marchmeena29/iStock through Getty Photos

eGain Company (NASDAQ:EGAN) is a promising inventory, representing a share in a next-gen digital service supplier, that I imagine is a purchase for traders. The post-Covid shift in the direction of digitization and altering dynamics places EGAN on the forefront of this transformation, positioning the corporate to be an business chief within the near-term future. Its spectacular ROCE calculations additional reinforce its attractiveness from an funding standpoint. EGAN’s inclusion into any portfolio is more likely to increase each progress in addition to return on capital.

Firm Overview

eGain Company is an organization that operates within the area of customer support infrastructure. It notably focuses on cloud-based software program options {and professional} providers, based mostly in California. It holds a presence in numerous markets spanning North America, Europe, the Center East, and the Asia Pacific.

EGAN’s major technique rests on delivering options that make sure the automation of buyer engagement mechanisms, together with its augmentation and orchestration. Its enterprise mannequin is sales-based, in addition to subscription-based, while concurrently providing skilled providers reminiscent of consultancy to its purchasers. On account of E-Achieve’s experience, the character of its providers falls into a number of sub-sectors reminiscent of healthcare, telecommunications, monetary providers, retail, authorities initiatives, and others.

Gaining Foresight by Wanting Behind: EGAN’s Value Trajectory

Wanting again on the shifts in EGAN’s worth, we are able to achieve helpful perception as to how the market has priced the inventory, particularly amidst international shockwaves and disruptions. Within the final 5 years, EGAN worth ballooned by a level of seven instances, while buying and selling at $11.58 as of early April 2022. Nonetheless, this trip has not been clean, and the expansion pattern had steadily taken hits from exterior disruptions, but has persistently managed to beat these shocks. The place the expansion from April 2017 to April 2022 quantities to 600%, the expansion within the first 15 months of this timeframe was near 1000%, which noticed EGAN climb from $1.65 to almost $18.

Finviz

When the Covid-19 pandemic had hit the globe, industries confronted shutdowns and international provide chains had seen critical disruption. Nonetheless, for EGAN, this section denoted great alternative, progress, and demand for its providers. Companies and organizations noticed a shift to distant fashions, which led to a surge in digital options providing on-line experiences to the enterprise. Customer support had been extensively prioritized all through this era.

The shifting market dynamics prioritized totally different areas that had been prioritized in customer support, reminiscent of cellphone wait instances. EGAN was fast to acknowledge this and provide providers that minimized cellphone wait durations. In consequence, EGAN costs ballooned by over 3 times from March 2020 to November 2020, rising steadily from $5.81 to $18.33.

EGAN’s Covid-linked progress spurt was adopted by a tough plummet following the discharge of its earnings report for fiscal Q1 2021. The corporate topped earnings estimates however missed expectations on income. Furthermore, its monetary outlook for the second was considerably under the expectations of Wall Road, resulting in traders dumping the inventory.

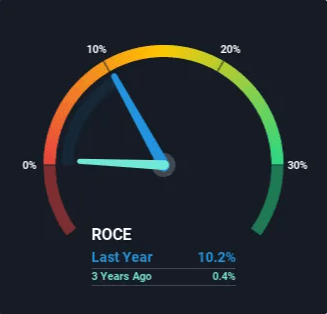

From then onwards, the value of EGAN rose and fell, finally stabilizing at its current worth of $11.59. Amidst the rises and dips of March 2022, EGAN had managed to realize 8.8% in its worth. The earnings Q2 launch from February 2022 gave EGAN a considerable increase upwards of 32%. By surpassing analysts’ expectations of an EPS of $0.03 per share, EGAN had managed to ship an EPS determine of $0.10 per share. Because of this spectacular monetary efficiency and progress, the corporate’s return on capital employed (ROCE) climbed up from 0.4% to a staggering 10.2% in a mere 3-year timespan. This brings us to an in-depth dialogue relating to the corporate’s ROCE.

Merely Wall St

The EGAN Comeback Story Hyperlinks Intently to its ROCE Enchancment

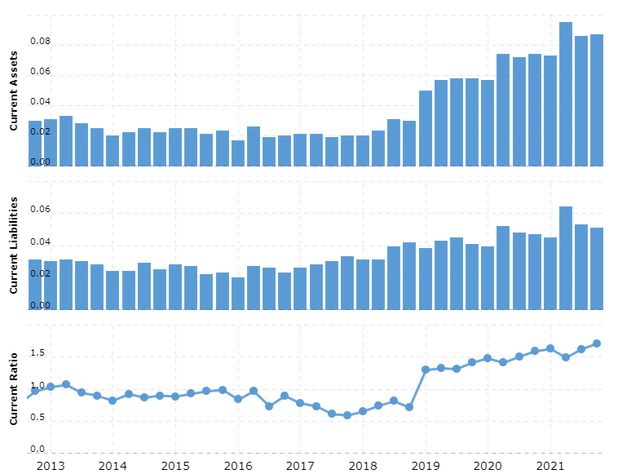

Whereas in 2017 the corporate was reporting constant losses, its ROCE determine of 10.2% signifies a turnaround for EGAN’s path from a capital burner to at least one including worth to its investor’s monetary sources. This comeback additionally relates closely to its capital utilization, which is 300% greater than the place it stood in 2017. The corporate has grown in dimension and has improved in capturing alternatives. Moreover, this elevated ROCE and capital utilization has coincided with a 50% lower in its present ratio, indicating that EGAN has grown robustly and sustainably as an alternative of a pure debt-based progress surge.

