gleitfrosch

DouYu International Holdings Limited (NASDAQ:NASDAQ:DOYU) was once one of the largest Chinese IPOs in the US in 2019, recording a 78% increase in share price in barely 2 years. After Beijing’s regulatory obstructions affected the outlook of the gaming industry, DOYU’s stock price tanked by over 86%. We believe this stock is a sell, despite earnings beating analysts’ consensus for every quarter since then. Our investment theses centers around a bearish industry outlook as we think that regulatory risks in this entire industry will still linger. We also observe that one of DOYU’s largest shareholders has been selling down its investments in Chinese companies in these few quarters, and feel that a sale of its stake in DOYU is plausible. Our valuation of the company will forecast negative future cash flows for the company as well, thus we believe that the price will continue to fall from this level.

Lackluster Gaming Industry Outlook

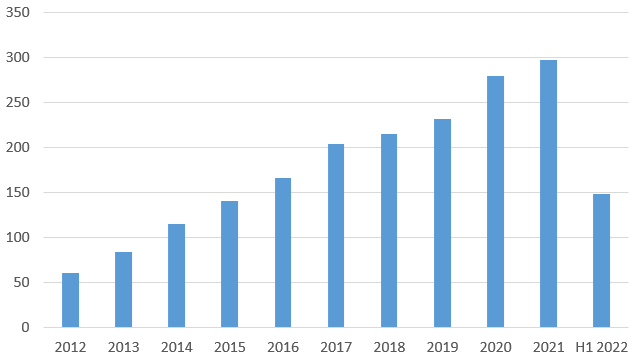

According to a report published by the China Audio-Video and Digital Publishing Association, the gaming sector’s revenue declined in the first half of 2022 for the first time in 14 years. This is attributed to the multiple restrictions and regulations Beijing enforced on both users and gaming companies; not limited to, banning children under 16 from live streaming, limiting video game time by minors, and registering and logging into gaming accounts under their real name. Gaming companies like Tencent (OTCPK:TCEHY) and NetEase (NTES) were also forced to step up their measures, with both companies launching a facial recognition technology to police online for minors gaming after 10pm and before 8am. This is a huge step up from Tencent’s Gameplay Management System that launched in 2019, which used to just remind users to take breaks. From the regulators’ tightening response, it is unlikely that there is much room for the entire industry to grow as regulators froze approvals of new games before resuming them in April and July 2021. Both gaming companies mentioned above have only won licenses for one new game each, while National Press and Publication Administration (NPPA) approved the release of another 67 new titles from other game developers.

Total Revenue for Gaming Industry in Billion Yuan (Statista)

This move seems to hurt the revenue for bigger companies like Tencent and NetEase, but it caused more damage to the bottom line for smaller companies with tighter net income margins. It is estimated that 14,000 gaming-related firms shut down as a result of the crackdown in 2021, on top of the 18,000 that shuttered throughout 2020 as a result of the pandemic.

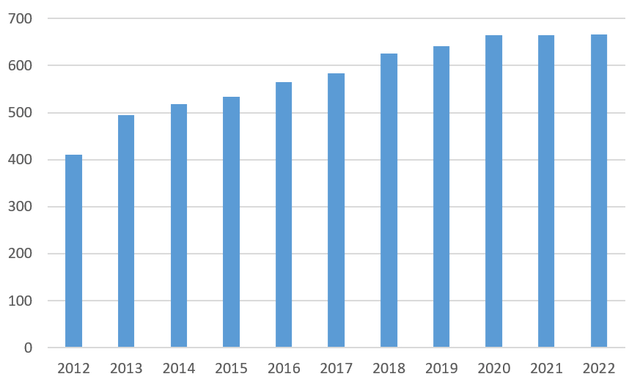

China’s Total No of Active Gaming Users in Millions (Statista)

Based on the number of active gaming users in China, user growth is not as fast as in the previous decade and has slowed down even prior to the pandemic. As a result of the strict regulations that gaming companies need to comply with and many red tapes that developers of gaming content have to follow, we predict that the number of active gaming users would stagnate or grow marginally from here, as users begin to internalize the effects and thus affecting the economy of the gaming industry.

