Solskin/DigitalVision by way of Getty Photos

Doximity (NYSE:DOCS) is a high-quality firm that we beforehand lined. On the time we got here to the conclusion shares have been too costly. For these not acquainted with the corporate we advocate going again to that article, the place we go into extra element as to what the corporate does and why it’s an fascinating platform.

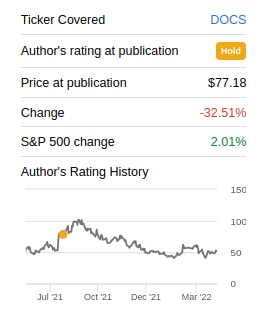

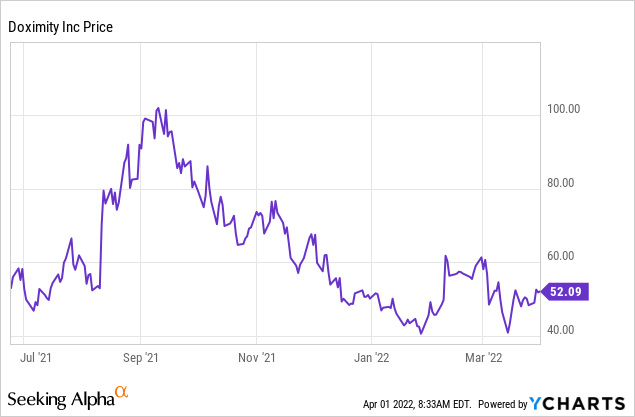

Initially, we seemed like full fools, since shares gained nearly 50% after we mentioned we weren’t prepared to purchase on the then present worth of ~$77, nevertheless since then shares have been nearly reduce in half, bringing us to ask ourselves if maybe now could be the time to begin investing within the firm.

In search of Alpha

Financials

Doximity went public at $26.00 per share and has thus far by no means dropped beneath its IPO worth. Based on a current Barron’s article utilizing Renaissance Capital knowledge, three quarters of 2021’s IPOs are actually buying and selling beneath their providing worth. Of the few winners, Doximity is presently the one that’s buying and selling with the largest achieve, at ~100% achieve from its IPO. Whereas that makes it much less seemingly that shares might be a cut price, it does communicate to the standard of the corporate that it is without doubt one of the few 2021 IPOs with beneficial properties after the market rout.

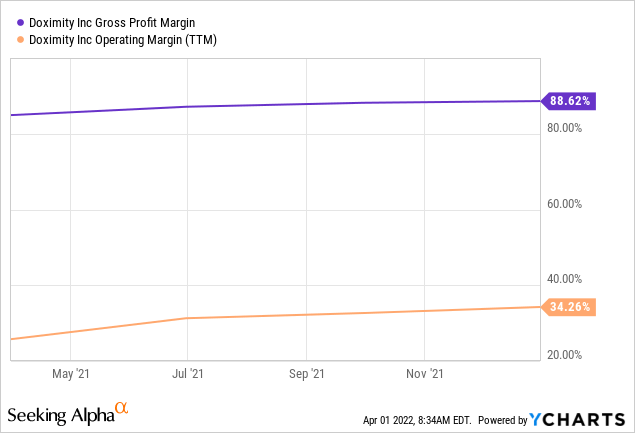

There are some things in Doximity’s financials that we significantly like. It has very excessive gross revenue margins which hover round 88%, has demonstrated working leverage, and is now solidly worthwhile.

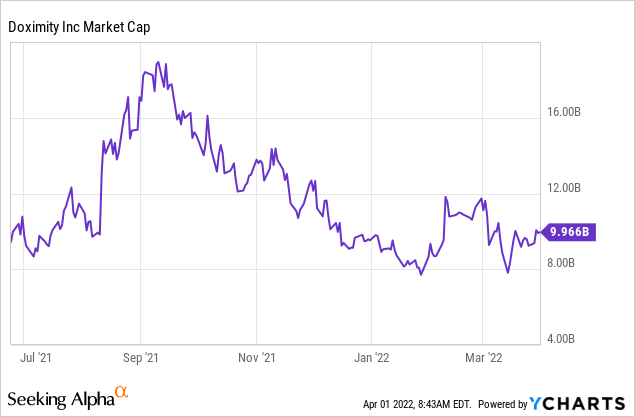

The issue we nonetheless have is the value tag, with the corporate sporting a market cap of ~$10 billion. It is a lot higher than when it was buying and selling at roughly $20 billion, however we have now bother paying a lot for an organization that also generates modest income. That mentioned, the valuation is beginning to make some sense and we imagine a case will be made for a starter place at present costs.