Macrotrends

EGAN’s steadiness sheet signifies it’s standing in a much better place in paying off its present obligations than it was earlier than. It comes as no shock, due to this fact, that traders affiliate the advance with a big diploma of threat discount.

eGain Taking Buyer Service to the Future

Simply because the outbreak of the Covid-19 pandemic demonstrated, the character of eGain holds immense potential in a time of disaster, the corporate has made a mark as a service supplier of the long run. The Covid-19 age has initiated a number of traits that relate to digital customer support and cloud-based options, which proceed to affect the trail the business has taken as an entire. EGAN is more and more proving to be an organization trying to the long run, and addressing upcoming challenges.

In March 2022, the corporate participated within the Cellular World Congress in Barcelona, the place it introduced the success story of its shopper agency from the telecommunications sector, BT Shopper. On account of using eGain options, BT Shopper fully restructured its customer support portal serving 20 million clients. By means of using AI-based processes, it had managed to considerably enhance each buyer engagement, in addition to retention. Most spectacular, nevertheless, was the sheer cost-cutting that BT Customers managed to implement because of eGain providers, which noticed optimization by means of the elimination of tens of hundreds of customer support brokers and retailer associates.

Furthermore, analysis has indicated that the post-Covid shift to digitization has most importantly impacted buyer experiences, together with worker administration and operations. E-Achieve’s focus has at all times been on enhancing buyer expertise, by guaranteeing a extra private expertise achieved by means of emotional engagement. By means of using AI instruments and knowledge analytics, E-Achieve permits its purchasers to higher perceive its clients, and guarantee worth creation by shifting choices based mostly on these insights.

E-Achieve company is, in some ways a torchbearer for progress on this planet of digital providers realm. By means of its revolutionary use of synthetic intelligence, traders maintain grounds to anticipate future progress. As the worldwide customer support industries shift to the digital area, eGain’s potential market seize continues to boost. With its information administration method developed in the course of the Covid-era, eGain has redefined customer support by means of subcategorizing queries into informational, transactional, and situational divisions. In gentle of those developments, the corporate claims to be on the forefront of next-generation customer support, while “leaving rivals within the mud.”

Firm Insiders Transactions: Dangers and Prospects

To realize affirmation of the market prospects about EGAN, trying to insider transactions might show extremely insightful, given the knowledge benefit firm higher-ups have over the market. In early February, director Christine Russel’s possibility of 20,000 shares, vested in 2018, was exercised. This feature value $1.8 supplied a considerable earnings premium over the then-market worth of $12.21. Following the train of this feature, Russell had offered all 20,000 of the newly acquired shares, given the sheer long-term appreciation led to, because of EGAN’s progress. This might level to a possible threat for market shareholders. Nonetheless, the director’s whole possession of 56,250 shares remained unaffected because of the transaction.

Nonetheless, trying in the direction of extra constructive insider transaction information, a brand new replace had come about in late February 2022. In an alternative choice being vested, the CEO of eGain, Ashutosh Roy, gained 200,000 shares on the train worth of $5.28. Nonetheless, not like the director Russell, the CEO determined to carry on to those newly added shares, pushing his whole possession as much as 8,767,050 EGAN shares.

Though the newly exercised choices remained minuscule in comparison with whole possession, the CEO selected to carry on to them, regardless of a possible sale revenue of $1.25 million, and proceeds of $2.3 million, with out impacting internet possession. It is a clear indication that the corporate’s higher-ups are of the view that holding on to their shares will lead to greater profitability than the current alternative. It’s clear that progress and profitability are anticipated by insiders, given their info benefit.

Remarks and Conclusion

EGAN is a inventory that has its sights set excessive. Nonetheless, not like most corporations that do, it has the monetary efficiency to show it as being upon this bold path of transformational progress. Taking a look at these components holistically factors to eGain inventory being a transparent purchase for market contributors.

The Covid-19 outbreak in 2020, while a disaster for international business, proved to be an opportunistic shift for the corporate. Demand for digital customer support surged to an unprecedented diploma. The corporate efficiently grabbed on to this chance, and this was mirrored within the explosive progress in its ROCE figures. That is, largely, as a result of E-Achieve’s revolutionary method, and using AI-based processes that minimize down prices considerably and improve each buyer engagement and retention, throughout a number of industries. Firm insiders anticipate additional profitability and progress realization but to return.