Ronald Martinez

Investment Thesis

Halliburton (NYSE:HAL) has gone through a volatile period along with the energy sector in the past decade or so, but its recent growth has been stable with healthy financials. However, exogenous pressure is brewing in the company’s development due to the near-term macro environment and longer-term energy transition initiatives. The company has strong potential for long-term growth, but perhaps some transition will be needed. We assess its current prices and recommend a hold.

Company Overview

Halliburton, established in 1919, is one of the largest providers of products and services to the energy industry in the world. The company, headquartered in Duncan, Oklahoma, provides hydraulic fracturing services in its Completion and Production (C&P) segment, and field and reservoir drilling in its Drilling and Evaluation (D&E) segment to energy oil & gas operators and energy exploration & production companies.

Strength

Halliburton has an integrated services solution that caters to solving challenges throughout the oilfield life cycle that leverages its full line of services. Customers can choose parts or the whole range of services. Its Completion and Production segment, which focuses on production enhancement, control, and delivery, has slightly higher revenue than the Drilling and Evaluation segment, which provides field and reservoir modeling, drilling, and optimization services.

Halliburton: Participates in the whole life cycle of oilfield (Company Q4 Presentation)

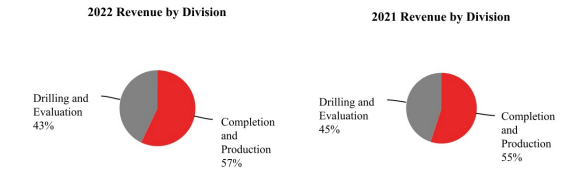

By segment, the C&P’s contribution to revenue expanded by 2% YoY while D&E has decreased by 2%. And by region, on a YoY basis, the company is seen expanding in North America, Europe, and Middle East/Asia, while slightly decreasing the revenue in Latin America.

Halliburton Revenue by Division (Company 2022 10K) Halliburton Revenue by Region (Company 2022 10k)

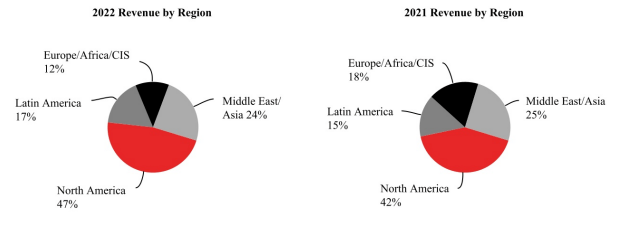

Overall, not only has its revenue been growing, its segment margin has been improving since 2020 as well, with its D&E segment’s margin improved by almost 72% while the C&P margin has improved by 38% since 2020.

Halliburton Segment Margin (Charted by Waterside Insight with data from company)

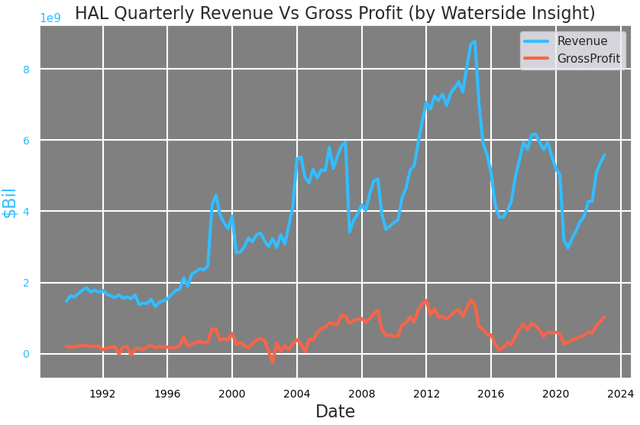

The momentum in its sales and margin shows in revenue and gross profit growth. Both of them have greatly improved since the low in 2020.

Halliburton Revenue vs Gross Profit (Calculated and Charted by Waterside Insight with data from company)

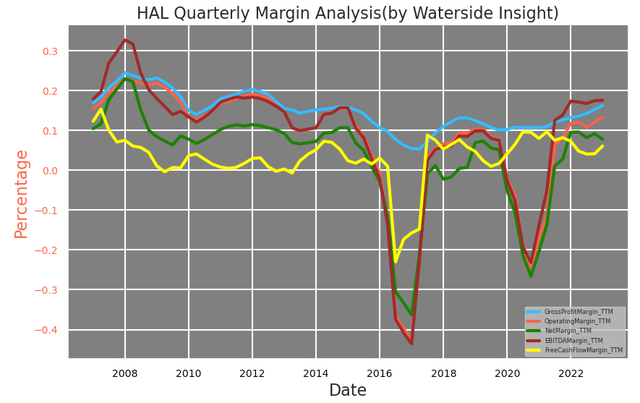

Due to quarterly fluctuations, we opt to look at its margins on a TTM basis. Halliburton’s gross profit margin, EBITDA margin, and operating margin are all still trending upward. In the meantime, its net margin and free cash flow margin are staying flat. Looking back at its past 15 years of history, all of the important margins stay within a narrow range, except when crude oil and gas prices had a significant slump in 2015 and 2020. On the one hand, it reflects the energy companies’ quick response to market conditions; on the other hand, it also shows Halliburton is able to weather most of the competitive factors but is still not immune to structural regime shifts in the energy markets.

