Shares of Hormel Meals Company (NYSE: HRL) have declined 26% year-to-date. The branded meals firm is slated to report its earnings outcomes for the fourth quarter of 2025 on Thursday, December 4, earlier than the markets open. Right here’s a have a look at what to anticipate from the quarterly report:

Income

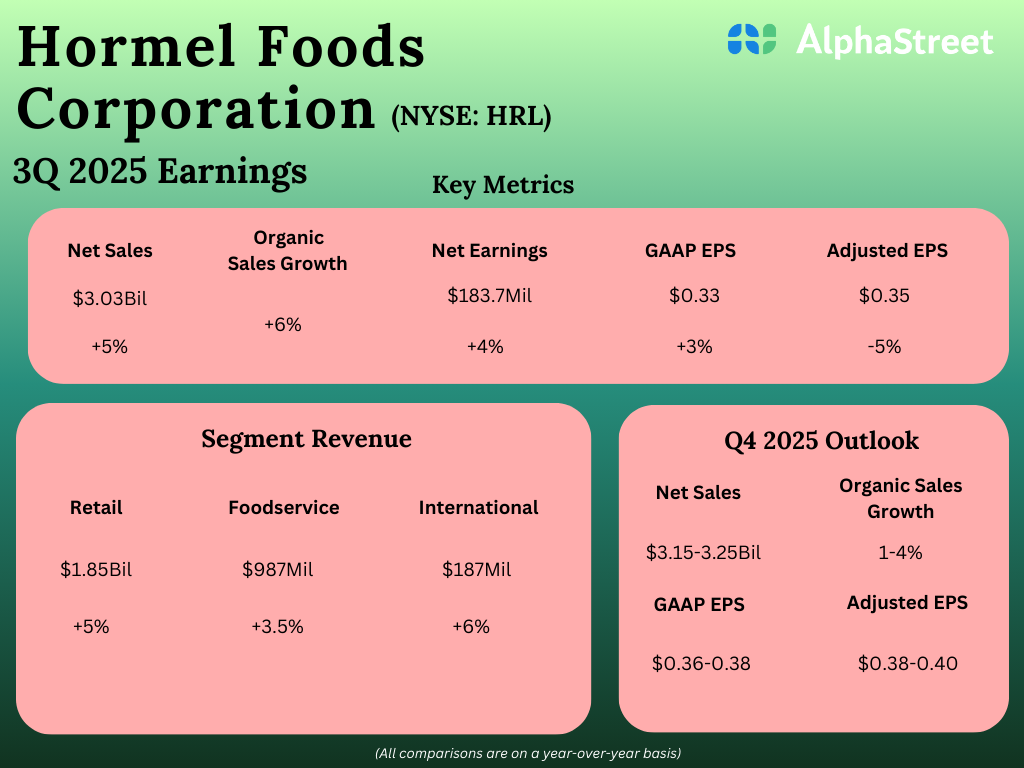

Hormel has guided for internet gross sales to vary between $3.15-3.25 billion within the fourth quarter of 2025. Analysts are projecting income of $3.24 billion for This fall, which signifies a development of over 3% from the identical interval a 12 months in the past. Within the third quarter of 2025, internet gross sales elevated almost 5% year-over-year to $3.03 billion.

Earnings

Hormel has guided for adjusted earnings per share to vary between $0.38-0.40 in This fall 2025. Analysts are predicting EPS of $0.31, which suggests a decline of 26% from the year-ago quarter. In Q3 2025, adjusted EPS decreased 5% YoY to $0.35.

Factors to notice

Hormel continues to function in a dynamic client atmosphere, and though the meals firm’s high line is benefiting from its robust model portfolio, larger enter prices are weighing on its backside line.

Hormel has guided for natural gross sales development of 1-4% within the fourth quarter of 2025. The corporate expects continued gross sales development supported by its main positions within the market. The Planters model and the turkey portfolio are anticipated to be robust development drivers of the highest line.

In Q3, Hormel’s natural gross sales rose 6%, marking the third consecutive quarter of natural gross sales development. This development was broad-based, pushed by all its segments. Final quarter, the corporate noticed gross sales enhance throughout all its segments, helped by the robust efficiency of its manufacturers.

Within the Retail section, manufacturers comparable to Wholly guacamole, SPAM, Black Label bacon, and Applegate, noticed robust client quantity demand. The Jennie-O lean floor turkey enterprise benefited from shoppers’ preferences for lean, inexpensive protein. The Worldwide section witnessed development pushed by momentum within the China market. This section continues to learn from innovation within the snacking portfolio.

The Foodservice section noticed gross sales development helped by beneficial properties from Planters snack nuts, Jennie-O turkey, and Hormel pepperoni. Nevertheless, this section continues to face stress from tender site visitors, inflation, and shifts in client conduct.

Hormel’s backside line continues to be pressured by larger commodity enter prices. The corporate is taking focused pricing actions to counter this commodity inflation. It expects to see a restoration in revenue solely within the subsequent 12 months, because the pressures seen within the third quarter are anticipated to have continued via the fourth quarter. Hormel has guided for GAAP EPS to vary between $0.36-0.38 in This fall 2025. HRL is anticipated to see advantages from its Remodel and Modernize initiative, which is projected to ship $100-150 million of incremental advantages in fiscal 12 months 2025.