Cindy Ord

Thesis

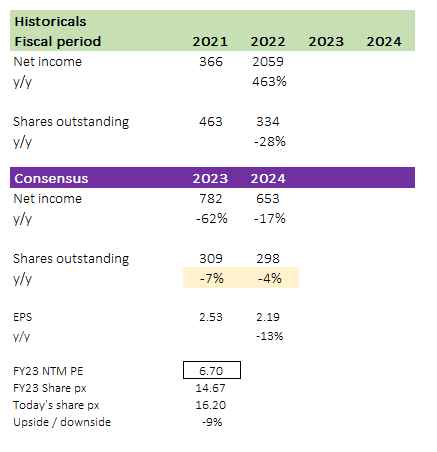

Hertz Global Holdings (NASDAQ:HTZ) offers renting and leasing of cars from its many locations across the globe and online reservation systems. As of FY22, 86% of pretax income comes from the US and the remaining from International. For anybody that has traveled abroad, it is likely that you have seen the Hertz brand at the airport counters or at the car park, as such it is not an unknown brand. I believe HTZ is enjoying two tailwinds today that will make it easy to hit FY23 consensus numbers. First, it is the effect of semiconductor chip shortage, which I believe has forced OEM to reallocate their chip resources to new fleets sold to retail customers that carries higher price. In turn, it has led to a lesser supply of rental fleets. As the supply and demand curve tips towards supply deficit, prices go up which benefit HTZ Revenue per day. Second, is the benefit from the current hot inflation, which enables HTZ to further raise prices. That said, HTZ is being valued at 6.7x forward earnings today (just a little higher than its all-time-low since relisting), which I believe reflects market expectation of earnings normalization once the semiconductor supply issue. While HTZ has enjoyed a strong period of elevated earnings, I believe the FY24 and FY25 numbers are where investors should focus on. Using consensus figures, EPS is expected to decrease from LTM $3.82 to $2.19, and I note that this is partially supported by share buybacks. While consensus already has this embedded, I believe the stock narrative could turn for the worse if the pace of normalization is sharper than expected. As such, I recommend a hold rating as the good days of over earnings are likely to end soon.

Results review

HTZ’s 1Q23 revenue was $2.05 billion, and the company’s adjusted EBITDA of $237 million, which included $88 million in interest rate cap monetization, was higher than expected. More rental days and a price increase helped drive $1.73 billion in revenue in the Americas, while $317 million came from overseas. Strong seasonal demand that is consistent with previous years has led management to predict a sequential increase in volume of around 20% from 1Q23 to 2Q23. While this is great news on the surface, it’s important to note that it likely means prices will remain unchanged, rather than rising as they have in the past. This isn’t necessarily a cause for alarm, as it could be attributable to the steady increase in weekly rentals to rideshare drivers and the normalization of higher volumes of lower margin corporate rentals.

Ridesharing

I’d add that the industry’s over-reliance on tourism has made it vulnerable to cyclicality, but the increase in rentals to rideshare drivers may help mitigate this risk. This is an intriguing development that, if HTZ is successful in expanding this division of the business (which grew by nearly 100% in Januay’23 compared to January’22), could shift the paradigm by which the company is currently valued (ie higher valuation due to more stable earnings). To begin with, the leisure and travel sectors have very seasonal demands, while ridesharing has a more predictable and recurring demand that provides a baseline cash flow for the business. Second, HTZ can get more mileage out of each car it owns by using them for ridesharing, where the priority is less on “high quality and new vehicles” and more on simply getting the passenger from A to B. However, providing options for new cars is important for leisure and travel, especially given the emphasis on safety. As a result, HTZ has to invest more money and time upfront to continually modernize its fleet. Earnings could be negatively impacted by the high fixed cost if demand is lower than expected.

Valuation

Using consensus estimates, they are expecting EPS to fall to $2.19 in FY24 supported by ~10% of share buyback. While I believe management would continue its share buyback program, I am worried that they do not buy back as much as consensus expected. The headline EPS reported would then come lower, and with the press reporting “HTZ miss earnings estimates” floating around, it could spur a narrative momentum on the stock.

Own model

Risks

Recent events have shown that macroeconomic factors can derail tourism, the main driver of rental car demand. HTZ profits might plummet once more if another covid-like event occurred. Next, there is the possibility of an oversupply, as is common in industries where businesses routinely stock up on goods in advance to meet anticipated demand. In this scenario, the industry may over-fleet in the long run due to expectations of demand that never materialize, putting downward pressure on both utilization and prices.

Conclusion

While HTZ is currently enjoying elevated earnings, it is important to note that the semiconductor chip shortage and hot inflation that are driving these numbers may not be sustainable in the long run. The FY24 and FY25 numbers are where investors should focus on, as EPS is expected to decrease from LTM $3.82 to $2.19. Additionally, macroeconomic factors like another Covid-like event or oversupply could derail HTZ’s profits. Therefore, I recommend a hold rating on HTZ as the good days of over earnings are likely to end soon.