Khanchit Khirisutchalual/iStock through Getty Photos

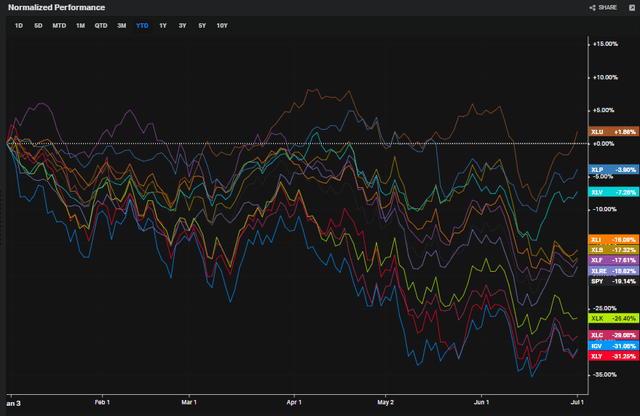

The S&P 500 endured its worst first half since 1970. Possibly you heard about it. On a complete return foundation, the -20.6% drubbing was truly the most important drop since H1 of 1962 when it fell 26.5%. Digging into the poorest sectors, one can find Communication Companies (XLC) and Client Discretionary (XLY) which had been each down about 30% by way of final Friday. Between these two dreadful figures is the expertise software program business fund, down 31.1% so far in 2022.

2022 Sector Returns: IGV Among the many Largest Losers

Koyfin Charts

The iShares Expanded Tech-Software program Sector ETF (BATS:IGV) seeks to trace the funding outcomes of an index composed of North American equities within the software program business and shares from interactive dwelling leisure and media and companies industries, in keeping with iShares. With greater than $4 billion in web belongings and an expense ratio of 43 foundation factors, it is a well-liked buying and selling car to play the risky software program area of interest.

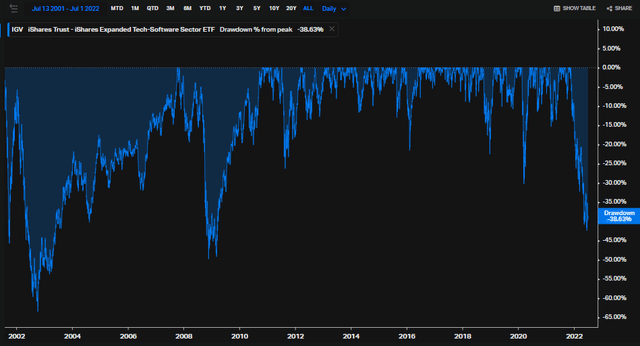

IGV is at present in an enormous drawdown off its November 2021 all-time excessive, however shares have discovered some help close to the pre-pandemic peak and pullback lows from 2Q 2020. At a decline of 39%, that is far greater of a bear market versus dips seen from 2011 by way of 2020.

IGV Historic Drawdowns: Largest For the reason that GFC

Koyfin Charts

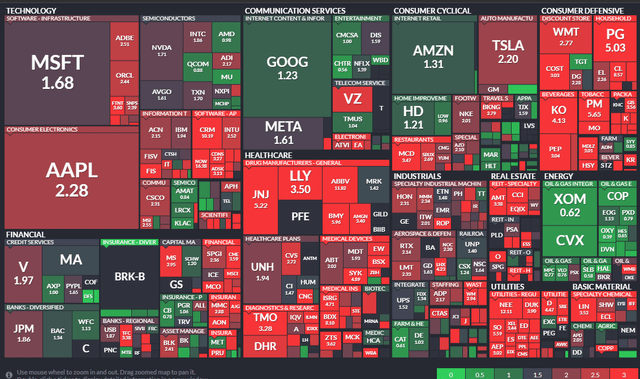

IGV is closely weighted in a handful of big-name tech shares. Microsoft (MSFT), Salesforce (CRM), and Adobe (ADBE) every symbolize about 8% of the fund’s portfolio. These corporations characteristic comparatively excessive price-to-earnings ratios, however with respectable progress, their PEG ratios counsel cheap valuation given the numerous share value drops this yr.

