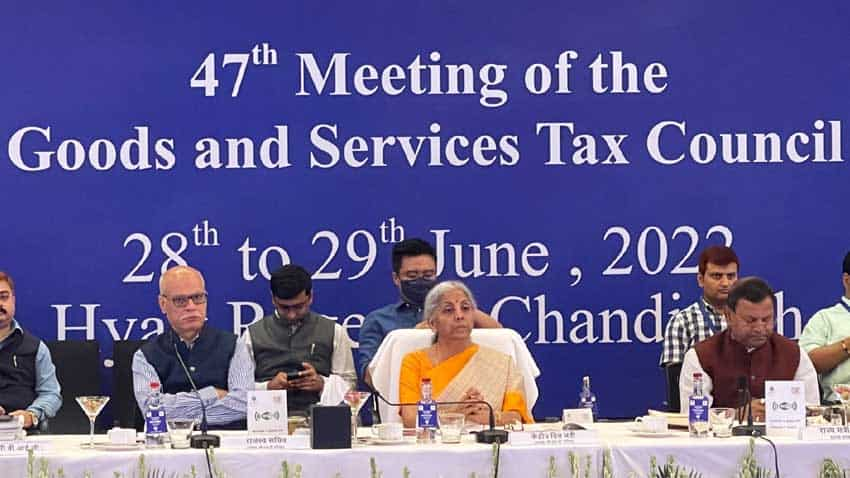

The GST Council on Wednesday deferred determination on levying a 28 per cent tax on casinos, on-line gaming, horse racing and lottery pending extra consultations with stakeholders, Union Finance Minister Nirmala Sitharaman stated.

A bunch of ministers headed by Meghalaya Chief Minister Conrad Sangma has been requested to contemplate submissions of stakeholders once more on the valuation mechanism and submit its report by July 15, she instructed reporters right here.

The council will meet once more within the first week of August to determine on the problem, she stated.

A two-day assembly of the panel thought-about a report of the GoM however deferred a call as Goa and a few others wished to make extra submissions.

The GoM had beneficial that on-line gaming ought to be taxed on the full worth of the consideration, together with the competition entry payment paid by the participant on taking part within the recreation.

In circumstances of race programs, it had prompt that GST be levied on the complete worth of bets pooled within the totalisators and positioned with the bookmakers.

It additionally beneficial that no distinction ought to be made on grounds of recreation of ability or recreation of probability for the aim of the levy of GST and ought to be taxed on the highest price of 28 per cent.

The problems of extension of GST compensation mechanism for states and a highest 28 per cent tax price on on-line gaming, casinos and horse racing is slated for dialogue on the second day of the GST Council assembly in Chandigarh, as per a PTI report.

GST Council Assembly – What occurred on 1st day?

– On the primary day, the forty seventh GST Council chaired by Union Finance Minister Nirmala Sitharaman and comprising state counterparts, determined to tweak tax charges of some items and providers, together with bringing pre-packed and labelled meals gadgets underneath the tax web to examine evasion.

– Moreover, a number of procedural and authorized adjustments, together with month-to-month GST return type, and mechanisms for coping with high-risk taxpayers have been additionally mentioned.

– Whereas suggesting a uniform tax price and valuation technique for these actions, the Group of Ministers, headed by Meghalaya Chief Minister Conrad Sangma, stated for the aim of levy of GST, no distinction ought to be made in these actions merely on the bottom that an exercise is a recreation of ability or of probability or each.

– The GoM has beneficial that on-line gaming ought to be taxed at full worth of the consideration, together with contest entry payment paid by the participant on taking part within the recreation.

– In case of race programs, the GoM has prompt that GST be levied on the complete worth of bets pooled within the totalisators and positioned with the bookmakers.

– In casinos, GoM beneficial that the tax can be levied on the complete face worth of the chips/cash bought from the on line casino by a participant. No additional GST would apply on the worth of bets positioned in every spherical of betting, together with these positioned with winnings in earlier rounds.

LIVE: GST Council Assembly – What’s slated for at present i.e. 2nd day of Chandigarh meet?

The 2-day assembly of the GST Council is being attended by Union Minister of State for Finance Shri @mppchaudhary, apart from Finance Ministers of States & UTs and Senior officers from Union Authorities & States. (2/2)@PIBChandigarh

— Ministry of Finance (@FinMinIndia) June 29, 2022

– The Day-2 of GST Council Assembly will see deliberations on points like compensation to states past June 2022, and a Group of Ministers (GoM) report on 28 per cent tax on on-line gaming, casinos and horse racing, the PTI report added.

(With PTI inputs)