gremlin

Investment action

I recommended a hold rating for Hubbell Incorporated (NYSE:HUBB) when I wrote about it the last time (3rd Dec 2023), as the HUBB valuation was not trading at an attractive level. However, HUBB has exceeded my expectations, beating my FY23 estimates. Based on my current outlook and analysis of HUBB, I recommend a buy rating. I expect a 1-year return of 12% for HUBB based on my current target price. Unlike my previous post, I am quite confident that HUBB can meet or beat its FY24 guidance given the current outlook and the conservatism embedded in the guide.

Review

HUBB reported very strong results for 4Q23 on 30th Jan, where sales came in at $1.35 billion, growing 10%. Growth was led by both segments: electrical and utility growth of 6% and 13%, respectively. Strong growth was followed by a stronger segment profit growth of 34%, driven by both segments and margin improvement from ~16% to ~19%. EPS saw a stronger leap from $2.60 in 4Q22 to $3.69 in 4Q23. On a full-year basis, the top line saw 8.6% growth to $5.37 billion in sales, EBIT came in at ~$1 billion, which was a ~42% growth FY22, and EPS came in at $14.44 vs. 9.62 last year.

HUBB

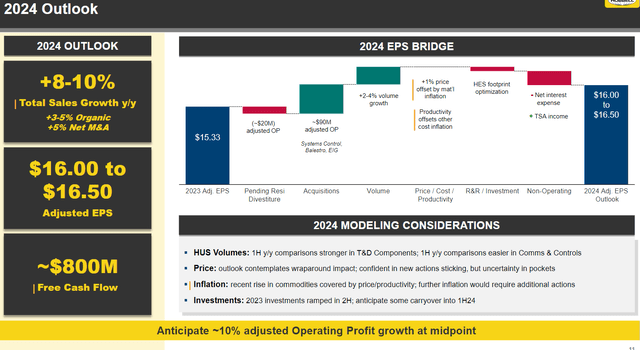

Looking at how HUBB performed in 4Q23, I believe there is a good chance for HUBB to meet FY24 guidance if the momentum continues. Specifically, management is guiding organic growth of 3-5%, driven by 3% volume at the midpoint (2 to 4%) and 1% price, and M&A to contribute another 5%, bridging to ~10% growth for FY24. In the below sections, I will break down each part of this guidance equation to discuss what drove the change in mind that HUBB can meet this guide.

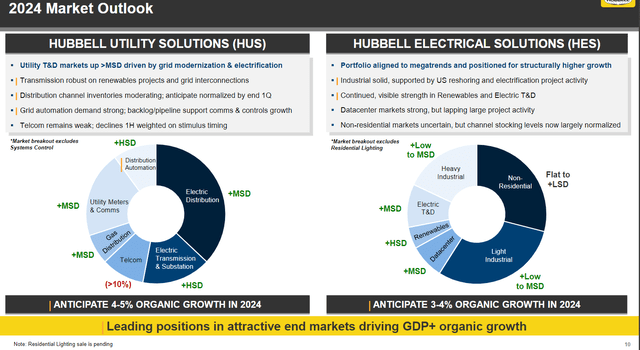

Starting with volume growth, end market demand trends at both electrical and utility continue to trend well, as management has not called out any demand shifts since 3Q23. The outlook remains positive, where utility T&D (transmission and distribution) markets are expected to be up more, at least by mid-single-digits, driven by strength in T&D. I believe this outlook for the utility segment has high creditability, but the backlog is still at an elevated level, which provides visibility. As for the electrical segment, the outlook also remains positive, with a mostly mid-single-digit growth outlook for all its end markets. In my view, I think management guidance for the electrical segment is on the conservative side, which means there is possibility for a beat. In the presentation slide, they noted the non-resi market as uncertain, but also noted that channel stocking levels have normalized. From the call, we can infer that this segment saw a low-single-digit impact from destocking in FY23. This also means that the flat-to-low-single-digit guide is essentially from the easy FY23 comp (since FY24 will not have the same destocking issue). If the macro situation recovers, it is likely that the non-resi segment outperforms expectations—a possible upside catalyst.

