Friday Four Play: The “Housing Market’s Crazy Train” Edition

Great Ones, it’s crazy … but that’s how it goes.

Millions of people. Giving up on homes.

Maybe it’s not too late?

What? To learn how to refinance? Nah, man, it’s way too late.

Inflation wounds still screaming. Housing’s a bitter shame. It’s going off the rails on a crazy train!

Of course, I had to link to the Randy Rhoads version. Dude was a guitar god.

Anywho, I hate to tell y’all … but I was dead right on the housing market. Dead. Right.

Home prices rose too high, too fast due to easy money that the Federal Reserve allowed for far too long. A correction in housing prices was unavoidable.

Inescapable.

Inevitable, even.

I’ve chanted this mantra for about the past year to prepare y’all for what was coming.

Some of you listened, but many Great Ones pushed back, saying I was off my rocker. That I was wrong. That this time was different.

Well, it is different in that we don’t have banks on the verge of collapse due to extreme leveraging and wonky credit default swap derivatives. But then, I never claimed this time around would be exactly like the 2008 financial meltdown.

This is just your ordinary, “run of the mill” 10% to 30% correction in housing prices after a massive easy money bubble.

A 30% plunge in housing prices?! You can’t be serious.

I am dead serious. After the Federal Reserve’s string of 75-basis-point rate increases, average mortgage borrowing costs are at their highest levels since 2008. The current average mortgage rate on a 30-year fixed loan sits at 6.2%.

Putting that rate in perspective: Homebuyers who purchased a house for $600,000 back in 2021 are making the same monthly payment as homebuyers who purchase a $392,000 home right now. The only difference is the mortgage interest rates, which were 2.6% back in 2021.

The result of all this is that home bidding wars are over, and sellers are starting to lower home prices. And you can’t really blame them for lowering prices. I mean, mortgage payments on median-priced homes are now eating up 36% of household income. That’s the highest percentage since 1985!

Look, I even found a chart detailing the nightmare we’re facing:

And you wonder why housing starts, new home purchases and basically every metric associated with the housing market is plummeting. At this rate, it won’t be long before millions of homeowners are upside down on their mortgages. Stranger things, indeed.

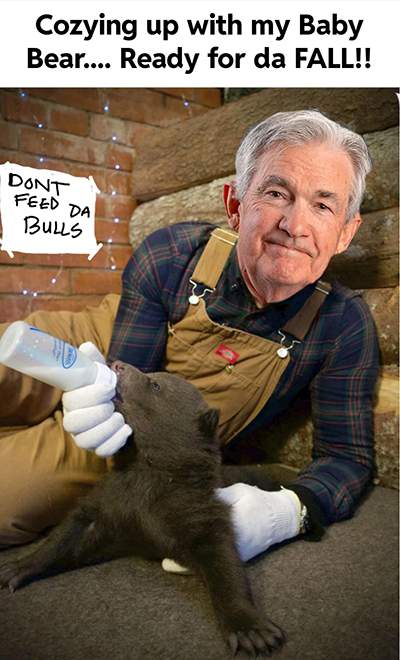

Meanwhile, Federal Reserve Chairman Jerome Powell warned last Wednesday that a housing correction is coming. Better late than never?

Who am I kidding? Powell knew this was coming all along and plowed ahead anyway. He just held off stating it officially because he knew that Wall Street couldn’t handle the truth.

Goldman Sachs concurred, saying it expects housing prices will fall 5% to 10% from peak prices, with prices dropping 15% to 25% in the formerly hottest real estate markets. But Goldman noted that its worst-case scenarios were based on a mild recession happening.

Umm … I hate to tell ya, Goldman, but a mild recession is already happening. By the time the talking heads all agree that we’re in a recession, we’ll have gone from “mild” to “holy $#!t,” and that “worst case” drop of 15% to 25% in housing prices will look conservative.

Now, you can all sit around and blame Fed Chair Powell for this mess … and you wouldn’t be entirely wrong. The Fed waited far too long to fix the easy money situation, resulting in record inflation and ridiculous home prices.

Mr. Powell … what went down in your head?

Oh, Mr. Powell. Did you talk to the Fed?

Your inflation plan to me seems so tragic. There’s no thrill here at all.

You fooled all the people with magic. Yeah, you waited way too long…

Or you can realize that I’ve been right about the housing market correction all along. And maybe some Great Ones listened and are prepared for this eventuality.

But even if you didn’t listen, it’s not too late to save your investing capital and do the right thing. You can literally get off this crazy train whenever you want … but you don’t have to give up on bringing in income. Bread. Cash.

Let my colleague Charles Sizemore show you how you can conquer this market volatility with five of his favorite high-yielding dividend stocks. He’ll send you the entire list for FREE! And I mean it … no strings attached.

Plus, Charles will send you his brand-new book, Income Forever.

It’s packed full of the tips, tricks and secrets gathered over 20 years of helping independent investors gain financial independence.

Click here to get all the details now … before this FREE offer expires!

And without further ado, here’s your Friday Four Play:

No. 1: Members Only

While the housing market’s in crisis, the stock market’s bleeding like a stuck pig and the world’s at odds with itself every day — hey, at least Costco (Nasdaq: COST) isn’t raising its membership prices after all.

