Campaigning for a second time period, President Donald Trump dedicated the USA to sweeping tariffs that don’t have any precedent because the Second World Conflict. Shortly after his inauguration, Trump issued a number of Govt Orders (EOs) and press releases each to enact and generally reverse tariffs. Anticipation, enactment after which pauses within the president’s tariff agenda all affected US and international fairness markets. This essay studies available on the market influence of Trump’s a number of tariff selections.

Desk 1 summarizes values, as of April 30, 2025, for a number of US and overseas fairness markets. It additionally studies our calculations of day by day constructive and unfavourable market worth modifications ensuing from Trump’s tariff selections between election day (November 5, 2024) and April 30, 2025. The day by day occasions are summarized in desk 2 under. Cumulative modifications on the foot of desk 1 symbolize the summation of unfavourable and constructive day by day modifications following tariff occasion days, not complete market modifications between November 5, 2024, and April 30, 2025.

The cumulative unfavourable influence of choices imposing tariffs subtracted $377 billion from the market worth of the Russell 2000, $2 trillion from the Magnificent Seven, $4.7 trillion from the S&P 500 (which incorporates the Magnificent Seven), and $2.2 trillion from the market worth of equities in six severely affected overseas nations.

Market losses had been sharply reversed when Trump paused pending tariffs on April 9, 2025. Excluding the rebound following the April 9 pause, the unfavourable day by day modifications far exceeded the constructive day by day modifications. oreover, US shares had been by far the largest loser from Trump’s tariffs, particularly the Magnificent Seven.

Desk 1. Every day market capitalization modifications between November 4, 2024, and April 30, 2025. $ billion.

Notes: For every nation, the next indexes symbolize the respective fairness markets: Mexico (S&P/BMV IPC, ticker: MEXBOL), Canada (S&P/TSX Composite, ticker: SPTSX), China (CSI 300, ticker: CSI300), Europe (STOXX Europe 600, ticker: STOXX600), Japan (Tokyo Inventory Value Index, ticker: TOPIX), Korea (Korea Composite Inventory Value Index, ticker: KOSPI). Cumulative one-day influence is the sum of day by day modifications following tariff occasions. Because the February 1 announcement was on a weekend, February 3 was used as an approximation. For China, February 5, 2025, was the primary buying and selling day of the month on account of nationwide holidays and was thus used to approximate the response to the tariff announcement on February 1 (*).

US Fairness Market Reactions

Determine 1 depicts US fairness markets for 2 fairly completely different share classes – the Russell 2000 and the Magnificent Seven – starting with the final election on November 5, 2024, and ending on April 30, 2025. The Russell 2000 index consists of roughly 2,000 small-cap US equities, corporations with restricted publicity to overseas commerce or funding. In contrast, the Magnificent Seven are extremely profitable tech corporations deeply engaged in world markets, each by commerce and funding: Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla.

As determine 1 reveals, the Russell 2000 index rallied after Trump’s election, however then misplaced most of these features by inauguration day. The Magnificent Seven, nonetheless, loved a stronger and extra sturdy rally, gaining about 20 % between election and inauguration. Evidently, buyers believed that Trump’s insurance policies can be extremely favorable, at the least for big tech corporations.

On inauguration day and within the following weeks, Trump issued a number of Govt Orders (EOs) decreeing far increased and extra complete tariffs than markets had anticipated. Gloomy prospects of home inflation, overseas retaliation, and enterprise chaos shocked the monetary markets. Each the Russell 2000 and the Magnificent Seven indexes fell sharply till Trump introduced a dramatic tariff pause on April 9, 2025.

Determine 1. Russell 2000 and Magnificent Seven market indexes.

Notes: Every index is normalized to 100 primarily based by itself worth on November 4, 2024. This enables for a direct comparability of relative efficiency over time.

Digging deeper, we discover fairness market valuation modifications instantly following every Trump tariff announcement. For this train, we study the change in market costs between the shut on the day prior to this and the shut on the announcement day. However for “reciprocal” tariffs that had been introduced after the market closed on April 2, 2025, we study the change between the shut on April 2, 2025, and the shut on April 3, 2025.

