The ILS Advisers Fund Index has reported a +0.17% return for February 2025, however the firm has highlighted a second consecutive month the place there was a broad dispersion between ILS fund returns and efficiency, as results from losses as a result of California wildfires continued to stream via the market.

Along with the wildfire associated unfavourable efficiency hits felt by sure disaster bond funds and personal ILS funds in February, ILS Advisers additionally notes that up to date loss info associated to the flooding from hurricane Helene additionally dented some positions within the month.

ILS Advisers famous that solely roughly 753% of the ILS fund constituents inside its Index have reported their information for February 2025 to date.

Discussing disaster exercise in February and its impact on the disaster bond and broader ILS market, ILS Advisers stated, “February was a quiet month with no new pure disaster occasions. Nonetheless, up to date loss info from the Los Angeles wildfires and the inland flooding attributable to Hurricane Helene has led to additional declines in fire- and flood-exposed ILS positions.”

We had reported again in February that the NFIP’s estimate of flood insurance coverage losses from hurricane Helene had risen throughout the month, which had an impact on a number of the FloodSmart Re cat bond offers with worth actions and extensions of maturity evident a couple of weeks later.

“Moreover, a collection of multi-peril annual combination buildings stay beneath stress as we enter the height of extreme thunderstorm season in March, April, and Might throughout the central United States.”

After a considerably unfavourable January for the ILS Advisers Fund Index, after full reporting got here in and drove a -1.99% month for the benchmark, with February’s constructive 0.17% return the year-to-date determine for 2025 after February now stands at -1.82%.

That’s more likely to transfer as soon as the remaining ILS funds have reported their information to incorporate within the Index for February, which like final month may have a significant impact given the wildfire impacts seen.

Recall that, when 75% of ILS fund constituents had reported, the ILS Advisers Fund Index was initially unfavourable by -0.38% for January 2025.

However, as we later reported, as soon as the previous few ILS funds information was integrated, the January 2025 return fell to -1.99%, revealing a really vital close to 20% efficiency hole between the most effective and worst performing methods.

For February 2025, ILS Advisers experiences that pure cat bond funds as a gaggle averaged a 0.35% acquire for the month, however funds incorporating non-public ILS methods, similar to collateralised reinsurance and retrocession, had been down -0.20% on common.

With 27 ILS funds out of the 37 constituents having reported outcomes for February to date, 19 had reported constructive returns for the month, whereas 8 had reported unfavourable.

ILS Advisers highlighted that “dispersion in efficiency remained excessive in February” with the best-performing ILS fund delivering a +1.64% return for the month and the worst a -2.17% consequence.

Which leads to a efficiency hole of three.81% for the month of February 2025 to date, however as different ILS funds report there’s a likelihood this might widen.

ILS Advisers stated, “Prolonged reporting instances are frequent following main insured occasions, as valuation processes rely on the receipt of correct information from insurance coverage firms.”

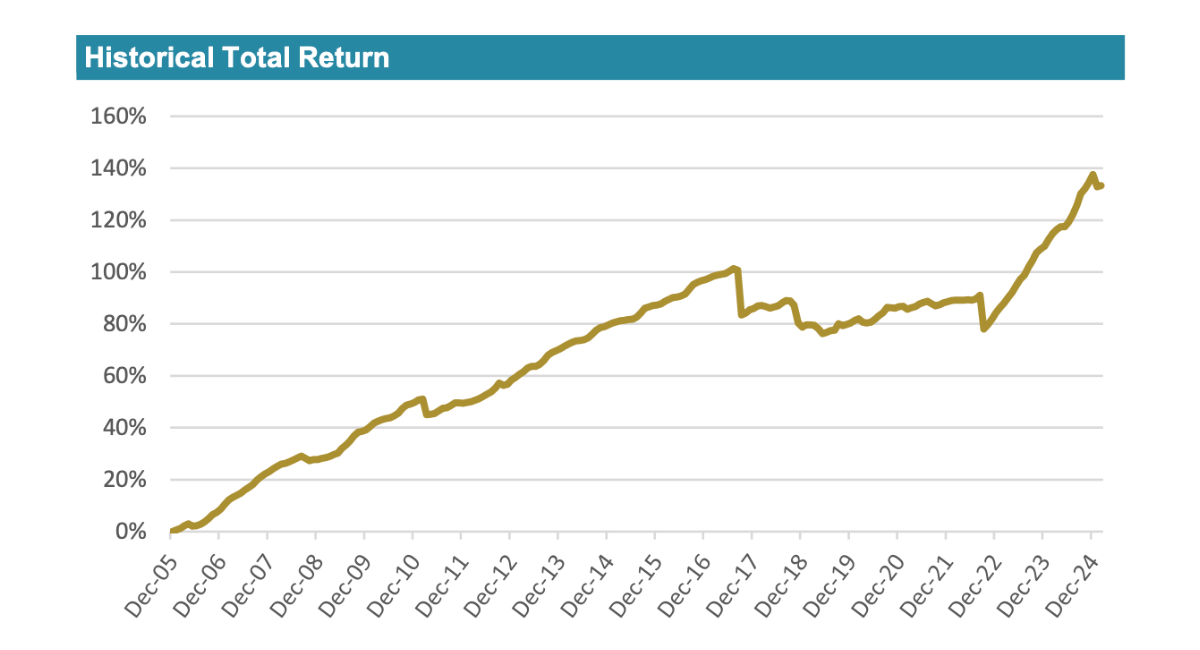

You possibly can monitor the ILS Advisers Fund Index right here on Artemis. It includes an equally weighted index of 37 constituent insurance-linked funding funds which tracks their efficiency and is the primary benchmark that enables a comparability between totally different insurance-linked securities fund managers within the ILS, reinsurance-linked and disaster bond funding area.