Dave Kotinsky/Getty Photos Leisure

Proposed drug pricing laws from Senate Democrats, if handed, would have an effect on income for pharmaceutical and biotech firms, however the affect would not be that important, based on RBC Capital Markets.

The laws would have an effect on pharma greater than biotech a minimum of initially. It could initially impression solely 10%-15% of revenues for many affected firms, based on the agency.

RBC famous that the laws seems extra prone to occur this time round in comparison with the previous.

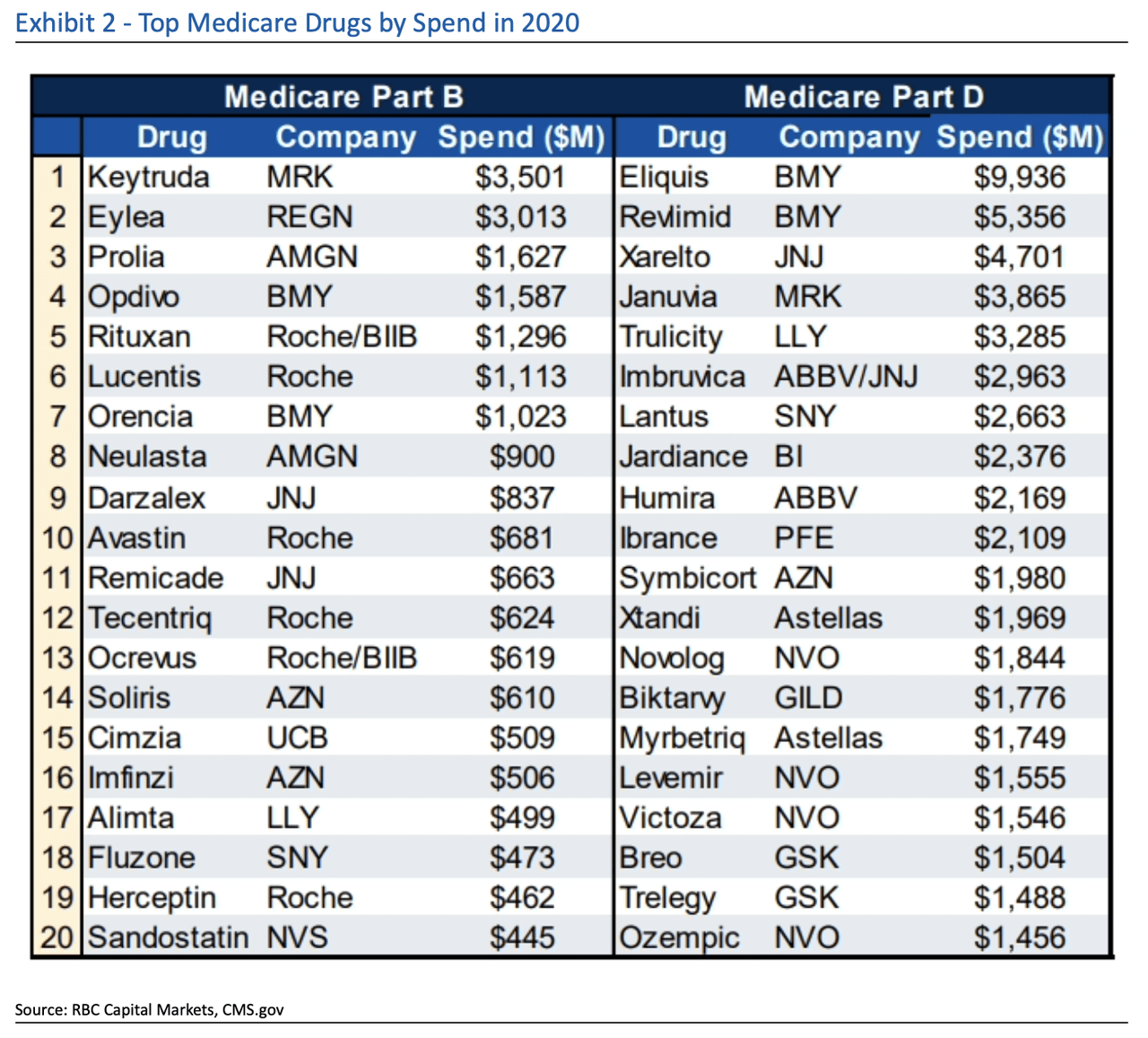

The Senate proposal says that starting in 2026, HHS can select 10 medication from among the many prime 50 in Medicare Elements B and D to be discounted. Twenty extra could be added by 2029.

The low cost relies on how lengthy the drug has been available on the market. For medication marketed greater than 9 years, a minimal 25% low cost is required; better than 12 years, 35%; and better than 16 years, 60%.

As well as, drug costs cannot rise quicker than inflation. Additionally, Medicare enrollees would have a $2k out-of-pocket max. After that stage is reached, the associated fee could be break up between the Medicare plan, authorities, and the drugmaker. The producer could be answerable for 20% of that value.

The report famous that among the largest spend medication by Medicare will truly lose patent exclusivity or be approaching it by 2026. Whereas this could assist in reducing Medicare spend, it might additionally negatively impression pharma firms backside traces with out considering the laws.

These medication embrace Pfizer (NYSE:PFE)/Bristol-Myers Squibb (BMY) Eliquis (apixaban), AbbVie’s (NYSE:ABBV) Humira (aducanumab), Regeneron Prescribed drugs’ (REGN) Eylea (aflibercept), Bristol’s (BMY) Revlimid (lenalidomide), and Merck’s (MRK) Keytruda (pembrolizumab).

With high-dose Eylea — which has but to be accredited — for example, with discounting starting in 2028, the damaging prime/bottom-line impression could be 6–9%/9–13%, based on RBC.

Nonetheless, firms which can be planning on launching medication aimed on the aged inhabitants might face extra long-term threat, the agency added.

“Our evaluation signifies that firms are already starting to speed up their charge of value will increase, maybe partially because of inflationary components however probably additionally because of anticipation of the laws and its attainable long-term impression,” the RBC group wrote.

However there are lots of unanswered questions that will dictate the complete impression of the the laws on drugmakers. Amongst these are what medication HHS would select and on what foundation, how lengthy for negotiations to happen, and when these reductions would truly be seen.

Different pharmas/biotechs that may very well be impacedt by the laws embrace Eli Lilly (LLY), Johnson & Johnson (NYSE:JNJ), Roche (OTCQX:RHHBY), AstraZeneca (AZN), Sanofi (SNY), Novartis (NVS), Gilead Sciences (NASDAQ:GILD), and Amgen (AMGN).

In March, the Home handed laws capping the price of insulin at $35/month.

Pricey readers: We acknowledge that politics typically intersects with the monetary information of the day, so we invite you to click on right here to affix the separate political dialogue.