Invoking the environment friendly market speculation, we assume that the anticipated results of an introduced tariff change on company earnings, rates of interest and different components are shortly mirrored in fairness valuations. Preliminary expectations could show too pessimistic or too optimistic. The environment friendly market speculation, nonetheless, asserts that fast expectations as to the value results of a shock present one of the best obtainable forecast on that day. Additional, by attributing all valuation modifications on the announcement dates to tariff modifications, we assume that different contemporaneous shocks had been typically minor.

Desk 2 lists the dates and summarizes the content material of Trump’s tariff bulletins, beginning along with his election on November 5, 2024. Election day is included as a result of market members then knew that main tariff modifications had been a close to certainty. Trump’s inauguration day, January 20, 2025, was additionally included as a result of that marked the start of particular tariff selections. Desk 2 additional reveals the share change on every valuation day of an ETF for the Russell 2000 (IWM) and the Bloomberg index (BM7P) for the Magnificent Seven. The day by day proportion modifications in desk 2 present the premise for calculating the day by day greenback modifications in desk 1.

On most valuation days, the Russell 2000 and Magnificent Seven share the identical route of change and roughly comparable magnitudes. For instance, following the “reciprocal” tariff announcement on April 2, 2025, the Russell 2000 dropped 6.3 %, whereas the Magnificent dropped 6.7 %

On the foot of desk 2, the primary row summarizes cumulative unfavourable market reactions recorded on valuation days, expressed in proportion phrases. Maybe stunning, the Russell 2000 index dropped virtually as a lot because the Magnificent Seven.

The second row on the foot of desk 2 summarizes cumulative constructive market reactions recorded on valuation days, expressed in proportion phrases. In complete, constructive market reactions exceeded unfavourable market reactions, because of the massive aid rally when Trump paused tariffs on April 9, 2025.

The third row on the foot of desk 2 summarizes cumulative constructive reactions in proportion phrases, aside from the April 9 aid surge. Evidently, with out the tariff pause, the Russell 2000 index and the Magnificent Seven would each have been deeply within the crimson on the finish of April 2025.

Desk 2. One-day value returns of Russell 2000 and Magnificent Seven on Trump announcement days. Every day % modifications.

| Analysis Day | Occasion | Russell 2000, 1-day returns (%) | Magnificent Seven, 1-day returns (%) |

| 11/5/2024 | Election Day | 1.9 | 1.8 |

| 1/21/2025 | Inauguration Day (Jan 20, 2025) | 1.8 | 0.3 |

| 2/3/2025 | On February 1, Trump issued EO saying tariffs on Canada, Mexico, and China. | -1.3 | -1.7 |

| 2/10/2025 | Trump introduced 25 % import tariffs on metal and separate proclamation imposing 25 % tariffs on aluminum as of March 12. | 0.4 | 0.4 |

| 3/4/2025 | EOs to lift the brand new tariffs on all imports from China from 10 % to twenty %, impose 10 % tariffs on imports of Canadian oil and vitality merchandise and 25 % tariffs on the rest of imports from Canada. | -1.1 | -0.6 |

| 3/25/2025 | The White Home issued secondary tariffs on third nations importing Venezuelan oil. | -0.7 | 1.2 |

| 3/26/2025 | The White Home imposed 25 % tariffs on cars and sure vehicle elements. | -1.0 | -3.0 |

| 4/3/2025 | On April 2, the White Home invoked IEEPA to impose baseline 10 % tariff beginning April 5 after which “reciprocal” tariffs beginning April 9. | -6.6 | -6.7 |

| 4/8/2025 | The White Home amended to impose extra 50 % tariff on imports from China, growing to 84 %. | -2.7 | -2.4 |

| 4/9/2025 | The US imposed an extra country-specific tariff on China; then paused different “reciprocal” tariffs for 90 days, aside from China. China will now face 125 % of tariffs. | 8.7 | 14.4 |

