1. Search by Location

To start, you’ll have to filter buyers by location: metropolis, state or nation.

Take note, the placement filter permits you to discover buyers that spend money on firms primarily based on this location. Should you begin your search in Boston, for instance, you would possibly discover an investor primarily based in California or India. That simply implies that they’ve deployed capital to a Boston-based startup.

2. Add Filters

Now the enjoyable begins. It’s time to slim your search. Click on the Extra Filters button subsequent to the Search button. You’ll now know how you can discover buyers in your startup primarily based on 4 standards:

- Markets: buyers which have put capital in direction of a sure sector (FinTech, cybersecurity, and many others.)

- Funding kind: Traders which were concerned in a selected spherical or stage (Angel by means of Collection E)

- Corporations: Companies which have invested in a selected firm

- Collaborative buyers: corporations which have labored with one other particular investor of your selecting

3. Seek for Startup Traders

Hit the Search button and also you’ll see data on as much as 10 buyers that match your search standards. Should you seek for Collection A buyers in Boston, for instance, all your outcomes shall be funding entities that have been concerned in a Boston-based firm’s Collection A spherical.

On the left aspect of the display screen, you’ll see fundamental details about the investor: firm title, slogan, location, prime markets and hyperlinks to its web site and Gas firm profile.

4. Dig Deeper

Underneath the Investments tab on the best aspect of every end result, you’ll discover helpful data in your investor search.

You’ll see an identical share — the p.c of that investor’s involvement that falls inside your standards. Gas additionally tells you what number of rounds that investor has led, in addition to the common spherical dimension.

Moreover, you’ll discover data on the three most up-to-date investments by that investor. These three rounds don’t essentially match your standards, however they do offer you perception into current actions by your potential new VC companion — together with collaborative buyers that additionally participated in these rounds.

Swap over to the Individuals tab to see which buyers from the agency to contact, together with their LinkedIn and social profiles. (Word: This tab will solely be populated if the agency lists its contacts on-line.)

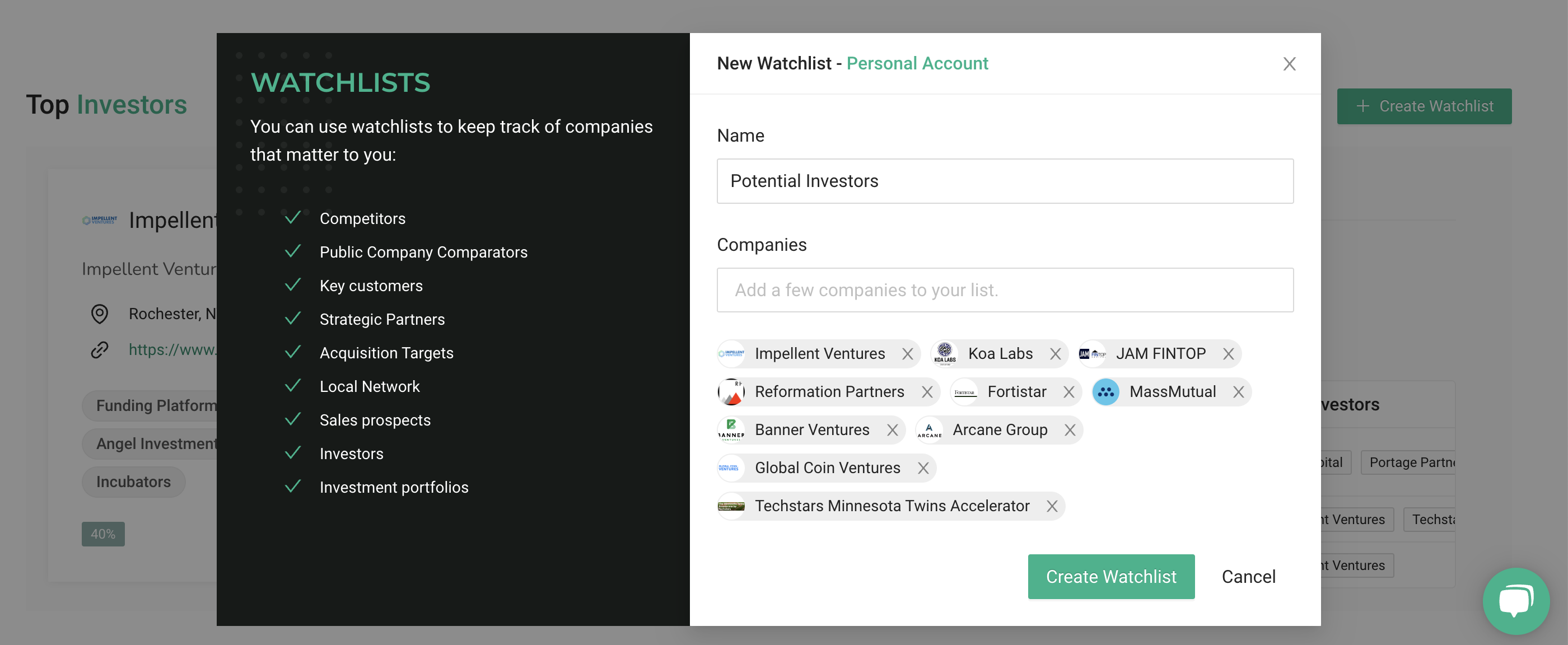

5. Create a Watchlist of Potential Traders

Now that you simply’ve discovered a pool of potential buyers, you possibly can click on the Create Watchlist button to simply monitor your new targets in a single place. Keep updated with these corporations’ newest funding actions so that you’re arming your self with the market intelligence you want.

Be taught The way to Discover Traders and Make Fundraising Simpler

Founders and early-stage workers have lots on their plates: new enterprise, constructing the product, recruiting new hires, and many others. Conducting investor analysis on prime of all of this may be overwhelming.

Gas’s Investor Analysis instrument presents a technique to streamline the method, so you possibly can spend much less time doing chilly LinkedIn outreach and making hopeful journeys to in-person startup occasions. Goal buyers with a historical past of investing in your location, market and stage, leaving extra time for different important startup scaling actions.

Join Gas and begin discovering buyers in your startup right this moment!