by Fintechnews Switzerland

January 25, 2024

Europe is undergoing a profound transformation in its instant payment landscape as the bloc strives to become a leader in payment innovation. Recognizing the need for enhanced adoption of real-time payments, regulatory bodies are driving the push for better instant payment infrastructure and working towards the unification of systems and experiences across the Single Europe Payments Area (SEPA).

Last year, the European Union (EU) moved closer to making instant payments ubiquitous across the bloc by advancing instant payment regulation. The regulatory proposal, which was first put forward in 2022, amends and modernizes the SEPA regulation of 2012 by adding specific provisions designed to expedite the adoption of instant payments and the SEPA Instant Credit Transfer scheme (SCT Inst).

The European Commission’s Instant Payments Regulations, Source: Instant Payments: a spotlight on the European Commission for Regulation, PwC, Dec 2023

Launched in 2017, SCT Inst is a pan-European instant payment scheme that allows domestic and cross-border payments in euro to be made to and received from participating PSPs. It provides tangible benefits for public administrations, with funds being made available immediately to the payee, and removes the limitations of traditional credit transfers, which are typically bound to the business hours of the handling payment service provider, with credited funds taking more time to appear as a result.

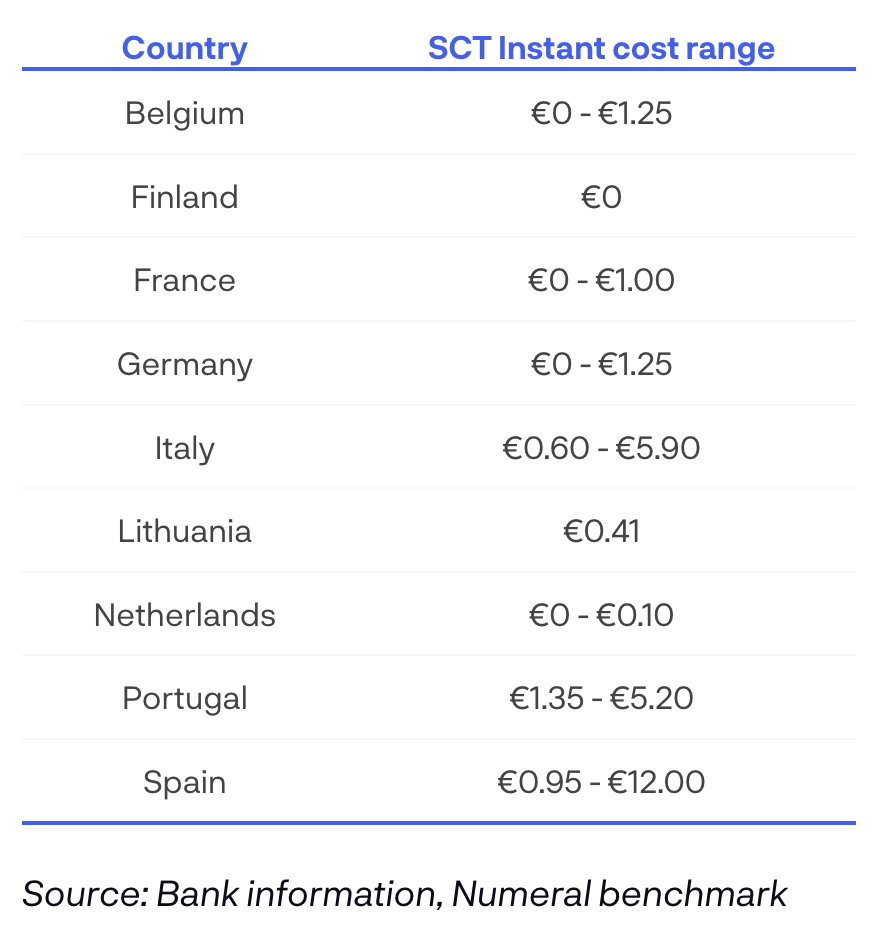

Though SCT Inst has been available for some time and despite the system’s clear advantages, adoption of instant payments across the EU has been slow, partly due to high bank pricing. The new regulation aims to address that by mandating payment service providers (PSPs) including banks to offer the service of sending and receiving instant payments in euro at no extra cost.

