Political giveaways, leading to sharp improve in income expenditure, not matched by commiserate improve in States’ personal tax revenues, seem like the prime causes behind this rising debt pile.

| Photograph Credit score:

erhui1979

The Centre in addition to the States needed to improve their borrowings sharply due the extra spending through the Covid-19 pandemic, which took their fiscal deficits and cumulative debt to alarming proportions. However the subsequent restoration within the financial system has helped rein within the deficits.

Now that the pandemic is behind us, businessline did an evaluation of the borrowing of 15 of the most important States, based mostly on GSDP ranks, to see the place their debt stands. Numbers present that a lot of the bigger States have budgeted for increased borrowing in FY26 and there’s marked deterioration within the leverage ratios of the extremely indebted States.

Political giveaways, leading to sharp improve in income expenditure, not matched by commiserate improve in States’ personal tax revenues, seem like the prime causes behind this rising debt pile.

Approaching the market

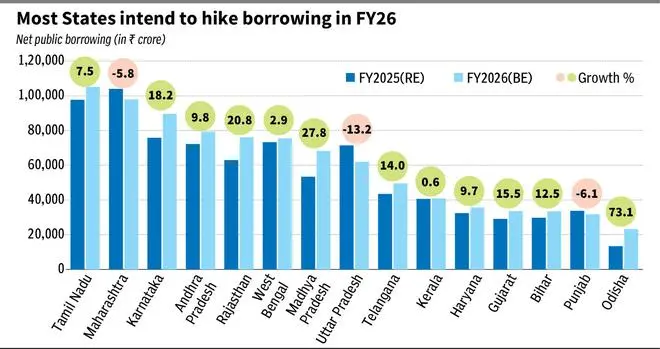

Of the 15 States analysed, 12 have budgeted to extend the web market borrowing for FY26, when in comparison with the revised estimates for FY25.

Tamil Nadu had budgeted for the very best market borrowing for FY26 adopted by different massive States equivalent to Maharashtra and Karnataka. States equivalent to Madhya Pradesh, Rajasthan and Karnataka have recorded massive progress within the internet market borrowing for FY26, in comparison with funds estimate for FY25.

“All States have to borrow, and this pattern has solely intensified after Covid. Debt can solely decline if States handle to manage their fiscal deficits,” says Madan Sabnavis, Chief Economist at Financial institution of Baroda.

Odisha has recorded the very best, 73 per cent, soar in borrowing. However that’s on a low base and due to this fact not a priority. In absolute phrases, Odisha has budgeted for the bottom borrowing in FY26.

Above high-water mark

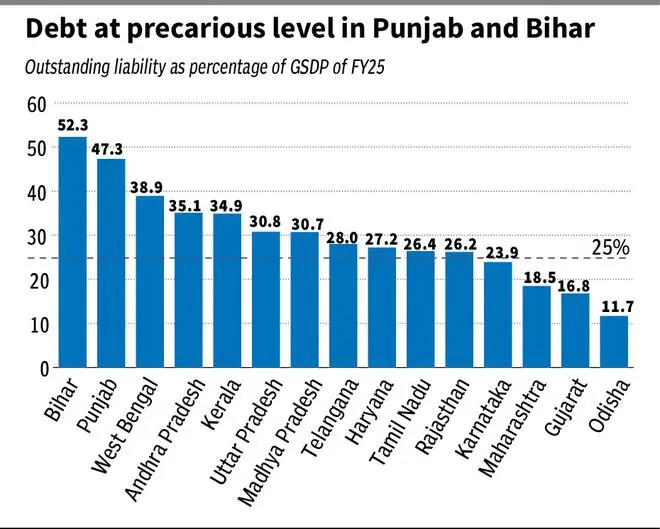

However a greater method to decide if a State is over-leveraged is to view its debt in opposition to the dimensions of its financial system. The optimum debt to GSDP ratio for bettering progress and financial savings in a State is pegged at 25 per cent.

However evaluation of the debt to GSDP ratio of the 15 largest States reveals that debt ranges are getting precariously excessive in lots of States together with Bihar (52.3 per cent), Punjab (47.3 per cent), West Bengal (38.9 per cent) and Andhra Pradesh (35.1 per cent).

“Bihar is closely depending on Central authorities funds and has been sustaining increased expenditure progress than its receipts, leading to excessive fiscal deficit, which is why its debt can also be piling up, says Paras Jasrai, Affiliate Director, India Rankings & Analysis. “The State’s debt burden elevated as a result of Covid-related expenditures in 2021 and stabilising it can take time.”

Jasrai provides that Punjab’s debt was excessive even earlier than the pandemic. After the State elections, the brand new authorities introduced increased energy subsidies alongside different new schemes, growing general dedicated expenditure and additional elevating the debt. Challenges in nominal GSDP progress relative to the speed of curiosity have contributed to the rising debt burden for the State.

Kerala, Uttar Pradesh and Madhya Pradesh even have debt to GSDP ratio above 30, whereas States equivalent to Telangana, Tamil Nadu and Karnataka have managed to rein this ratio nearer to the 25 per cent mark.

