NurPhoto/NurPhoto via Getty Images

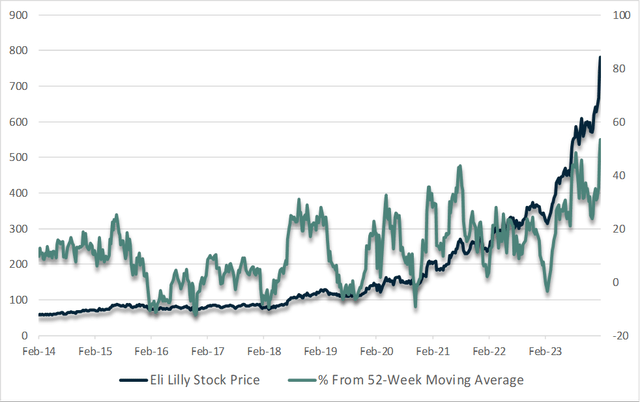

Eli Lilly (NYSE:NYSE:LLY) has seen a parabolic rise that has accelerated in a classic bubble formation. After a complete frenzy in call option buying and retail interest in the stock, investors are betting heavily in favour of further gains, despite it trading at 83x earnings, more than 4x the pharmaceutical industry average. Even under optimistic revenue growth assumptions, LLY now seems significantly overvalued, and a reversal of speculative activity could cause a large correction.

Bloomberg

Retail Buying And Options Frenzy Points To Peak Euphoria

Eli Lilly’s stock appears to have been the recipient of indiscriminate buying by retail investors, options traders, and short sellers. On the retail front, the surge in media coverage of the obesity drug market as well as its newfound status as a Magnificent 7 stock, which it achieved when it overtook Tesla in January, have driven a rise in retail interest in the stock.

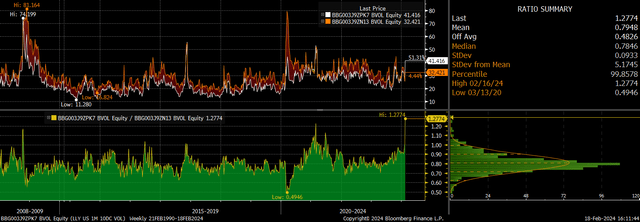

The stock has also been the beneficiary of the proliferation call option interest as I highlighted here. The leveraged nature of options means that notional buying power can become huge, pushing up prices. The frenzy in call option demand is highlighted in the chart below, which shows the implied volatility levels for put and call options over a 1 month horizon. Calls now trade significantly higher than puts which is rare indeed and reflects extreme greed and a lack of fear.

1 Month Implied Volatility. Call/Put Ratio (Bloomberg)

LLY has also benefitted from short covering as bearish investors have been forced to buy the stock, often due to margin calls rather than a fundamental conviction, and short interest is now at multi year low as a share of float. As Bob Farrell’s 4th rule to remember states – parabolic advances usually go further than you think, but they do not correct by going sideways. I would not be surprised to see LLY continue its advance in the short term as talk of a $1trn market cap intensifies. However, I would be very surprised if any further gains are not given back as the current level of euphoria burns out. The price-incentive buying that has occurred over the past few months could easily shift to indiscriminate selling.

Overvalued Even Under Optimistic Growth Projections

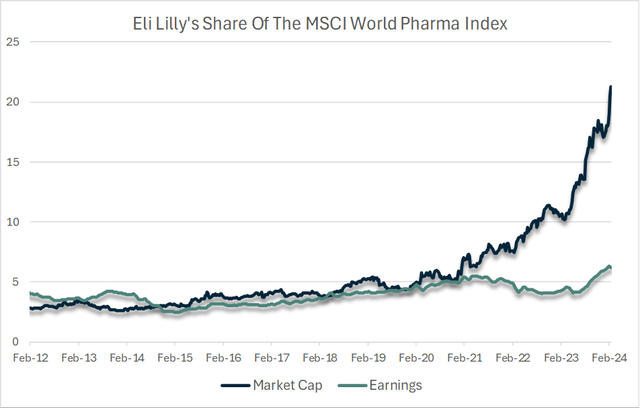

Eli Lilly’s parabolic advance has outstripped the impressive rise in sales and earnings over the past year, resulting in it trading at a PE ratio of 83x. This is high for any stock, but pharmaceutical stocks have tended to trade at below-market valuations over the past decade, meaning that LLY currently trades at 4.2x the average of the rest of the sector. As shown below, Eli Lilly’s market cap has risen to 21% of the entire MSCI World Pharmaceutical Index, despite its earnings representing just 6%.

Bloomberg

Last week Morgan Stanley upped its price target to $950, which would make the company worth $900bn. It now expects revenues to grow to $96bn by 2030, driven largely by the obesity drug market, which Goldman Sachs recently argued could reach $100bn by then. However, even these big numbers do not justify LLY’s current value. If we assume that the company can maintain its industry beating net margins of 25%, revenues of $96bn in 2030 would bring the stock’s PE ratio down to 31x assuming its value remains at its current $742bn.

While this may appear to justify further gains, two things are worth keeping in mind. Firstly, a 31x PE ratio for a company with $96bn in sales would be a very high multiple. Growth is a slowing function of market size and as companies move from mid size players to market leaders the scope for further growth diminished. There is a fairly robust inverse relationship between sales value and the price to sales ratio among the largest US companies as investors tend to price in slower growth and lower net margins for larger companies.

Secondly, investors have historically required a high rate of return on growth stocks and so it seems fair to say that most investors holding LLY today are anticipating at least 10% returns, which is the average long-term return on US stocks. This means that if the stock were to be value fairly assuming a 10% discount rate over 7 years it would have to be valued at just $462 today, 38% below current levels.

In order for LLY to be valued in line with its industry peers it would need to grow earnings by 4.2x relative to the MSCI World Pharmaceutical Index, which would justify is share of market cap. While LLY has huge potential in the obesity and diabetes markets, it seems highly unlikely that its earnings will reach 21% of the entire industry. While Eli Lilly has a number of promising products in the pipeline, its new GLP-1 weight loss drug Zepbound has driven the bulk of the surge in revenue growth expectations. However, this optimism surrounding one drug leaves the stock highly susceptible to competition in this space. Novo Nordisk (NVO) is its main competitor but there is also a race to develop an obesity drug in pill form. Despite recent setback, Pfizer (PFE), backed by net assets of almost 10x that of LLY, is expected by some to launch a product by 2026.

Summary

Eli Lilly’s stock price has been driven up price insensitive buyers including retail investors, options traders, and short covering. While parabolic moves can go on for longer than expected, we are already seeing record levels of greed relative to fear in options market. At over 4 times more expensive than its industry peers, even rapid sales and earnings growth is unlikely to justify current valuations.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.