| 4/11/2025 | The White Home issued an inventory of merchandise, together with smartphones and semiconductors, to be excluded from the April 2 govt order | 1.6 | 1.9 |

| 4/29/2025 | The White Home issued a proclamation and an govt order to handle considerations over stacking tariffs and avoiding the cumulative tariffs. The proclamation additionally amended earlier tariffs beneath Part 232 concerning cars and vehicle elements. | 0.6 | 0.6 |

| Cumulative one-day loss (%) | (13.4) | (14.4) | |

| Cumulative one-day features (%) | 14.9 | 20.6 | |

| Cumulative one-day features (%), with out April 9 | 6.2 | 6.2 | |

Supply: Bloomberg and authors’ calculations. Bown, Chad P, “Trump’s Commerce Conflict Timeline 2.0: An Up-to-Date Information.”

Notes: One-day value returns are calculated by the share change between the closing value on the announcement day and the closing value on the earlier buying and selling day.

The fairness market surge, following the tariff pause on April 9, 2025, was a game-changer, not just for the markets but in addition for Trump’s political fortunes. In accordance with press studies, Commerce Secretary Howard Lutnick and Treasury Secretary Scott Bessent bought Trump on the pause, overshadowing tariff hawk Peter Navarro.

If that account is correct, Lutnick and Bessent gave Trump good recommendation. With out the pause, fairness market losses for the six months between November 2024 to April 2025 would have overwhelmed fairness market features.

International Fairness Market Reactions

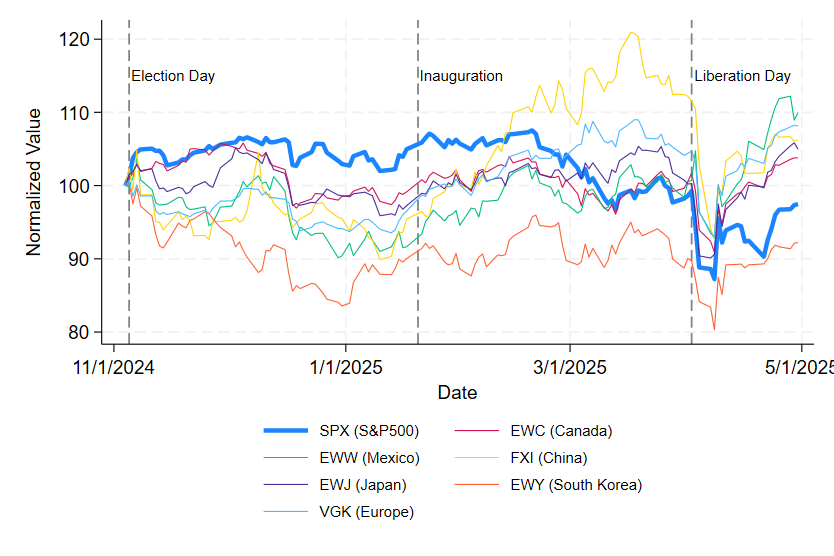

Determine 2 compares the S&P 500 index with indexes of exchange-traded funds (ETFs) for six affected nations. Between election and inauguration, the S&P 500 rallied about 6 %, whereas many of the nation ETFs fell to various extents.

Inside weeks after inauguration, because the breadth and extent of Trump’s tariffs had been revealed, most markets fell. After all, US tariffs weren’t the one shock transferring markets. Notably, Chinese language equities rose in response to authorities stimulus. Trump’s sweeping “Liberation Day” tariffs on April 2, nonetheless, provoked a stoop in all markets, reversed to various levels by the April 9, 2025, 90-day pause.

Determine 2. S&P 500 and International Market Indexes.

Notes: Every index is normalized to 100 primarily based by itself worth on November 4, 2024. This enables for a direct comparability of relative efficiency over time.