HUBB

Secondly, regarding pricing, I think the 1% guide is easily achievable given that it includes carryover from FY23 price actions and that FY24 pricing action will continue to benefit from raw material inflation. So far in January, management has noted that the market has been receptive to its pricing actions. This has a deeper implication that suggests potential higher pricing growth than 1%. If we look at HUBB historical pricing growth, it averages to be about 2% from FY04 to FY23. Assuming that HUBB is able to revert back to this average pricing growth, say 50% of this pricing is realized in FY24 (the rest is realized in FY25), this already implies a 1% growth. Adding the benefits of FY23 price actions, price growth for FY24 could exceed the 1% guideline.

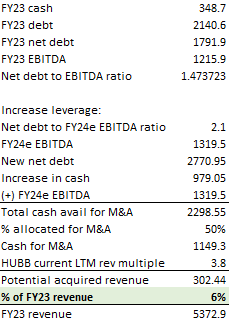

Lastly, for M&A growth, I believe it is a matter of balance sheet strength. As of 4Q23, HUBB has a net debt position of around $1.8 billion, or 1.5x net debt to EBITDA. This is a very comfortable range for HUBB, as it is at the midpoint of its recent low of 1x and high of 2.1x. HUBB has been a serial acquirer for some time now, making at least 16 known public acquisitions since FY12. Throughout this period, the implied price to sales ratio is usually ~1.3 to 1.6x (based on HUBB historical filings), which gives me some confidence that they will not overpay by a huge amount. Even if assuming that HUBB does not make an acquisition that is trading higher than its own valuation (~3.8x LTM revenue), I believe the 5% M&A contribution is plausible. Management also specifically called out that the M&A pipeline remains solid, so I would not be too worried about the number of targets available. Below is my math:

Author’s work

At the bottom line, management guided for an adjusted EPS range of $16 to 16.50, which implies a net earnings figure of ~$880 million at the midpoint, beating my original FY24 estimate of $853 million. In my view, a big part of this expected outperformance is that HUBB is going to see margin benefits from the sale of Resi Lighting. The Resi Lighting segment generated $228 million in FY22 and $190 million in FY23, which is around 10% of the Electricity segment. This business has a low double-digit percentage margin, so from a mix perspective, the consolidated margin should improve without it.

Valuation

Author’s work

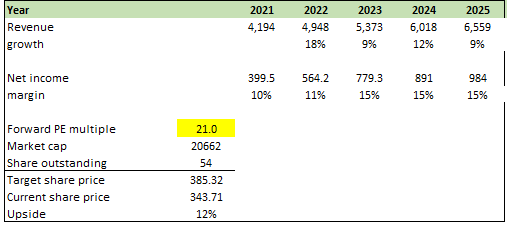

I believe HUBB can grow at 12% in FY24 (vs my previous expectation of 14% for FY24) and 9% in FY25. My growth estimate for FY24 is higher than guidance because I see potential for outperformance in non-resi (electrical) if the macro environment recovers, with better pricing and a higher M&A growth contribution. In FY25, growth should start to normalize back to historical growth of mid-single-digits (9% is the midpoint). For net margin, I expect HUBB to hit the high end of its guided range ($16.5 EPS), due to reasons I discussed above that led me to believe HUBB will see outperformance at the top line (vs my expectation of $853 million for FY24 previously). As the outlook seems to be bright, I believe the market will continue to value HUBB at 21x for this 1-year period. Hence, I have a price target of $385 by FY24e.

Risk and final thoughts

A big part of the growth equation is M&A, and many things could happen to steer this off course. For instance, the asking price is simply too expensive, the cost of capital gets more expensive if the Fed does not cut rates, and a deteriorating macro environment would also limit HUBB’s ability to be more aggressive as they need to be more careful. I think the only way to monitor this interest rate risk is by monitoring the key indicators (inflation and unemployment) that are released monthly to get a sense of the current economy situation.

To conclude, I am upgrading HUBB to a buy rating, anticipating a 12% 1-year return based on a robust FY24 outlook. The forecasted 3-5% organic growth, conservative electrical segment guidance, achievable pricing growth target, and a strong balance sheet led me to believe that meeting/beating FY24 guide is possible. Net margin will also benefit from the sale of Resi Lighting, driving margin improvements.