Scott Olson

Theses

ESPN BET, the collaboration between PENN Entertainment (PENN) and ESPN / Disney (DIS), is the newest player in the sports betting market. With one of the biggest sports networks in the world as its namesake, it looks like a serious competitor at first glance, but is this really the case? I don’t think so as it’s just the Barstool Sportsbook with new branding and therefore DraftKings (NASDAQ:DKNG) should be superior based on the software and its offerings. However, the ability to attract customers through all that ESPN offers is still a big plus and could be valuable as ESPN BET improves its software and user experience. But I think they are still a long way from having competitive software.

DraftKings Q3 Results Review

DraftKings Q3 Earnings Presentation

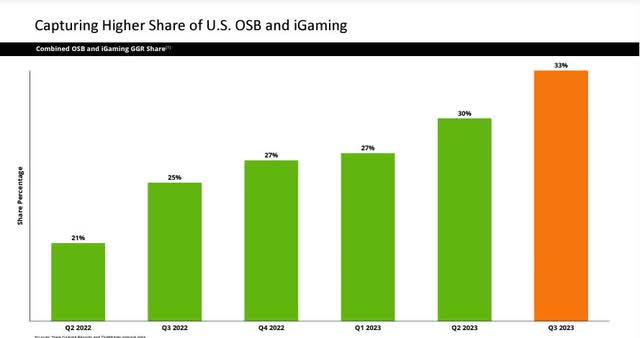

DKNG posted strong Q3 results, becoming the #1 player in terms of gross revenue for OSB and iGaming in the US. This is a strong performance, especially since they mentioned at their Investor Day almost 2 years ago that the long-term target for iGaming was 20% to 25% and for OSB 20% to 30%. But right now they are at 37% revenue share on a 3m basis for OSB and 27% for iGaming, which is way ahead of expectations. DraftKings’ management team has significantly exceeded expectations through intelligent capital allocation.

The average number of MUPs and the average revenue per MUP are also significantly higher at 2.3 vs. 1.6 and $114 vs. $100, respectively. This further demonstrates the excellent execution in the first 9 months of 2023. Old states turned positive in 2 to 3 years, but newer states seem to do it faster. Higher customer retention rates and more efficient business practices are part of the story. As marketing costs in mature markets declined and margins improved, the operating loss for the first nine months improved to -$745 million from -$1,279 million in the prior year period.

As marketing and sales costs are somewhat seasonal, the following are the costs in 2023.

- 03/2023: $389m

- 06/2023: $207m

- 09/2023: $313m

Sales and marketing costs in 09/2022 were $321 million, so 2023 is an improvement, but the 12/2023 quarter will most likely have higher sales and marketing costs than 09/2023, as the last quarter historically has many promotions. OSB customers in particular are event and seasonal in character. However, DraftKings has been able to reduce expenses while increasing revenue and users. A positive sign.

Guidance was also raised from $3.5 billion in revenue to $3.695 billion in FY23 and $4.650 billion in FY24. That, combined with the $1.1 billion in cash and most likely $1.2 billion at the end of 2023, gives DraftKings a lot of cash to invest. Debt is $1.25 billion, which is almost covered by the cash position, so liquidity is not at risk. FCF is also expected to be positive in FY24. However, revenue growth rates are likely to slow because they are now starting from a larger base, but there are still plenty of opportunities for growth in the coming years, just not as high as in recent quarters. But DraftKings has a history of beating guidance and delivering more than forecast.

Q3 and 2023, in general, are record year for the gaming industry due to the new states and in person and online wagering had a really strong 22.8% YoY increase to $2.15 billion in Q3. But on the negative side, as of the last investor day, existing shareholders can expect 3% annual dilution from SBC. And it is also a very competitive market, which has become even more so with the recent launch of ESPN BET.

Will ESPN BET be a threat?

Besides competitors like FanDuel (OTCPK:PDYPY), Fanatics (FANA), BetMGM (MGM), or bet365, there is a new competitor in town called ESPN BET, which is basically a rebranding of Barstool Sportsbook. ESPN BET launched in 17 U.S. states on November 14, and PENN Entertainment has the rights to use the ESPN BET trademark for 10 years, with the option to use it for an additional 10 years upon mutual agreement.

ESPN is a media heavyweight as the #1 sports media brand in the US with 105 million monthly digital unique visitors and 41 million followers on TikTok. Their membership base and ability to cross-sell during their broadcasts should provide plenty of opportunities to acquire new customers or drive existing ESPN customers to their sports betting app. ESPN is also a very strong brand, and many customers are familiar with the name. Having an audience of more than 200 million people interested in sports is certainly not a disadvantage.