Regulatory Risk Remains

The news of gaming industry crackdowns could be something of the past, but we believe that the risk of the government toughening its stance is like a dark cloud; ever-looming above investors and gaming companies looking at the profitability of this industry.

In 2007, it is estimated that approximately 14% of Chinese adolescent internet users had internet addiction—about 10 million teenagers. A decade later in 2018, this number jumped by 16%, with over 30% of teenagers suffering from the same addiction according to the China Internet Network Information Center. From this, it is evident that China’s harsh stance against the gaming industry is likely to continue throughout the next decade to prevent the spread of such an addiction.

Of course, this comes at the price of future revenues for fellow gaming companies in China, with lesser launches of new games and revenue generated from those. Gaming accounts for approximately a third of Tencent’s total revenue, forcing the technology and entertainment conglomerate to rely on its longer-established hit games like PUBG Mobile and Honor of Kings to drive revenue after just launching 3 mobile games in the second quarter of this year. William Ding, CEO of rival NetEase, reported the same scenario in the company’s Q2 earnings call as “players continued to gravitate to [the company’s] longstanding games”.

This affects the streaming industry since lesser players would adopt the newer games and develop a sizeable community for a new form of gaming, forcing projections to be largely based on the current broadcast of existing titles that are expected to decline in the aftermath of the crackdown. Bilibili, one of China’s biggest video-sharing sites, banned the broadcast of over 60 titles of games (including Grand Theft Auto V, The Witcher 3, Heart of Iron, World of Tanks, and Rainbow Six Siege) that contain “bloody, violent or pornographic content”, in an effort to align with the regulator’s view on the industry. This undoubtedly would affect DOYU, which primarily targets China’s esports market and has not been regulated by Beijing yet. We believe any news of regulation could further drive the stock down, which has been on a 39% decline YTD.

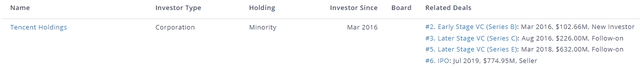

Tencent’s Rapid Sales of Holdings

The conglomerate has been trimming its holdings in its portfolio companies in the recent few quarters, targeting tech firms such as SEA Limited (SE) and JD.com (JD). Sources from CaiXin and Tencent attribute such a sale to a response to regulatory risks and financial returns. Regardless of the reasons, we believe that with declining valuations of Chinese companies, it would be in the best interest of both the company and shareholders to unwind already profitable deals in a bearish economic climate for equities. That could be applicable to its 37% stake in DOYU should the company wish to exit with accounting profit.

Tencent’s Funding Round for DOYU (PitchBook)

As seen from Tencent’s contribution to DOYU’s funding round throughout the years, the company would clear approximately US$1 million in profit if it were to sell its stake in DOYU at the time of writing this article. Considering a 32% YTD decline in share price, Tencent could cash out of their investment without incurring any substantial loss, and either acquire stakes in other foreign companies in the gaming industry positioned to grow or pay dividends to shareholders for the subsequent quarter.

This comes at a 40% rebound from DOYU’s July lows after reporting better-than-expected earnings in Q2. However, such levels could be revisited again as revenues for the quarter declined 21% year-over-year, a consecutive fall by double-digit percentages in the previous quarter. With reference to our preceding investment theses, it is likely the trend will continue with the regulators exacerbating the crackdown of the industry in the second half of 2021.

Thus, should a sale of Tencent’s stake in DOYU materialize, there would be further downsides in both the company’s valuation and investors’ confidence in DOYU.

Risks

Merger & Acquisitions (M&A)

After regulators in Beijing made a move against the merger between HUYA Inc. (HUYA) and DOYU, it is rather clear that there would be no further M&A opportunities for the company. The company has not completed any acquisitions since its inception, but the possibility of any vertical integration of companies (i.e. acquiring gaming peripherals and broadcasting sites) is not entirely out of the picture. Despite some of the market capitalization of these companies being too large to be acquired fully with DOYU’s cash in hand, there are still businesses that DOYU can vertically integrate into their operations and diversify its revenue stream. Such value creation would unlock DOYU’s true value, causing it to trade higher due to positive M&A news.

