The $7.1 trillion U.S. ETF business (as of three/31/22) is much from being a mature market. First developed within the Nineteen Nineties to supply entry to passive index monitoring and sector funds, the ETF universe has been in perpetual evolution. Now with current regulatory modifications decreasing market “obstacles to entry,” ETF issuers are being invited to convey to market extra artistic and distinctive approaches to the ETF construction. Initially pushed by typically decrease prices, simpler entry, and tax benefits, ETFs now characterize a broad engine for monetary providers innovation.

One other development dynamic may be added to this already exponential ETF development trajectory with Guinness Atkinson and Dimensional Funds main the best way in changing their mutual funds to ETFs. Bloomberg Intelligence estimates lively managers may convey $100 billion to the ETF business via mutual-fund conversions.

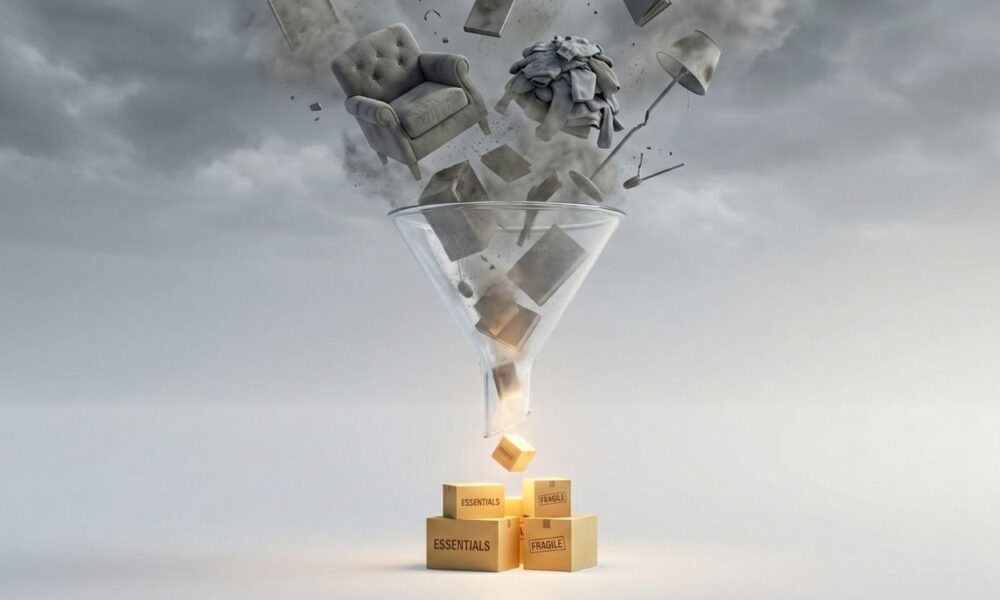

This dynamic development and huge number of intriguing new and re-engineered merchandise being launched are considerably rising aggressive pressures and presenting severe challenges for ETF issuers. To breakthrough at present’s more and more crowded market, these challenges reside round three elements: Entry, Price and Progress. In the end, development can’t be achieved with out entry to platforms and advisors, and the value of the inner sources wanted to successfully attain your shopper base can develop into prohibitive. Conventional distribution sources and personnel necessities will have to be rethought and reformulated.

As a way to study extra about these challenges and discover attainable options, we went to Institute member Jillian DelSignore, Managing Director, Head of Advisor Gross sales at FLX Networks – a neighborhood platform revolutionizing the engagement expertise for asset managers, wealth administration corporations, and monetary advisors.

Hortz: Are you able to please give us a short lay of the land of the place we are actually with this ever-evolving ETF market?

DelSignore: ETF asset development, product innovation and the speed of recent launches are really spectacular. 2021 was a file 12 months as world ETF belongings surpassed $10 trillion and noticed flows of over $1 trillion. There has additionally been an rising price of recent ETF launches – 299 in 2020, 459 in 2021 and 146 to date this 12 months. With a lot of the eye and utilization targeted on passive index methods, it’s fascinating to notice that lively ETFs now characterize over 29% of the universe using all kinds of funding methods from adaptive sector rotation to volatility administration to mounted earnings diversification, amongst many others. ETF.com, ETF Developments and ETF Database are nice sources of knowledge to observe the continued developments of this market.

Hortz: What do you see as essentially the most fascinating innovation tendencies available in the market at present?

DeISignore: A number of the extra fascinating product improvement is coming in areas like ESG and impression investing, outcome-oriented methods and thematics. Thematics, particularly, have ballooned in the previous few years. You see issuers creating ETFs that supply investor entry to exposures in blockchain, emergent meals themes and others impacted by shopper tendencies and demographic shifts. You even have lively ETFs, each absolutely and semi-transparent, persevering with to evolve and develop market share.

The final development I’ll be aware is mannequin portfolios more and more using ETFs. Fashions have been a development for a lot of years, and so they proceed to speed up as advisors and wealth administration residence workplaces look to supply turnkey funding options. To not point out issuers seeking to create mannequin portfolios to assist commercialize their ETFs.

Hortz: Earlier this 12 months, you interviewed 30 ETF managers and compiled a analysis white paper “The Altering Panorama of ETF Distribution.” What have been a number of the predominant take-aways?

DelSignore: There have been just a few key takeaways from the report.

The primary takeaway was the conclusion that an issuer should convey extra than simply product. Having a novel product with nice efficiency are simply desk stakes at this level. Advisors are working with a fewer variety of companions and are on the lookout for extra help from these companions. The dialog has advanced to serving to advisors perceive how an ETF is differentiated, in addition to how exactly to make use of it, the place it matches within the portfolio and different portfolio development associated help.

