DNY59

IAF Overview

The abrdn Australia Equity Fund Inc (NYSE:IAF) is a closed end fund that invests in Australian companies listed on the Australian Stock Exchange. Its primary aim is to achieve long-term capital appreciation. Secondary to that is the objective to deliver regular income. This is expected to be derived primarily from the underlying dividends received on the portfolio of stocks it holds.

I previously covered this Australian CEF almost a year ago and I rated the fund as a sell at that time. I noted that the market was towards the top of the range and valuations not that compelling. I also viewed there were risks of a recession later in 2023. Additionally, I saw a reasonable chance the discount to NAV could easily widen from about 5% at that time.

Australia narrowly avoided a recession last year, however if you ask many people living there, it did not feel like it. To quote directly from the article just linked, “For many, life in 2023 certainly felt recession-like as Australians faced more interest rate hikes, a rising tax bill and a still-increasing cost of living that again outpaced wage growth.”

Despite noting the tough time there for many Australians, IAF at the time of writing has still returned a positive return of approximately 7% since my article almost a year ago. A key question now is whether Australia escaping a recession last year means such risks for this year have now subsided? Other questions remain about cost-of-living pressures, interest rates, and taxes within the economy. These issues have still dominated the media headlines in Australia at the beginning of 2024.

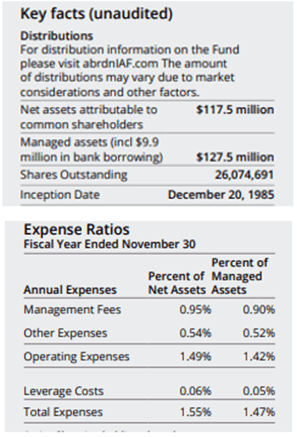

IAF key facts and expense ratios

Some noteworthy facts below are the relatively low fund size, which continues to put upward pressure on the expense ratios.

Source: abrdniaf.com, the Aberdeen Australia Equity Fund factsheet November 30, 2023.

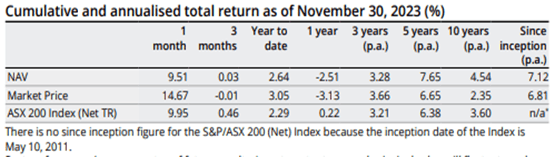

IAF performance

If we look at the long-term NAV relative performance, there is some indication of a bit of alpha in the last decade.

Source: abrdniaf.com, the Aberdeen Australia Equity Fund factsheet November 30, 2023.

I would not however consider this a compelling reason to invest in this fund for a variety of reasons.

- They could be described as a closet index hugger given the similarities between NAV and benchmark returns.

- They have the advantage of utilizing leverage (currently about 7%), but despite that they have still not managed to add alpha to any major extent consistently.

- Low returns over the last decade yet maintaining high distributions have put upward pressure on the expense ratios. This is a headwind to the future potential of the fund to add alpha.

IAF distribution history

The fund trades on a 9% yield based off last year’s quarterly distributions, which may appeal to some.

CEF fund connect

I do not view this as sustainable in the long run however, as such a yield exceeds the underlying historical performance of the fund. Whilst Australia has a renowned high dividend paying stock market, it still yields well below 9%. IAF will therefore need to improve performance going forward to keep paying these high distributions and grow the fund size. If not, then that headwind I mentioned earlier of the high cost ratios will only worsen.

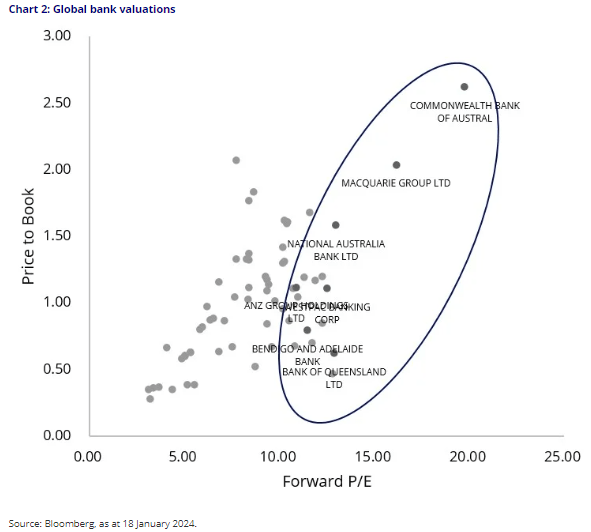

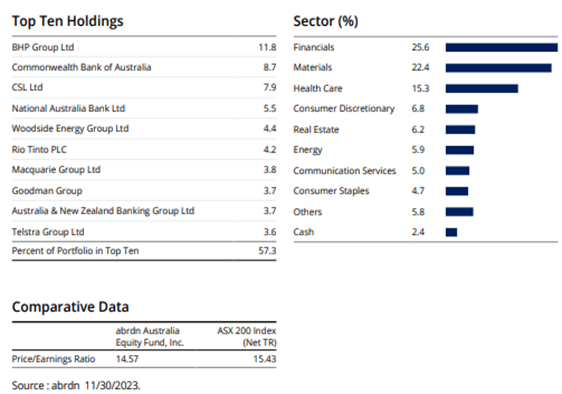

Australian bank stocks are expensive

The chart below I came across from an article last week from VanEck. It referred to Australia’s big banks as expensive, as well as facing continuing headwinds in 2024.