For instance, Scienjoy Holdings (SJ) focuses on mobile live streaming platforms in the People’s Republic of China through the same level of interaction that DOYU has with its viewers. It operates four live streaming platforms (Showself Live Streaming, Lehai Live Streaming, Haixiu Live Streaming, BeeLive Live Stream) and allows viewers to chat with broadcasters and buy virtual gifts for them. The company has a current market capitalization of $178 million, which is a fraction of what DOYU would need to pay to acquire all 39.55 million shares outstanding floating in the market now. This would translate to an 11.66% minority stake in the company and would diversify its revenue stream outside of just broadcasting games.

Besides acquiring other targets, DOYU could potentially be acquired by a company looking to vertically integrate its gaming broadcasting business into its revenue streams. For example, Inkeverse Group (SEHK: 3700) is an investment holding company that operates mobile live streaming platforms in the People’s Republic of China. The company has $429.53 million of cash in hand that is able to purchase most, if not all of DOYU’s 317.48 million shares floating in public markets at its current price. Unlike the previously failed merger, such acquisitions could potentially work due to the target and acquiring companies being in different business sectors. Of course, given the current political situation between the US and China, such an acquisition would require the Federal Communication Commission’s approval, which would not be an issue after we present the next risk.

Privatization, Delisting & Relisting

A continuous decline in its share price, aided by Beijing’s clamp down on the gaming industry has stripped DOYU of its unicorn status. At its current low valuation, privatization is an option that both investors and the management should consider. A false rumour stating that Tencent could take the company private saw the stock soar 14% in Jan 2022, thus it is likely that any offers from private equity firms based in China should propel the stock further.

We believe that as China tries to become more economically and financially self-reliant, there is a high possibility of DOYU listing on the HKSE as well. This move not only will allow for M&A to occur smoothly between companies under the same jurisdiction, but it will also keep DOYU within arm’s reach of the regulators for the ease of implementation of rules and guidelines for the gaming industry. Whether the company would adopt a secondary listing in the next few quarters or a direct listing, such a move displays strength and willingness for the company to cooperate with Beijing, reflecting further upsides in its stock price.

As such, a delisting of DOYU is probably inevitable considering the factors above, unless they comply with the US reporting requirements.

Valuation

In the case of an M&A, it is hard to model the expected valuation of the firm without knowing the acquirer or target company. DOYU could even complete a deal by issuing stock, further complicating the valuation process. However, we believe that there would definitely be upsides in the stock, similar to if the company were to be delisted from the NASDAQ. According to the Holding Foreign Companies Accountable Act, Chinese companies would have till 2024 to delist, which leaves a lot of quarters for an expected decline in revenue to affect DOYU’s earnings and its stock price.

We would not be using our calculations for liquidation value either, since they have a negative enterprise value. That means the management could pay off any outstanding debt and repurchase all of its stocks, and still end up with excess cash to pay the executives’ bonuses. This would also mean that it is difficult for us to do our valuation from peer comps. Even the commonly utilized method of valuation, DCF and dividend discount models, would not be possible as the company does not pay dividends.

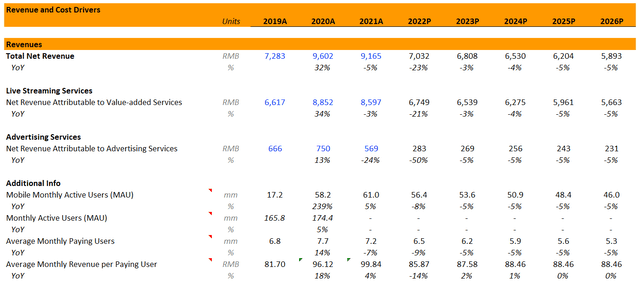

As such, we have projected a fair valuation of DOYU using the P/FCF method. Before figuring out how much FCF DOYU would be likely to have in the next 5 years, we have to project its revenue and cost through these drivers below.

Assumptions for Revenue Drivers (DouYu’s SEC Filings )

Considering revenue from live streaming decreased by 13.6% and 18.8% in the first two fiscal quarters, we think that this trend is likely to continue throughout the fiscal year. As such, we think that the average monthly revenue per paying user could see a decreasing growth as DOYU could hike up the prices of gifts or run promotional packages for users to purchase for streamers. However, the average monthly paying users could see a slow decline of single-digit figures as existing paying users drop out with lesser new games in the market and in the pipelines, translating to lesser streams and generally providing lesser value to the audiences.