ETF issuers must commit money and time to supply sources, training and detailed portfolio development commentary, share analysis and supply due diligence help. These value-add choices can present robust differentiators that advisors and their shoppers are on the lookout for as they’re navigating the rising variety of new and current ETF merchandise.

The second takeaway was on the necessity for knowledge – what sources and companions to make use of for that knowledge, how a lot will that value, tips on how to use it to concentrate on clever and focused communications and create an optimized gross sales expertise. The dialog is limitless and it’s driving distribution choices and capabilities.

The third takeaway resides round what we name the “Institutionalization of retail.” Stated in another way, the funding choices have gotten extra concentrated with fewer folks. Whether or not it’s wealth administration residence workplace personnel approving merchandise for advisor entry or mannequin suppliers deciding on investments for inclusion, the choices that may result in important business alternative are largely decided by fewer folks than ever earlier than.

Hortz: What are your ideas on mutual fund conversions and do you see extra mutual fund managers changing to ETFs? What are their key determination elements for making that transfer?

DelSignore: I feel conversions are going to proceed to alter the panorama as they create a path for asset managers to enter the ETF business with their current methods and belongings. One level of consideration is how the wealth administration platforms will deal with these merchandise as conversions speed up. These asset managers contemplating conversion as an choice ought to contemplate the next:

Platform entry: ETF issuers ought to look to have interaction the wealth administration platforms prematurely to know the concerns of placement the place their mutual fund could have been obtainable. The identical will not be the case for the ETF.

Distribution plan: For some asset managers, the conversion marks their first entrance into the ETF business. Understanding how the agency will deal with distribution of the ETF is a important consideration. Will you rent ETF specialists to help the product? Do you intend so as to add the ETF to your present gross sales groups’ obligations? These choices ought to be thought-about properly prematurely of any launch.

Hortz: Out of your perspective, the place do see the ETF business evolving over the following decade?

DelSignore: I really feel like we’re in concerning the 3rd or 4th inning for the ETF business. I feel just a few key areas will proceed to gasoline development:

Lively ETFs: We’ve got but to see the true impression that the doorway of a number of the largest asset managers can have on the event and utilization of ETFs. This captures each new launches and conversions, in addition to clear and semi-transparent ETFs.

Mannequin portfolios: this can be a twofold alternative. Wealth Administration platforms and corporations can create mannequin portfolios for his or her advisors to supply outsourced funding options and take the time-intensive portfolio administration choices out of their palms. Mannequin portfolios additionally present a robust commercialization technique for the ETF issuers.

Evolution of customers: which means, we’re consistently studying about how buyers are utilizing ETFs of their portfolios. I feel that the evolution in an asset class like mounted earnings, the place significant white area for product improvement nonetheless exists, we are going to see distinctive functions significantly within the institutional market.

Growth globally: The US is essentially the most mature market, however you’re seeing robust development everywhere in the world as ETFs seize maintain in each the institutional and retail markets.

Distribution technique: Distribution is about extra than simply salespeople and gross sales supplies. It has advanced right into a holistic method incorporating built-in advertising, media, digital technique and understanding the usage of expertise and knowledge.

Hortz: Any phrases of recommendation you possibly can supply asset managers with ETFs or serious about launching an ETF?

DeSignore: There are a number of concerns that I might put on the high of the record. That is under no circumstances exhaustive, however simply a few of what an asset supervisor ought to take into consideration in making the choice:

Who’re your consumers? Are you able to entry these consumers? Are you counting on explicit wealth administration platforms that will or could not approve your ETF to be used given their onboarding necessities?

How are you elevating your first $50 million? This goes hand in hand with the primary consideration. An in depth, holistic distribution technique is important – this isn’t simply gross sales personnel, however advertising, PR, media, digital presence and expertise stack.

If you’re an current asset supervisor, will your present gross sales staff help the ETF or will you rent ETF Specialists?

I don’t wish to lean on efficiency, given it should inevitably ebb and movement, however frankly that may be a key purpose why buyers purchase lively merchandise. If the technique will not be gathering belongings in a special construction (SMA, mutual fund), for no matter purpose, simply placing it within the ETF wrapper is unlikely to alter the tide.

As to the aggressive panorama, what ETFs are presently obtainable in your asset class and at what value? What’s your differentiator versus these merchandise? You will need to additionally contemplate that you need to convey one thing past simply your product to the desk for advisors – assume analysis, content material, and so forth.

It is advisable create scale throughout all facets of a distribution technique to compete. I consider that’s one purpose that FLX has develop into such an essential associate to ETF issuers and all asset managers. We’ve got helped to create scale to help all facets of an ETF enterprise technique, whether or not a brand new or established issuer. Particularly, we convey high tier sources at aggressive costs via shared sources that help from product ideation, to creation, operations, and distribution. Concurrently, we’re making a neighborhood via the gravitational pull of intriguing funding options and insightful content material, bringing collectively asset managers immediately with advisors and wealth managers.

The Institute for Innovation Growth is an academic and enterprise improvement catalyst for growth-oriented monetary advisors and monetary providers corporations decided to steer their companies in an working atmosphere of accelerating enterprise and cultural change. We place our members with the mandatory ongoing innovation sources and greatest practices to drive and facilitate their next-generation development, differentiation, and distinctive neighborhood engagement methods. The institute was launched with the help and foresight of our founding sponsors – Ultimus Fund Options, NASDAQ, FLX Networks, Pershing, Constancy, Voya Monetary, Advisorpedia, and Constitution Monetary Publishing (writer of Monetary Advisor and Non-public Wealth magazines).

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.