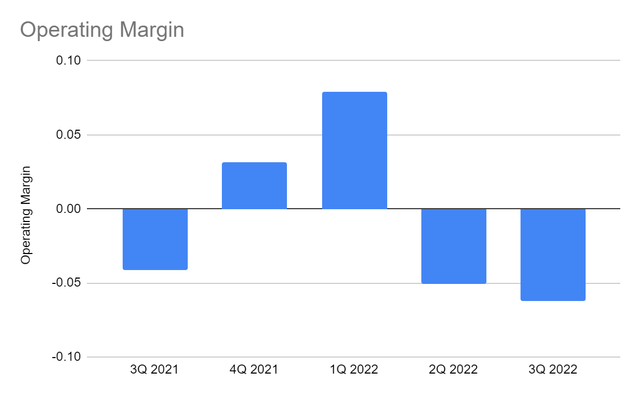

However, insurance claims and expenses quickly offset it, given their 7% year-over-year increase. They quickly offset revenues, leading to a lower operating margin of -6.2% versus -4.1% in 3Q 2021. Various factors contributed to the highflying claims and expenses. First, the fire and Hurricane Ian raised claims by 5%. Despite its concentration on commercial lines, it was not exempt from excessive claims. Massive fire losses affected more businesses. In fact, the impact was more evident than Hurricane Ian’s. Also, inflationary headwinds raised operating expenses by 11%.

Operating Margin (MarketWatch)

But overall, DGICA remained durable, driven by its premium retention across all segments. Its premium rate increases are still reasonable as inflation persists. As such, it now has to find ways to improve efficiency and stabilize costs. It may increase its presence in high-performing states to secure its positioning. It may also have to sell some underperforming investments. We expect interest rate hikes to persist as the Fed remains conservative. Hence, its government-backed securities can help improve valuation amidst rising interest rates. It will be good preparation for the potential economic cooldown across states.

How Donegal Group, Inc. May Sustain Its Capacity

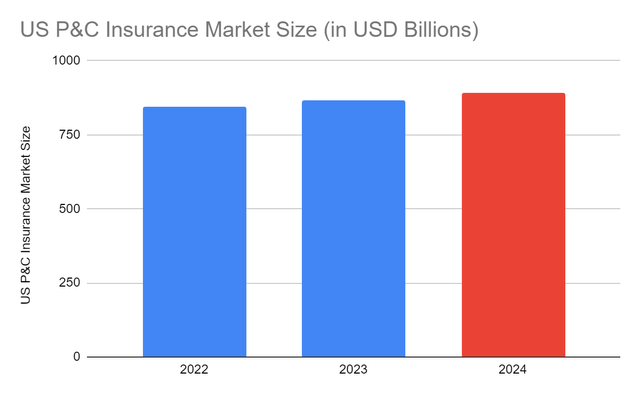

The P&C insurance industry stays an integral component of climate finance. And while the industry faces pressures that may squeeze margins. Claims for Hurricane Ian damages and bias lawsuits are the prevalent issues. Donegal must be cautious since it is present in coastline states and Illinois. These are the states heavily impacted by Hurricane Ian and bias lawsuits. Thankfully, a considerable portion of its business is in Pennsylvania. But it is crucial to weigh the risks and opportunities for P&C insurance companies this year. Currently, the projected growth in P&C insurance is 2.2%, down from the 3% projection last year.

US P&C Insurance Market Size (ALM And IBISWorld)

Meanwhile, inflation and interest rate hikes softened demand across industries. Inflation peaked at 9.1%, while interest rates had a 75 bps increment for four quarters. These changes intensified recession fears in the US. Despite all these, the potential economic cooldown may not lead to a deep recession. First, inflation has already relaxed further than expected. It is now 6.4%, 29.7% lower than the peak. Second, interest rate increments slowed down to 25 bps this quarter. The Fed succeeded in stabilizing inflation. Although it may stay conservative, my expected rate is 4.8-5% versus the 5-5.25% consensus.