Desk 3 reveals the share change on every valuation day for the S&P 500 ETF (SPY) and ETFs for six closely affected nations: Mexico (EWW), Canada (EWC), China (FXI), South Korea (EWY), Japan (EWJ) and the European Union (JGK). The primary three are the highest US buying and selling companions. All six have giant bilateral surpluses of their merchandise commerce with the US, leading to excessive (however falsely named) “reciprocal” tariffs. All ETFs are traded in New York, guaranteeing that valuation modifications happen throughout the identical time interval.

On the foot of Desk 3 the primary row reveals cumulative unfavourable losses between November 5, 2024, and April 30, 2025, expressed in proportion phrases; the second row reveals cumulative constructive features in proportion phrases; and the third row reveals cumulative constructive features, aside from the surge on April 9, 2025, once more in proportion phrases.

In proportion phrases, the S&P 500 skilled the largest cumulative losses from Trump’s unfavourable tariff bulletins, although Canada and South Korea had been shut. China and Europe had been least affected. Trump’s tariffs dealt a heavier blow to US fairness values than to the supposed targets, particularly China.

Furthermore, overseas fairness markets typically loved equal or bigger cumulative features than the S&P 500 from Trump’s constructive tariff bulletins. International one-day features, aside from the April 9 surge, exceeded the S&P 500 features. Value noting is that cumulative S&P 500 losses, aside from the April 9 aid rally, had been virtually twice as giant as features. If President Trump desires US fairness market to prosper, he ought to pause extra tariffs.

Desk 3. One-day value returns of chosen ETFs on Trump announcement days. Every day % modifications.

| Analysis Day | S&P500 | EWC (Canada) | EWW (Mexico) | FXI (China) | EWJ (Japan) | EWY (South Korea) | VGK (Europe) |

| 11/5/2024 | 1.2 | 1.1 | -0.1 | 2.4 | 1.5 | 0.4 | 0.7 |

| 1/21/2025 | 0.9 | 1.7 | 1.9 | 1.1 | 1.7 | 1.6 | 2.3 |

| 2/3/2025 | -0.8 | -1.6 | 2.5 | -0.5 | -1.0 | -1.1 | -1.5 |

| 2/10/2025 | 0.7 | 0.9 | 0.2 | 2.7 | 0.4 | 1.8 | 0.7 |

| 3/4/2025 | -1.2 | -1.7 | 0.3 | 1.5 | -0.8 | 0.5 | 0.2 |

| 3/25/2025 | 0.2 | 0.5 | 1.1 | -1.0 | 0.7 | -0.4 | 0.6 |

| 3/26/2025 | -1.1 | -0.8 | -1.1 | -0.1 | -1.3 | -0.5 | -1.4 |

| 4/3/2025 | -4.8 | -2.3 | 4.0 | -0.9 | -4.1 | -2.7 | -1.4 |

| 4/8/2025 | -1.6 | -1.6 | -0.9 | -1.4 | 0.5 | -3.7 | -0.4 |

| 4/9/2025 | 9.5 | 6.4 | 7.9 | 7.1 | 7.6 | 8.9 | 7.4 |

| 4/11/2025 | 1.8 | 2.9 | 0.8 | 4.4 | 2.5 | 4.8 | 2.7 |

| 4/29/2025 | 0.6 | 0.2 | -2.9 | -0.6 | 0.4 | 0.8 | 0.2 |

| Cumulative one-day losses (%) | (9.5) | (8.0) | (5.1) | (4.5) | (7.2) | (8.4) | (4.7) |

| Cumulative one-day features (%) | 14.8 | 13.7 | 18.6 | 19.2 | 15.4 | 18.7 | 14.8 |

| Cumulative one-day features (%), with out April 9 | 5.3 | 7.3 | 10.7 | 12.2 | 7.8 | 9.8 | 7.4 |

Supply: Bloomberg and authors’ calculations.

Notes: One-day value returns are calculated by the share change between the final value of the analysis day and the earlier buying and selling day. If an announcement is made on a non-trading day, the analysis shall be primarily based on the closest buying and selling day.