S&P 500 PEG Ratio Warmth Map: Some Low cost Shares in Tech

Finviz.com

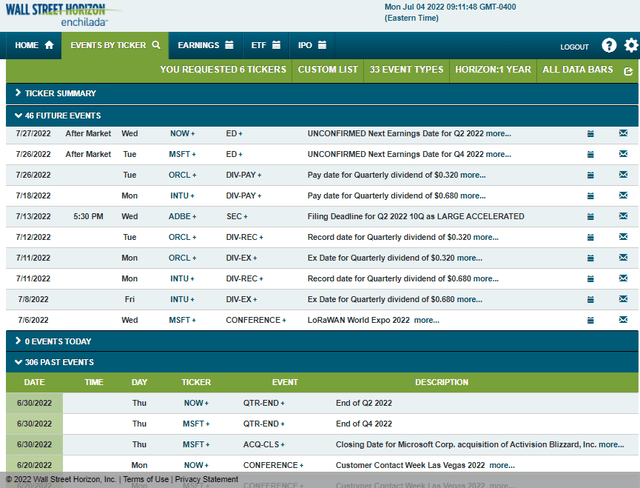

What will probably be notably attention-grabbing to observe within the coming weeks is what occurs throughout earnings season. Tech corporations begin reporting in the course of the week of July 25, in keeping with the company occasion calendar from Wall Road Horizon. That is additionally when the subsequent Fed determination arrives, so count on volatility to kick up because the month progresses.

Tech Earnings Start In the course of the Last Week of July

Wall Road Horizon

The Technical Take

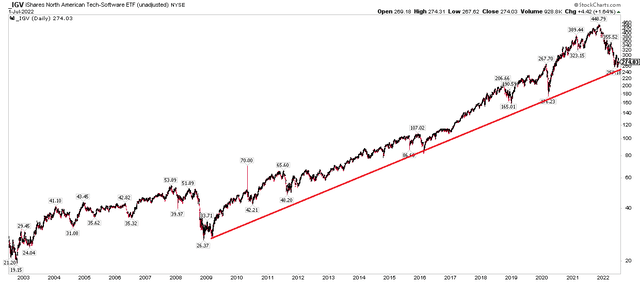

Turning to the charts, IGV is close to key long-term development help. I favor to research the speed of development over extended durations with log-scale charts. From the GFC lows to the 2016 correction low after which by way of at the moment, an uptrend help line is in play. A transfer beneath that line may result in vital additional losses.

Lengthy-Time period Assist Line In-Play

StockCharts.com

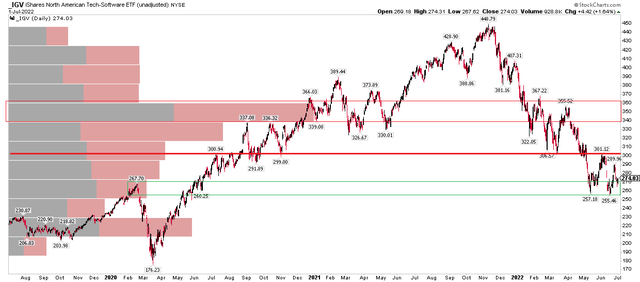

The near-term look yields extra exact ranges to observe. Merchants can take a shot lengthy right here with a cease beneath the Could and June lows within the mid-$250s. I do not typically present volume-by-price, however I feel it’s acceptable right here. Discover the excessive quantity of shares traded within the $335 to $365 vary. A rally would possibly pause when that zone is hit as a result of a provide of shares trying to promote on the psychologically vital breakeven stage. $300 to $305 is perhaps robust slogging too.

IGV: Resistance Close to $305 and The place Quantity-by-Value Spikes

StockCharts.com

The Backside Line

Whereas in a giant downtrend, the tech software program ETF units up for a bounce right here, however income ought to be taken first on an strategy of $300, however extra aggressive merchants would possibly look to the $335-$365 space for resistance. A cease beneath the Could-June lows is prudent to chop losses.