Image credits: SergiyN/Depositphotos

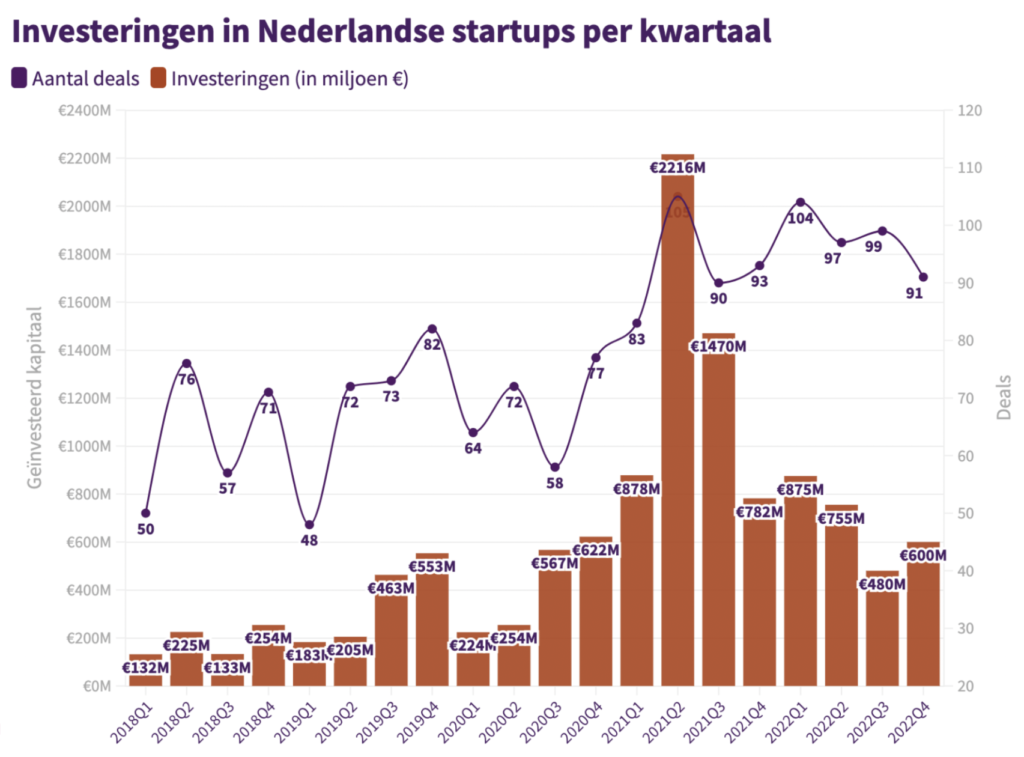

The Quarterly Startup Report for Q4 2022 is out! This quarter, Dutch startups have raised €600M in venture capital, 25 per cent more than in Q3, reveals the quarterly data analysis.

The Quarterly Startup report was published in collaboration with Dealroom.co, Golden Egg Check, KPMG, the Regional Development Companies (ROMs), Dutch Association of Participation Companies (NVP), Dutch Startup Association (dSa), and Techleap.nl.

Here are key insights from the report.

Raised €600M

According to the quarterly data analysis, Dutch startups raised €600M in venture capital in Q4, 25 per cent more than in the third quarter but less than in the same quarter last year (€760M).

Drop in late-stage deals

The number of deals remained stable in 2022 at 415 compared to the previous year, however, there is a change in dynamics, states the report.

![]()

The report says there was an increase in early-stage deals (under €15 M) and a sharp drop in late-stage deals (over €15M) from 57 to 37 due to uncertainty in the (public) markets in 2022.

The decrease in larger rounds explains the sharp drop in investments compared to the exceptional year 2021. Large rounds then raised by Dutch scaleups such as Mollie, Messagebird and Bunq mainly came from foreign investors.

The analysis states these funds have fallen back to the levels seen during the early days of the coronavirus pandemic in terms of participation.

Top 5 deals in Q4, 2022

As per the quarterly report, the top 5 deals in Q4 2022 are:

- Mews – $185M

- Crisp – €75M

- econic – €40M

- Dwarves – €30M

- Axelera AI – $27M

€2.6B investment in Dutch startups

The quarterly data analysis says that in 2022, a total of €2.6B was invested in Dutch startups. After the record year 2021 (€5.3B), 2022 is the best year ever measured, highlights the report. Further, the investments were one and a half times higher than in 2020 (€1.7B).

“Taking into account the pre-corona era, a long-term, structural growth can be observed in investments in Dutch startups,” says the report.

Top 10 deals throughout 2022

The report also listed the top 10 deals throughout 2022. They are:

- Mews – $185M

- Leyden Labs – $140M

- Backbase – €120M

- Pyramid Analytics $120M

- In3 – €81M

- Lightyear – €81M

- Crisp – €75M

- SMART Photonics – €75M

- Ambagon Therapeutics – €75M

- TestGorilla – $70M

Lack of larger Dutch funds

According to the report, the lack of large Dutch investment funds for startups remains a concern. Dutch startups are majorly dependent on foreign parties for large rounds of growth capital.

“Not only does the return disappear abroad, but the organisations are also concerned about the retention of innovative companies and important technologies in the Netherlands,” the report calls out.

Dutch pension funds are in a great position to help increase the size of Dutch venture capital funds. Doing so would reduce the level of reliance startups have on larger (particularly US-based) funds, says the report.

In addition to a large number of new funds, a great deal of uninvested money (‘dry powder’) is also available from Dutch funds, adds the report.

“Structural growth in investment is expected to continue, following the current pattern of more early phases, if these are sufficiently boosted, and then the more late phase,” says the report.

The X factors behind investment

The report states that these investments are driven by our current pressing challenges such as climate change, energy usage, health concerns, and safety.

Climate startups were most popular with investors for the major rounds last year.

International regulations, public opinion, and the post-corona era challenges provide a great opportunity to establish a long-term wave of sustainable startups and investments.

However, Dutch funds and regulations will be key for determining how much the Netherlands will benefit from this effort and its international competitive position and business climate to regain.

Lucien Burm, chairman of the Dutch Startup Association, says, “The real economy is experiencing great uncertainties, and scaleups are feeling this. Young startups are not yet due to limited growth or turnover. Investments have therefore shifted more to the early phase.”

“Local capital for follow-up rounds, therefore, remains a major concern for the future; The Netherlands is too dependent on foreign countries for this,” says Burm.

“It is important that fiscal measures are introduced to stimulate this and that institutional investors turn their eyes to startup funds, given their focus on sustainable development, an area where startups can generate a lot of returns,” adds Burm.

Maurice van Tilburg, Managing Director of Techleap.nl, says, “It is encouraging to see that, despite the current economic challenges, there is still a structural increase in the available growth money for startups that provide solutions to the major societal challenges of this era.”

“To continue the growth and to ensure that we continue to develop vital technology in our country in the future, we have more active participation from Dutch investors, such as pension funds, both themselves and as part of a co-investment with foreign investors,” he adds.