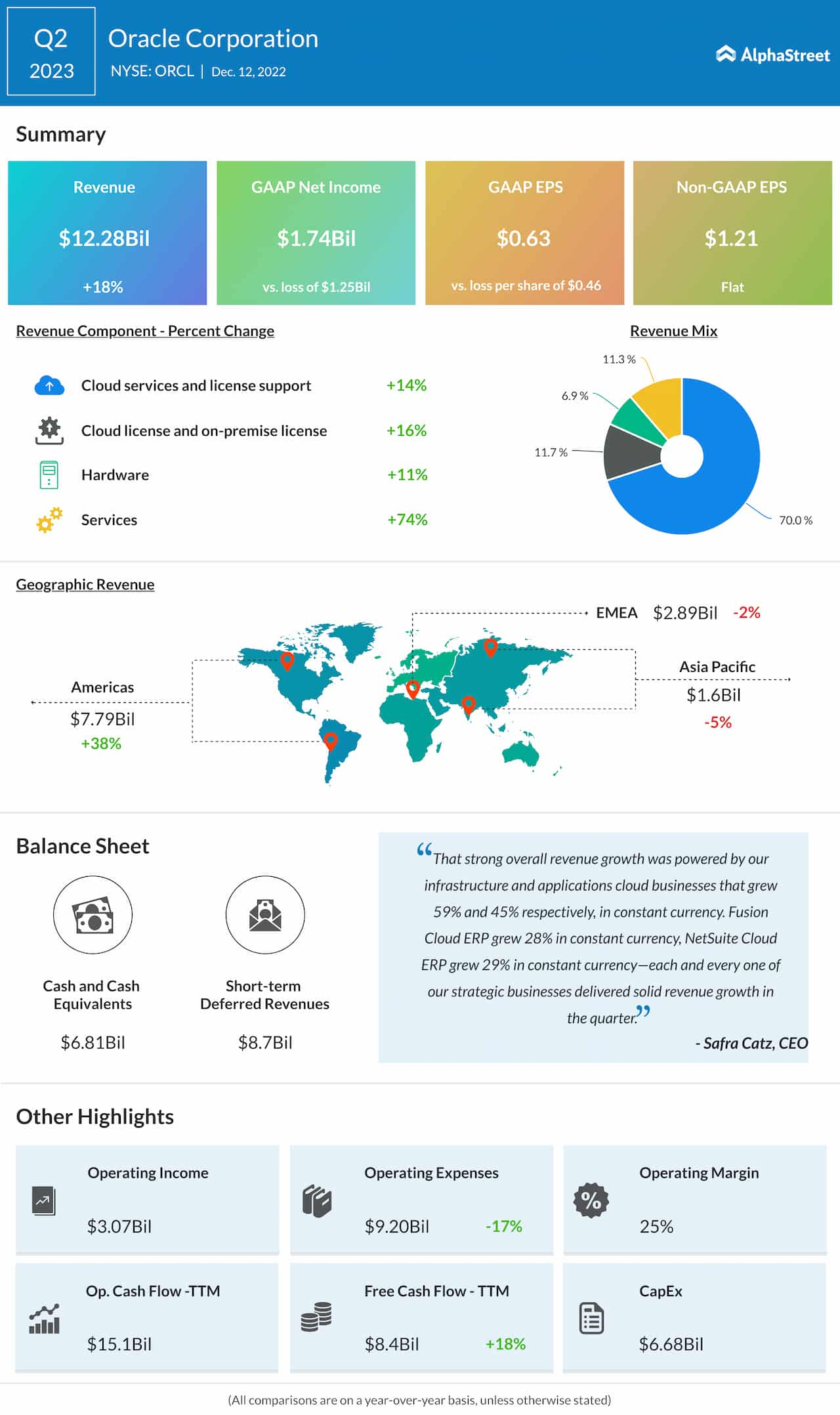

Software giant Oracle Corporation (NYSE: ORCL) Monday said its second-quarter revenues rose 18%. Meanwhile, adjusted earnings remained unchanged year-over-year. The results beat Wall Street’s forecasts.

At $12.3 billion, revenues were up 18% year-over-year in the second quarter of fiscal 2023. The top line also exceeded the market’s projection.

Adjusted earnings were unchanged year-over-year at $1.21 per share in the most recent quarter, but topped expectations. Net income, including one-off items, was $1.74 billion or $0.63 per share, compared to a loss of $1.25 billion or $0.46 per share last year.

Check this space to read management/analysts’ comments on Oracle’s Q2 results

“Our goals are ambitious: fully automate clinical trials to shorten the time it takes to deliver lifesaving new drugs to patients, enable doctors to easily access better information leading to better patient outcomes, and provide public health professionals with an early warning system that locates and identifies new pathogens in time to prevent the next pandemic. The scale of this opportunity is unprecedented—and so is the responsibility that goes along with it,” said Oracle’s CTO Larry Ellison.