Published in November 2023, the final regulation proposal requires banks to provide instant payments to their customers without exceeding the costs of non-instant transfers.

To address increased speed and potential risks, the regulation instructs providers to verify the match between the bank account number (IBAN) and the name of the beneficiary provided by the payer in order to alert the payer of a possible mistake or fraud before the payment is made. This aims to stop scams like authorized push payment fraud where people are manipulated into sending large sums to bogus accounts while believing they’re paying a legitimate invoice.

Speaking to Fintech Futures, the EC said that a mandate is essential at this point in time to realize the comprehensive benefits of instant payments for EU citizens, businesses, public authorities and society.

“Five years after the necessary technology was put in place to process euro payments instantly, it is apparent that the efforts of the European payments industry or member states have not been sufficient to remove these obstacles throughout the EU in a timely fashion,” the EC told the media outlet.

“Legislative intervention is necessary to unlock the full-scale network effects by connecting all payment service providers to instant payment technology, tackling high prices and frictions, and mitigating the risk of fraud or errors.”

Slow uptake of instant payments

Although policymakers are pushing for instant payment adoption, the current state of adoption varied widely across countries within SEPA. Denmark, for example, has embraced instant payments through MobilePay, an app that enables low-cost instant payment capabilities and which is said to have reached a 93% penetration rate amount the country’s adult population, according to data from the Danish central bank.

France, on the other hand, has seen lower adoption due to the popularity of the national debit scheme, Cartes Bancaires, and the high cost associated with using real-time payments. In France, while users typically receive instant payments for free, instant payments still incur a costly premium fee of up to EUR 1 per transaction for senders, according to Victor Mithouard, vice president of growth at UK paytech provider Numeral.

Mithouard believes that a key challenge to widespread adoption of instant payments in the EU is the current high pricing by banks, estimating that instant credit transfers cost on average five times more than regular credit transfers.

Average cost of SCT Inst transfers in Europe, Source: Victor Mithouard, vice president of growth of Numeral, Dec 2022

Currently, only 11% of the EU’s euro money transfers are instant, Carlos Cuerpo, secretary general of the treasury and international financing of the government of Spain and minister for economy, trade and companies, told The Banker in November 2023.

The new EU mandate seeks to address these obstacles and benefit consumers by reducing operational delays and costly requirements associated with credit transfers. However, the implementation may pose challenges for smaller PSPs.

Nadish Lad, managing director and global head of strategic business at Volante Technologies, an American paytech firm, expects major banking players to adapt more easily to the new requirements. “Some institutions are very tech savvy, and so would look at probably doing something internally with their own teams,” Lad told Fintech Futures.

However, smaller PSPs with limited internal leverage may encounter some difficulties and could opt for the outsourcing route.

“If [you are an experienced vendor with an established history of implementations] you have implemented it in other countries, you know the pitfalls, you know what needs to be done,” he said. “And that is where we think that a lot of the preference is going to be more on using a vendor rather than doing something internally.”

Interoperability with international markets

Lad noted that while the mandate underlines SEPA-wide connectivity, it also encourages a global view of interoperability with international markets, such as the Middle East and the US.

“If we look at the steps where we are heading now, it is probably important to look at a more global scale, because the concept is that, at the end of the day, we are looking at Europe today, but within a few years, we fully expect some key corridors, for example, USD to euro,” he told the media outlet.

“All the key ingredients for an international global standardization approach are there. If you have to do it, let’s think about where it’s heading and think about the next steps.”

