One other new personal disaster bond issuance from the Eclipse Re Ltd. transformer automobile has come to mild, the eighth from the platform in 2025 to date. At $100 million in measurement, this Eclipse Re Ltd. (Collection 2025-8A) cat bond lite has develop into the most important from the issuer this yr.

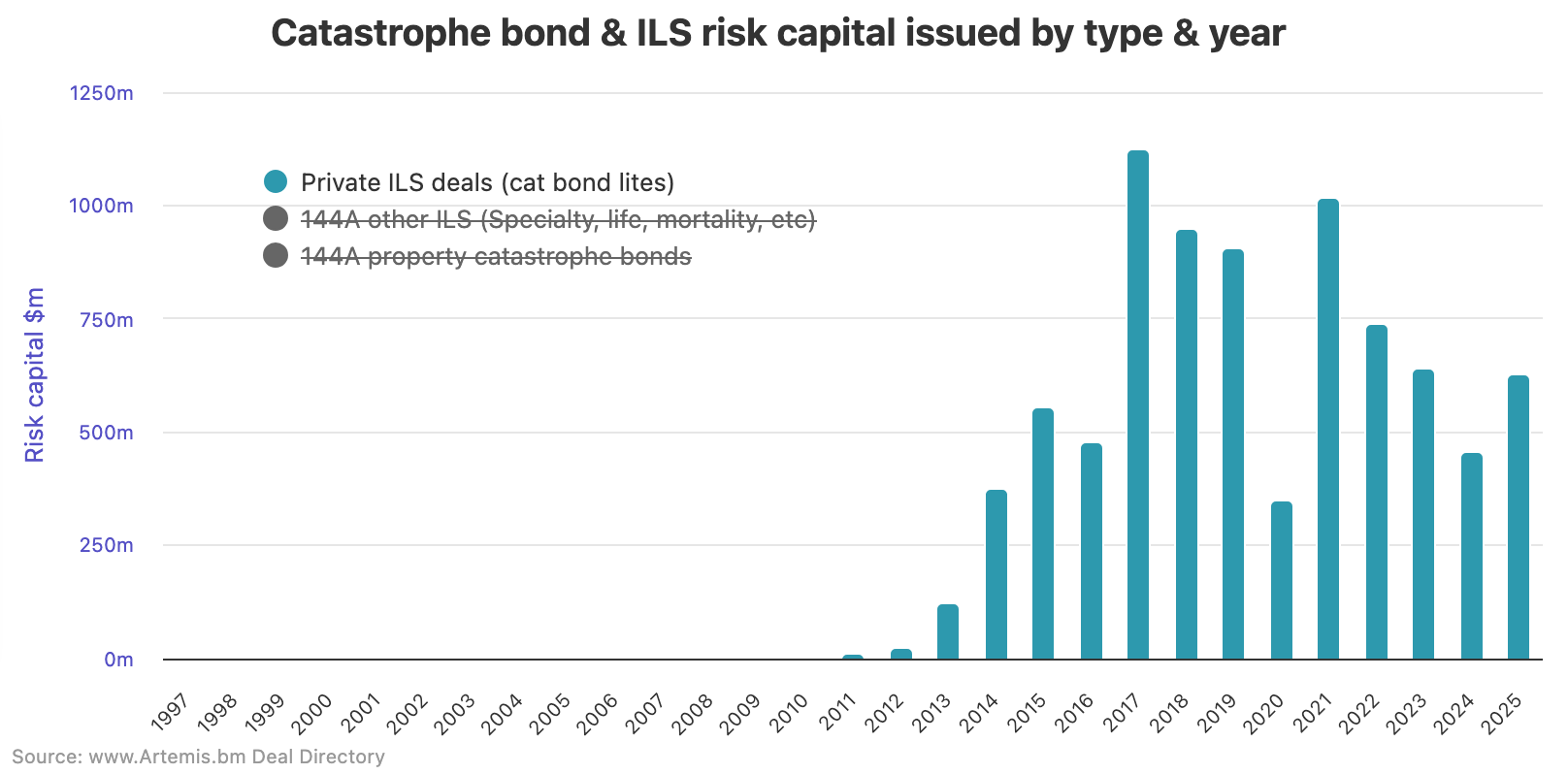

Issuance of privately positioned disaster bonds has resurged considerably in 2025 after a slowdown within the prior yr, with the whole coming to market to date already well-exceeding the quantity of those cat bond lites tracked in 2024.