We believe that this would cause the mobile monthly active users to decline in tandem with the average monthly paying users, resulting in decreasing revenue from advertising and others as advertisers would advertise less frequently on a declining platform.

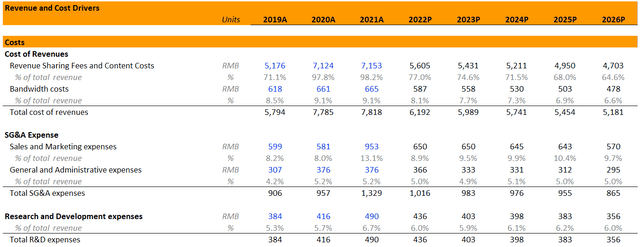

Assumptions for Cost Drivers (DOYU’s SEC Filings)

Considering the management forecast of decreased revenue sharing fees to be in line with the company’s decreased live streaming revenues for Q1 and Q2, we projected the same level percentage decrease in revenue sharing fees and content costs for the next two quarters, and for subsequent years. For bandwidth costs, the company is likely to continue to use lesser peak bandwidth as fewer eSport tournaments are purchased by users and improved procurement efficiency. Thus, we pegged our projections to the decline in average monthly paying users.

After slashing headcount in Q2, DOYU is expected to record decreasing personnel-related expenses as well as marketing expenses for user acquisition, considering the negative outlook for the industry and market in general. Thus, we project sales and marketing expenses to decline massively in tandem with the drop following Q2, while project general and administrative expenses till the end of FY22 to be consistent with the previous year. We believe that 2023 onwards, DOYU could allocate a bigger portion of its revenue to sales and marketing to remain competitive and not lose market share. Besides, the VP of Finance for DOYU, Hao Cao, mentioned in the earnings call that with the resumption of new games being approved, developers will slowly resume promotional campaigns.

For research and development, we believe that the company will be focusing on long-term technological innovation and development of the platform to provide synergy between developers and users. Thus, there could be further customized features being launched in response to the new games to allow better development of a robust and healthy game-centric ecosystem.

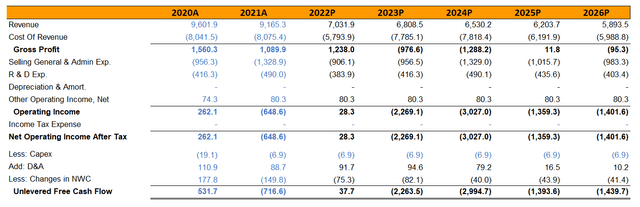

DOYU’s Unlevered Free Cash Flow Calculations (Author’s Spreadsheet)

With all the assumptions above, we translate that into a free cash flow model to figure out the PV of future FCF. Unsurprisingly, the company would have negative FCF as early as next year, if our assumptions hold. Our assumption for D&A is that the amortization period of intangible assets will be projected from that of its weighted average of components in 2021, at 4 years; while leasehold improvements are estimated at 5 years from 2019-2020 depreciation expense.

Conclusion

Despite Tencent and Netease’s games finally making it to the list for the fifth batch of licenses granted by regulators, it is apparent that established gaming companies are gaining lesser traction in the eyes of the regulators. As such, we believe that the regulators would still firmly control the content and genre of games being released to the population. This will inadvertently affect the consistent growth in the large following that these gaming companies have, on top of the several red tapes that gamers have to abide by for existing popular games. This spillover effect crosses into the streaming industry as lesser new games and restricted content in the market could translate to lesser streams and generally less exciting gameplay, causing DOYU’s monthly active users to gradually decline. Even if the company were to create value for shareholders by aggressive marketing, hiking up prices for gifts, or running promotional packages, growth is unlikely or would remain marginal relative to our projections.

Therefore, we believe that DOYU is a sell until there are further macro changes in the industry. However, should investors consider investing in the live streaming industry, they could take a deeper dive into HUYA, which is DOYU’s closest competitor in providing a platform for the live streaming of games. HUYA has a lower debt-to-equity and long-term debt-to-capital ratio than DOYU. Furthermore, HUYA’s positive TTM net operating cash flow could be well positioned to generate more future cash flows compared to DOYU. As such, HUYA’s overall strength in its balance sheet would be a better pick than DOYU.