The States which rating one of the best on this parameter are Odisha (debt to GSDP of 11.7 per cent), Gujarat (16.8 per cent), and Maharashtra (18.5 per cent). A wholesome progress within the economies seems to be aiding these States.

Be careful for ensures

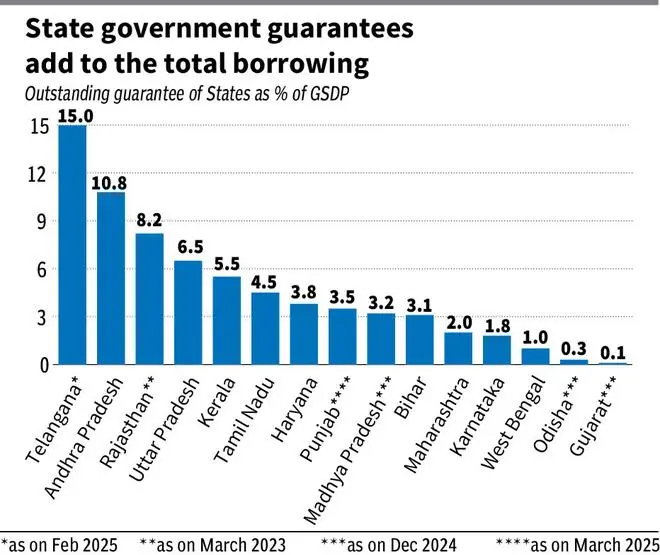

The research on State Funds, printed yearly by the RBI, has repeatedly highlighted the dangers posed by the ensures given by State governments for loans taken by State public sector enterprises. These ensures are usually not a part of the State debt and create a contingent legal responsibility, which might trigger issues to the State’s fiscal place in future.

Telangana has the very best excellent ensures as of February 2025 and the ensures as a proportion of GDP quantity to 14.9 per cent. The debt to GSDP ratio of Telangana will improve to 43 per cent if the ensures had been accounted for. Andhra Pradesh. Rajasthan, and Tamil Nadu are different states with massive excellent ensures.

“The general fiscal efficiency and the monetary well being of PSUs play a major function within the rising ensures. States like Andhra Pradesh, Telangana, Uttar Pradesh, and Rajasthan have loss making PSUs thus requiring State assist and which is why their assure ranges are additionally increased. Whereas States like Odisha and Gujarat, the place the facility sector is in a robust place, have decrease ensures in consequence,” says Jasrai.

Is the quilt sufficient?

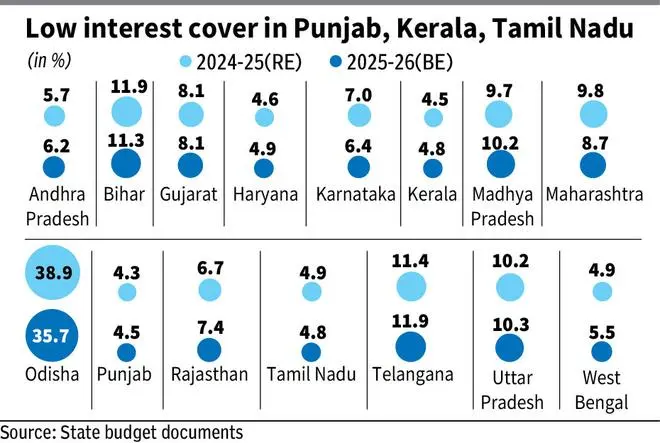

The primary fallout of mounting debt is the growing curiosity expenditure within the State Budgets. Finance prices are dedicated expenditure, which implies that States should spend on them. As finance value will increase, different productive capital bills could get sacrificed.

The opposite side with curiosity value is whether or not States have sufficient sources to fund the curiosity. This may be measured by curiosity cowl, which is derived by dividing the income receipts by curiosity value. The upper the curiosity cowl, the higher.

Odisha, not shocking, has the very best curiosity cowl of 35.7 per cent in keeping with the Funds estimate of FY26. Bihar, Madhya Pradesh, Telangana and Uttar Pradesh have curiosity cowl between 10 per cent and 12 per cent, implying that they might not have a lot bother paying curiosity on their debt.

Punjab, Tamil Nadu, Kerala and West Bengal have the bottom curiosity cowl, between 4 per cent and 6 per cent, indicating that curiosity value is biting a big chunk of the States’ income.

Lastly

It’s not simply the States, however the Centre too has seen a big spike in its debt after the pandemic; the Centre’ debt is at 56.2 per of GDP in FY25, above the FRBM dictated 40 per cent mark. However the Centre has laid a highway map for bringing down the ratio to 50 per cent by 2031, as excessive stage of presidency debt hurts investments and general progress.

The States will also be requested to attract up comparable methods for holding the expansion in debt, which is growing at very quick price in some States. This might assist usher in larger fiscal self-discipline and tighter management over income expenditure.

Revealed on April 6, 2025