A retailer not passing the buck? What the $@*#?

It’s good news for Costco members and soon-to-be members, at least.

Costco investors, however … take this news for what you will.

On one hand, Costco not raising its membership prices means the chain’s doing A-OK with costs and inflation as things stand. But if you’re the kinda investor who wants your invested companies to squeeze every last bit of capital out of its consumers, well, there’s a little less cash on the table for you right now.

Bully for you.

So what were Costco’s earnings anyway?

The bulk-shopping stalwart just beat estimates on both counts: Revenue reached $72.09 billion and beat expectations for $72.04 billion by a hair. Earnings per share rose to $4.20 and beat estimates of $4.17. Nice.

For all the glowing numbers in its earnings report, for all the seemingly consumer-focused moves concerning membership prices … COST stock still sank over 3% today with the broader sell-off. At least Costco gave y’all a free sample of good news though … and cheap hotdogs. Can’t forget the cheap hotdogs.

No. 2: The Fubo Flip-Flop

Want to see how fast Wall Street can change its mind?

Want to see them do it again?

Wedbush Analyst Michael Pachter just upgraded fuboTV (NYSE: FUBO) stock from neutral to outperform.

Which is funny, because just last month he had downgraded FUBO from outperform to neutral because of “slowing subscriber growth, competition, inflation, and rising content costs” … all of which are still present.

What’s with the sudden reversal? Did somebody just realize that the NFL season started up again? And that this is probably going to be Fubo’s sports-streaming prime time season after a sleepy summer?

Why don’t we see what Wedbush’s reasoning is for the upgrade anyway:

FuboTV has a solid head start in offering live sports programming to its subscribers, has a thriving and growing advertising business, and presents a compelling opportunity for a sports wagering company to partner with an established sports television broadcaster. — Wedbush Analyst Michael Pachter.

Our takeaway from this episode: Fubo’s been beaten to a pulp so badly that now might be a good entry point into the stock if you’re the gamblin’ kind.

With that said … this is a fine example of why you shouldn’t always put too much weight on the opinions and ratings of analysts, which change with the winds, week to week, minute to minute.

No. 3: UPS Is Fine, But FedEx Is Quicker…

Shipping times are slow with liquor … er, maybe not.

Remember the other day — was it Monday? Then, no — when FedEx (NYSE: FDX) warned everyone about that nasty, dreaded, dirty word called “stagflation?” And everybody took a bottle, drowned their sorrows, thinking it’d flood away tomorrows?

Yeah … about that.

Apparently, FedEx saw the market’s horrible reaction to its stagflation proclamations that the company went: “Huh, seems like the damage is already done. Might as well release that god-awful earnings report while we’re at it.” And so it did.

FedEx reported earnings of $3.44 per share — nowhere near analysts’ targets of $5.10 per share. Things were slightly better on the revenue side, but not by much: Sales of $23.2 billion just missed the mark for $23.5 billion:

We saw a decline in our volumes during the [fiscal] first quarter, which accelerated in the final weeks. Our softening volumes in Asia and the U.S. were predominantly due to the economy while the shortfall in Europe was both economic- and service-related. — CEO Rajesh Subramaniam

Softening volume? Sounds like a personal problem…

No, really: While the global macroeconomic pressures certainly aren’t FedEx’s problem — practically everyone is blaming the economy for any misses and missteps this earnings season — dealing with those pressures is FedEx’s problem.

And yet, you get analysts saying stuff like this: “Citi analyst Christian Wetherbee didn’t like the news, writing Friday that FedEx was in a deeper hole than he expected.” You’re still going to blame FedEx for reporting exactly what it said it was going to report? What?

And sorry to say it, Wetherbee, but the global economy is in a deeper hole than you expected.

When did we stop doing “phrasing?”

No. 4: As American As…

Diabeetus.

Probably from a mix of apple pie and bacon cheeseburgers, if I had to guess.

Though for any Type 2 sufferers out there, good news! (Yes, actual good news in Great Stuff … we do that from time to time, you see.)

Eli Lilly’s (NYSE: LLY) new drug for Type 2 diabetes, Mounjaro, just earned the company an upgrade from the analysts over at UBS.

Mounjaro, aka tirzepatide, was approved to treat Type 2 back in May, and Eli Lilly is seeking further approval for the drug as a treatment for weight-management therapy.

Whoa. So what you’re saying is … I’m about to let my eating habits get a lot worse?

What? No, that’s not what I’m saying at all! What analysts are saying is that if the drug takes off: “Tirzepatide’s robust efficacy in both obesity and [Type 2 diabetes] should drive sales into a range that we believe could see this being one of the best-selling drugs in history.”

You can practically hear Big Pharma’s eyelids widening at the imagined riches. UBS predicts sales to peak around $25 billion, which is no chump change to be sure. I can’t tell who’s more excited, UBS or Eli Lilly itself.

What do you think, Great Ones? Got any thoughts on today’s Great Stuff? Head on over to our inbox to share your side of the conversation: [email protected].

In the meantime, here’s where you can find our other junk — erm, I mean where you can check out some more Greatness:

Regards,

Joseph Hargett

Editor, Great Stuff