Supertruper/iStock via Getty Images

Global Net Lease (NYSE:GNL) is an industrial and office net lease REIT externally managed by AR Global. Investors interested in gaining exposure to industrial real estate might be tempted by GNL’s nosebleed 11% dividend yield. But caution is warranted here, because interests between common stock shareholders and the external manager do not appear to be remotely aligned.

In short, AR Global is incentivized to grow GNL’s assets under management, even if it results in shareholder dilution and falling adjusted funds from operations (“AFFO”) per share over time. For example, from 2021 to 2022, AFFO per share dropped over 5% – in a year when nearly all types of real estate were thriving!

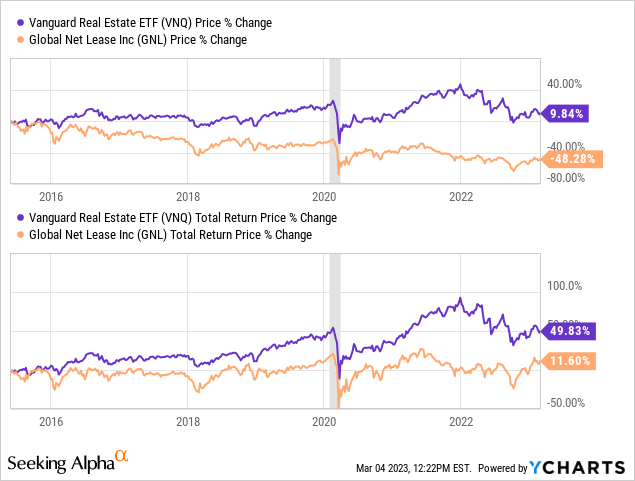

GNL has established a consistent track record of poor financial results and underperformance against the Vanguard Real Estate ETF (VNQ):

I’ve included both price performance and total return performance in the above chart for those who might be tempted to think that GNL is basically a high yield play and that the dividends make up for the capital depreciation.

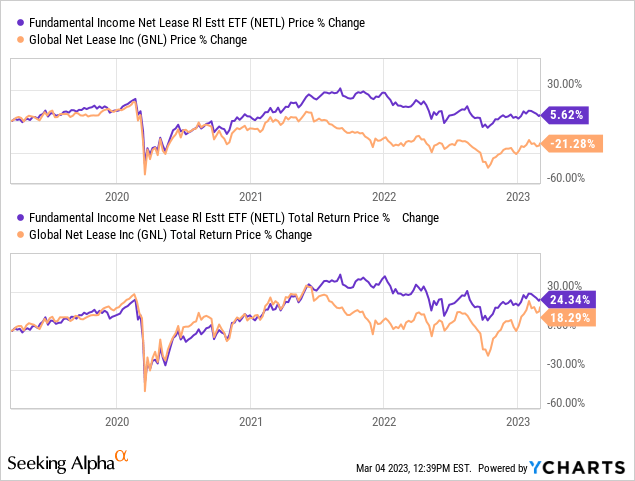

Another objection might be that it’s unfair to compare a net lease REIT to the broader real estate index, so let’s also compare GNL’s performance against the NETLease Corporate Real Estate ETF (NETL), a net lease-only REIT index.

GNL’s total returns come a bit closer to those of NETL, but it still underperforms despite its heavy exposure to the hot industrial sector.

Varying degrees of underperformance can be seen in all four of the public REITs that AR Global manages:

AR Global

But GNL’s two preferred stocks – Series A 7.25% (NYSE:GNL.PA) and Series B 6.875% (NYSE:GNL.PB) – are a different story.

Unlike GNL’s dividend, which has been cut multiple times, the preferred stock dividends are safe. The preferreds trade like bond alternatives, rising in price when interest rates fall and falling in price when interest rates rise. As such, when the preferreds prices fall, as they have recently, it doesn’t indicate that the preferred dividends have become unsafe but rather that corporate bond yields have become incrementally more attractive in comparison.