Bloomberg as at 18 January 2024 via vaneck.com.au

The VanEck article notes that Australia’s biggest bank, the Commonwealth Bank of Australia (OTCPK:CBAUF), remarkably has 13 out of 15 analysts with a sell recommendation on it. CBA accounts for about 9% of the ASX200 benchmark. The 5 biggest banks represent approximately 23% of the ASX200. IAF’s last monthly report noted it also had a 9% weight in CBA. The fund nearly also matched the same index weight of 23% to the 5 banks, although I noticed it was underweight Westpac.

Deteriorating Net Interest Margins (NIMs) are likely to be a significant headwind for the banks in 2024. The last year has seen Australian banks get a bit of a free kick, increasing mortgage rates whilst lagging with any upward move on their deposit rates. This trend is likely to be over this year.

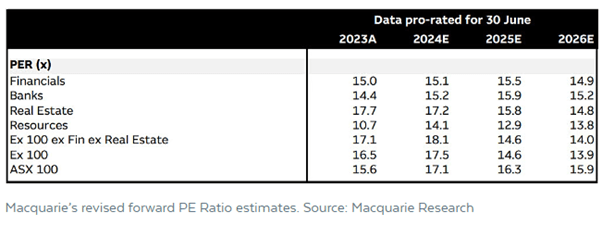

Australian stock market PE ratios have expanded in recent months

It is not just the Australian banking sector where valuations are getting more stretched. After a big rally in Australian stocks in December, the following article reveals Australian stocks just got more expensive. To quote from the article directly, major broker Macquarie noted that, “prices have risen since December faster than forecast earnings. Aussie stocks have generally become more expensive.”

Below are Macquarie’s updated estimates on December 19th last year after a big rally in Australian stocks during December.

Macquarie Research via livewiremarkets.com

The 2024 forward P/E above of the ASX100 of 17.1 sits comfortably above the long-term average of 15.7.

On a more optimistic note, I do concede that the resources sector looks relatively attractive in the table above even acknowledging the sector usually trades at a discount. If one believes there has been an under investment in commodities in the last decade, then this is where the opportunities may lie.

Australia may still slip into recession in 2024

In reviewing IAF about a year ago I discussed the widely reported “fixed rate cliff”, where Q3 in 2023 was the period many feared. It was around then that a huge number of borrowers were to come off their 2% fixed rate home loans from a couple of years prior. They would then soon face variable rates towards 6% instead.

Some are of the opinion this risk was over hyped, and that in the end the fixed rate cliff was a myth.

Whilst that may turn out to be the case, I would argue it is still a little early to be sure. If Q3 indeed was the potential troublesome period, then it means many borrowers were still enjoying extremely low rates until then. We are only six months on from this period when rates effectively were changed for a large portion of this set of borrowers. This is widely considered a short time span when considering the generally accepted views on response lags of monetary policies.

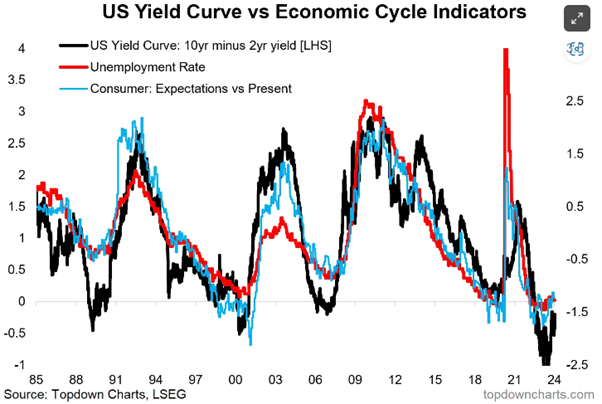

To examine such lags in the context of leading economic indicators, it also seems premature to declare the recession risks have already passed.

