What is an FSA?

Flexible spending accounts are an employer-sponsored benefit that allows workers to set aside pre-tax dollars to pay for qualified medical expenses. Using an FSA account can have a significant impact on tax liability, as consumers are not required to pay taxes on the money spent. According to the December 2020 ConnectYourCare publication Flexible Spending Account Trends in 2020, an estimated $30.7billion was saved in FSAs in 2020, an 8.7 per cent increase from 2019.

Since 2020, the Internal Revenue Service (IRS) has allowed contributors to defer up to $2,750 for a medical FSA and up to $5,000 per year for a dependent care FSA.

Too good to be true?

Unfortunately, there is a catch which has put many off FSAs. Funds do not remain in this tax-free state forever. In fact, if they were not used within the calendar year, all the leftover money got forfeited to the employer. At least that’s how they used to work. Nowadays, most accounts have some form of rollover service or grace period if all the funds aren’t used in time.

Due to covid-19, contributors’ 2021 balance was rolled over for the entirety of 2022. However, they must have declared they still wanted to use the service in 2022. According to AvacareMedical, there were still $1billion in FSA funds waiting to be used in December 2022.

FSA funds for medical supplies and equipment

Specifically, FSAs are an effective way to save money on medical supplies and equipment. Indeed, both of these are among the most common purchases made with FSA funds. Medical supplies and equipment rank as the third most common type of FSA spending.

According to the National Business Group on Health survey, the most common items purchased with FSA funds are doctor visits (42 per cent), over-the-counter medications (38 per cent), medical supplies and equipment (34 per cent), and prescriptions (32 per cent).

In a similar survey conducted by the National Association of FSA Administrators, consumers were said to be most likely to use their FSA funds to purchase over-the-counter medications (61 per cent), vision care products (35 per cent), and medical supplies and equipment (35 per cent).

More specifically, popular items include:

- pain killers

- acne treatment

- heat therapy

- sunscreen

- blood pressure monitors

- first aid kits

- allergy relief

FSA restrictions

Consumers should be aware of certain restrictions when purchasing medical supplies and equipment with FSA funds. For example, while most products are eligible for FSA reimbursement, there are some items that are not covered. This includes items such as nonprescription vitamins, health supplements, and cosmetic products. Additionally, consumers should be aware that FSA funds can only be used to pay for medical expenses that occur after the funds were deposited into their accounts.

Increased contribution limits

According to the IRS, the average contribution limit for FSAs is set to increase in 2023. This is due to the IRS adjusting the FSA contribution limits for inflation, as stated in their “Cost of Living Adjustments” from 2020-2023.

The following graph demonstrates the increases of contribution limits since 2015:

Increased spend

At the same time, the dollar amount of money that individuals and businesses are placing into FSAs is also increasing. According to data from the IRS and the Bureau of Labor Statistics (BLS), the average amount of money placed into FSAs has increased every year since 2015. In 2022, the average amount of money placed into FSAs was estimated to be $2,400.

Increased popularity

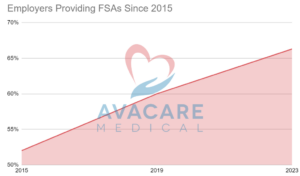

In recent years, more employers have been offering FSAs to their employees. They have recognised the potential for tax savings and other benefits. Studies have shown that employers who offer FSAs to their employees often have more satisfied and productive workers.

A study conducted by the National Business Group on Health found that the percentage of employers offering FSAs increased from 52 per cent in 2015 to 60 per cent in 2019. This trend is expected to continue into 2023, with 66.3 per cent of employers offering FSAs, making for an increase of 27 per cent in less than a decade.

Increased healthcare costs

FSAs have always offered tax savings and other benefits for individuals and businesses. They are seeing increased popularity due to the rising cost of health care. According to the Centers for Medicare and Medicaid Services, healthcare costs are expected to rise by an average of 5.4 per cent in 2023. Fortunately, the maximum allowance for FSAs is going up as well. The money saved by these accounts can be used to offset the higher costs.

With their tax-free benefits and ease of use, FSAs are an excellent way to save money. All the while providing much-needed medical supplies and services. As the data indicates, flexible spending accounts are becoming increasingly popular, and the amount of money placed into these accounts is growing. By being aware of the restrictions and deadlines associated with their FSA accounts, consumers can make the most of their FSA funds before they expire.