William_Potter

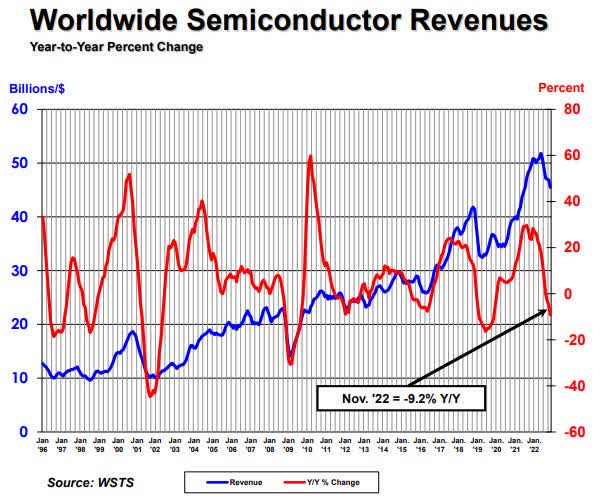

Macroeconomic headwinds and cyclicity led to lower semiconductor sales in November.

Total global semiconductor industry sales were $45.5B during the month of November 2022, a decrease of 2.9% from last month and down 9.2% Y/Y, according to Semiconductor Industry Association or SIA.

Region-wise Y/Y sales: Americas +5.2%, Europe +4.5%, and Japan +1.2%, but decreased in Asia Pacific/All Other -13.9% and China -21.2%.

Region-wise M/M sales: Europe -1.0%, Japan -1.2%, Americas -1.4%, Asia Pacific/All Other -3.0%, and China -5.3%.

The World Semiconductor Trade Statistics or WSTS Organization projects annual global sales will increase 4.4% in 2022 and decrease 4.1% in 2023, totaling $580.1B and 2023 projected to be $556.5B.

Top Semiconductor ETFs include: VanEck Semiconductor ETF (SMH); iShares Semiconductor ETF (SOXX); SPDR S&P Semiconductor ETF (XSD); Invesco Dynamic Semiconductors ETF (PSI); ProShares Ultra Semiconductors (USD); First Trust Nasdaq Semiconductor ETF (FTXL).

Top semiconductor names: Intel (INTC); Micron Technology (MU); Texas Instruments (TXN); Qualcomm (QCOM); NXP Semiconductors (NXPI); Microchip Technology (MCHP); Applied Materials (AMAT)

Looking at previous few months reports.

More insight in contributor reports: ‘Semiconductors Winners And Losers At The Start Of 2023’