Halliburton Margin Analysis (Calculated and Charted by Waterside Insight with data from company)

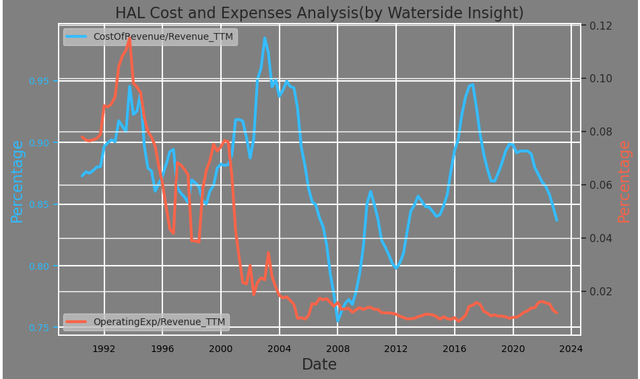

Most of the company’s margin metrics are not too far from each other. One of the crucial factors is its expense control. Its operating expenses out of its revenue have been kept more or less at the same levels for almost 20 years. While its cost of revenue has fluctuated dramatically over the years, it is taking less of a bite out of total revenue lately.

Halliburton Cost and Expenses (Calculated and Charted by Waterside Insight with data from company)

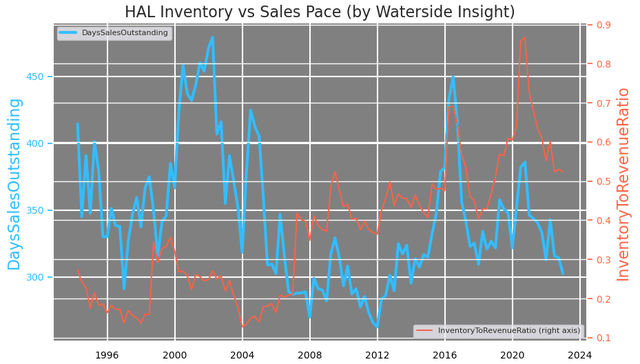

Since retreating from the Russian market, the company has completed the sale of its assets there in Q3 of 2022. The write-down related to assets in Russia and in Ukraine totaled about $366 million in 2022, among which $70 million was inventory write-down. But this number is still much smaller than the $505 million write-down of excess inventory disposal in 2020. This came after its inventory reached its highest level of revenue in 2020. Its current level of inventory is about the average level for the past ten years. Meanwhile, its sales pace has grown stronger, with the average number of days the company takes to collect revenue after a sale has been made reaching its lowest in nine years.

Halliburton Inventory vs Sales (Calculated and Charted by Waterside Insight with data from company)

From a financial perspective, Halliburton is hitting all the tones right while on a healthy growth trajectory.

Weakness/Risks

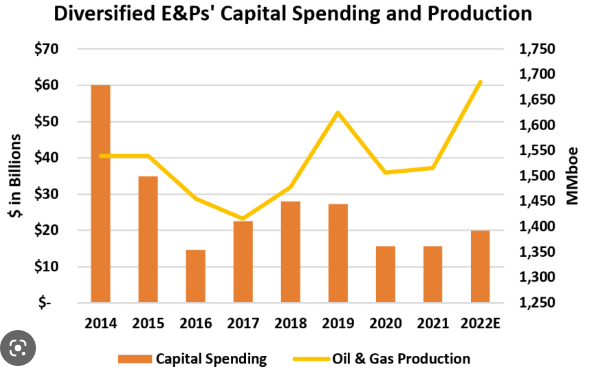

There is definitely a near-term demand for higher gas and crude oil production due to the Russian-Ukraine war and the supply chain bottleneck. But oil and gas E&P companies’ spending didn’t see a large revival in response to it. There are many factors at play, such as the lessons learned from the last boom time when significant production drove down prices and ignited a war with OPEC, or the green energy initiatives to transition away from fossil fuel, but one of the more intrinsic changes is the adaptation and evolvement of the industry.

E&P’s Capex vs Production (RBN Energy)

The E&P companies have adapted AI to direct their cost and production, and have more focused drilling in the field to maximize its efficiency. As a result, they are able to produce more with less. As we can see from the chart above, even with less capex spending, their production has been rising. Although they may have another spurt of new spending should the demand remain unsatiated, the competition is on with the rise of green energy to become more available at a lower cost. The significant spending period from 2005 to 2015 is unlikely to return. Halliburton’s upside from here could be capped due to this.