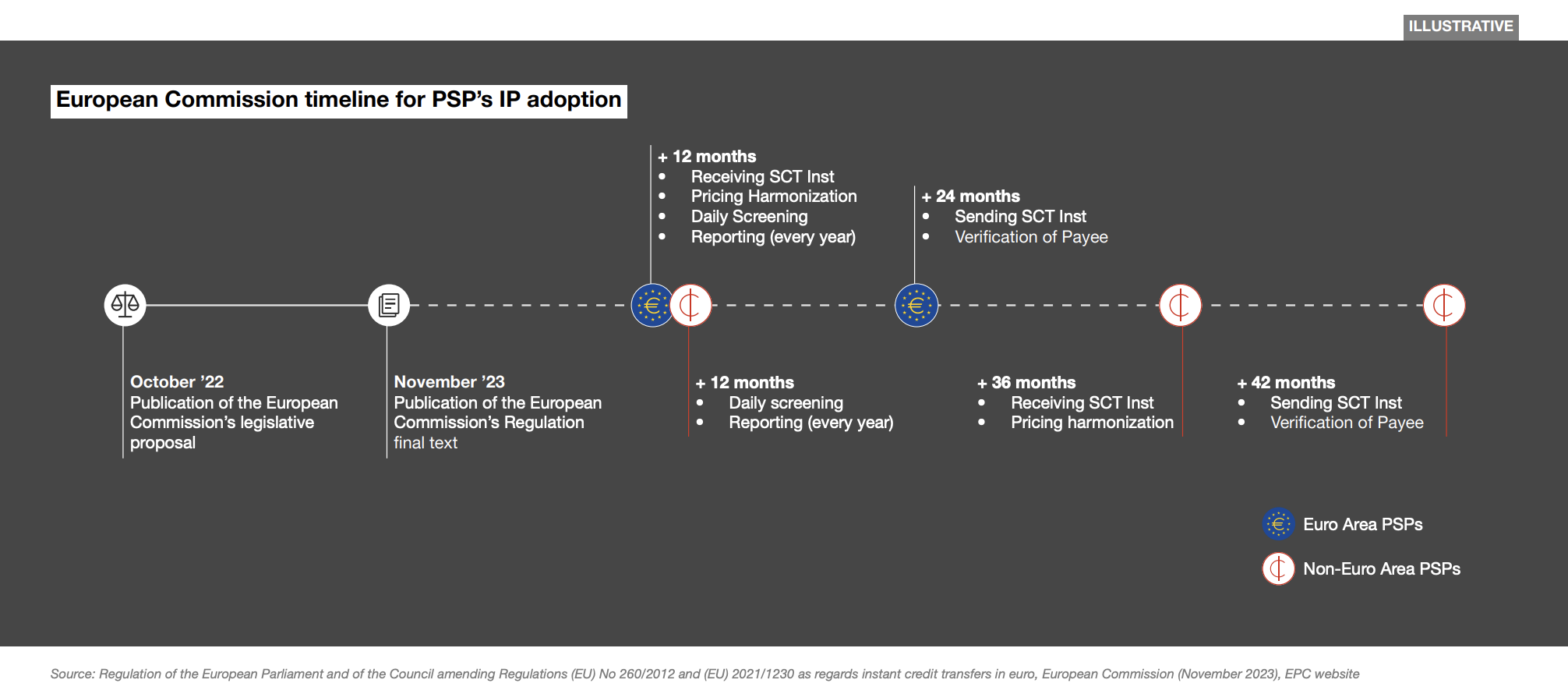

The main provisions of the instant payment regulation were agreed by representatives of the EU’s Council and Parliament in November 2023, but the law still however needs to be formally signed off by both those EU institutions.

The Parliament also voted in favor of implementation deadlines for the new regulation. The timeline, included in the text, requires all euro-area PSPs to support receiving and sending SCT Inst payments along with fulfilling IBAN name checking and entity screening requirements by the end of 2025. From the end of 2026 onwards, these obligations will be expanded to payment institutions and to banks located in non-euro area nations.

European Commission timeline for PSP’s instant payment adoption, Source: Instant Payments: a spotlight on the European Commission for Regulation, PwC, 2023

A webinar will be hosted by Bottomline on Feb 8, 2024 at 11am CET to discuss about SIC Instant Payments and its impact for Swiss banks and financial institutions. Join this webinar to learn more on getting ready for SIC Instant Payments by 2026, and new banking trends and initiatives.

Featured image credit: Edited from freepik