Eclipse Re, the Artex managed construction, is among the many most prolific yearly, and in 2025 we’ve now tracked over $218 million of personal cat bond notes issued by the automobile.

That makes Eclipse Re probably the most prolific issuer of cat bond lites in 2025 to date, throughout the offers we’ve seen data on and so been in a position to monitor.

Issuance coming from personal disaster bonds, or cat bond lite constructions continues to rise in 2025 and the yr has now risen well-above the whole we tracked in 2024, though stays barely behind the 2023 whole at the moment.

Complete personal cat bond issuance tracked by Artemis in 2025 now stands at $626.51 million year-to-date, forward of 2024’s $455.52 million and shutting on 2023’s $641.93 million.

You may view the main points of each personal cat bond issuance we’ve tracked by flitering our in depth cat bond Deal Listing.

Eclipse Re Ltd. is a Bermuda domiciled particular function insurer (SPI) and segregated account firm that operates as a personal insurance-linked securities (ILS) and collateralized reinsurance transformer and issuance platform.

Eclipse Re is owned and operated by insurance-linked securities (ILS) market facilitator and repair supplier Artex Capital Options.

The construction allows the environment friendly issuance of personal disaster bonds, or different privately issued and positioned insurance-linked securities.

Sometimes, that is to assist sponsors entry the capital markets effectively by offering a perform as a threat transformation construction, or by working on behalf of ILS fund managers and traders inside their origination and sourcing of investments.

These may be securitizations of cedent-specific threat switch offers, or of a slice of a reinsurance tower participation. And even the securitization of ILS fund-to-fund hedges.

Particulars are restricted as at all times, given the personal nature of those cat bonds, so we are able to’t be sure of the motives or actual options of this new deal.

This newest personal cat bond from the platform, noticed Eclipse Re Ltd. issuing a $100 million tranche of Collection 2025-8A notes, that we presume will cowl some kind of property disaster reinsurance or retrocessional perils for an unknown cedent. We additionally should not have any particulars on the set off kind, threat metrics or pricing, as is typical with these personal cat bonds.

The $100 million of Collection 2025-8A notes have been issued on behalf of Eclipse Re’s Segregated Account EC0077 and the notes have a closing maturity date of September thirtieth 2026.

Given the maturity date, it’s assumed that the $100 million of Collection 2025-8A notes are a securitization of a one yr or much less length reinsurance or retrocession association by Eclipse Re.

The $100 million of notes issued by Eclipse Re have been privately positioned with certified traders and listed on the Bermuda Inventory Alternate (BSX).

We assume this issuance contains a reinsurance or retrocession association, probably overlaying property disaster dangers, that has been reworked utilizing the Eclipse Re construction, to create and challenge a sequence of investable, securitized cat bond notes, usually for an ILS fund supervisor or investor’s portfolio.

The proceeds from the sale of the $100 million of personal cat bond notes from this 2025-8A sequence of personal ILS notes issued by Eclipse Re are anticipated to have been used to collateralize a associated reinsurance or retrocession contract, with funds held in a belief.

As we stated, with now eight personal cat bonds tracked from Eclipse Re this yr, the whole issued by the platform that we’ve seen has reached $218.2 million.

That’s now operating forward of the $184.4 million from eight sequence of notes that we tracked in 2024, however nonetheless far behind the report $411.12 million from ten points that we tracked from Eclipse Re in 2021.

Complete listed personal cat bond issuance has now reached $626.51 million year-to-date in 2025.

You may analyse personal cat bond issuance by yr in our chart that breaks down all our tracked issuance by kind right here.

2017 was the report yr for personal cat bonds tracked by Artemis, at simply over $1.12 billion of issuance recorded.

View the main points of each personal cat bond issuance we’ve tracked by flitering our in depth cat bond Deal Listing.

Analyse personal disaster bond issuance by yr utilizing our interactive chart.

You may view particulars of each personal cat bond we’ve tracked by filtering our Deal Listing to see personal ILS transactions solely.

All of our disaster bond market charts and visualisations are up-to-date and embrace knowledge on new cat bond transactions as they settle.