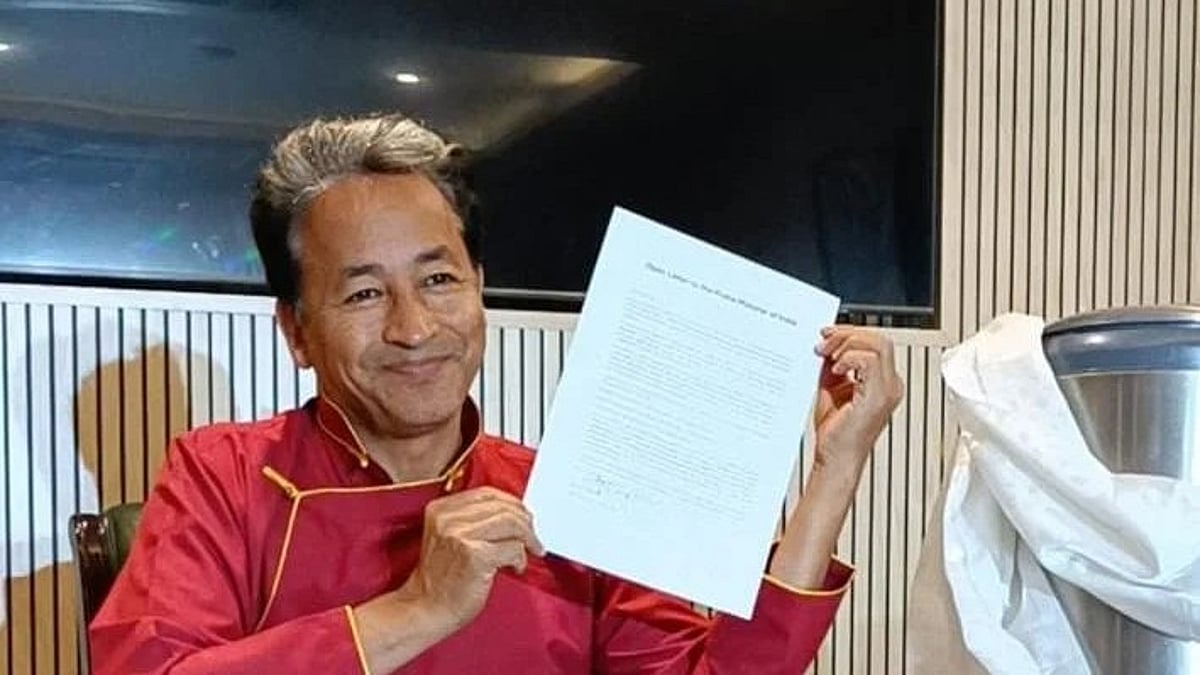

Hiroki Takeuchi, co-founder and CEO of GoCardless.

Zed Jameson | Bloomberg | Getty Images

Financial know-how unicorn GoCardless higher than halved losses in 2024 and said it’s aiming to achieve full-year profitability by 2026.

The London-based startup, which helps firms purchase recurring funds much like subscriptions, reported a web lack of £35.1 million ($43.8 million) throughout the full yr ending June 30, 2024.

That was a 55% enchancment from the £78 million GoCardless misplaced the yr prior.

The company well-known that “restructuring train” on the end of the whole yr ending June 2023 contributed to a reduction in working losses in 2024. In June 2023, GoCardless launched it was slicing 15% of its world workforce. That took GoCardless’ wage payments down 13% to £79.2 million throughout the agency’s 2024 fiscal yr.

Nonetheless, whereas this improved the company’s financial picture, GoCardless’ CEO Hiroki Takeuchi instructed CNBC that revenue improvement moreover helped significantly.

“We’re far more centered on the value aspect … We have to be getting very surroundings pleasant as we scale,” Takeuchi said in an interview remaining week. “Nevertheless we moreover must proceed rising. We would like every of those points to get to the place we have to be.”

GoCardless grew revenue by 41% to £132 million in full-year 2024. Of that entire, £91.9 million obtained right here from purchaser revenue.

Remaining yr moreover seen GoCardless report its first-ever month in income in March 2024. Takeuchi said its his goal for GoCardless to submit its first full-year income in 12 to 18 months’ time, together with it’s “correctly on observe” to take motion.

‘No plans’ to IPO

Once more in September, GoCardless acquired a company known as Nuapay, which helps firms purchase and ship funds by the use of monetary establishment swap.

Requested whether or not or not GoCardless is considering further mergers and acquisitions in future, Takeuchi said the company is “actively making an attempt,” together with: “We’re seeing a whole lot of alternate options come up.”

Following its acquisition of Nuapay, Takeuchi said GoCardless is in the intervening time testing a model new attribute that allows customers to distribute funds to their very personal prospects.

“In case you are taking one factor like vitality, the overwhelming majority of the funds are about amassing money,” he instructed CNBC.

“Nevertheless then you definately positively may have a number of of your prospects which have photograph voltaic panels on their roof they normally’re sending vitality once more to the grid, and they need to receives a fee for that vitality that they’re producing.”

GoCardless, which is backed by Alphabet’s enterprise arm GV, Accel and BlackRock, was remaining privately valued by merchants at $2.1 billion in February 2022.

Takeuchi said the company had no need for exterior capital and that there are “no plans” for an preliminary public offering throughout the near time interval.

Fintechs have been watching Swedish fintech Klarna’s plan to go public intently — nevertheless many are able to see the best way it goes sooner than deciding on their very personal plans.

With know-how IPOs at historic lows, various startups have in its place opted to supply workers and early shareholders liquidity by selling shares throughout the secondary market.

In November, Bloomberg reported that GoCardless had chosen funding monetary establishment Lazard to advise it on a $200 million secondary share sale. GoCardless declined to the touch upon the report.