Leading indicators globally like the US yield curve inverting are also a concern. Although the consensus seems to have shifted to a soft landing there, history shows there can be a long lag before problems show up.

topdowncharts.com

Australian monetary policy risks are intertwined with recent political and taxation moves

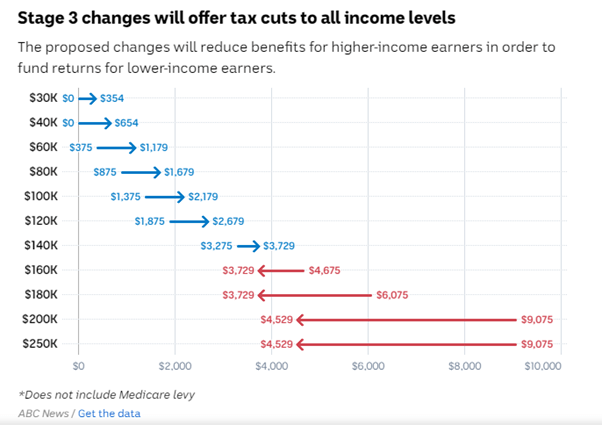

The political and taxation landscape in Australia has been hotly debated already in 2024. In a controversial move this year, the government announced changes to promised tax cuts.

The original promised tax cuts were passed in parliament in 2019 in a major move to address “bracket creep”. The effective proposed changes to these are illustrated below.

ABC News Australia

Effectively lower income earners will now get more of a boost, and higher income earners will be worse off compared to earlier promises.

Lower income earners are likely to spend more of the net benefits and this has the potential to be more inflationary. Ironically, there is a risk that interest rates cannot be cut to the extent this group of earners may have desperately hoped for.

Australia’s population ponzi scheme

Another much debated topic in Australia of late is immigration. This is seen as adding pressure to rental inflation, which was running rampant in particular this time last year. Bowing to political pressure, the government announced a crackdown on the abuses of the migration system. The abuse of the student visa program was widely reported, and a crackdown was announced last October. Then just last month, Australia halted its “Golden Visa” program for wealthy applicants investing more than AUD $5 million into the country.

For a long time now, Australia has used high levels of immigration as a tool to boost economic growth. Now it is becoming more widely acknowledged the country is experiencing a “per capita recession”.

Now that it appears that reducing immigration levels has become a political vote winner, this raises longer term questions. Can we rely on Australia’s high population growth to continue to boost GDP and company profits the way it has done so for the last two decades?

It has even been described by some as Australia’s population ponzi scheme, which has been enjoyed by equity investors. To quote from the link just provided, “The beauty of the Australian population growth story for equity investors is how our companies can have the cake all to themselves”, [ UBS Australia strategist Richard Schellbach] says.

IAF top holdings and sector allocations

abrdniaf.com, the Aberdeen Australia Equity Fund factsheet November 30, 2023.

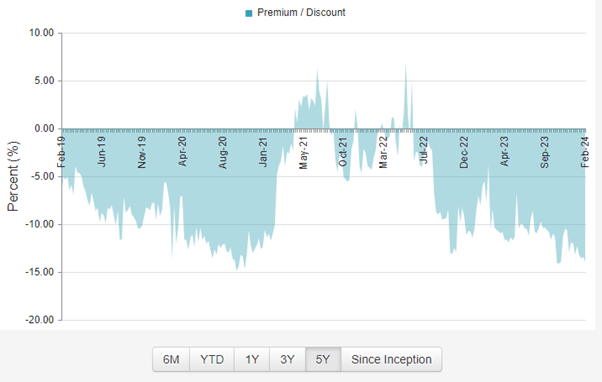

IAF discount to NAV

One bright spot at least for IAF shareholders, is that the discount to NAV is at the wide end of the historical range. When I previously covered IAF this time last year I cited risks of the discount to NAV widening from the then 5% level. At a discount in recent months of around 13% I don’t see a big risk of further significant discount widening.

Having said that, I do not see catalysts to close the discount in a major away either. As I touched on earlier, the small fund size is a negative, so I expect the discount to settle in this 10-15% range.

CEF fund connect

Conclusion

I have covered some risks to IAF that have been mounting in part due to the big bounce of around 15% in Australian stocks since the end of October lows.

Valuations have become stretched, particularly in the banking sector which faces headwinds. Cost of living pressures are hurting lower- and middle-income Australia. This in turn means that the government is facing increasing political pressure not to go to its usual strategy of boosting population growth. In the last couple of decades, such a strategy was a handy tailwind for Australian equity investors.

Whilst the discount to NAV for IAF is reasonably wide, I don’t see catalysts for it closing given the weak economic backdrop and small fund size. Given the risks cited, I regard IAF as a sell at this point in time.

The discount available and high distribution yield still offers some support for the bulls. Upward momentum is strong, so some possibilities exist for further upside in the next few months. For example, the market may latch onto the hope of rate cuts towards the middle of the year.

Any such further rallies in Australian stocks I would look to sell into however, as buying stocks for the hope of the first rate cut in a cycle can be risky. The Australian stock market may then quickly turn its attention to the worrying reasons the Reserve Bank of Australia needs to cut rates.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.