Forward-Looking: Long-term Growth and Carbon Capture

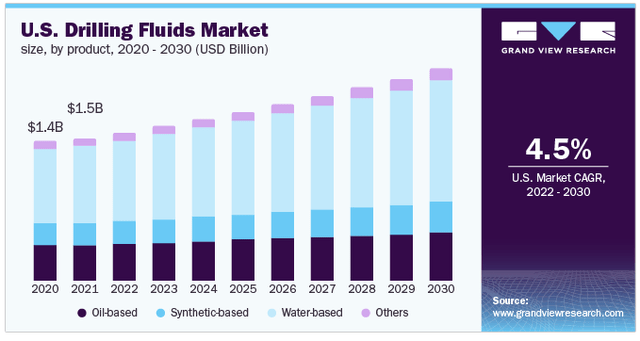

As a solid technological provider to the energy industry, we shouldn’t be too quick to write off Halliburton’s potential growth. In the long term, the growth in the oilfield market is flattening, although the overall drilling fluids market is expected to have a CAGR of 4.5%.

US Drilling Fluids Market (GrandView Research)

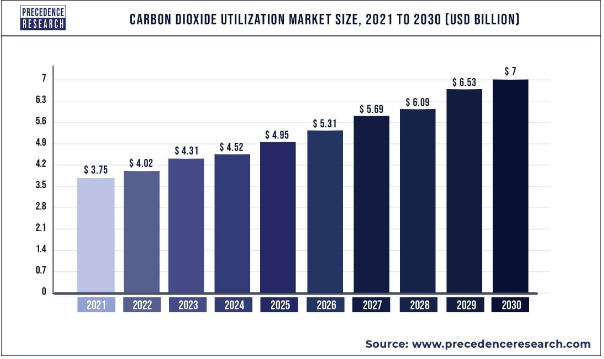

While in the meantime, a nascent carbon utilization market is expected to almost double during the same time span. The Carbon Dioxide utilization market is part of the carbon neutral market that automates part of carbon capturing with technological products. This could be right down Halliburton’s alley.

To quote the company’s own words,

“The long-term effects of moving to a lower carbon-based energy economy are difficult to predict, but we are actively preparing for the transition through emissions reduction across our value chain”.

The company talked about its focus on sustainability in 2023: emission control and carbon capture, although it didn’t report any financials related to it. If the company can ride this wave of growth, it could add some exciting new color to its story. It has first-hand access to all the emissions and carbon dioxide produced at the oilfield; indeed, it could be at the front line to capture it. It is possible that the company can make waves and upgrade the production process with significant carbon capture and storing capability while making a windfall doing it. Although at the moment, it only mentions carbon reduction as part of the environmental focus. So we won’t be pricing this into our future projected growth yet.

Carbon Dioxide Utilization Market (Precedence Research)

Overall, Halliburton has a lot of opportunities ahead with its know-how and deep roots in the energy sector. Perhaps to generate more growth, all it needs is a change of perspective.

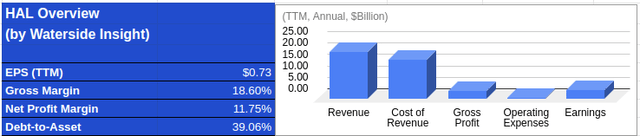

Financial Overview

Halliburton Financial Overview (Calculated and Charted by Waterside Insight with data from company)

Valuation

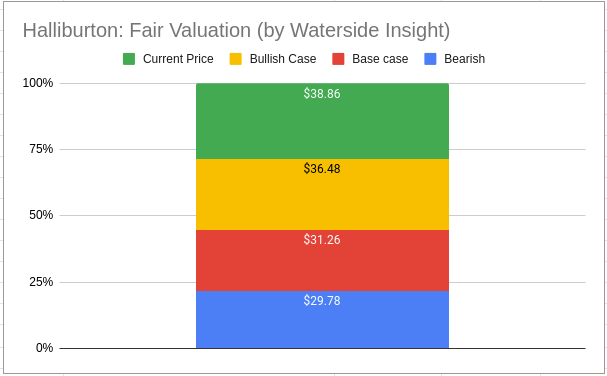

We take into account all the analysis above and use our proprietary models to assess the fair value of Halliburton with a ten-year projection forward. In our bullish case, we price in periodic changes, as the near-term growth remains robust but long-term decline starts to surface within five years as the energy supply becomes more diversified from fossil fuel, although this process is gradual and non-linear; Halliburton is priced at $36.48. In the bearish case, there is less near-term growth due to Fed’s inflation-fighting mission that eventually pushes down oil prices; it is priced at $29.78. In our base case, the near-term growth moderates, but 2023 remains strong due to overseas energy demand recovering; it was priced at $31.26. The current market price is higher than our top valuation.

Halliburton Fair Valuation (Calculated and Charted by Waterside Insight with data from company)

Conclusion

After years of volatile growth, it appears Halliburton has reached a steady and solid state with its financials. We think there is still more near-term growth ahead, although some could be moderated due to the macro environment. However, the long-term trend remains subdued as energy sources continue to diversify from fossil fuels. The company has begun to pursue more environmental focus technologies. But it remains to be seen if it has the vision to develop them into revenue streams, such as carbon-capturing, which it has mentioned as one of 2023’s focuses. Until that happens, we assess its fair valuation based on its current growth trajectory. We perceive the market assigns some premium based on the company’s recent solid performance. Although the stock price is a tad higher than our top valuation, we recommend a hold.