As of this writing, GNL.PA offers 12.6% upside to par value plus a ~8.2% dividend yield, while GNL.PB offers 18.4% upside plus a ~8.1% yield.

In what follows, I’ll demonstrate why I believe the preferred stock dividends are safe.

8% Yield From Investment Grade Industrial & Office Real Estate

It’s possible to combine a pretty good portfolio with very bad financial management. I think that exactly describes the case with GNL.

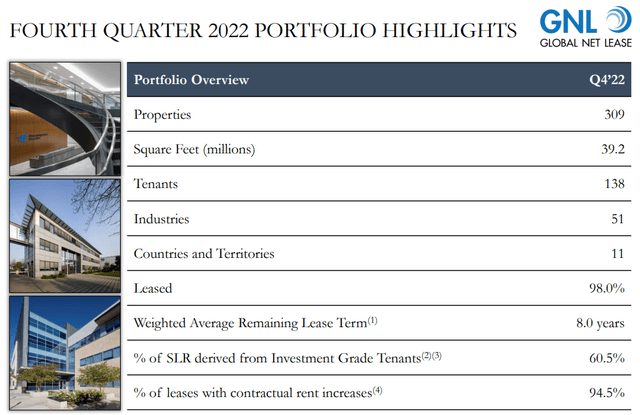

The REIT’s portfolio spans 309 properties across 11 countries in North America and Europe. Occupancy is quite high at 98%, while nearly 95% of leases feature contractual rent increases, providing some same-property rent growth.

GNL February Presentation

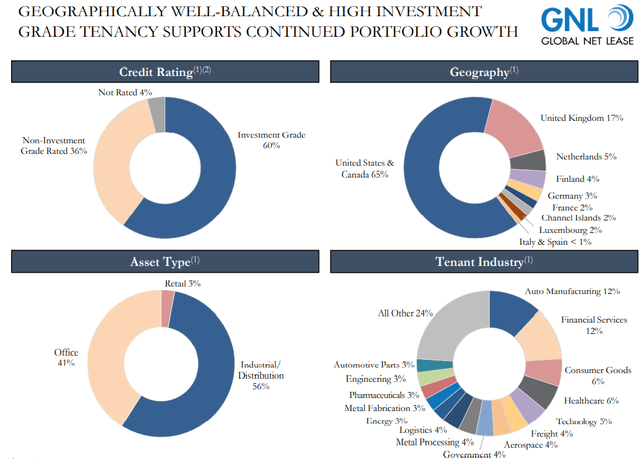

Like it’s much larger and internally managed net lease peer, W. P. Carey (WPC), GNL’s geographic diversification is roughly 2/3rds North America and 1/3rd Europe. Moreover, GNL’s industrial exposure of 56% is slightly higher than WPC’s ~51%, but GNL does have a significantly higher exposure to office than WPC.

GNL February Presentation

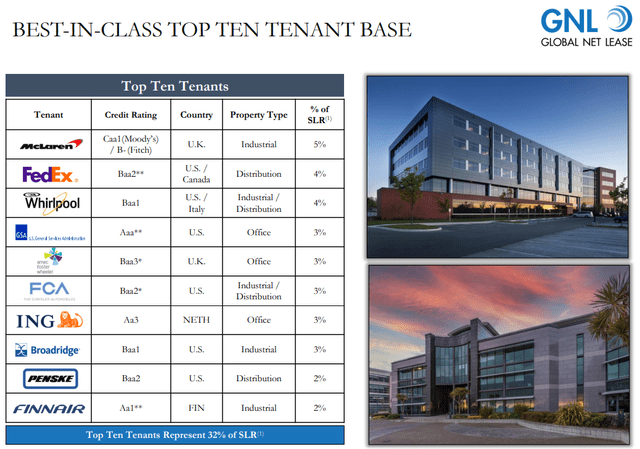

But, interestingly, GNL’s investment grade tenancy is roughly double that of WPC: 60.5% compared to WPC’s 31.5%. And GNL’s single-tenant office properties are occupied largely by high-credit corporations and organizations like Merck (MRK), Aviva (OTCPK:AVVIY), Johnson Controls (JCI), and the US General Services Administration, all investment grade rated.