Given all these, purchasing and borrowing power may improve. Donegal may maintain its pricing flexibility. It may adjust premium rates to generate more premiums. Also, expenses may decrease, which can improve margins. These may materialize in the second half since the market demand is still normalizing. Even better, its reputation for those with poor credit can become another tailwind. It may attract more potential policyholders and increase policy retention.

Concerning properties, sales have started to cool down. And although prices are still increasing, the growth rate has moderated. Even so, I don’t expect a property market crash or a recession for various reasons:

- Property shortages remain high. We can attribute it to builders who have remained conservative over the past decade. They have not ramped up construction and sales since the Great Recession.

- Lenders are stricter, unlike in the early 2000s. There is no speculative mania and unethical market practices today.

- Inflation has relaxed, although it remains elevated.

- Business reopenings are high despite the higher prices and interest rates.

- Unemployment is stable, a far cry from the labor market scenario more than a decade ago.

These points show that properties remain valuable. Hence, P&C insurance is a staple.

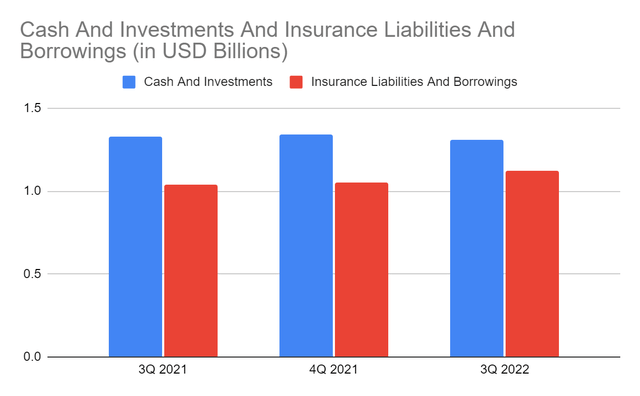

Moreover, Donegal maintains a solid financial positioning. Although cash has been cut by more than half, it remains adequate. Total investments are lower but well-managed. Their combined amount of $1.31 million comprises 58% of the total assets. Also, they are more than enough to cover insurance liabilities and borrowings. They can cover 74% of the total liabilities. Indeed, Donegal can sustain its capacity while withstanding more headwinds this year.

Cash And Investments And Liabilities Insurance And Borrowings (MarketWatch)

Stock Price Assessment

The stock price of Donegal Group, Inc. has been in a slight uptrend over the past decade. The uptrend has remained visible in the last year, although it has not bounced back to 2022 highs. At $15.10, it is 8% higher than last year’s value. But it is 9% lower than in my first coverage. What disappoints me is that since the Great Recession, the price has been almost the same. At this point, I would like to apologize for failing to notice this before. If we check its PTBV ratio, there will be a potential overvaluation. It has a BVPS of 14.7 and a PTBV Ratio of 1.02x versus the 2019-2022 average of 0.89x. Using the current BVPS and average PTBV Ratio, the target price will only be $13.09. The EV/EBITDA model adheres to it. It has a target price of (493 M EV – 8 M Net Debt) = 32,414,000 shares = $14.97, which shows potential overvaluation.

Meanwhile, it is an attractive dividend stock, given the dividend yield of 4.3%. It is more than thrice as much as NASDAQ with 1.36%. However, investment returns are not enticing at all. The average price change in 2019-2022 was $1.54. Meanwhile, the cumulative retained earnings are $2.51. So for every $1 increase in retained earnings, the stock price only increased by $0.70. To assess the stock price better, we will use the DCF Model.

FCFF $10,880,000

Cash $27,000,000

Borrowings $35,000,000

Perpetual Growth Rate 4.8%

WACC 9.2%

Common Shares Outstanding 32,414,000

Stock Price $15.10

Derived Value $10.44

The derived value also shows that the stock price is overvalued. There may be a 31% downside in the next 12-18 months.

Bottomline

Donegal Group, Inc. sustains revenue growth but not enough to improve its hammered margins. It has excellent liquidity, which can help it withstand more headwinds and rebound. However, the stock price is overvalued. Dividend yields are attractive but cannot compensate for disappointing investor returns. The recommendation is that Donegal Group, Inc. is a sell.