In addition, ESPN BET will replace DraftKings’ advertising on ESPN, and in the early stages, some customers may switch from DraftKings to ESPN BET to test it out. But in the gaming industry, customers are most likely to use more than one app as they look for promotions, arbitrage bets, and different odds at bookmakers. However, the user experience and the software are critical to long-term success. We have also seen with PokerStars and GGPoker that GGPoker has overtaken PokerStars as the number one site because it feels more like a video game and they are offering interesting and innovative new games.

Does DKNG have a competitive advantage?

Right now, I would say that DraftKings has a slightly better customer experience than FanDuel and is far ahead of ESPN Bet. Companies like GameBlazers are still in their infancy, but are trying to innovate the DFS and gaming market, but are likely a few years away. In addition, the DraftKings brand is well established and continues to gain market share with new products and personalized betting.

Opportunities for growth in the future?

DraftKings Investor Presentation

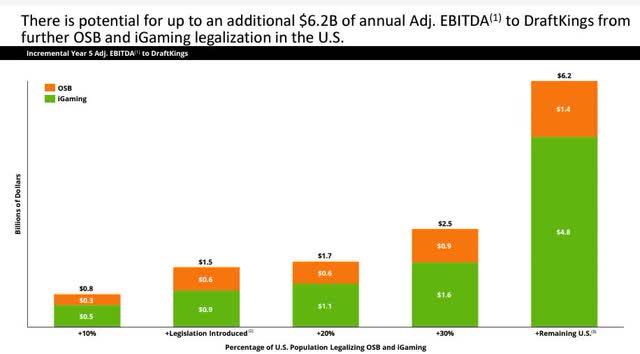

With approximately only half of the US population approved for OSB, there is a long runway for growth, and with the even lower rate for iGaming, the opportunity is even greater. Add to that the opportunity for growth in Europe, China, and many other countries. A highly addictive product like sports betting, combined with strict regulation and therefore high barriers to entry, is a powerful combination for high profits for the established players. Especially when they do not have to pay the high costs of brick-and-mortar casinos, such as wages for all employees and real estate costs.

However, the downside is that switching costs are low, as it probably only takes about 5 minutes to register on a new site. And that there is not much differentiation at the moment and the operators are relatively similar. Even in the established markets in Europe, where sports betting has been legal for some time, the providers are very similar.

Valuation of DraftKings

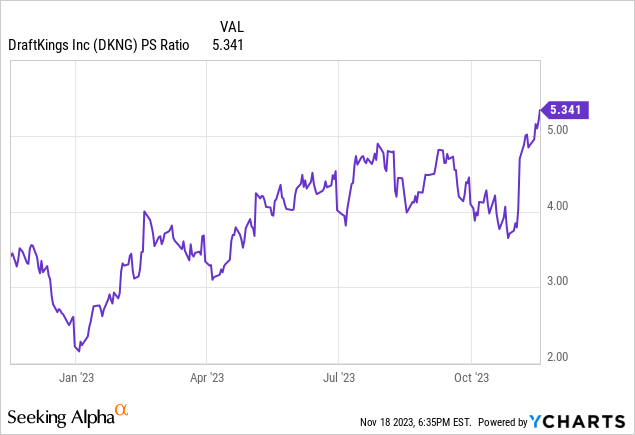

With a PS ratio of about 5x, DraftKings is not cheap, but it is reasonable for the growth it delivers. Unfortunately, with the PS ratio nearly doubling this year, much of the stock’s performance this year has been due to multiple expansion. Sure, revenue growth has played a role, but it is more the combination of these two factors this year. However, if growth rates remain strong and DraftKings FCF is positive in 2024, the multiple should remain so and the risk of multiple compression should be relatively low. More mature states with strong cash flows and declining customer acquisition costs should make the industry and DraftKings attractive to long-term investors.

Conclusion

It is a highly competitive market with high barriers to entry but low switching costs, currently driven by which app offers the best experience and innovative betting formats that drive average revenue per user. DraftKings, with its new progressive parlays, is always on the lookout for innovation and trying to provide its customers with a good betting experience. And with DraftKings iGaming only available to about 11% of the US population, there is a huge market for them to target in the future. However, with lots of money for promotions and good software, established players can be attacked by new entrants, as we have seen with GGPoker and PokerStars. The industry is growing fast and players are often attracted by the best bonus offer, rakeback, or other promotions. In the long run, it will be important to retain players and create loyalty. DraftKings has been successful in retaining players this year, so they have already achieved an important milestone.

I’m giving it a Hold rating for now, even though I don’t think ESPN BET will be a threat, I want to see how the market reacts and how the lack of advertising on ESPN will affect DraftKings. After all, ESPN is an important player in advertising because of its market power and the right target audience.