If you had only GNL’s top tenants list as an indication of the REIT’s quality, you would think that it is among the highest in the net lease space.

GNL February Presentation

Owning mission-critical real estate leased by large, financially strong tenants is the name of the game in net lease real estate, and by all appearances, GNL does this well. And for the most part, GNL’s office properties are higher quality buildings leased to creditworthy tenants.

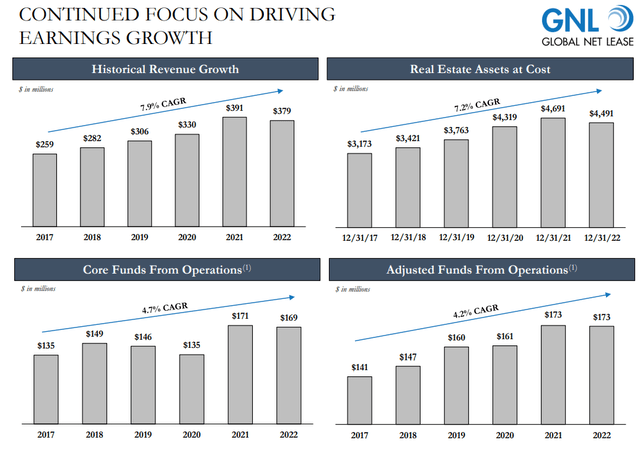

And yet, despite solid growth in assets, revenue, and total AFFO…

GNL February Presentation

…AFFO per share has declined from 2017’s $2.10 to 2022’s $1.67, a roughly 20% drop.

This steadily declining AFFO per share occurred (despite rising total AFFO) because the external manager persistently issues common equity well below GNL’s net asset value in order to grow the portfolio.

In order to grow AFFO per share, net lease REITs need to issue a combination of equity and debt at a weighted average cost of capital below their acquisition yields. And, of course, if they have free cash flow after dividends, they can use that as well to lower their total cost of capital, but GNL has essentially no retained cash after dividends.

What happens when your weighted average cost of capital is higher than your investment yields? You destroy shareholder value by eroding AFFO per share. That is exactly what GNL does over time.

However, while management regularly issues common shares, they do not regularly issue preferred stock shares. Common stock issuance grows the asset base, EBITDA, and total AFFO while the preferred dividend remains stable. Thus, as the portfolio grows, the preferred dividend coverage increases over time.

The primary threat to the safety of the preferred dividend is not common equity issuance but rather interest expenses, because interest on the debt has to be paid before preferred dividends can be paid.

Fortunately, despite rising interest expenses in the last year, both fixed charge coverage and the preferred dividend coverage remain quite high.

| Q4 2022 | FY 2022 | |

| Interest Expense | $25.7m | $97.5m |

| Preferred Dividends | $5.1m | $20.4m |

| Adjusted EBITDA | $68.1m | $288.1m |

| Fixed Charge Coverage | 2.21x | 2.44x |

| Preferred Div Coverage | 8.31x | 9.34x |

If we compare this to 2019’s metrics, we find that 2022 coverage has only eroded because of the higher interest expenses in the second half of the year.

| FY 2019 | |

| Interest Expense | $71.8m |

| Preferred Dividends | $18.6m |

| Adjusted EBITDA | $248.7m |

| Fixed Charge Coverage | 2.75x |

| Preferred Div Coverage | 9.51x |

Thus, both preferred stocks have very well-covered 8%-yielding dividends, and that coverage has remained stable over the years.

GNL.PA’s call date was in September 2022, while GNL.PB’s call date does not come until November 26th, 2024. However, given GNL’s high cost of capital and lack of available cash, it does not appear likely that the company will redeem its Series A preferred stock anytime soon.