Valuation

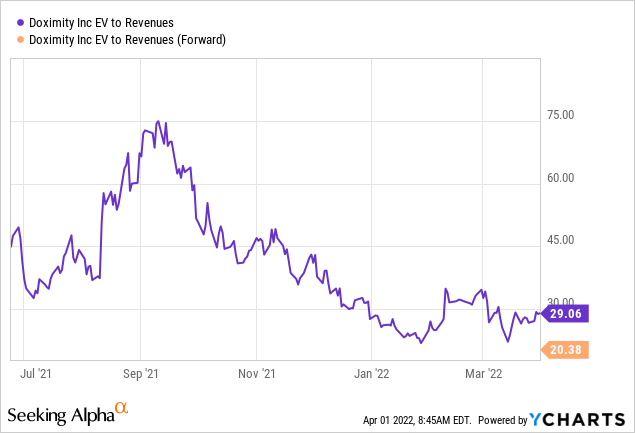

Having a look on the income multiples we see that the corporate is now buying and selling with a trailing twelve months EV/Revenues of ~29x, and a ahead EV/Revenues a number of of ~20x. That is nonetheless removed from low cost, however no less than the corporate continues to develop revenues at a really fast tempo and is already worthwhile. It would really develop into its valuation in a few years if it continues on the present path.

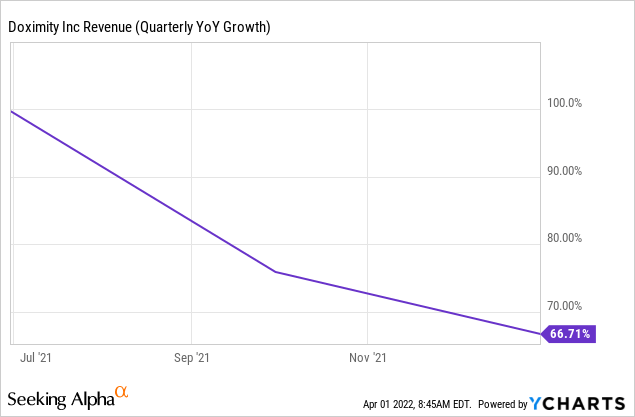

One factor to notice is that income progress has been decelerating. A couple of 12 months in the past the corporate was rising revenues at ~100% price, and it has now decelerated to about 67%. That is one thing to observe, since a continued deceleration might change our thesis, and make the corporate loads much less interesting than it presently is.

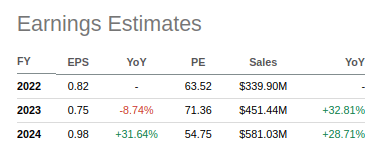

Focusing our consideration on earnings we see that shares are presently buying and selling at greater than fifty occasions anticipated earnings in 2024. That may be a very excessive a number of for one thing that’s anticipated to occur in two years. Nonetheless, given the expansion and the standard of the corporate, it might probably develop into its valuation and if progress continues at its present price paying such a excessive a number of will be justified. The large query is how lengthy the hyper progress part will final, and we would not have the reply to that. That’s the reason we plan on shopping for a really small place and to be extra aggressive ought to shares fall to an actual cut price degree.

In search of Alpha

Dangers

There are a couple of dangers value contemplating earlier than investing in Doximity, chief amongst them is the danger that income progress will proceed decelerating at a quick tempo. We imagine the corporate has engaging platform economics, and due to this fact profitability shouldn’t be an excessive amount of in danger except the platform turns into unattractive and customers flock to different alternate options like LinkedIn. LinkedIn is way more generic and never tailor-made to medical professionals, however ought to they make a critical effort to cater to their wants, this might be a critical threat too.

Conclusion

Doximity is a horny platform that we wish to personal a bit of, however the worth stays elevated. We’re altering our ranking from “Maintain” to “Purchase” following the numerous worth decline since our earlier article, coupled with continued progress from the corporate. Collectively these two elements have introduced the valuation near cheap, and we’ll take into account a starter place at present costs. It is a nice firm and hopefully we’ll get the chance to purchase at extra engaging costs.